How do I initiate a withdrawal, outgoing transfer, outgoing ACAT or outgoing rollover?

The withdrawal flow will vary depending on the account type you are withdrawing from. If you have funds invested that you want to withdraw, you'd need to sell these holdings and wait until they settle before you are able to initiate the withdrawal of the cash in the account.

Once the cash is showing as available to withdraw from your Carry account (you can confirm this by clicking into your Cash tab within the account), first go to the Accounts tab. Then select the account you wish to withdraw from.

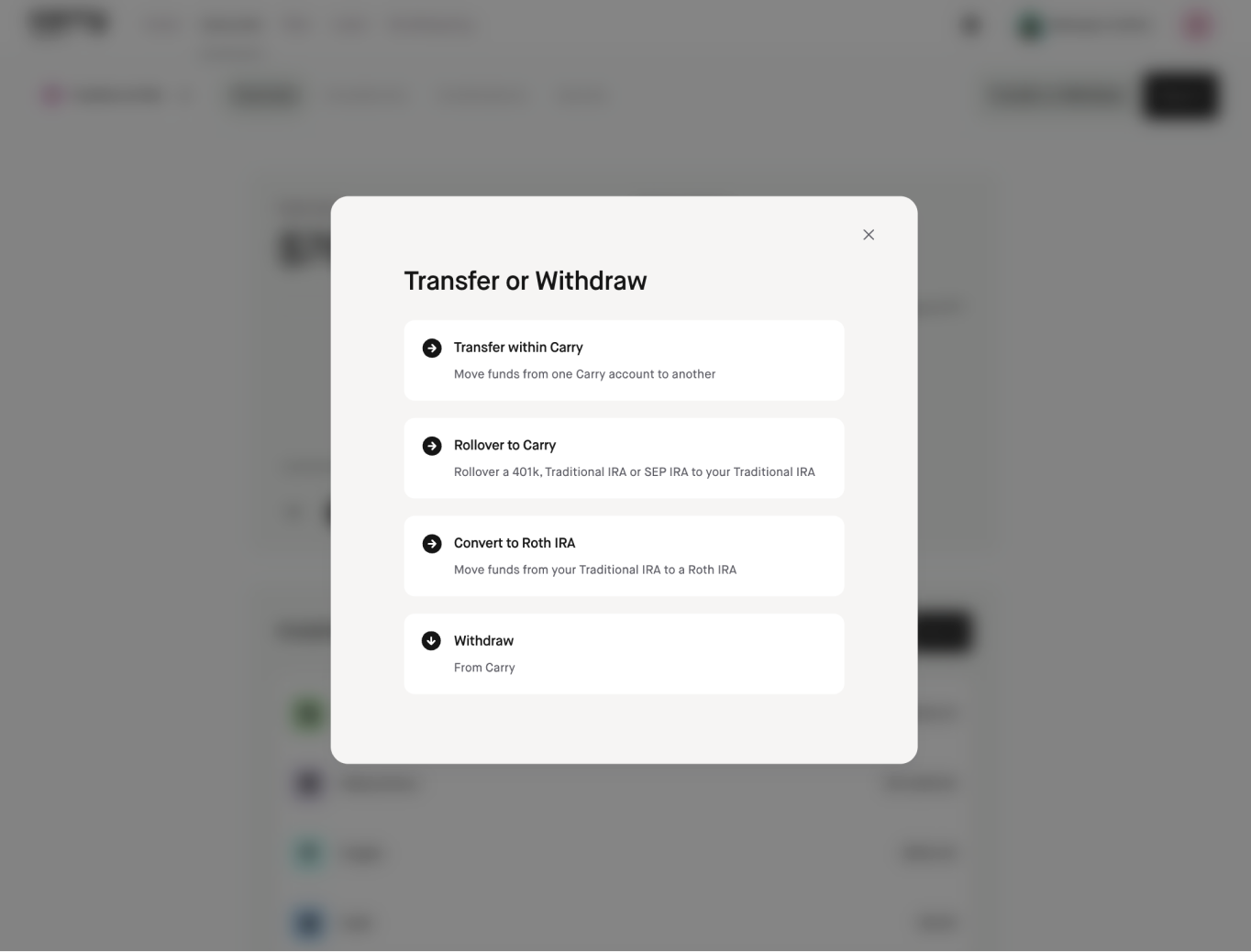

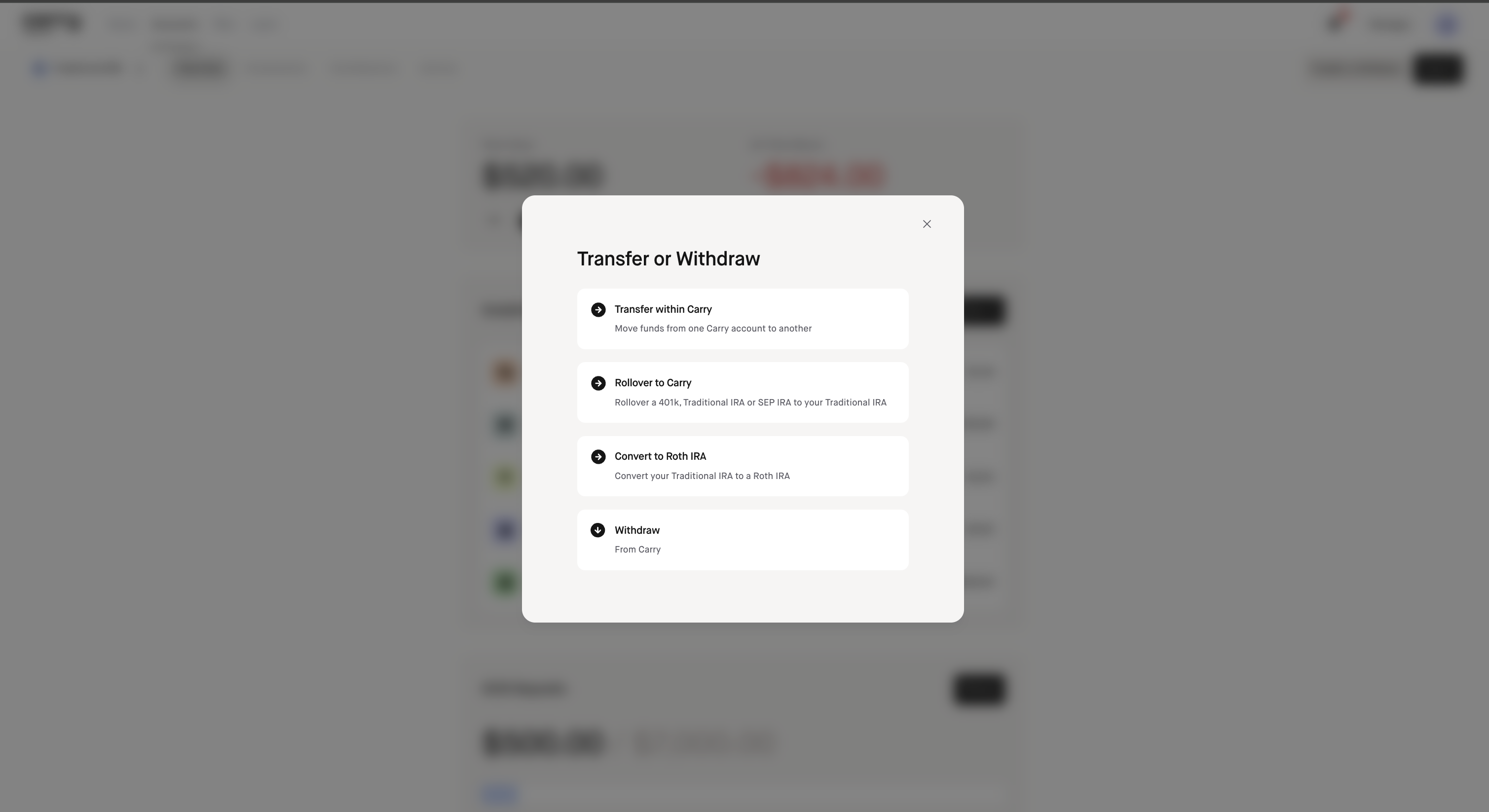

Once you've selected an account, choose "Transfer or Withdraw" from the menu on the top right hand side and select Withdraw.

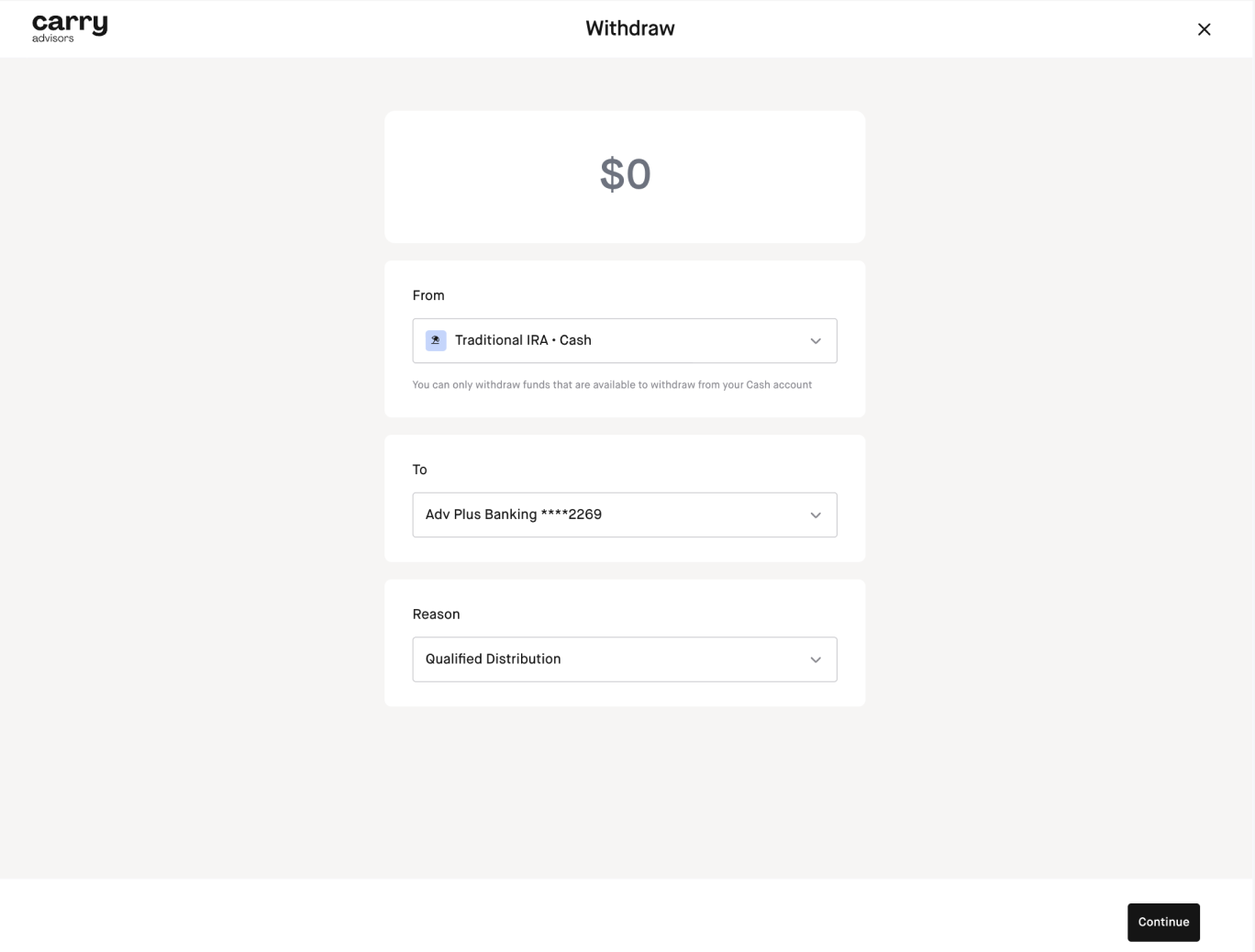

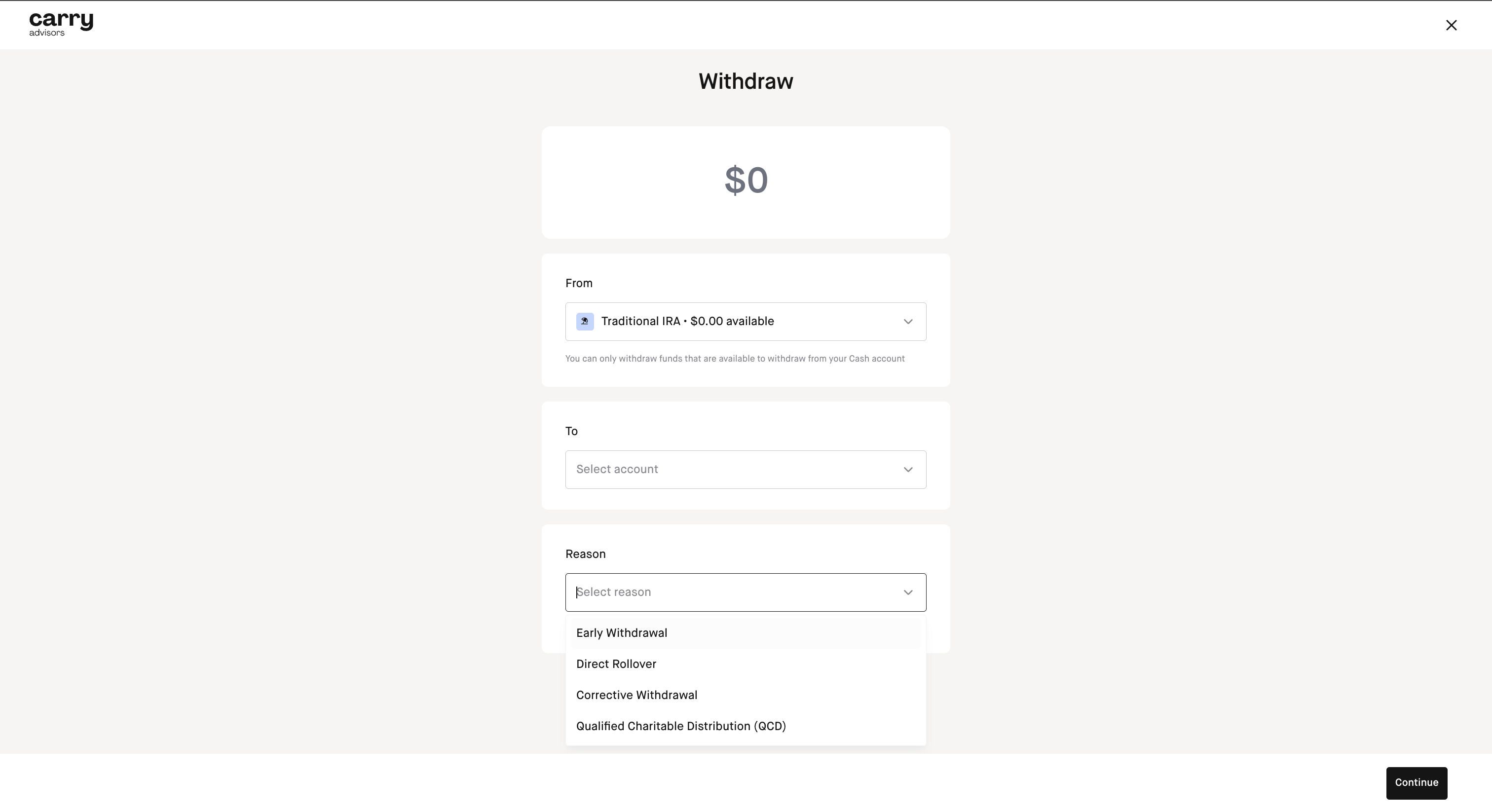

From there, you can choose how much you want to withdraw from your account, and where you want to send the funds. Depending on the type of account you are moving funds from, such as retirement accounts - there will also be a 'Reason' option where you will select the corresponding selection for your withdrawal or rollover of funds to another qualified Retirement account.

It's important that you select the correct reason for your withdrawal as each will have different tax implications. If you need guidance on any potential withdrawal implications, we recommend you speak with your CPA or accountant.

Solo 401k Account Withdrawals & outgoing Rollovers and Transfers

If you are moving your funds to a new Solo 401K provider, best next step would be to check what their process is.

You would need to have the receiving accounts open on their platform if you want to move funds into them. If you are moving your Solo 401k funds into an IRA at another custodian, we'd also recommend you check with them on what the process is and ensure you have the receiving accounts open on their platform to move funds into.

If you terminate your Carry membership subscription and wish to keep your Solo 401k plan, you'll need to find a new plan document provider and transfer ("restate") your Solo 401k over to them.

If a Solo 401k plan owner plans to retire, sell the related business, close the business, or file bankruptcy for the business, it is the responsibility of the plan owner to properly determine to and terminate the plan.

Instructions for moving your Solo 401K plan funds out of Carry:

Please note you'll do the below process twice if you have funds in both Pretax Solo 401K and Roth Solo 401K accounts within your Solo 401K.

> Select the Solo 401K account

> Transfer or Withdraw

> Withdraw

> Select account

> Toggle 'withdraw full account balance'

> Select Domestic Wire Transfer and Manually input the wire details your receiving custodian's retirement team provides to you for your receiving account (This account cannot be linked via Plaid and needs to be input manually using the information your receiving custodian provides to you for your account)

> Input Reason 'rollover'

> Submit

IRA account Withdrawals & outgoing Rollovers and Transfers

Instructions:

> Select the IRA Account

> Click 'Transfer or Withdraw'

> Select 'Withdraw from Carry'

> Input the amount or toggle 'Withdraw full account balance'

> Select the destination account (you may need to obtain these details from your receiving custodian if you are transferring between firms and will be able to input the details in the subsequent steps)

> Select the 'Reason' and click 'Continue'

> If you input 'domestic wire' on the next screen you will be able to input these numbers (if you are moving funds to another custodian you will need to obtain these details from your receiving custodian for the account you are moving funds to)

> On the next screen you can confirm your withdrawal details and click 'Continue'

*Please note that at this time our custodian, DriveWealth does not support any outgoing transfer of funds via check.

Outgoing wires to Vanguard

Typically the beneficiary information from our understanding needs to be formatted as follows but please confirm with Vanguard if you have any questions:

[Vanguard] [Vanguard Account Number] FFC [Client Name] [Account Name] [Client Account #] [Client Wire Code]

Here is an example sample from our understanding of how the beneficiary information for an outgoing wire from Carry (custodian: DriveWealth) to Vanguard would be input:

Vanguard 123456789 FCC Jean Smith Roth IRA Acct # 9231823 Wire Code 123456

Outgoing ACAT

An outgoing ACAT for your account would need to be initiated by the receiving custodian that your funds are going to if they support it. Please reach out to them to determine the process. Our custodian, DriveWealth's DTC # is: 2402. ACATs are done from like to like accounts example: Traditional IRA to Traditional IRA. You are not able to ACAT a Traditional IRA to a Solo 401k account for example.

Only whole shares can be transferred out via ACAT so please sell any fractional shares you have first before initiating an ACAT out.

Please note the outgoing ACAT fee is $65. This is the fee our custodian, DriveWealth charges for all outgoing ACATs so please ensure you have $65 in cash in the account you are ACAT'ing out to cover the fee.