How do I rollover or transfer funds from an IRA (Traditional IRA, SEP IRA, Simple IRA, Roth IRA) or previous employer 401k (403b, 457b) into a Carry IRA?

*Please note we do not currently support:

Alternative asset transfers

partial incoming account transfers via ACAT or cash (through wire or check) on our website. Any incoming transfer initiated via our website would be a full account transfer.

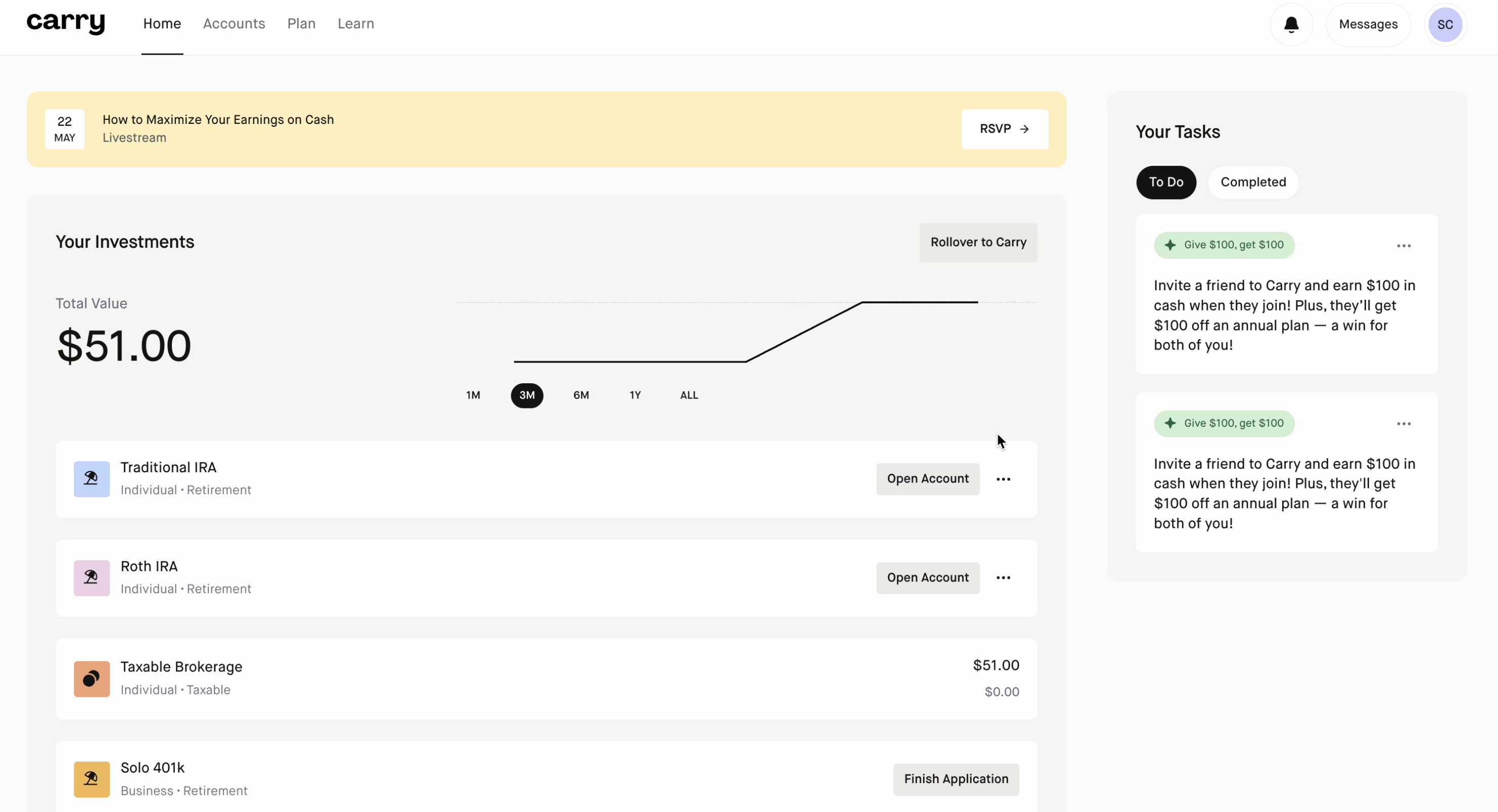

Step 1: Click 'Rollover to Carry' from the home screen

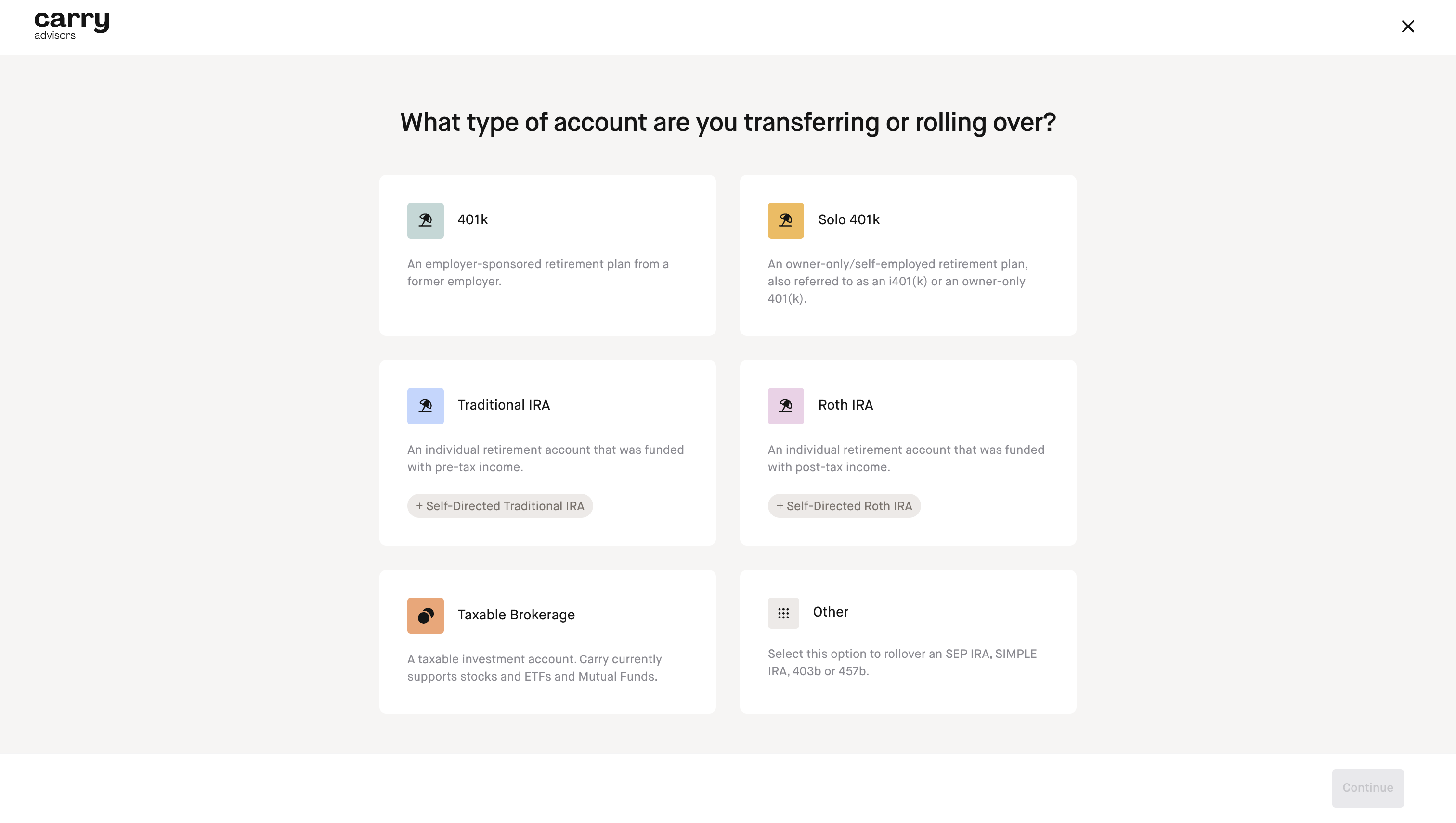

Step 2: Choose the account type you will be transferring over to Carry and click 'Continue'

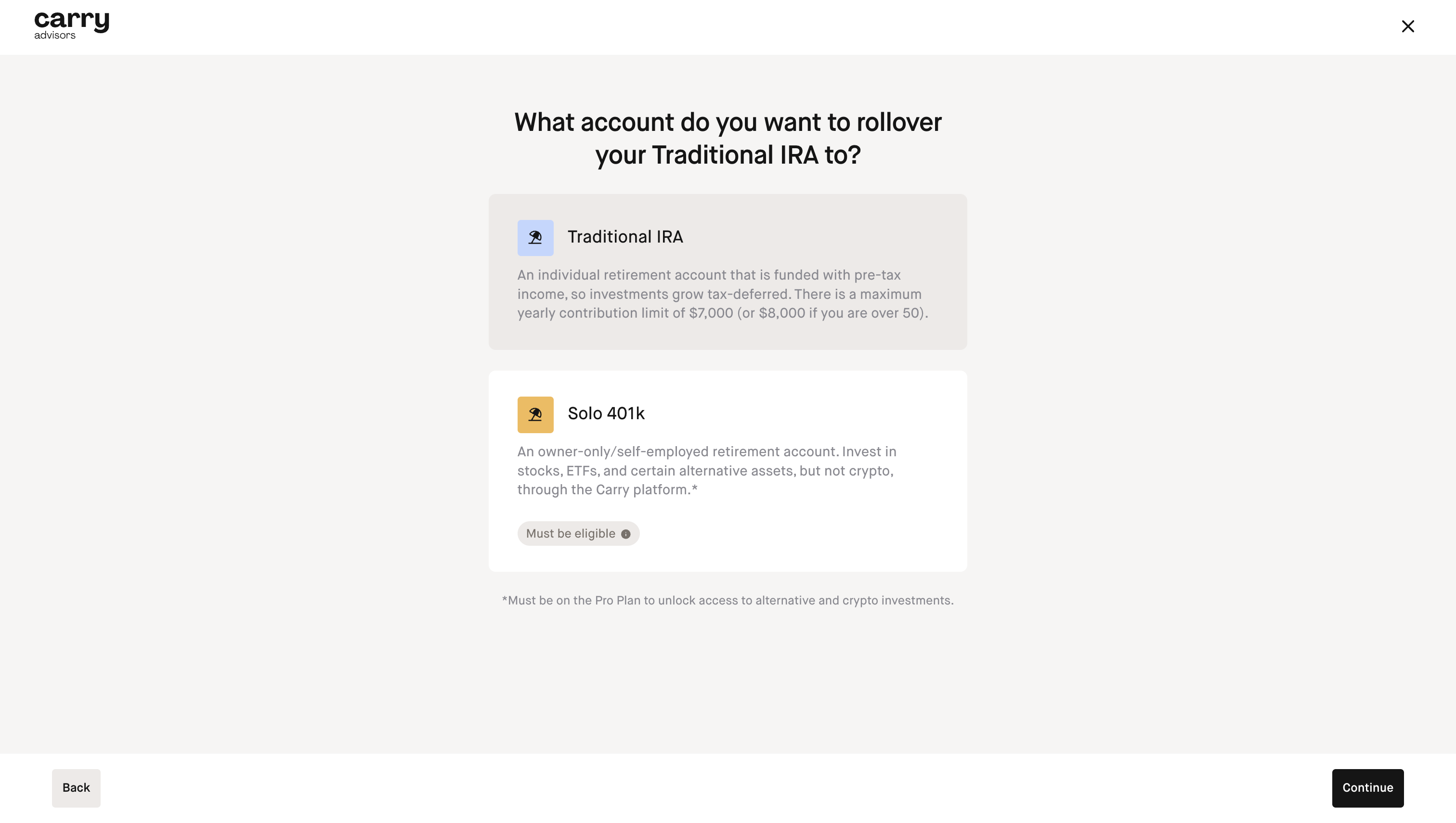

Step 3: Select the destination account on Carry and click 'Continue'

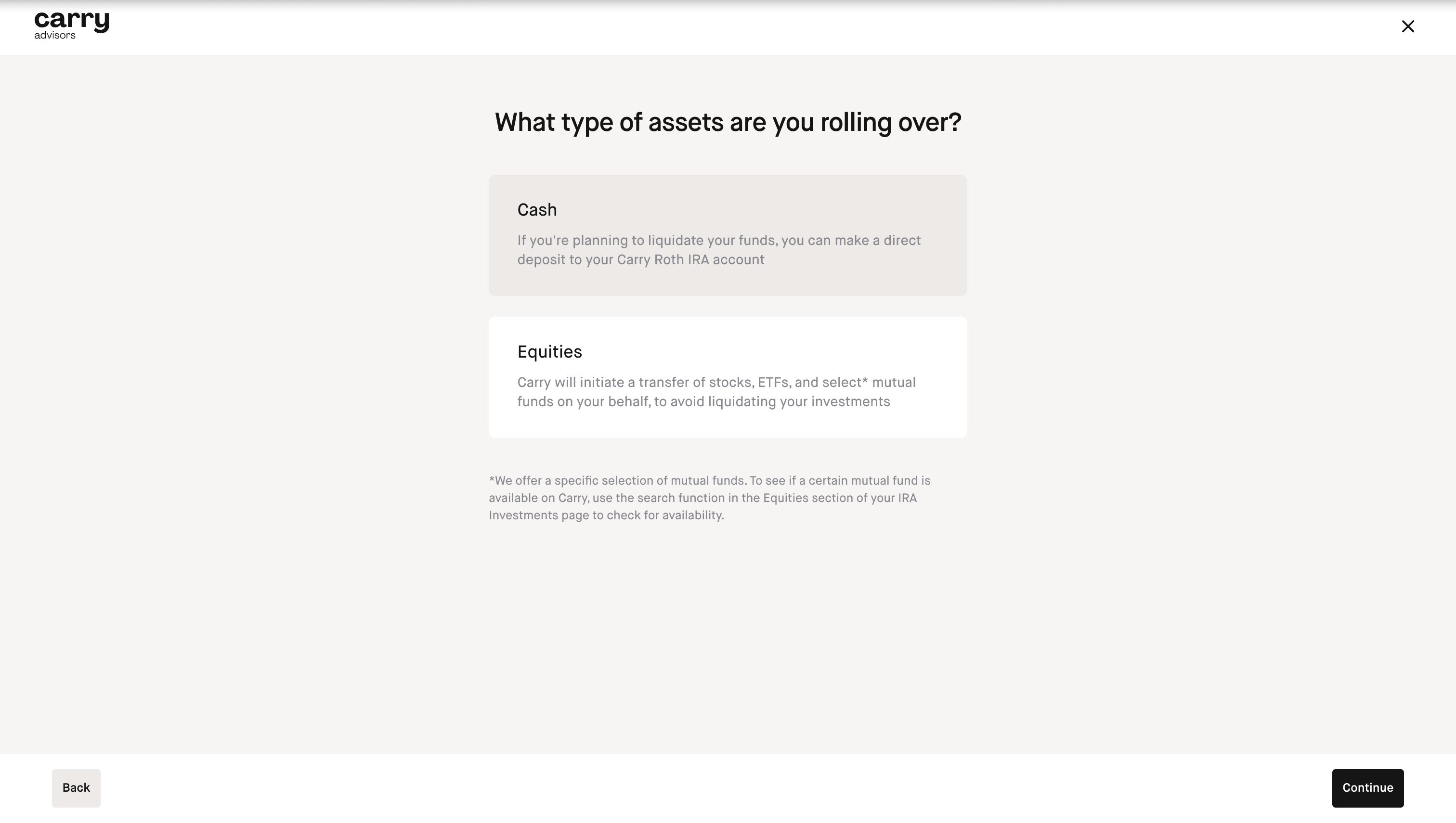

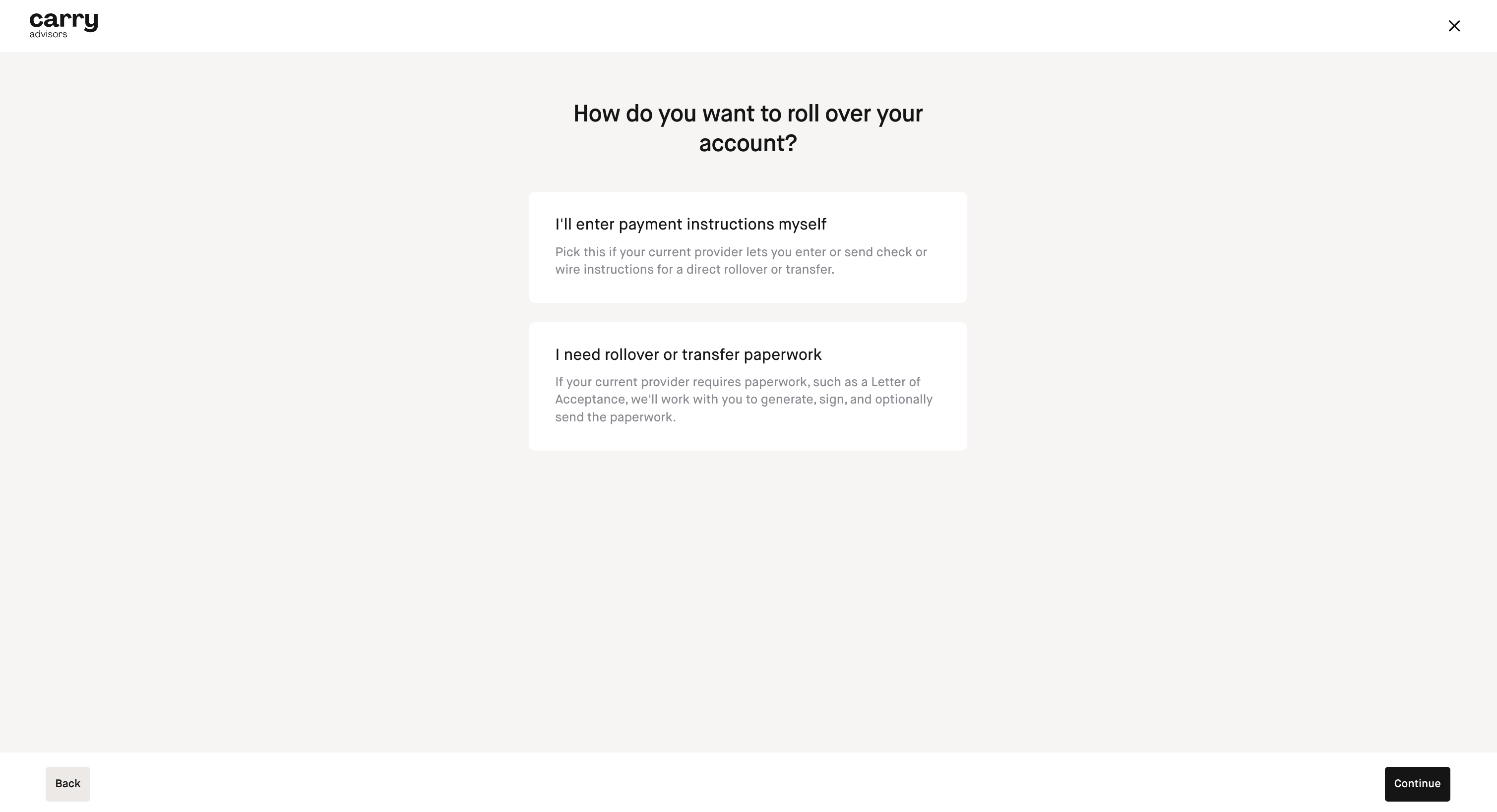

Step 4: On this page you have 2 options:

1) Select Cash if you plan to have your current firm send funds to your Carry account via wire or check

2) Select Equities if you want to transfer stocks, ETFs, cash or Carry platform supported mutual funds in your account via ACAT (if your sending custodian supports this for an in-kind transfer)

Once you've made your selection, click 'Continue'

If you selected Cash in Step 4, you'll be prompted to enter the payment instructions yourself or if you need transfer paperwork.

(If you're not sure if you need transfer paperwork - reach out to the firm where your account is currently held and ask them.)

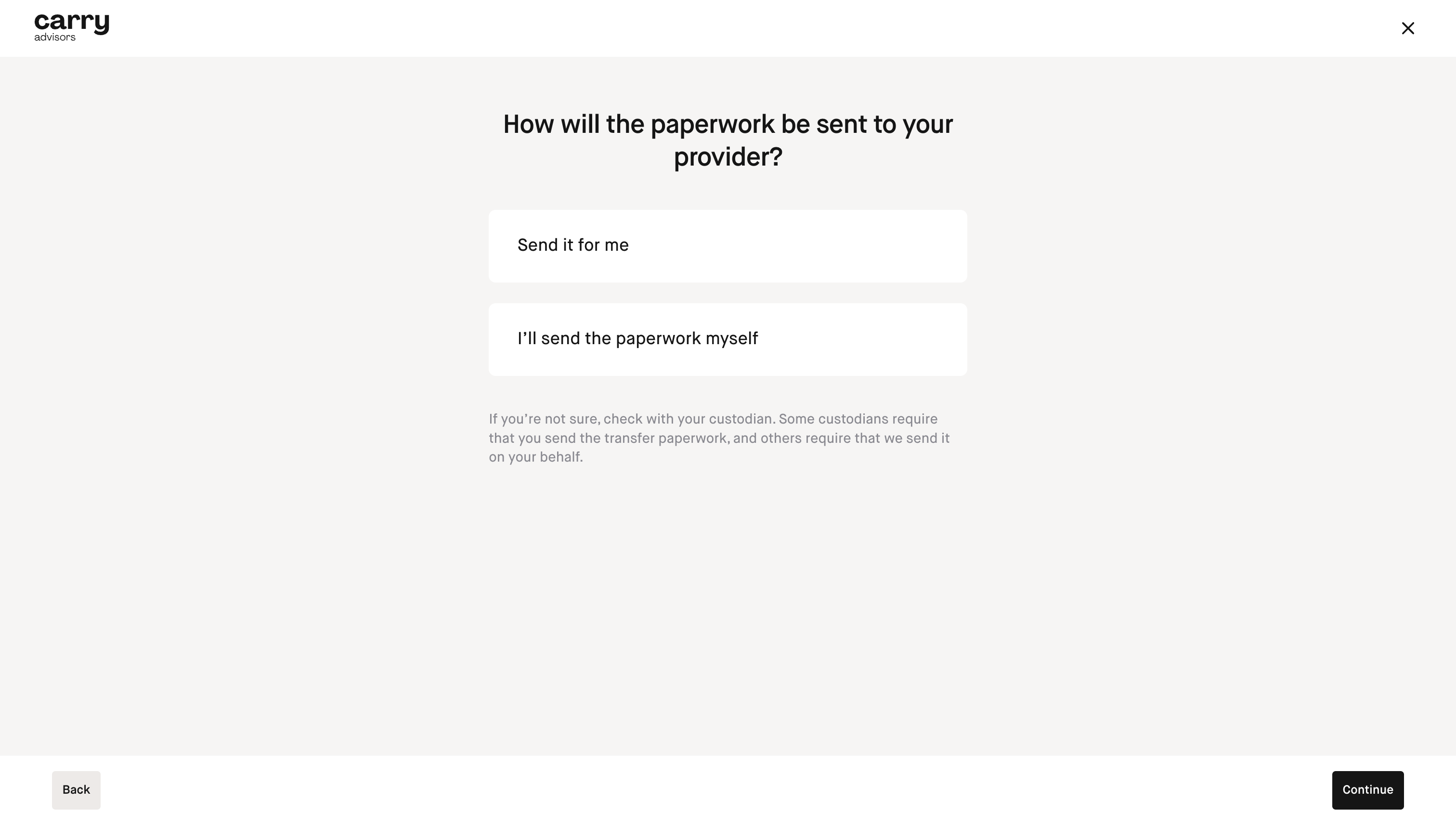

If you select that you need transfer paperwork you'll also need to pick if you want to send the transfer paperwork to your firm sending the funds over to Carry or if you want Carry to send the paperwork over to the sending firm for you.

Please note that the transfer paperwork step typically takes 2-5 business days for our custodian to sign the paperwork and return to us so we can provide to you to share with your sending custodian or for us to provide directly to your sending custodian depending on which option you selected.

Then click 'Continue'.

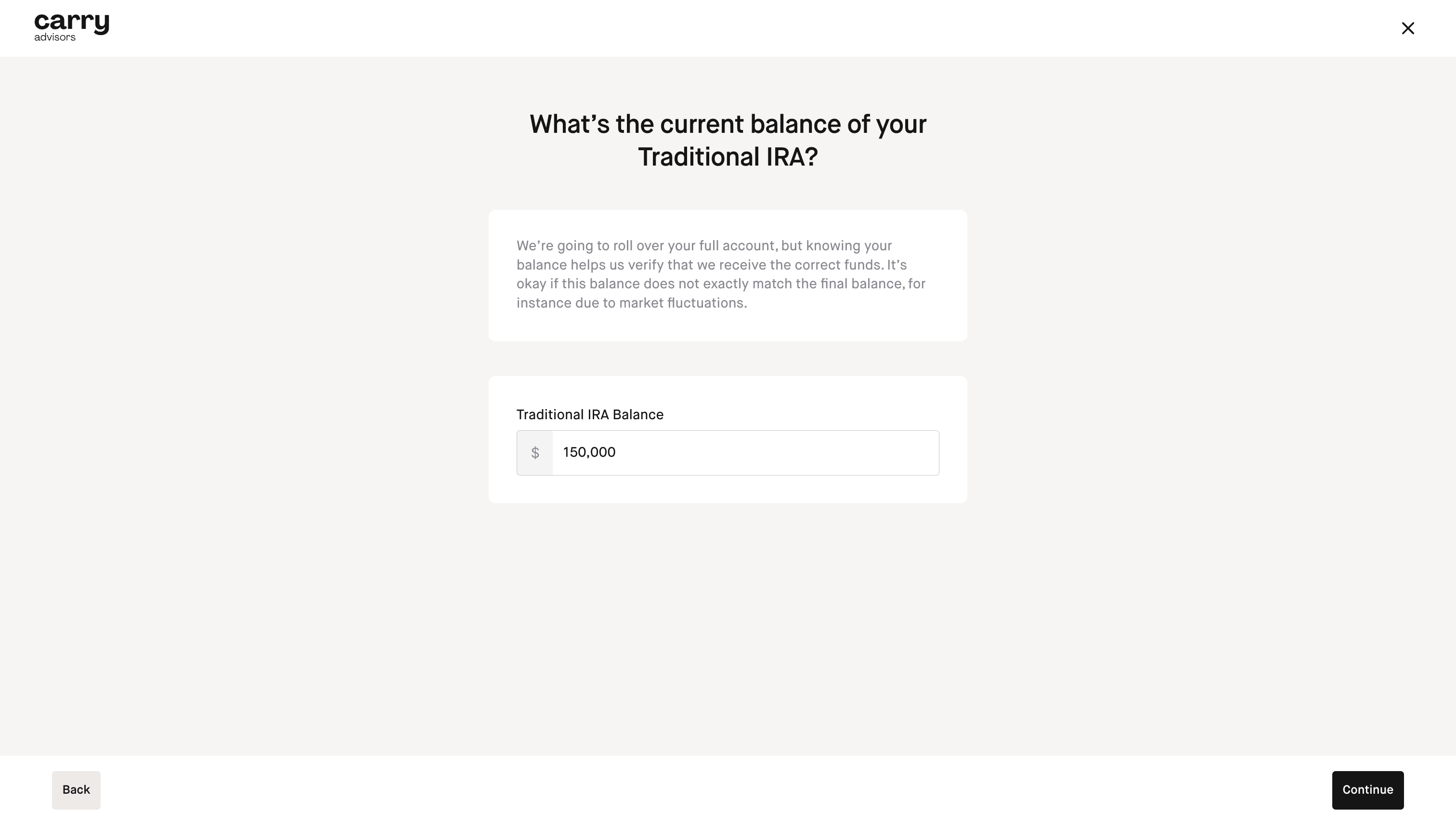

Step 5: Input the approximate balance of the account you're moving over and click 'Continue'

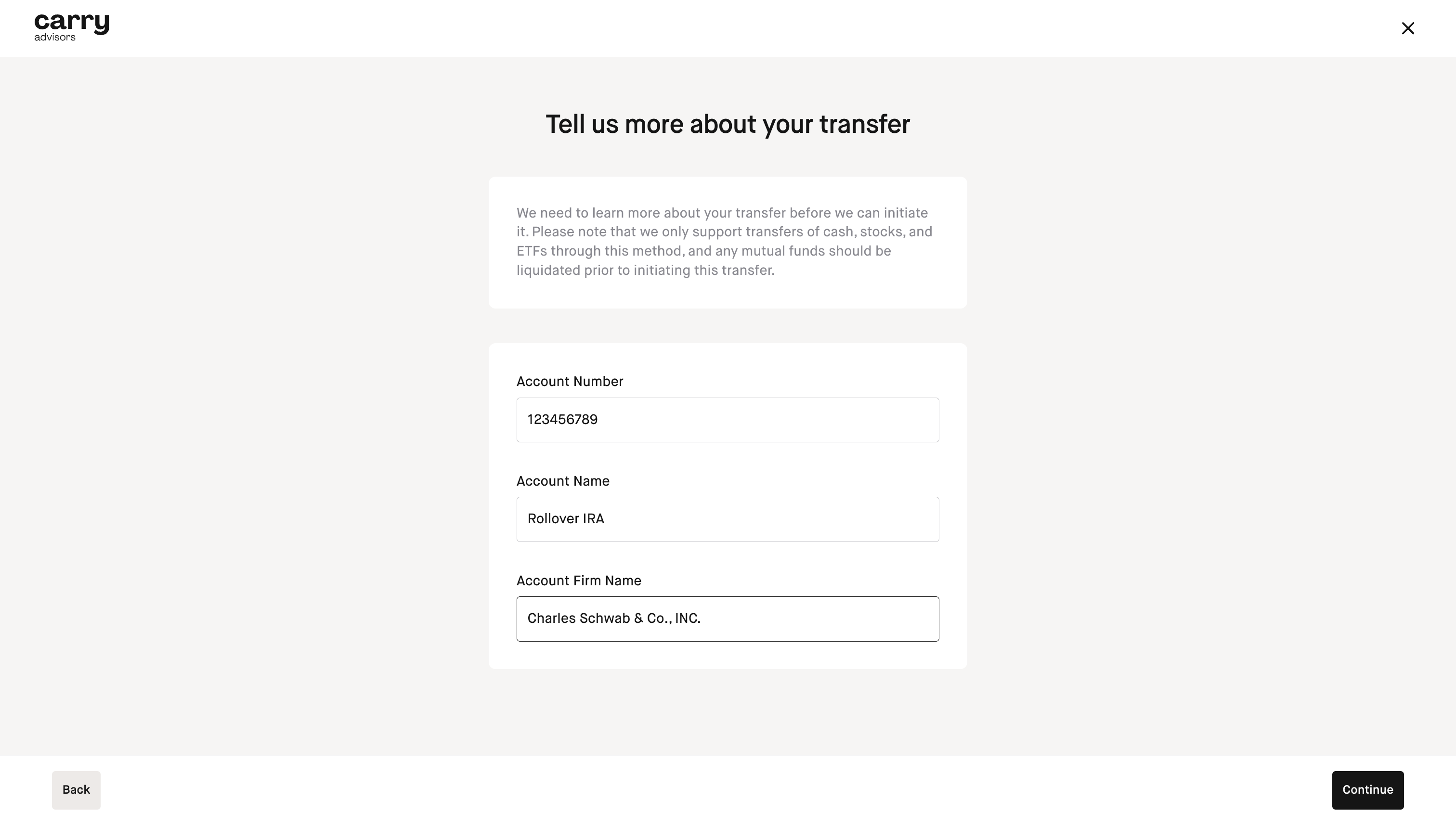

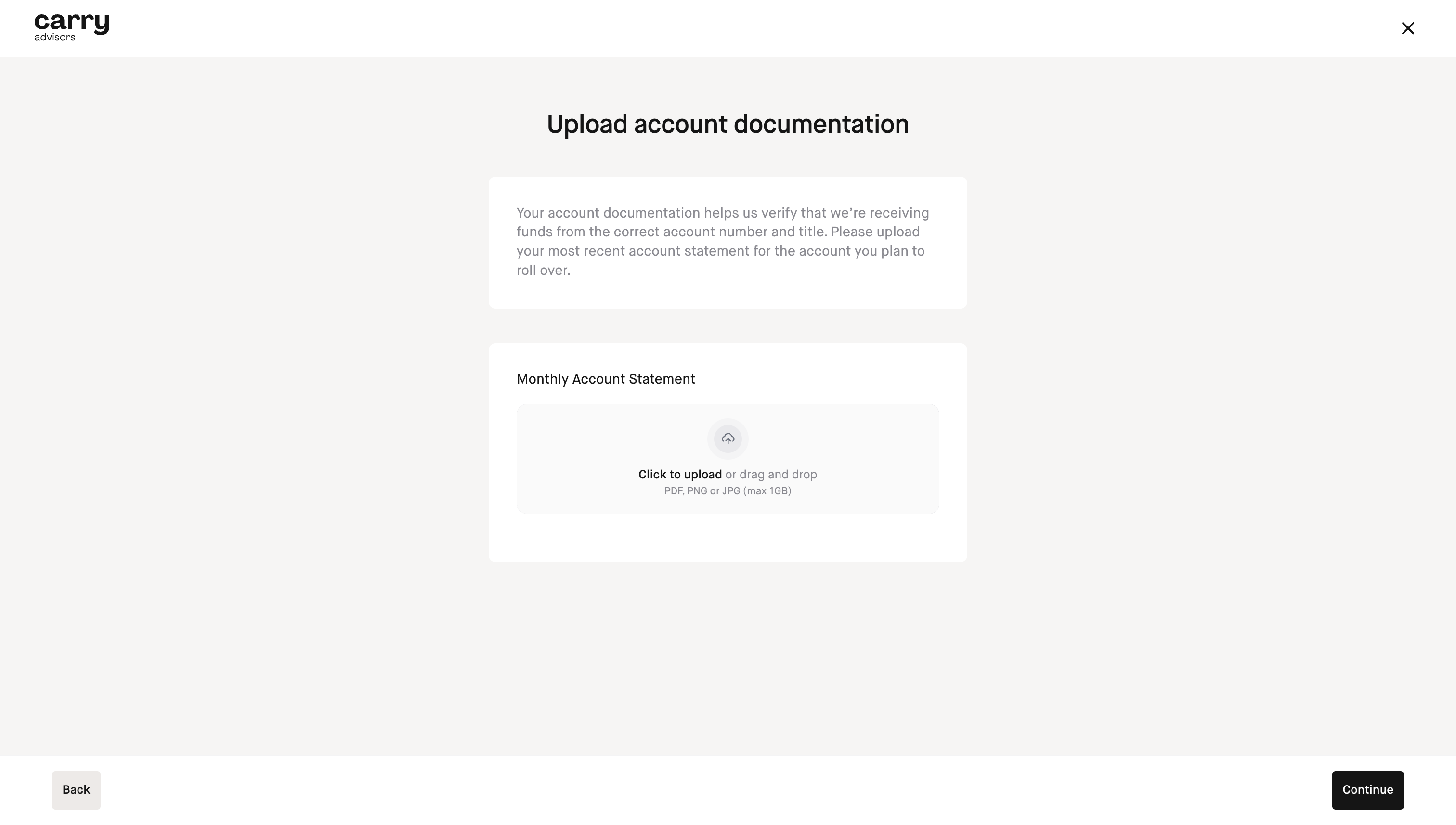

Step 6: Input the account number, name and Firm and click 'Continue'

Step 7: Upload the most recent available account statement for the account you're bringing to Carry and click 'Continue'

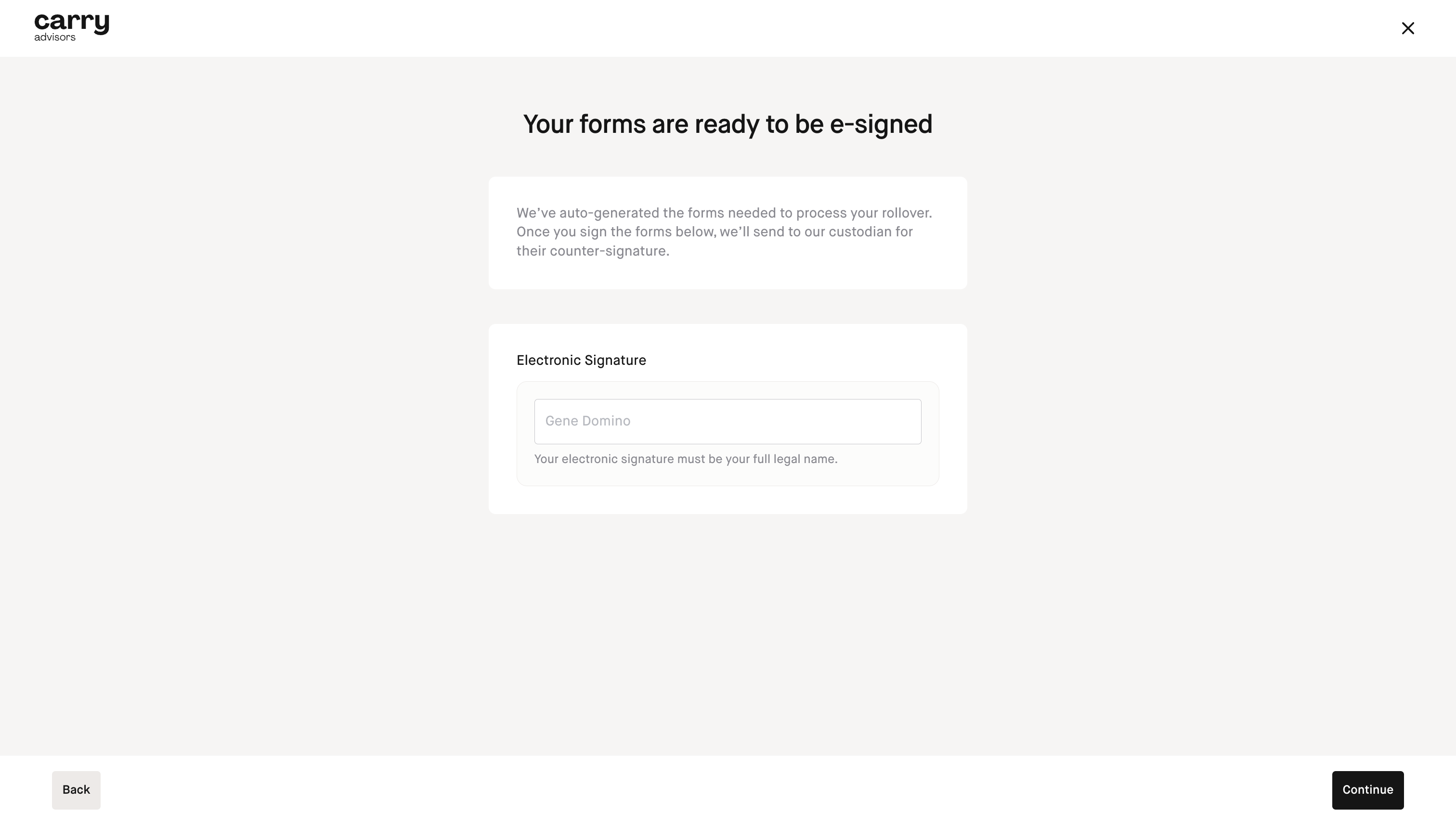

Step 8: Complete the e-signature and click 'Continue'

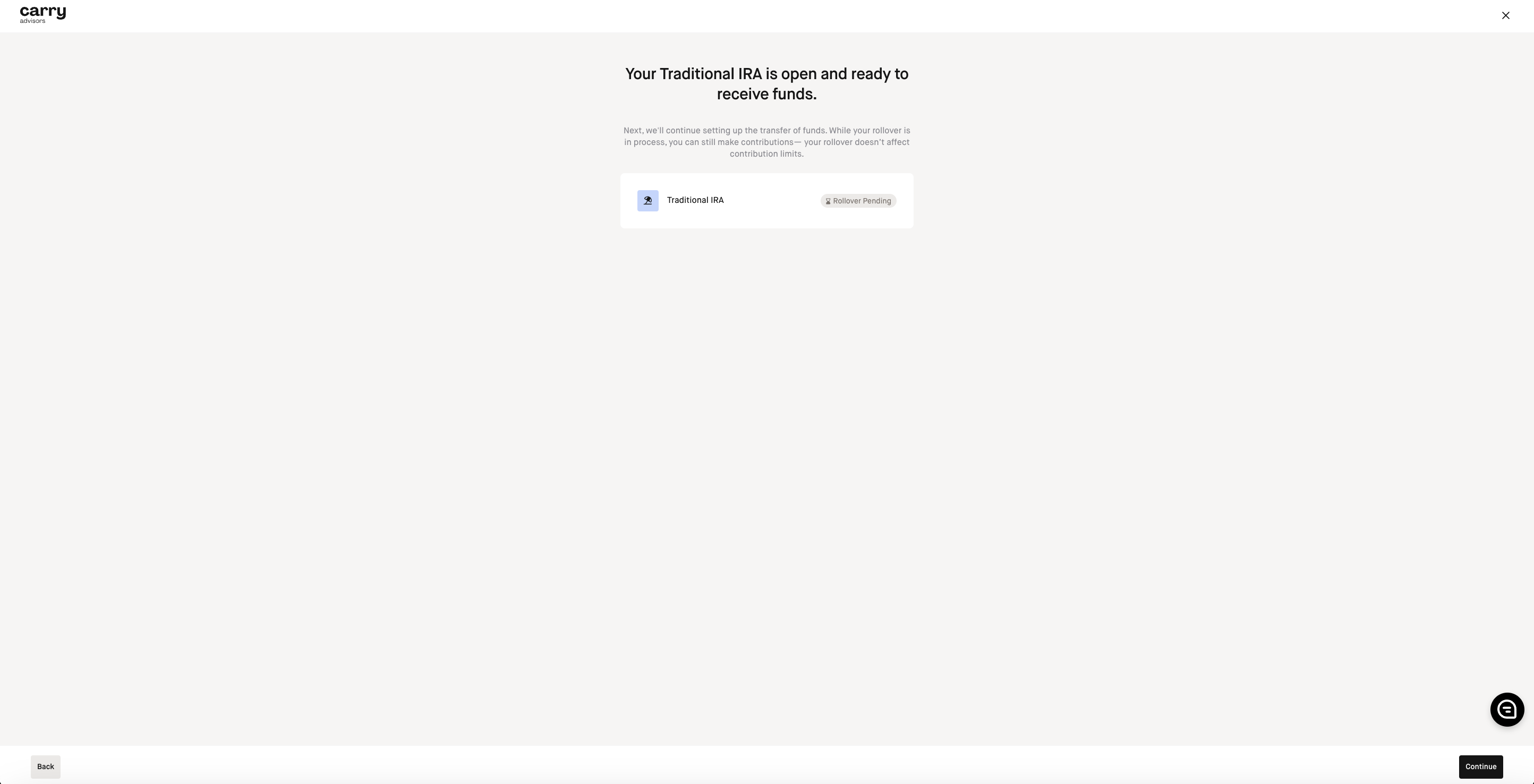

Step 9: Click 'Continue'

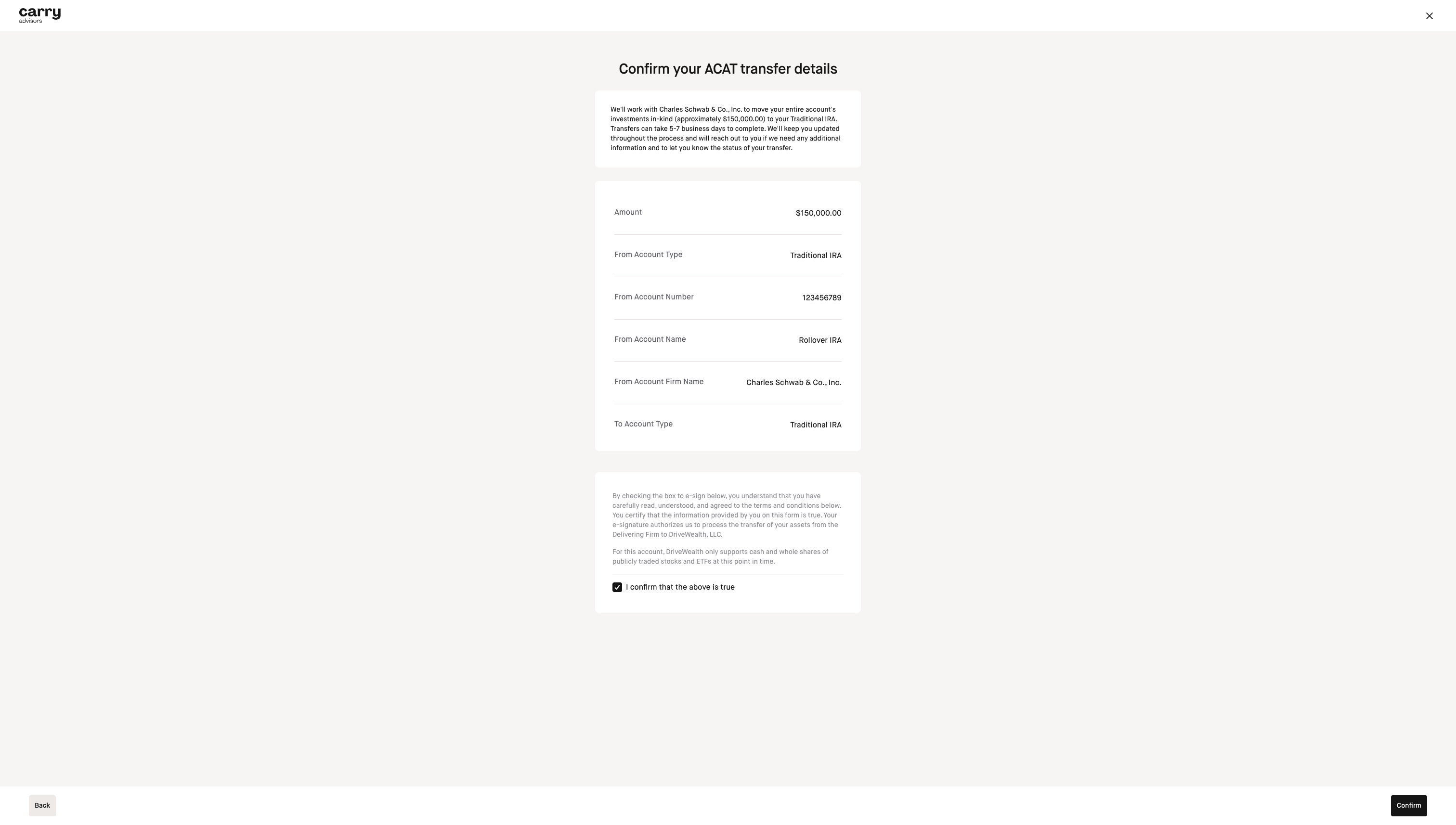

Step 10: Confirm your transfer details and click 'Continue' to Submit

Success! You will be brought to this confirmation screen:

*Please note the firm where your sending account is currently held may also have separate required processes or their own paperwork to process the rollover or transfer so we recommend you check with them if you have any questions.