How do I rollover or transfer a 401k (403b, 457b) or IRA (Traditional IRA, SEP IRA, Simple IRA) into my Carry Solo 401k?

Step 1: Ensure your Solo 401k plan has been set up so that the underlying Solo 401k receiving accounts for the funds you plan to roll over have already been opened or can be opened in the rollover flow.

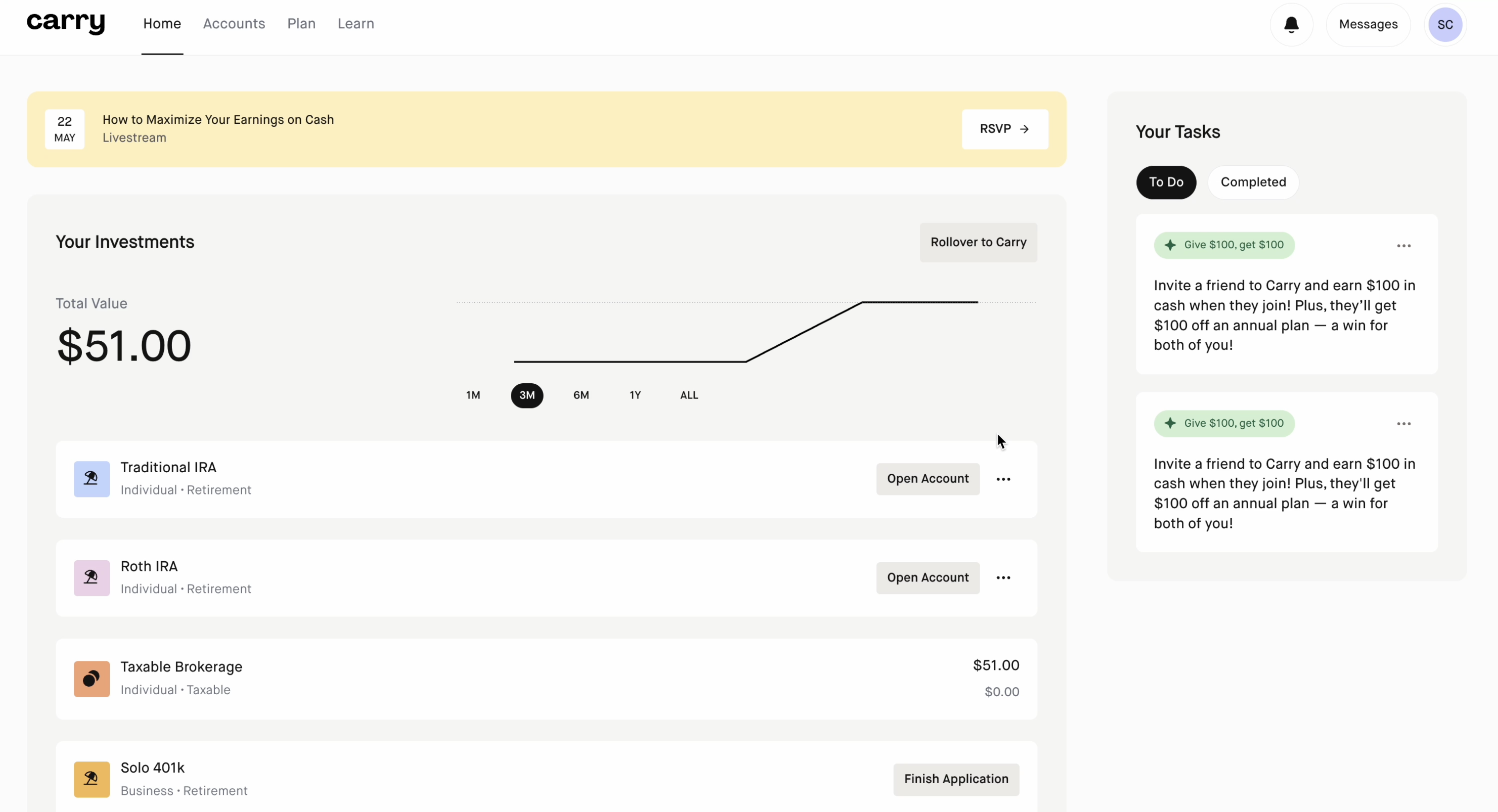

Step 2: From the home page click "Rollover to Carry' on the top right

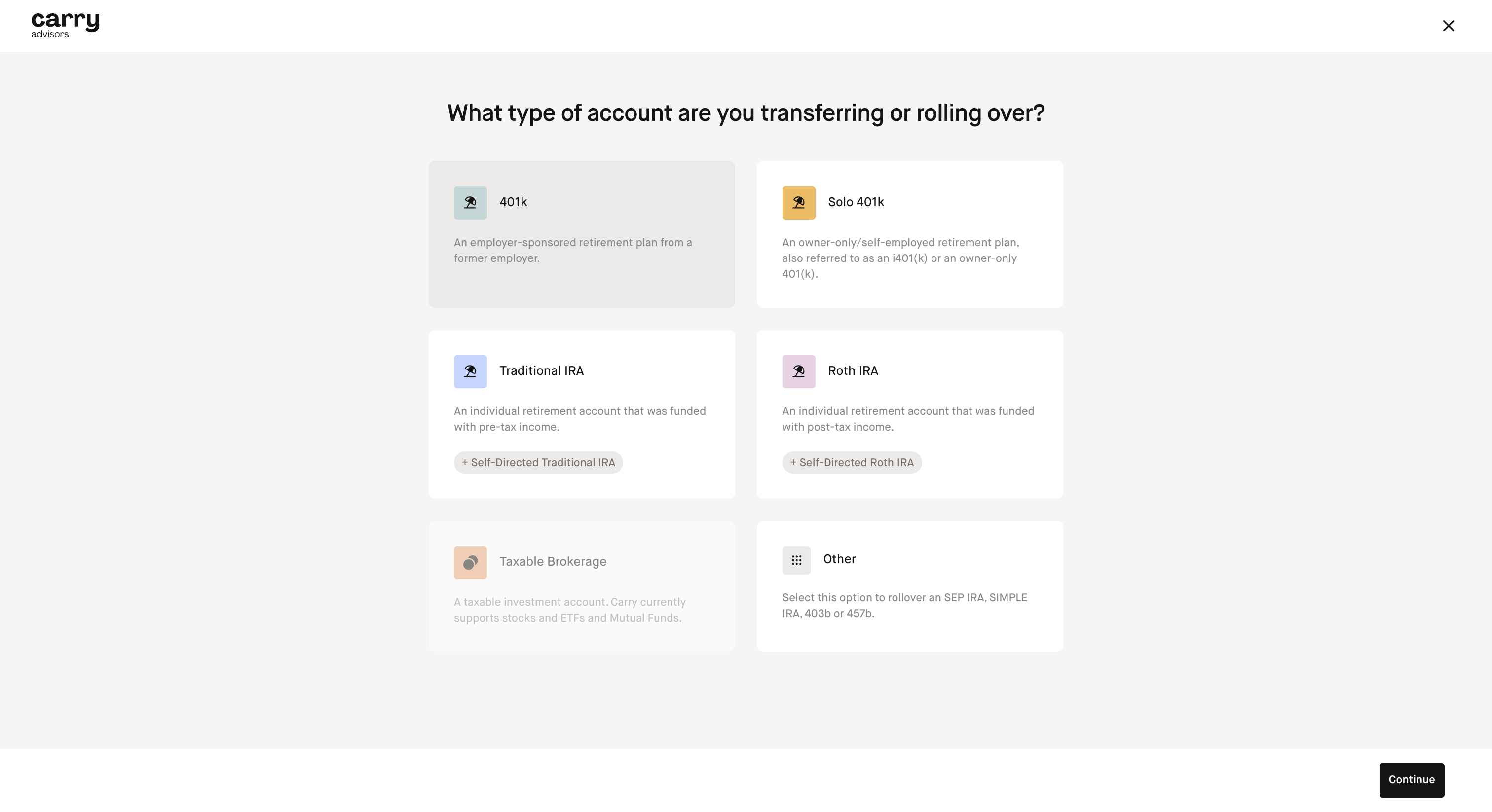

Step 2: Select what account type you are moving into your Solo 401k and click 'Continue'

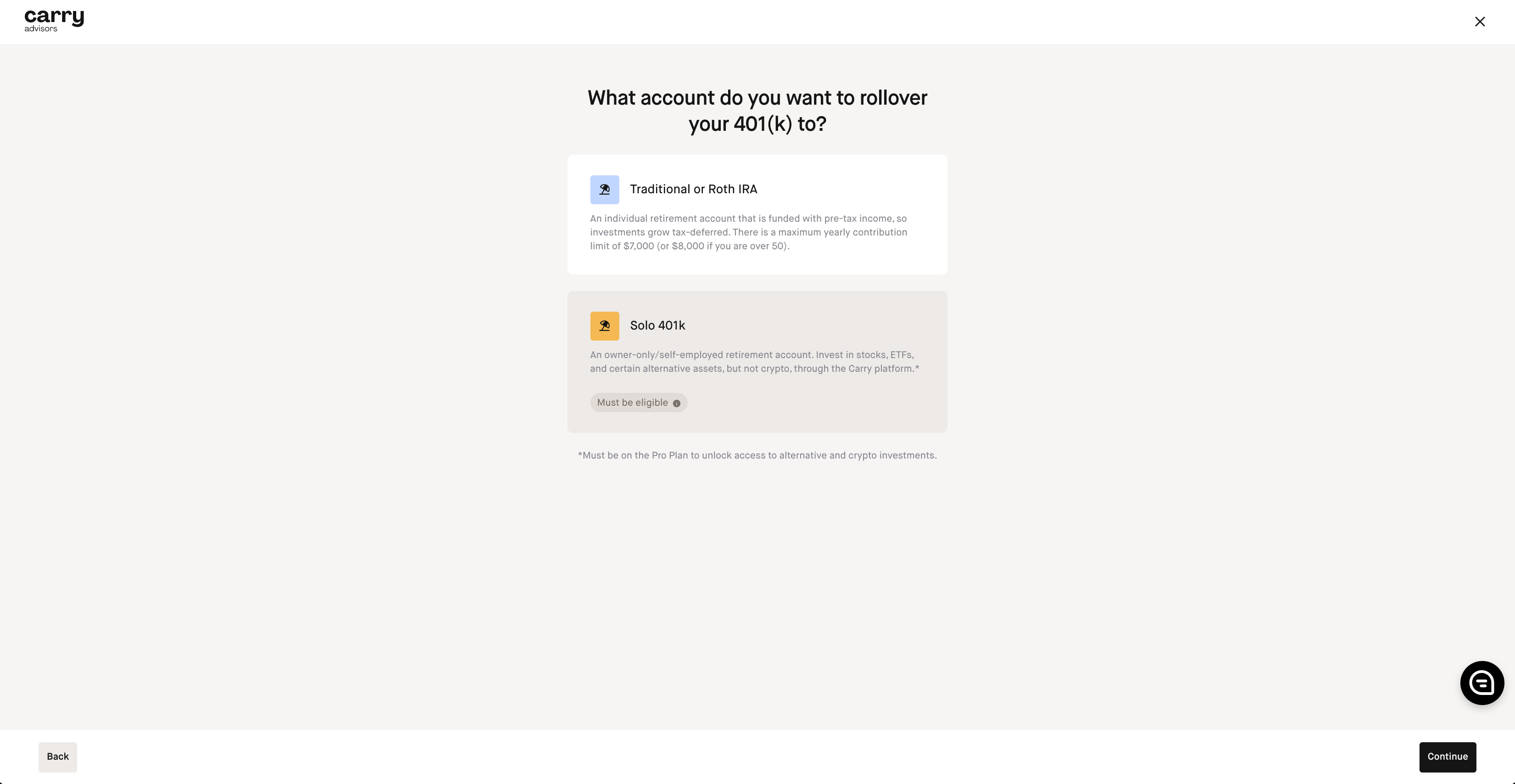

Step 3: Tell us which destination account on Carry you want the funds to go to and click 'Continue'

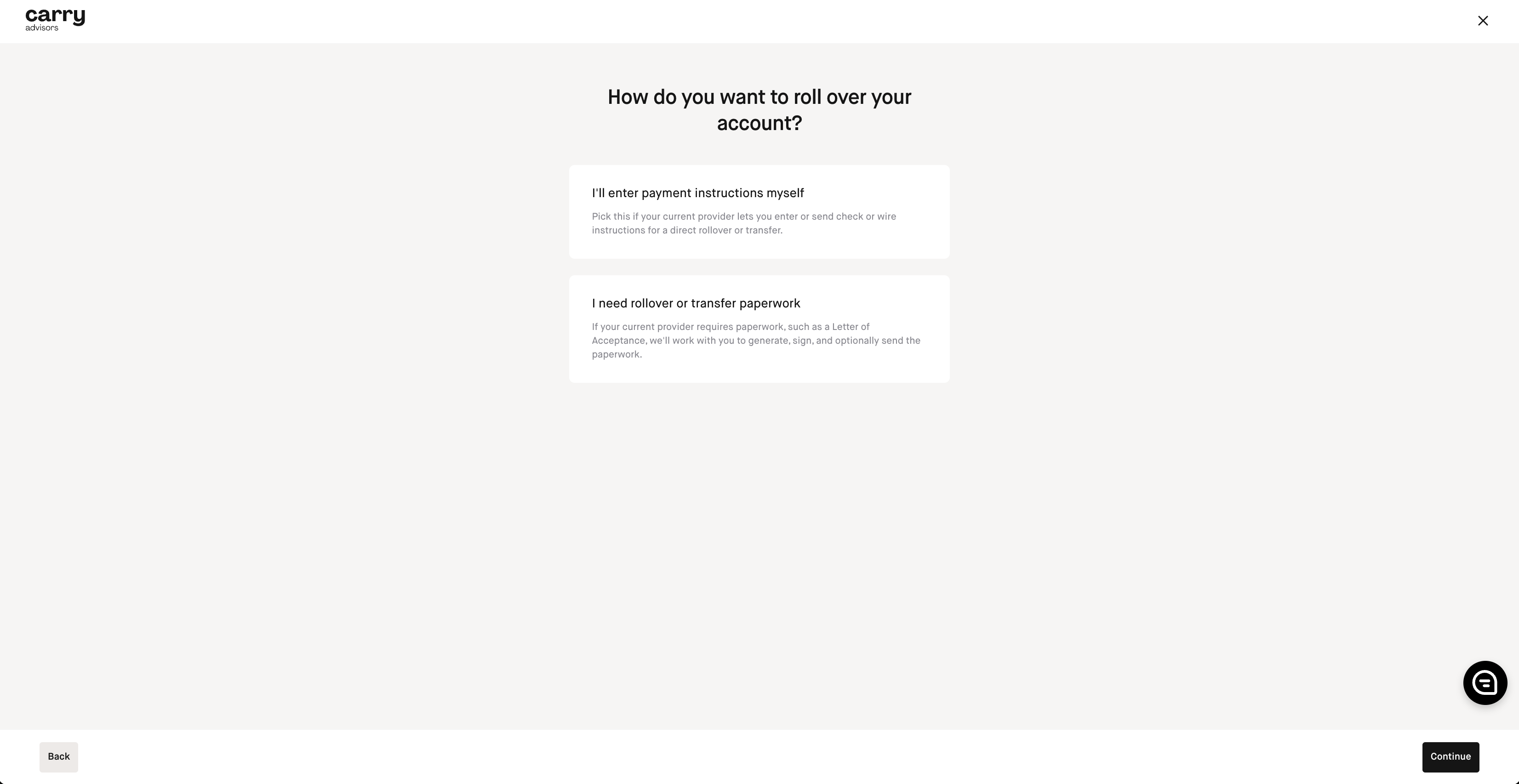

Step 4: Select if you'll enter the payment instructions yourself or if you need transfer paperwork.

(If you're not sure if you need transfer paperwork - reach out to the firm where your account is currently held and ask them.)

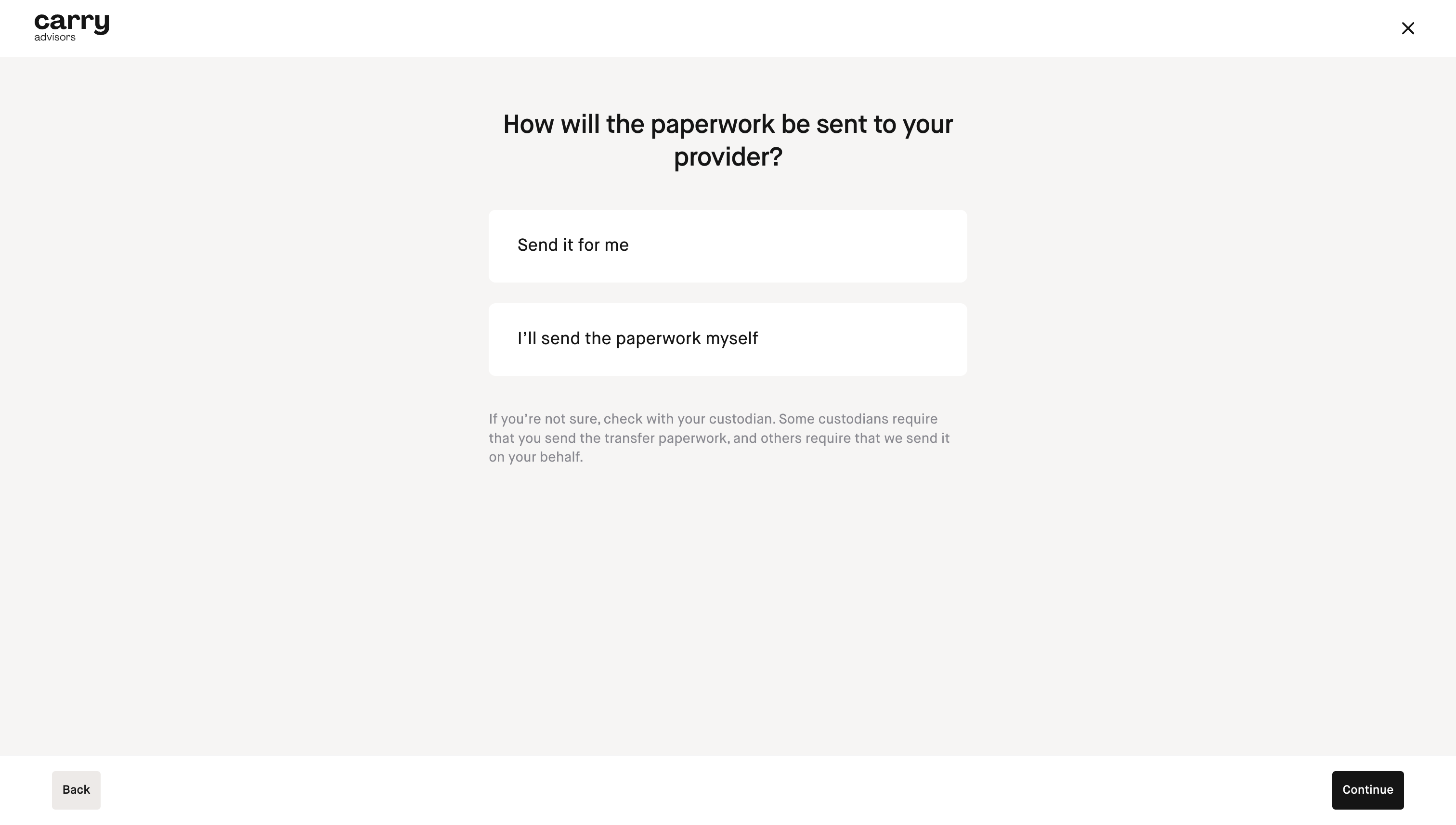

If you select that you need transfer paperwork you'll also need to pick if you want to send the transfer paperwork to your firm sending the funds over to Carry or if you want Carry to send the paperwork over to the sending firm.

Please note that the transfer paperwork step will take 2-5 business days for our custodian to sign the paperwork and return to us so we can provide to you to share with your sending custodian or for us to provide directly to your sending custodian depending on which option you selected.

Then click 'Continue'.

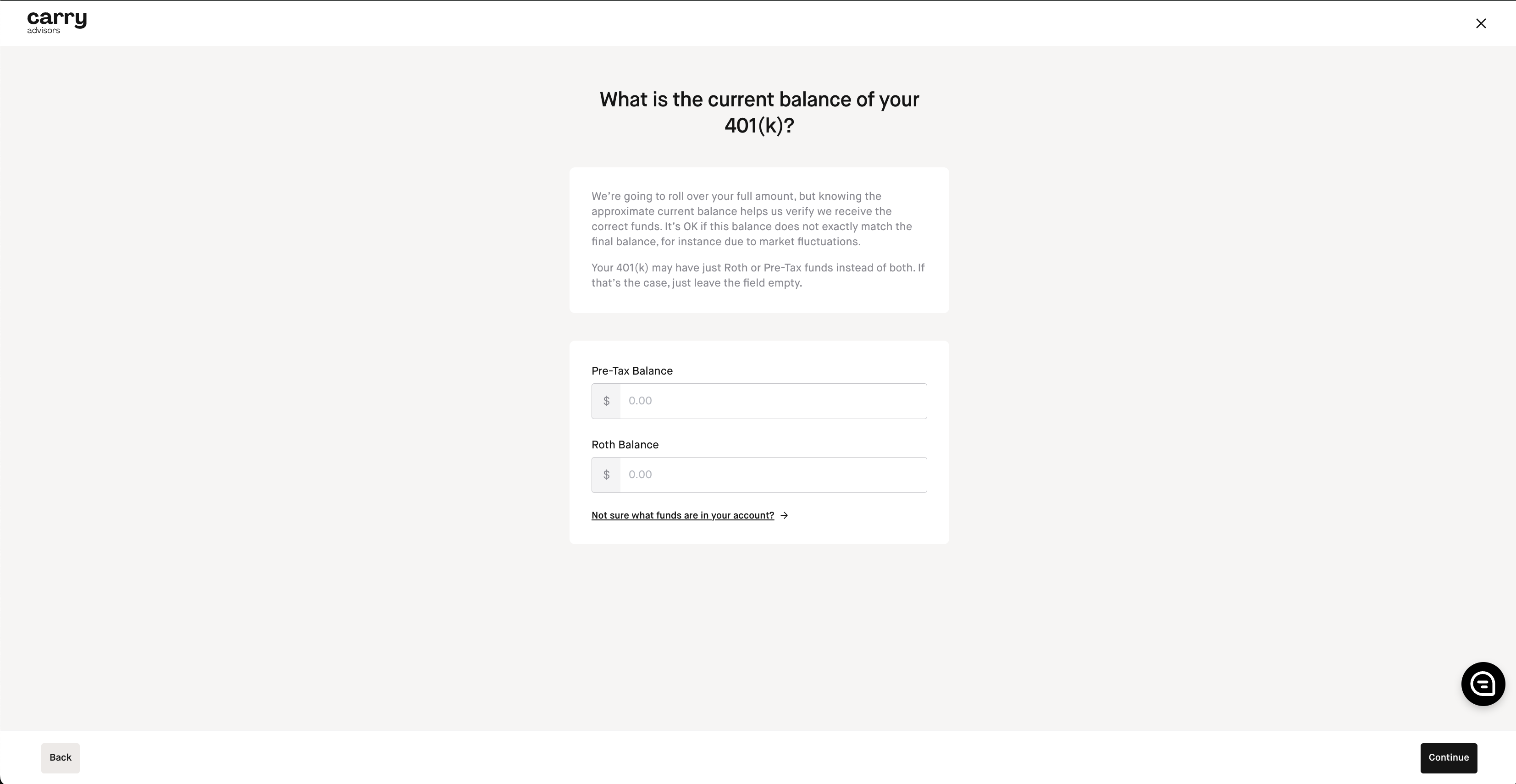

Step 5: Input the approximate current balance of the 401k account you're bringing to Carry and click 'Continue'

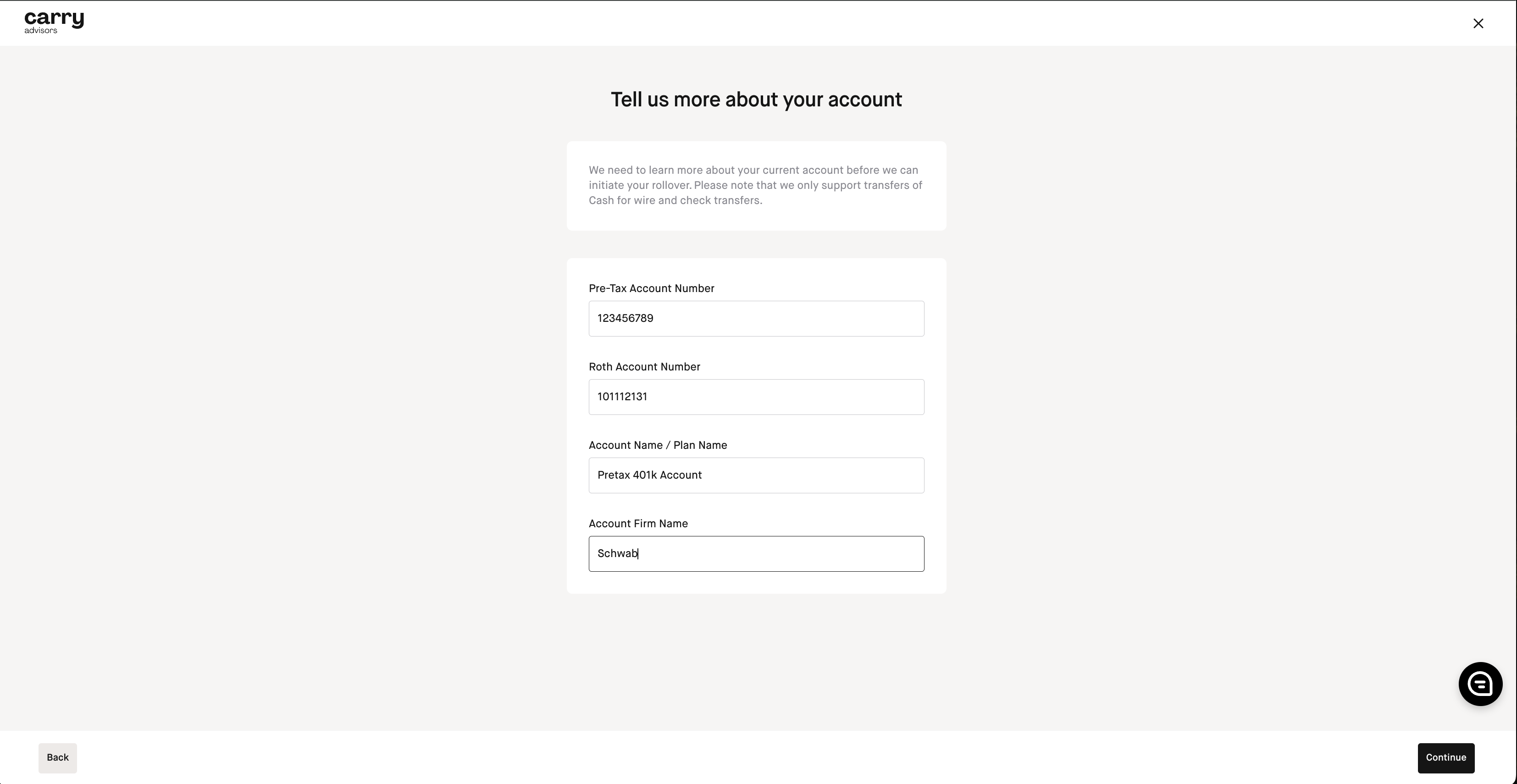

Step 6: Input your account number and details and click 'Continue'

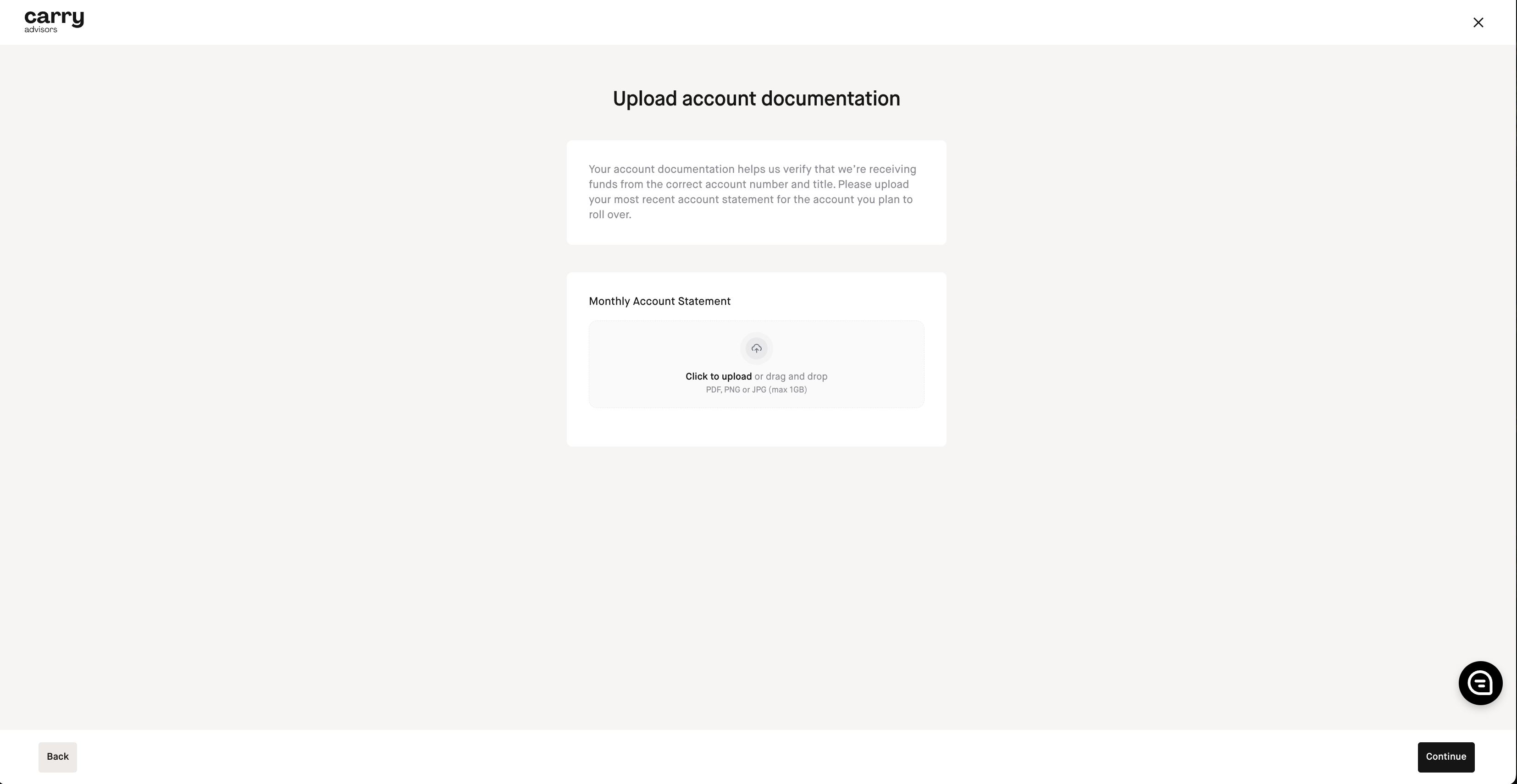

Step 7: Upload the most recent account statement available and click 'Continue'

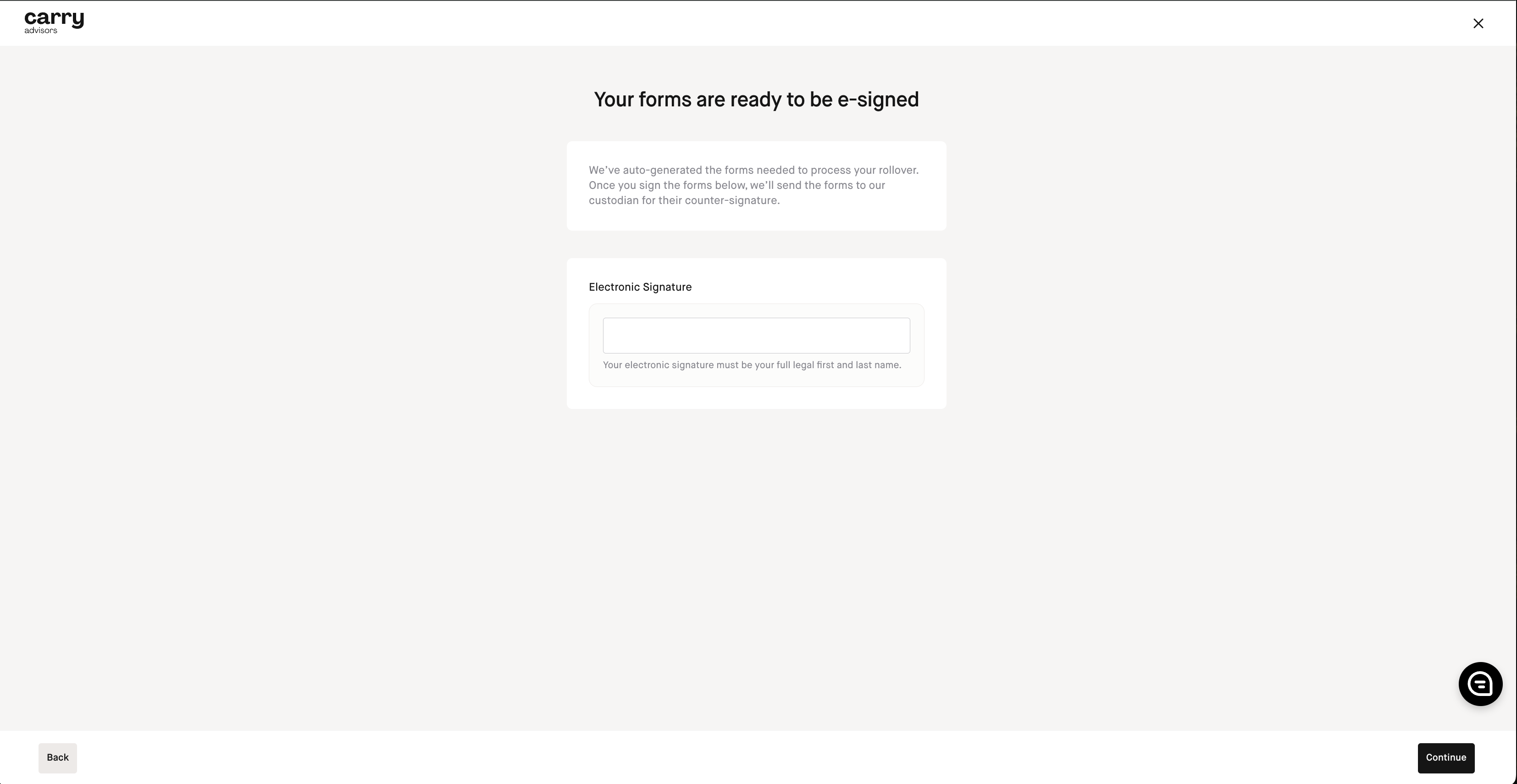

Step 8: E-sign the form and click 'Continue'

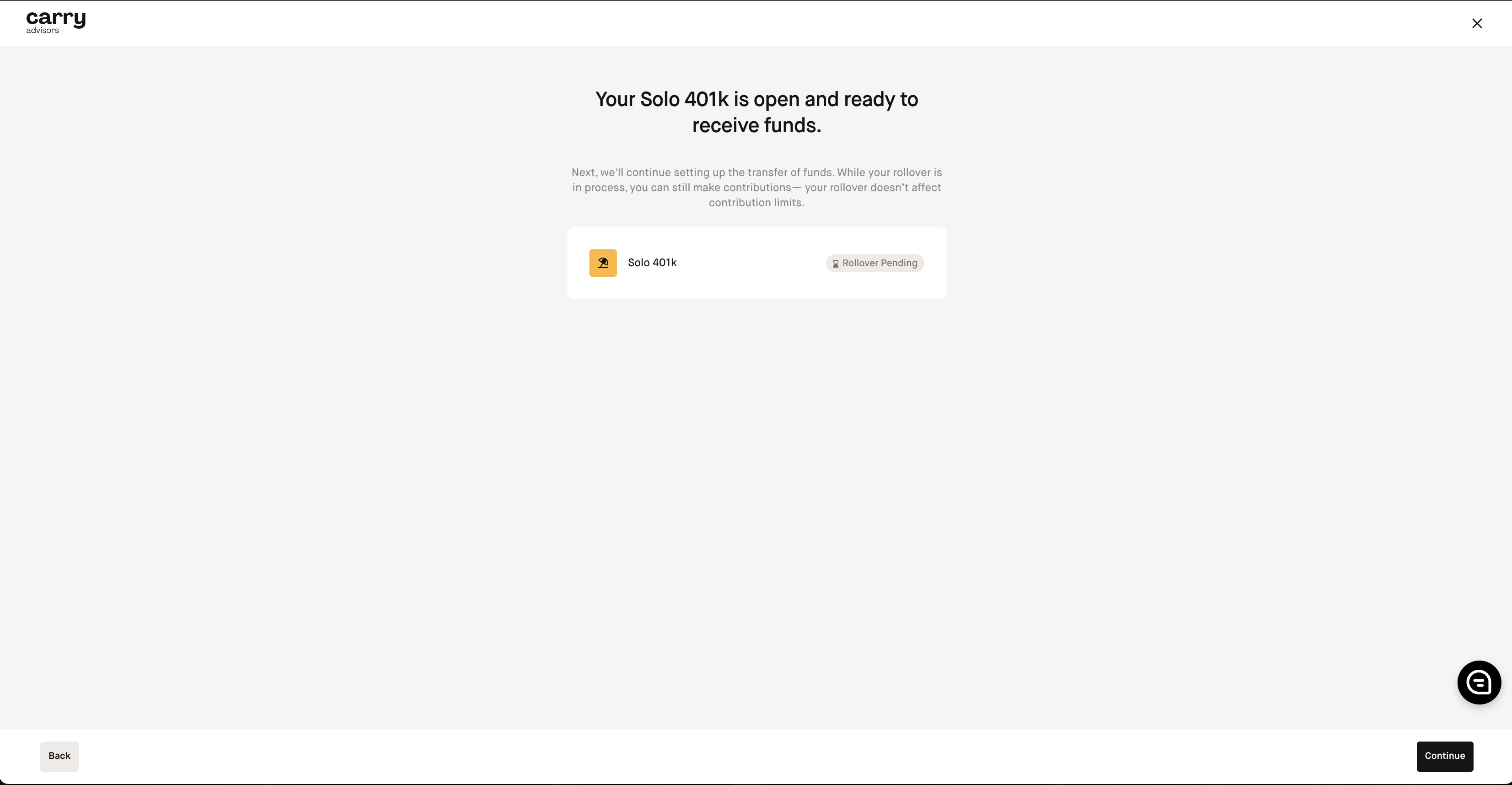

Step 9: Click 'Continue'

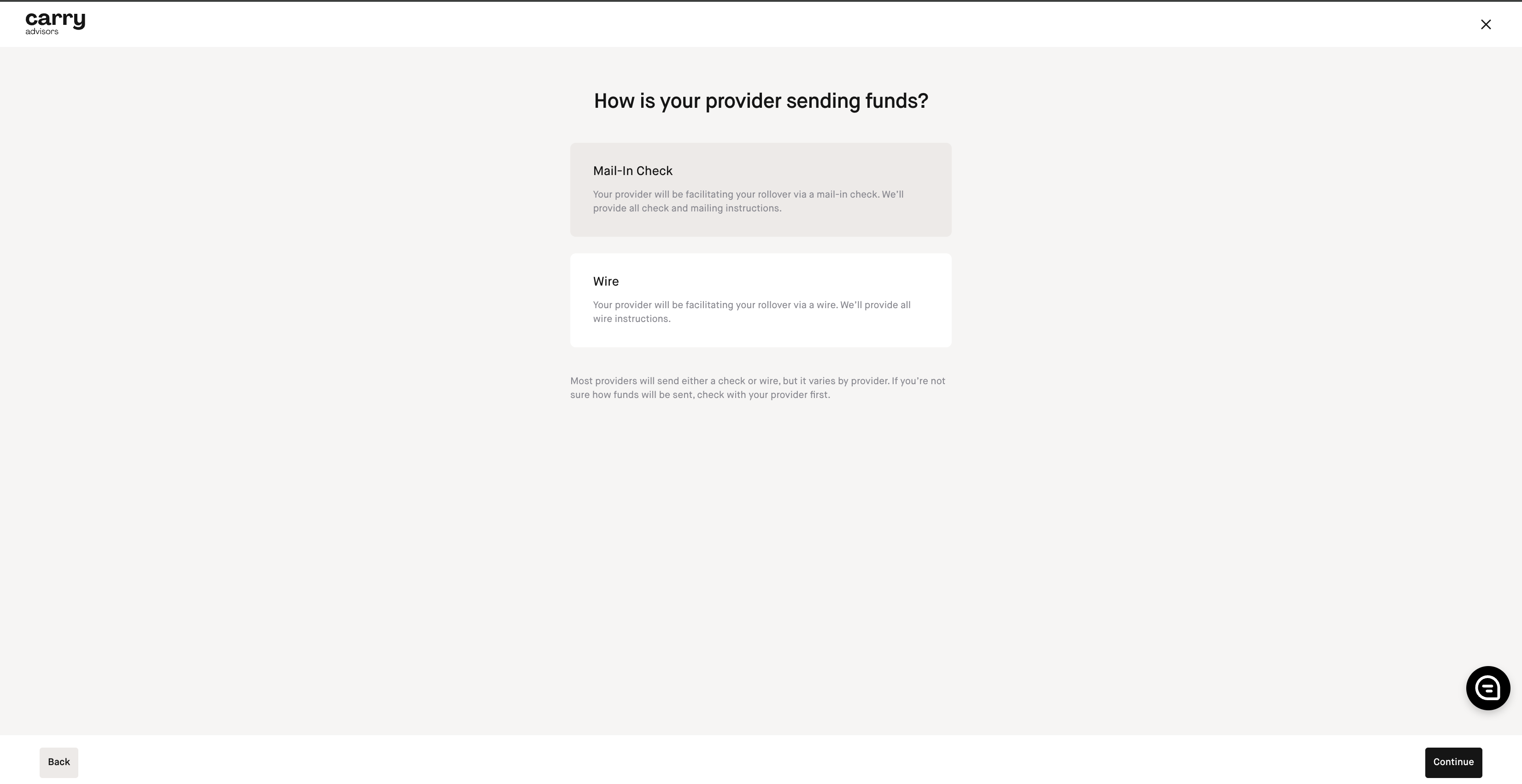

Step 10: Select how your account provider will be sending the funds over and click 'Continue'

Step 11: Obtain the unique wire or check details for your Carry destination account on this next screen shown to provide to the provider sending your account funds to Carry and click 'Continue'

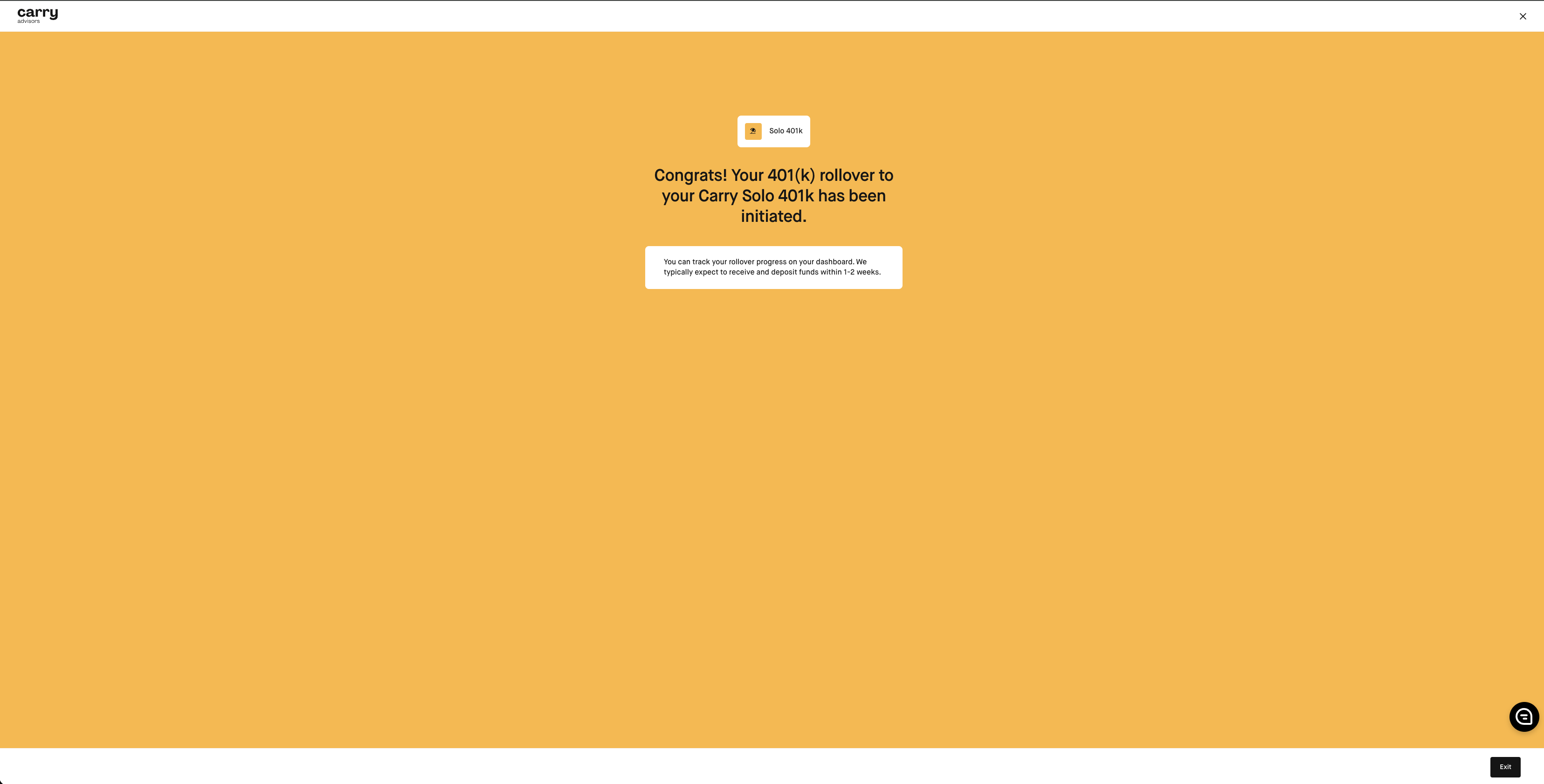

Step 12: You will reach the success screen and can click 'Exit'

If you are rolling over multiple accounts, repeat the process to get instructions for each account you're rolling over.

*Please note the firm where your sending account is currently held may also have separate required processes or their own paperwork to process the rollover or transfer so we recommend you check with them if you have any questions.

*Please note we do not support the transfer of any alternative assets at this time into a Carry Solo 401k.

How long do rollovers take?

Rollovers typically take several weeks to complete, depending on if transfer paperwork is required and if funds are sent by mail/check.

If you've given the wire or check instructions to your current provider and do not see any movement in your account over the next 1-2 weeks, we recommend reaching out to your provider directly to understand why, and if there are any blockers. Unfortunately, Carry is not able to inquire on the rollover status with the sending custodian on your behalf.