How to do a backdoor Roth IRA with Carry with funds from a new deposit

If your income exceeds the income limits, you can still get money into your Roth IRA by doing a backdoor Roth IRA. This involves making contributions to a Traditional IRA first (since it has no contribution restrictions based on income levels), and then immediately rolling over the funds into your Roth IRA.

Since the Roth IRA’s income limits only applies to contributions, and not rollovers, this backdoor conversion allows high income earners to put money into their Roth IRAs, regardless of their income levels.

Any timing considerations to be aware of?

It's typically recommended to do your contribution and conversion in the same year. The Pro Rata Rule (explained below) has a deadline of December 31. You should begin the process at latest by December 12 if you want to complete it in that year so the funds have time to move between accounts.

Here’s how it works in Carry.

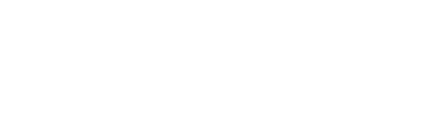

Step 1: Click into your Traditional IRA account and click 'Deposit'. Input the deposit amount you want to make and toggle the 'Enable Backdoor Roth conversion'

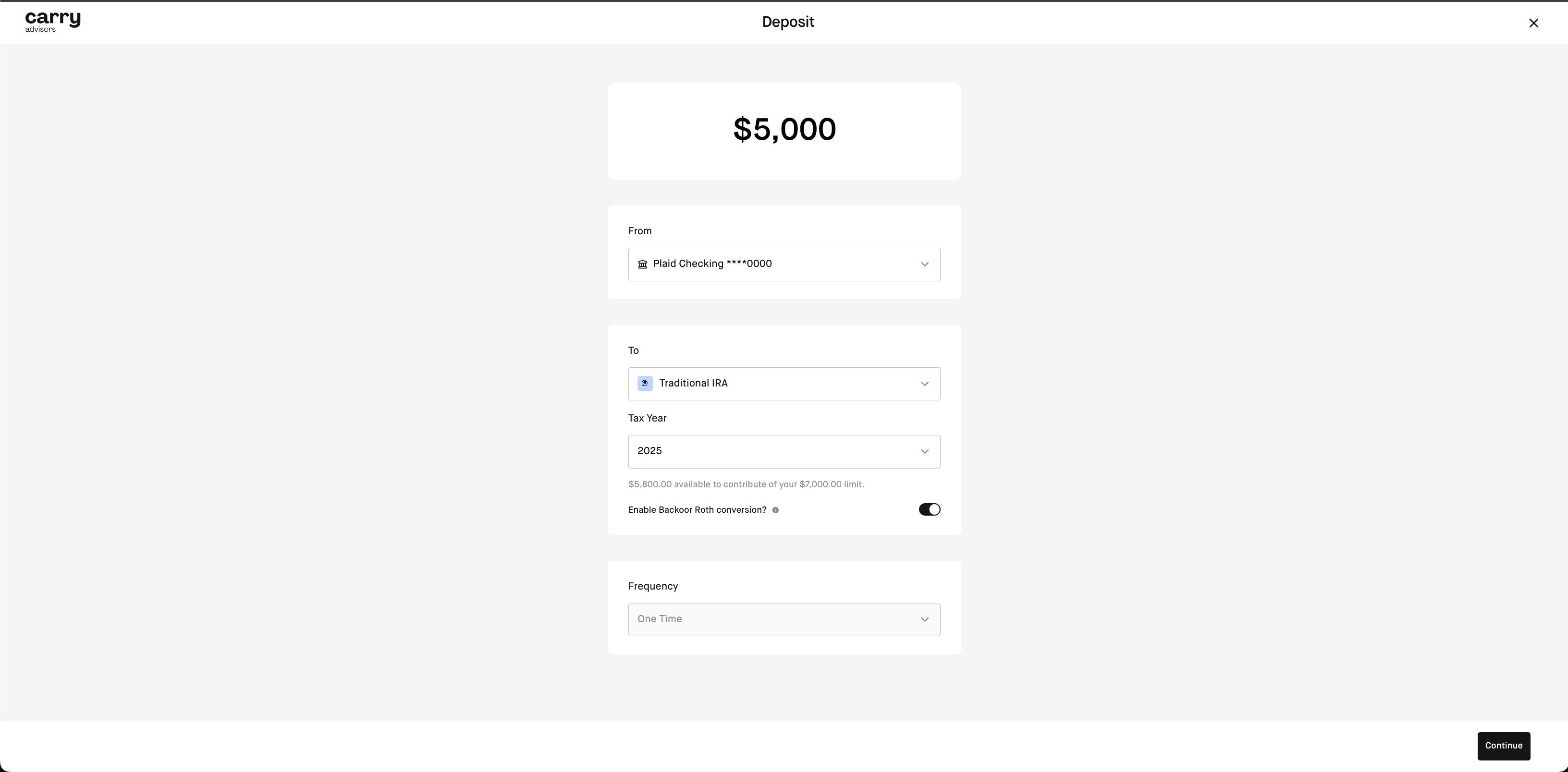

Step 2: Review the next screen and click 'Continue'

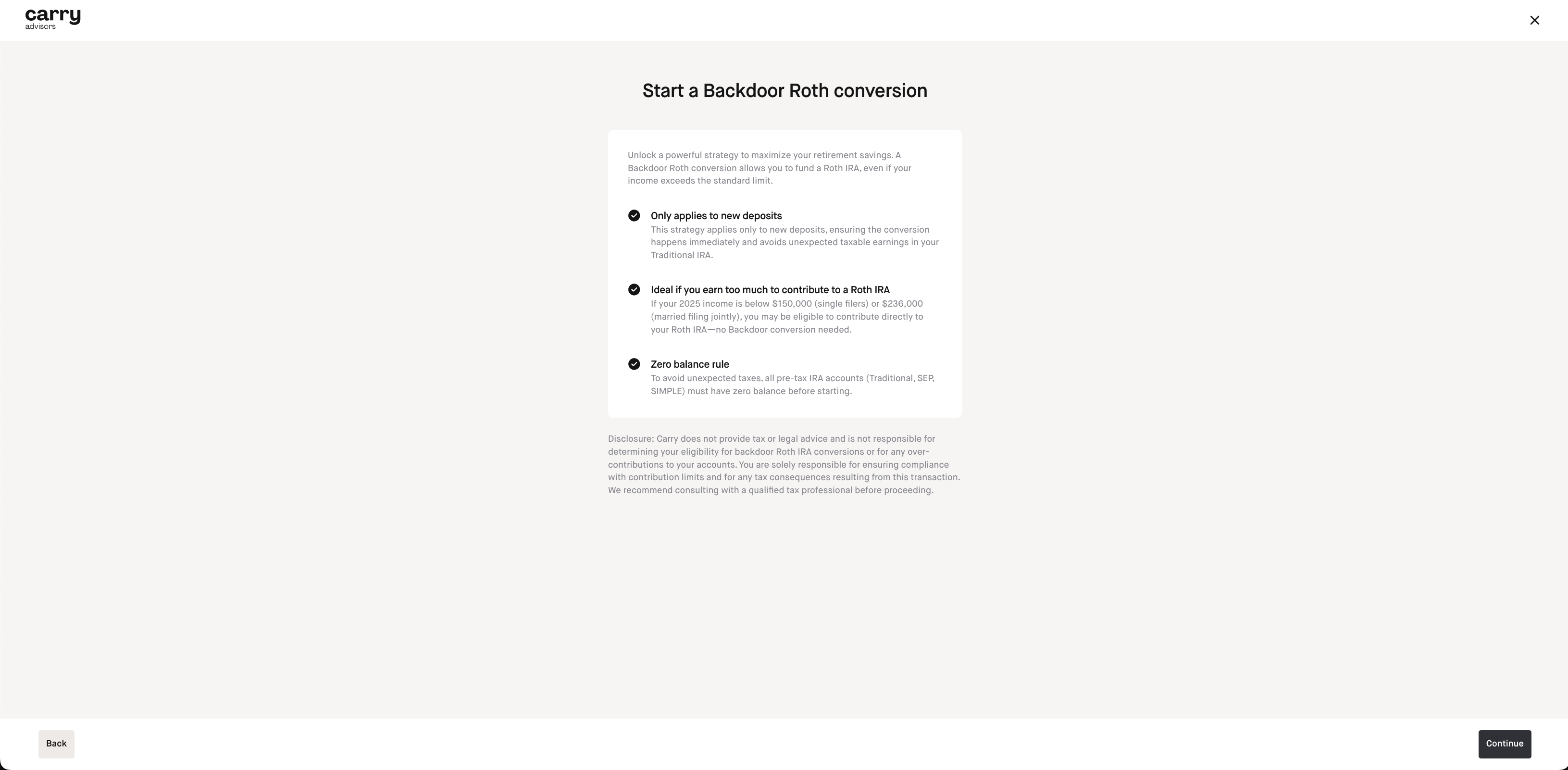

Step 3: Verify if you have any pre-tax assets outside of Carry

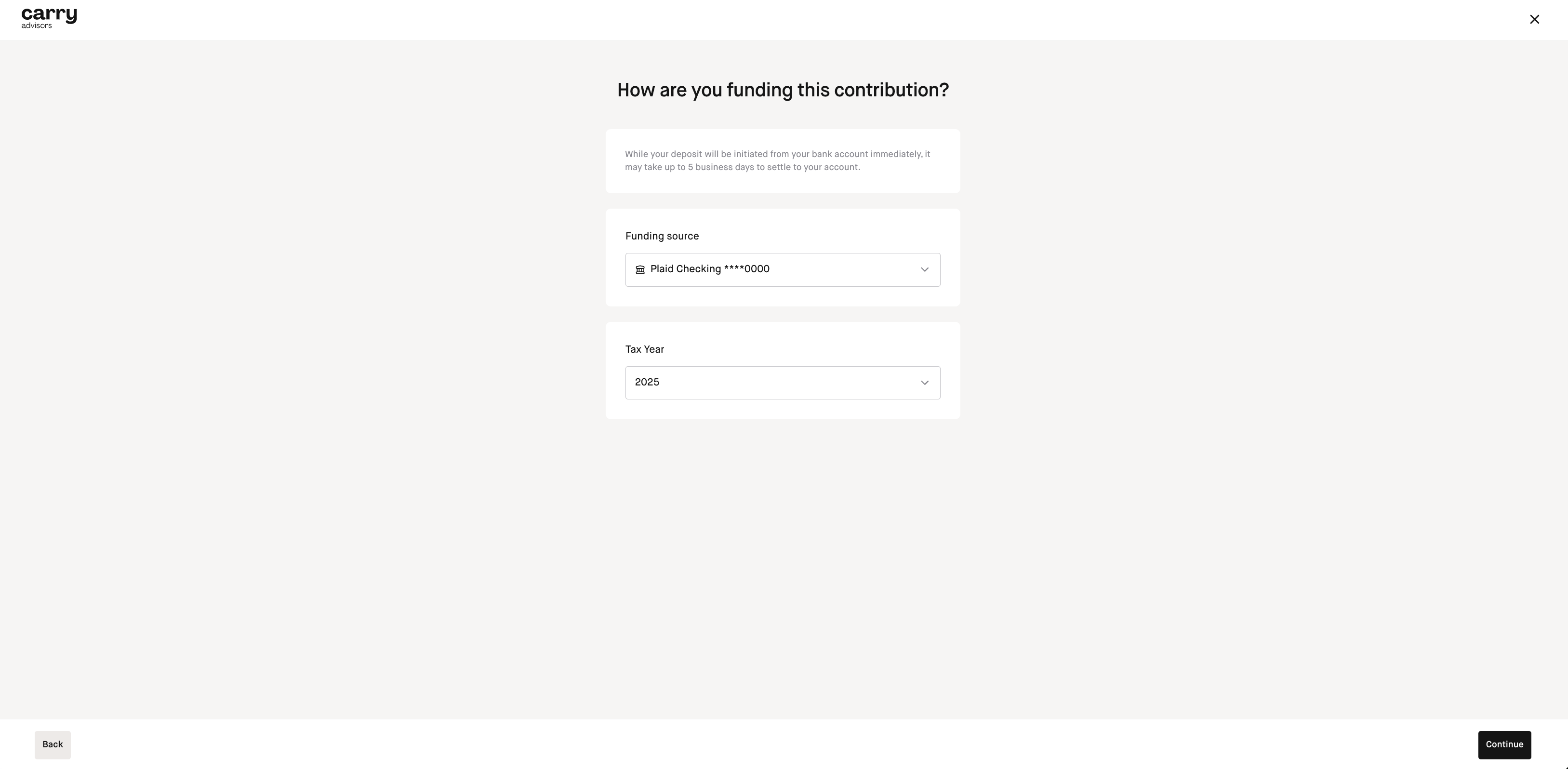

Step 4: Select your funding source and the tax year

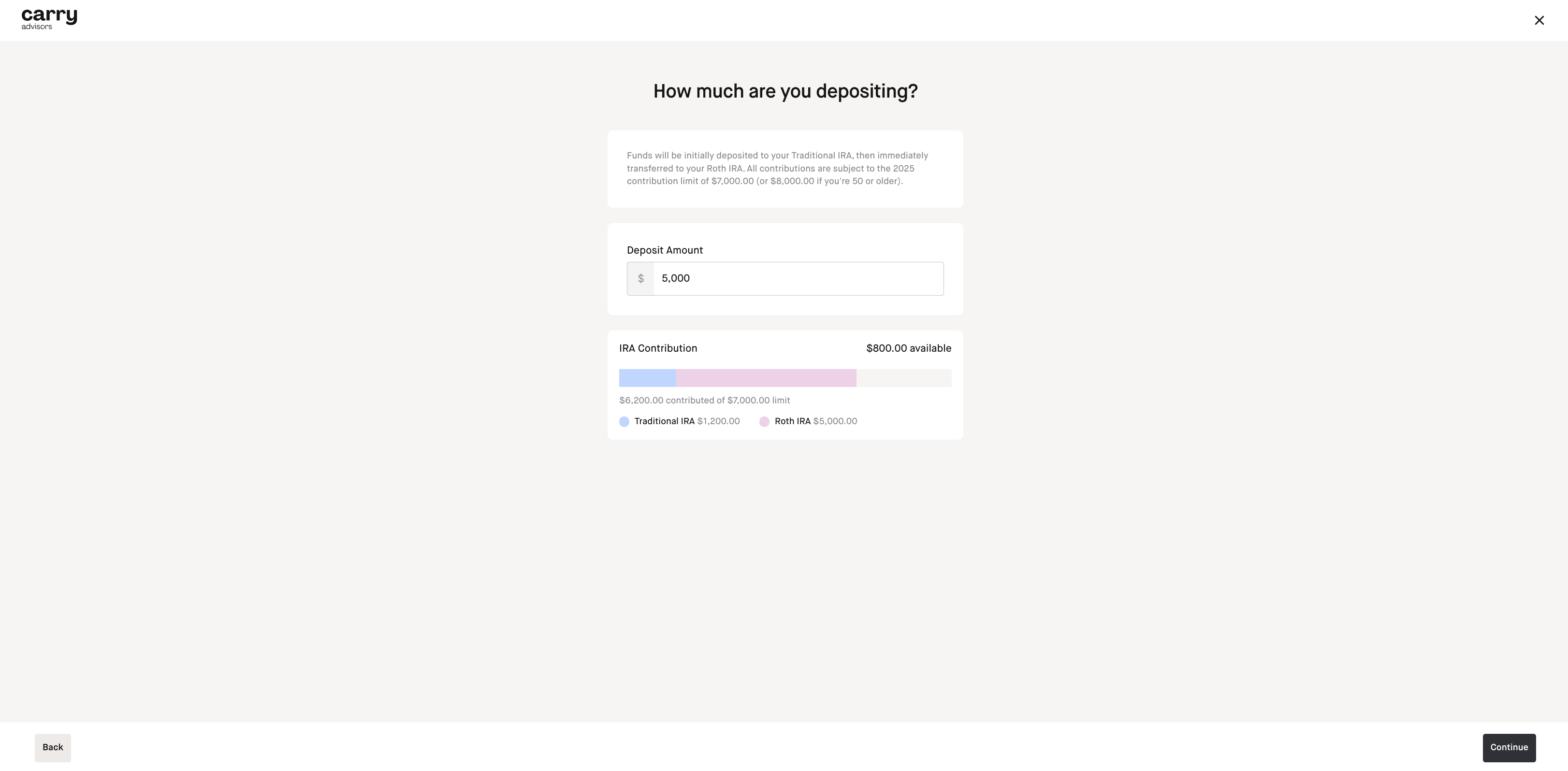

Step 5: confirm how much you are depositing and click 'Continue'

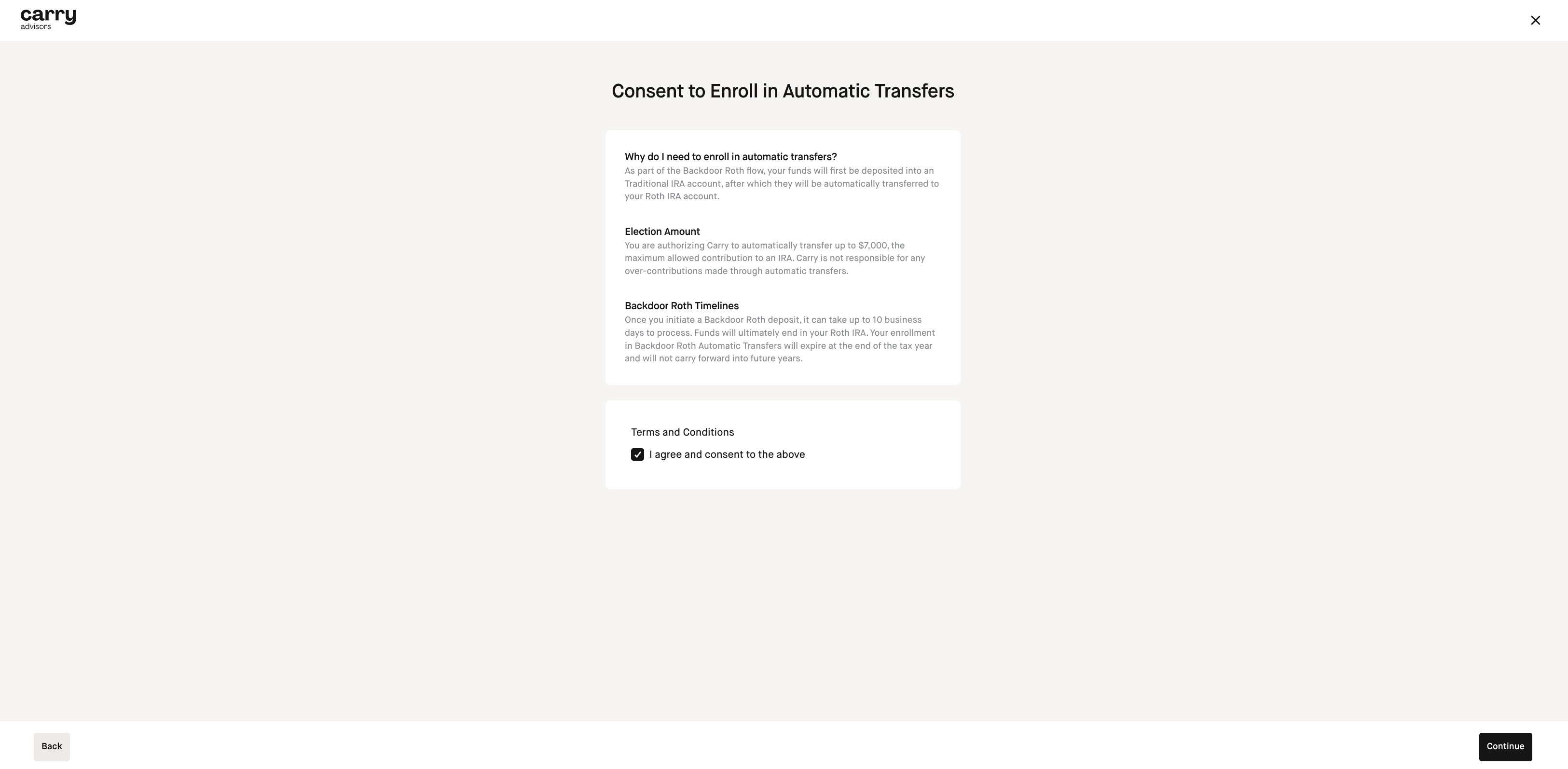

Step 6: Review the agreement and check the box to agree and click 'Continue'

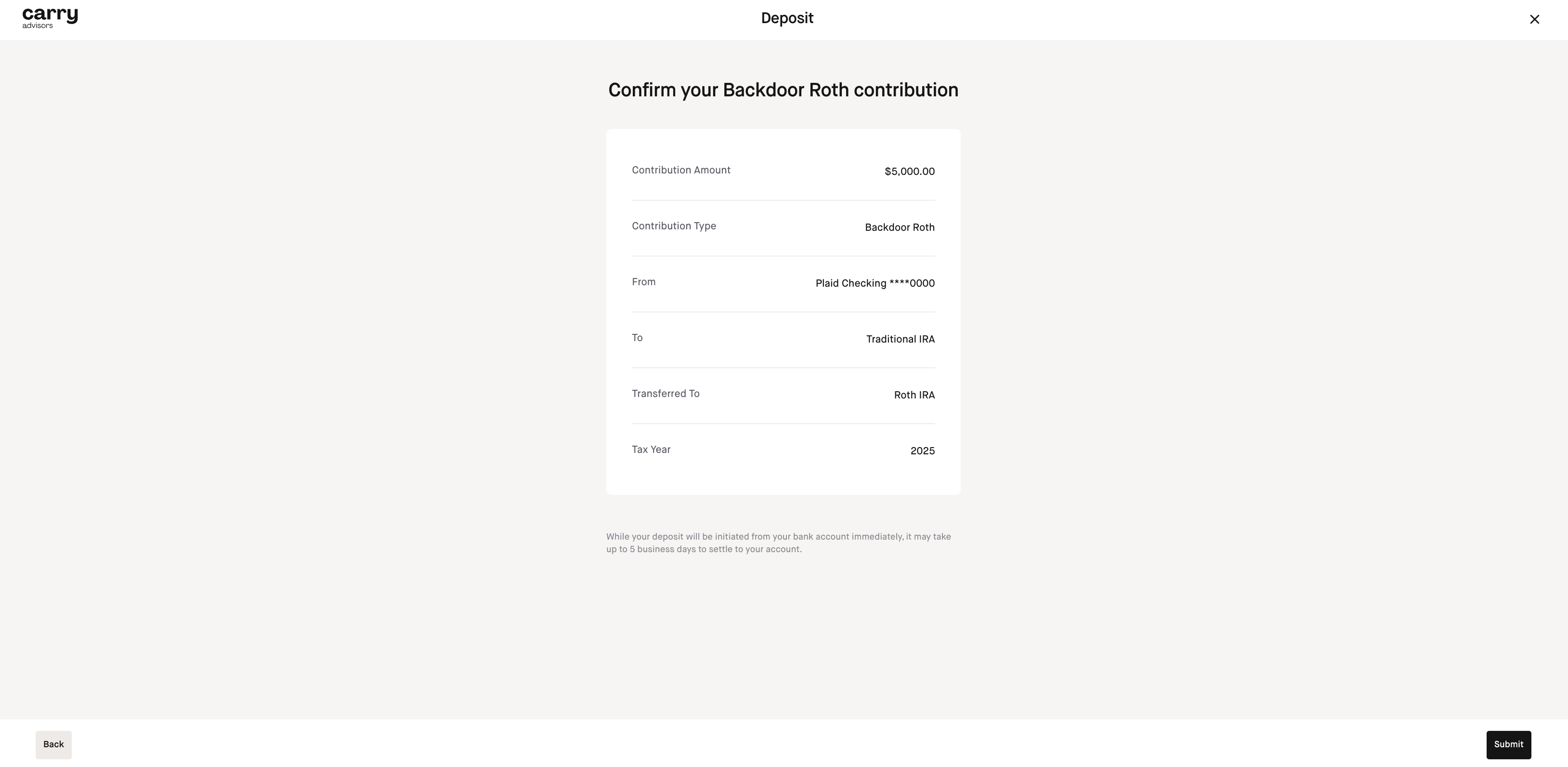

Step 7: Confirm your Backdoor Roth conversion by clicking 'Submit'

Work with a tax professional to understand and report the contribution and conversion in your taxes

You'll likely need to work with your accountant or tax filing software to add Form 8606 to report the non-deductible Traditional IRA contribution, as well as report the conversion amount.

A traditional IRA is funded with pre-tax income and a Roth IRA is funded with after-tax income. Therefore, a backdoor Roth IRA transfer from your Traditional IRA to your Roth IRA is a taxable event. The amount you transfer over is required to be added to your gross income for the tax year you make the transfer.

PRO-RATA RULE CONSIDERATIONS

Make sure to account for the pro-rata rule when determining your taxable amount from the conversion.

While a traditional IRA doesn’t have income limits that prevent high earners from contributing, it instead has a tax-deduction limit. If your modified adjusted gross income (MAGI) is over $83,000 for 2023 or $87,000 for 2024, you’re still allowed to contribute to your traditional IRA but you won’t receive any tax deductions. In other words, your contribution would be a post-tax contribution. If you had pre-tax funds in your traditional IRA, you would now have both post-tax and pre-tax money in the account, which would trigger the pro-rata rule when you do a backdoor Roth conversion.

The pro-rata rule applies whenever you have both post-tax and pre-tax income in your traditional IRA. You’re not allowed to choose only the post-tax portion when doing a Roth conversion. Instead, the pro-rata rule is used to determine the ratio that should be used to determine how much should be a pre-tax conversion and how much should be a post-tax conversion.

For example, if you have $100,000 in your non-Roth IRAs with a split of 90% pre-tax funds and 10% post-tax funds, this gives you a ratio of 9:1. In this case, your backdoor conversion would consist of 90% pre-tax funds and only 10% post-tax funds, and you would need to pay taxes on the amount of pre-tax funds being rolled over.

To avoid complicated tax situations when you file your taxes, it’s a good idea to ensure you have no other pre-tax IRA dollars across all your non-Roth IRAs. A clean solution for this is to rollover all your non-Roth IRA funds to your Carry Solo 401k first, which is fast and is not a taxable event. Once your non-Roth IRAs have a balance of zero, you can use it to make contributions into your traditional IRA and immediately rollover the funds to your Roth IRA, avoiding any occurrences where you have both pre-tax and post-tax funds in your accounts.