How can I do a Solo 401k Mega Backdoor Roth Conversion?

What is a Mega Backdoor Roth conversion?

The Mega Backdoor Roth allows you to bypass the Roth Solo 401k contribution limits by making an optional employee after tax contribution which goes to an After-Tax account first - then the funds are transferred into your Carry Roth Solo 401k or Roth IRA depending on which you have selected as your destination account for the Mega Backdoor Roth conversion. More details on destination accounts here.

A Mega Backdoor Roth conversion consists of many moving parts and can seem confusing if you’re attempting to do one for the first time. At Carry, we simplified it so that you can complete it in just a few clicks.

What is a Mega Backdoor Roth and is it right for you? Read this before getting started.

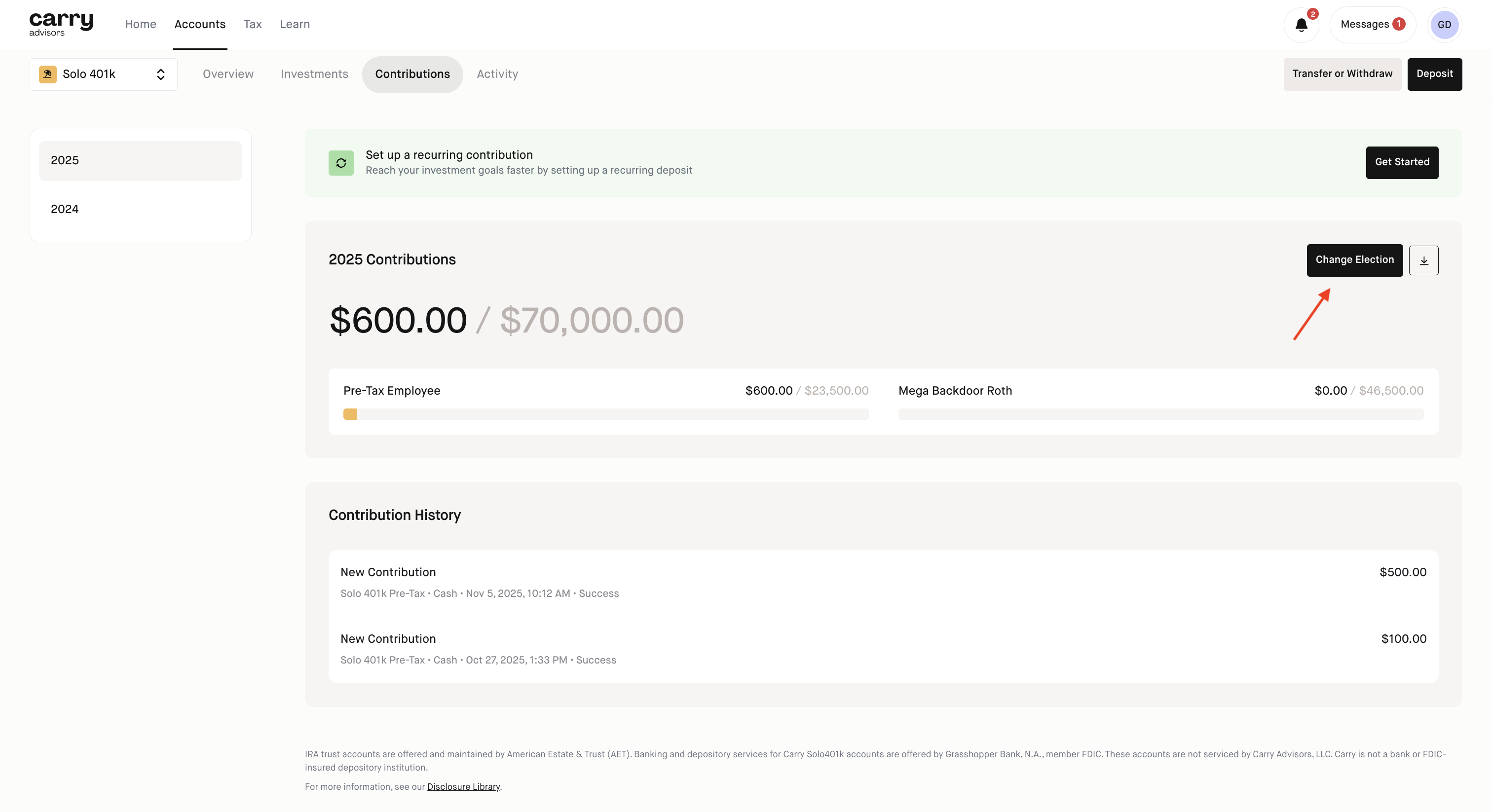

Step 1: If you don't already have it enabled, in your Solo 401k account, click 'Contributions' tab, then 'Change Election' or 'Calculate Limit' if you have not set up your election prior

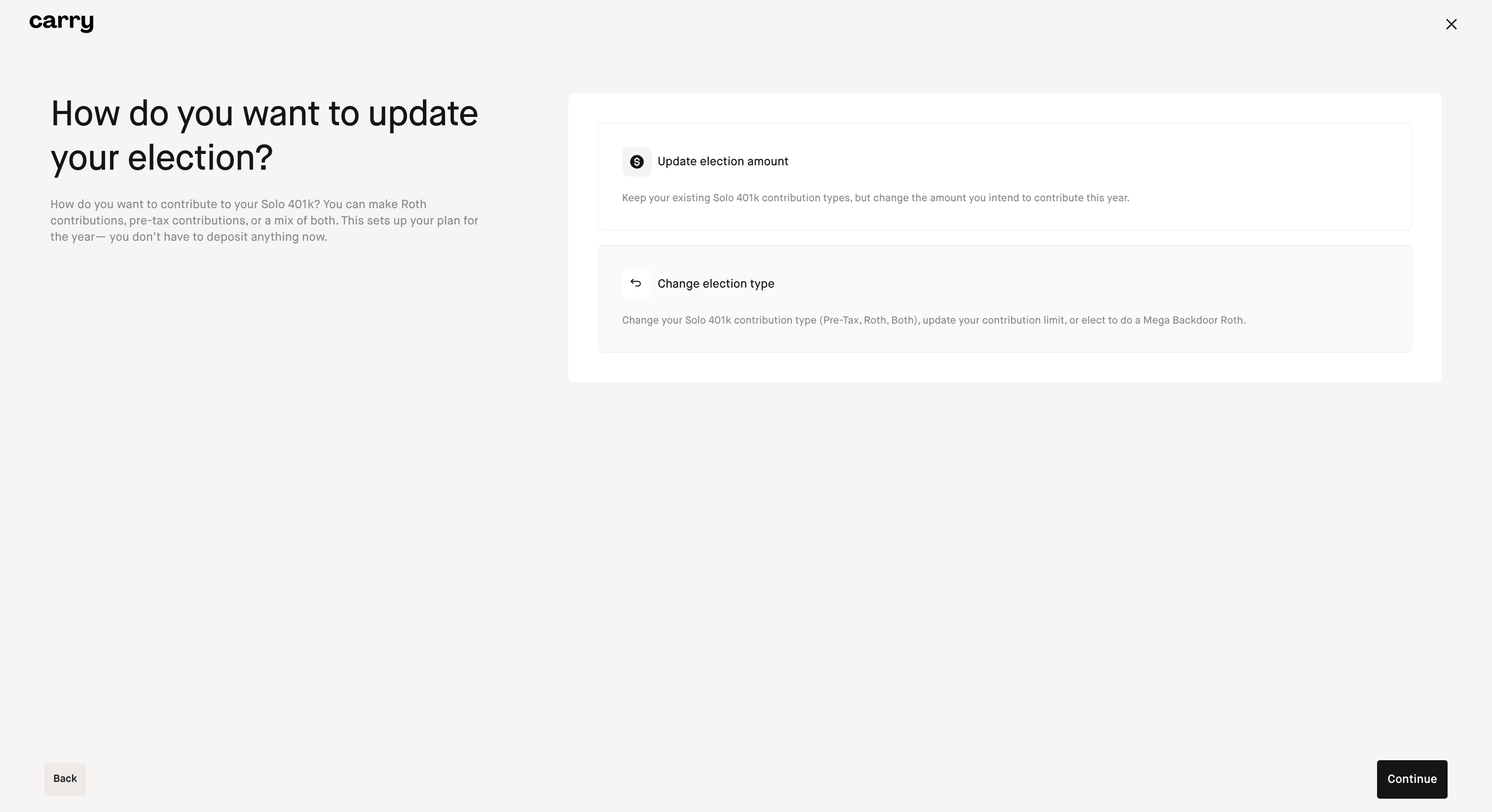

Step 2: Then select 'Change election type'

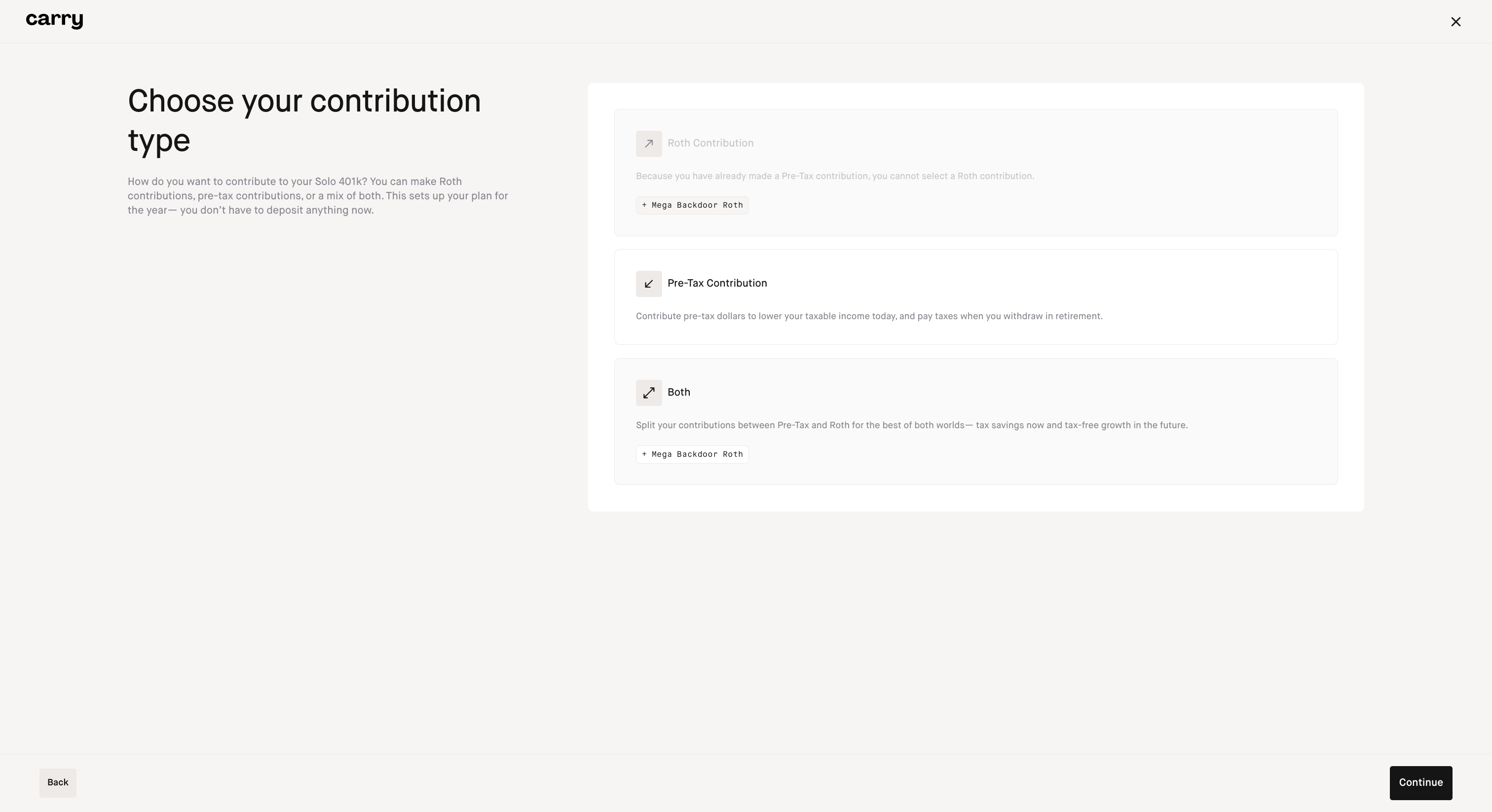

Step 3: Pick one of the options that includes '+ Mega Backdoor Roth'

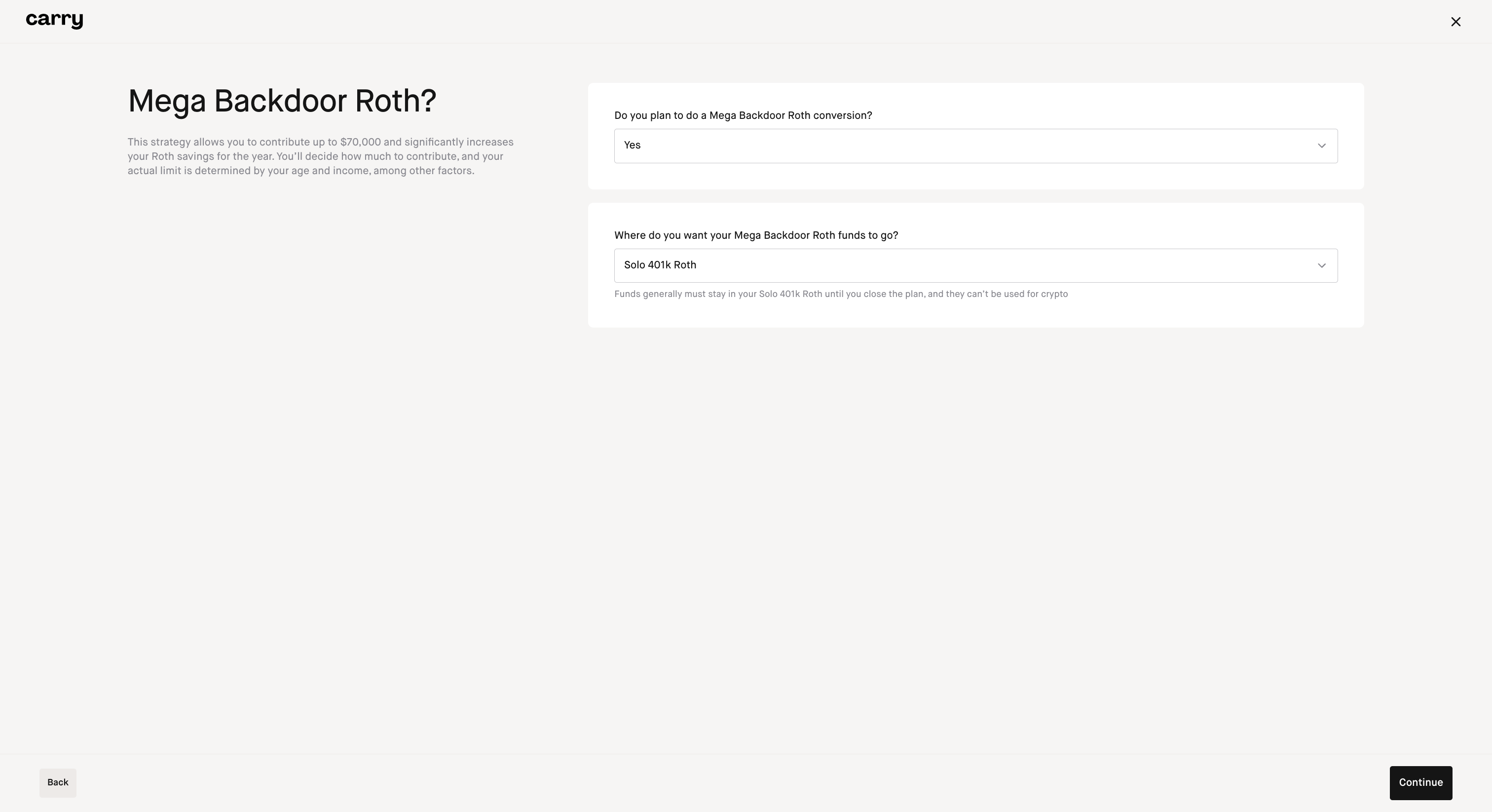

Step 4: Answer 'Yes' and select the destination account where you want your Mega Backdoor Roth funds to go: either a Solo 401k Roth account or a Roth IRA account

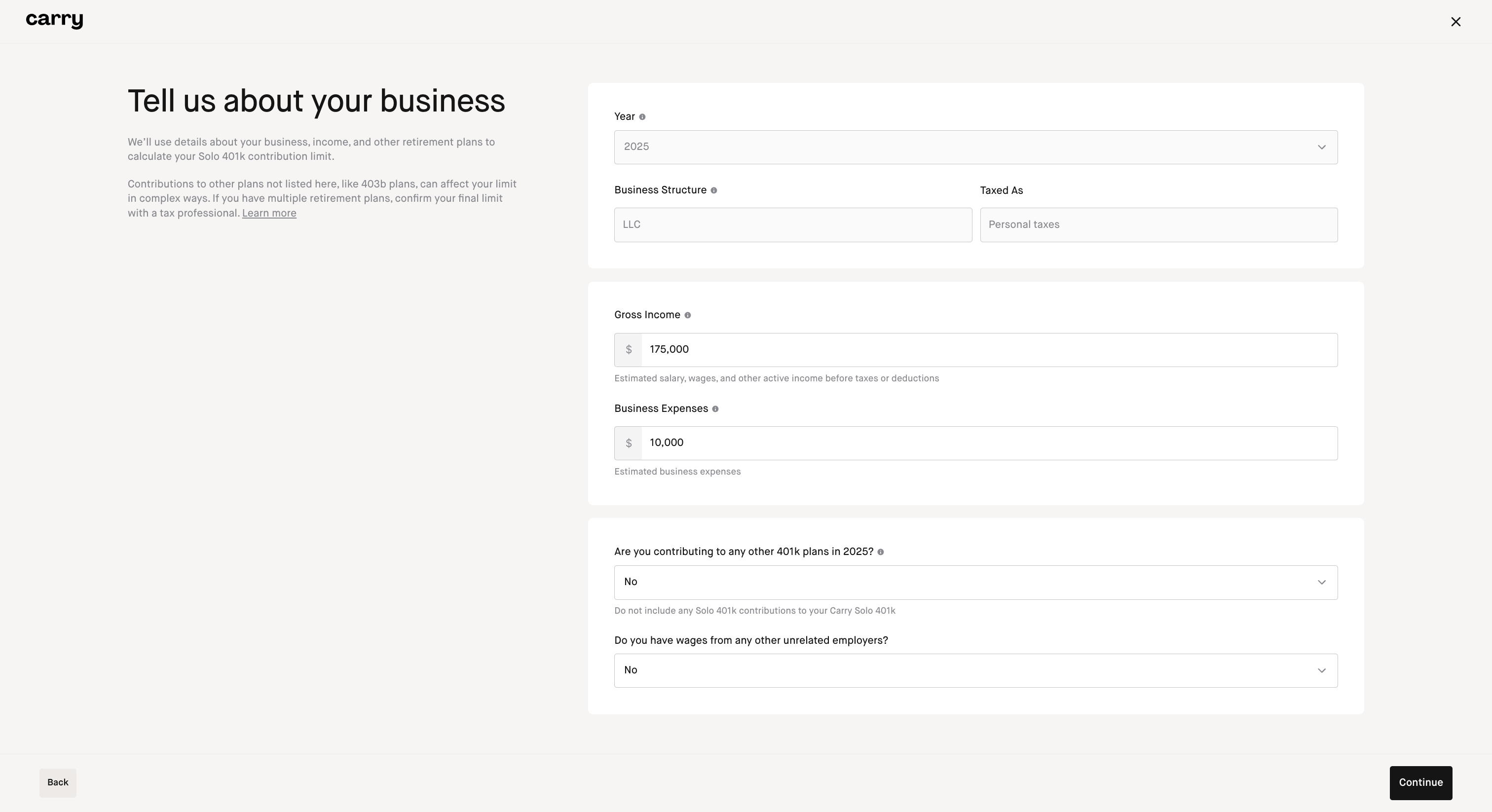

Step 5: Confirm your business details and income

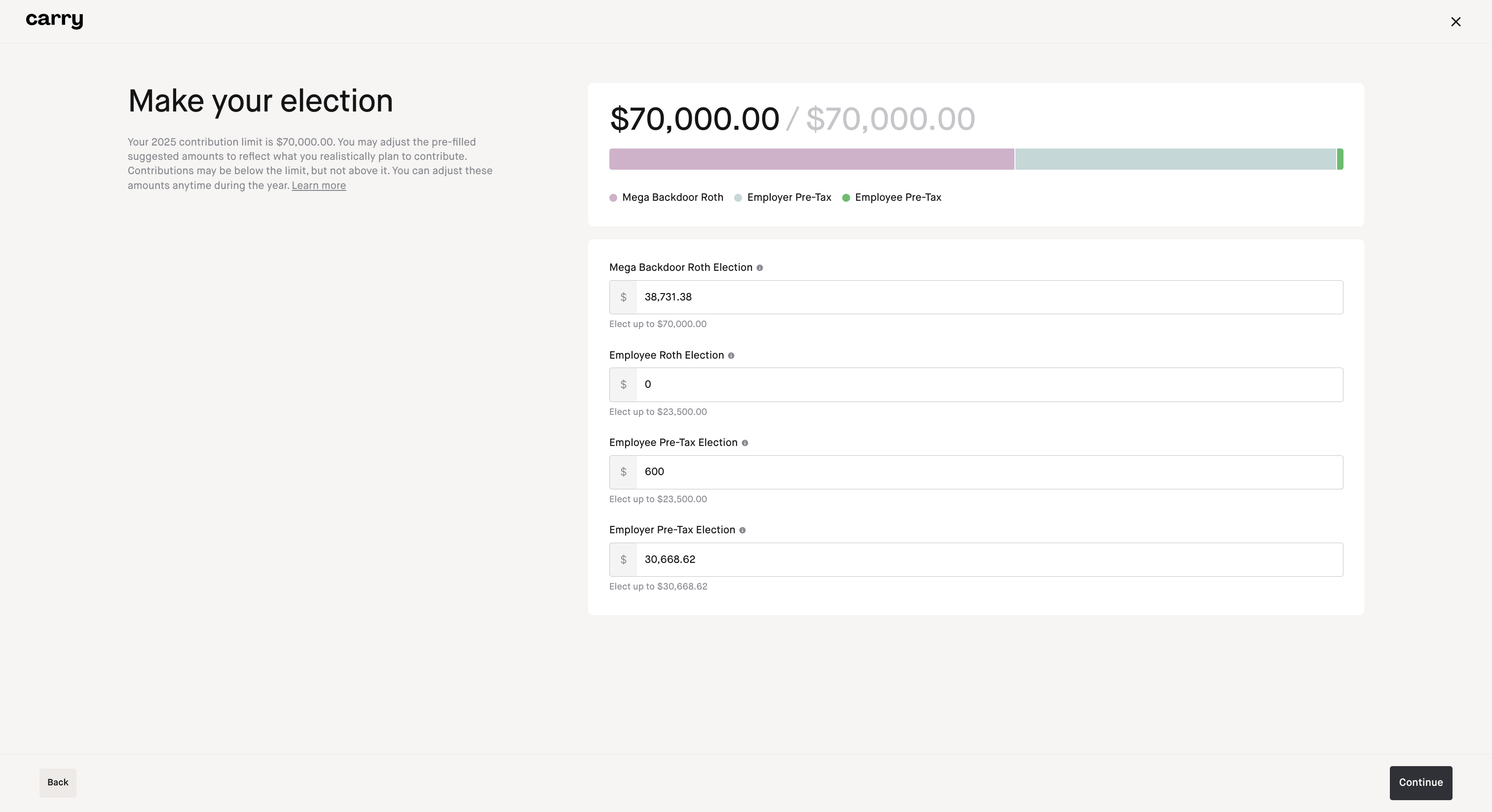

Step 6: Make your contribution elections for your preferred contribution types

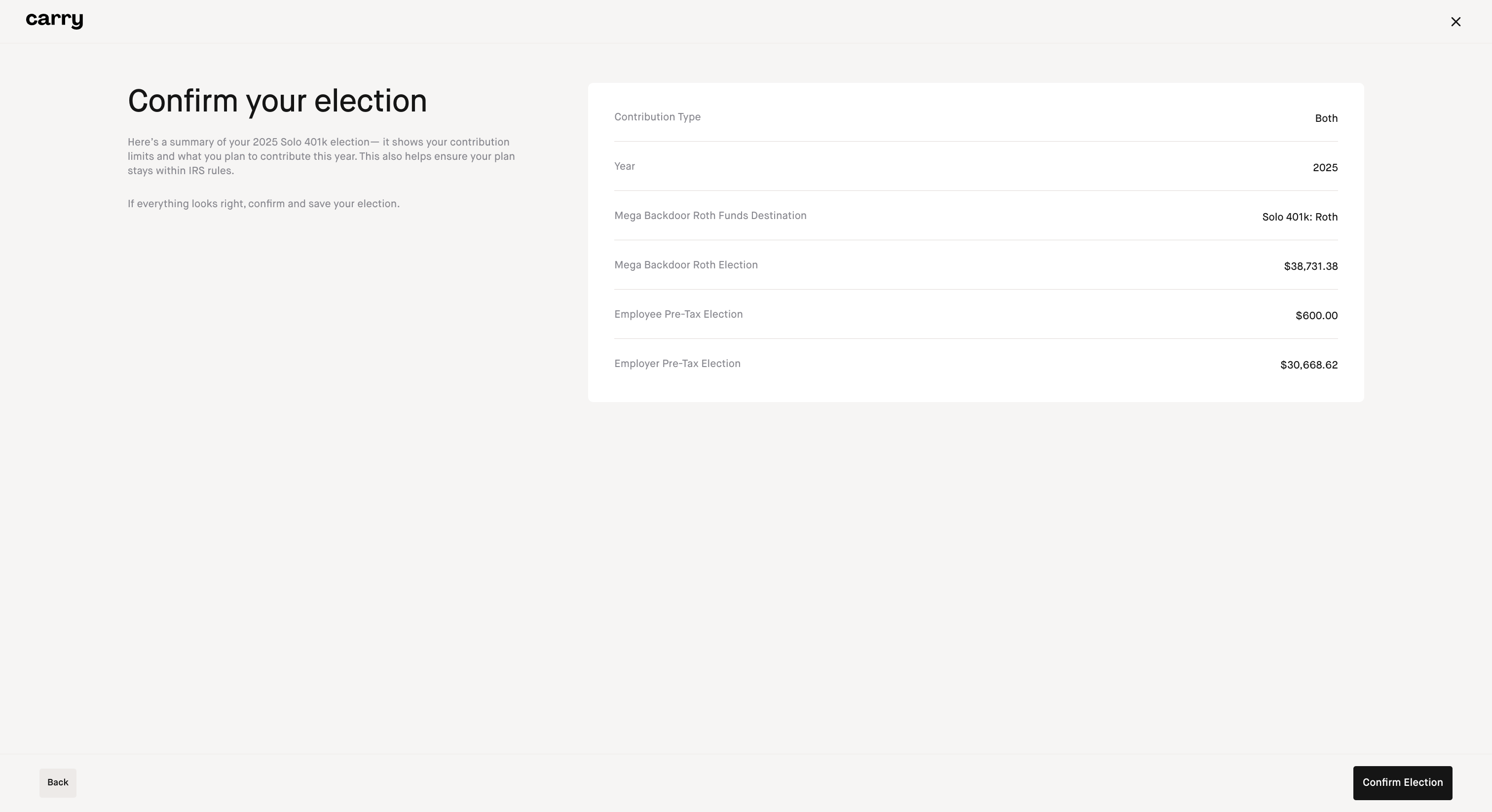

Step 7: Confirm your contribution elections

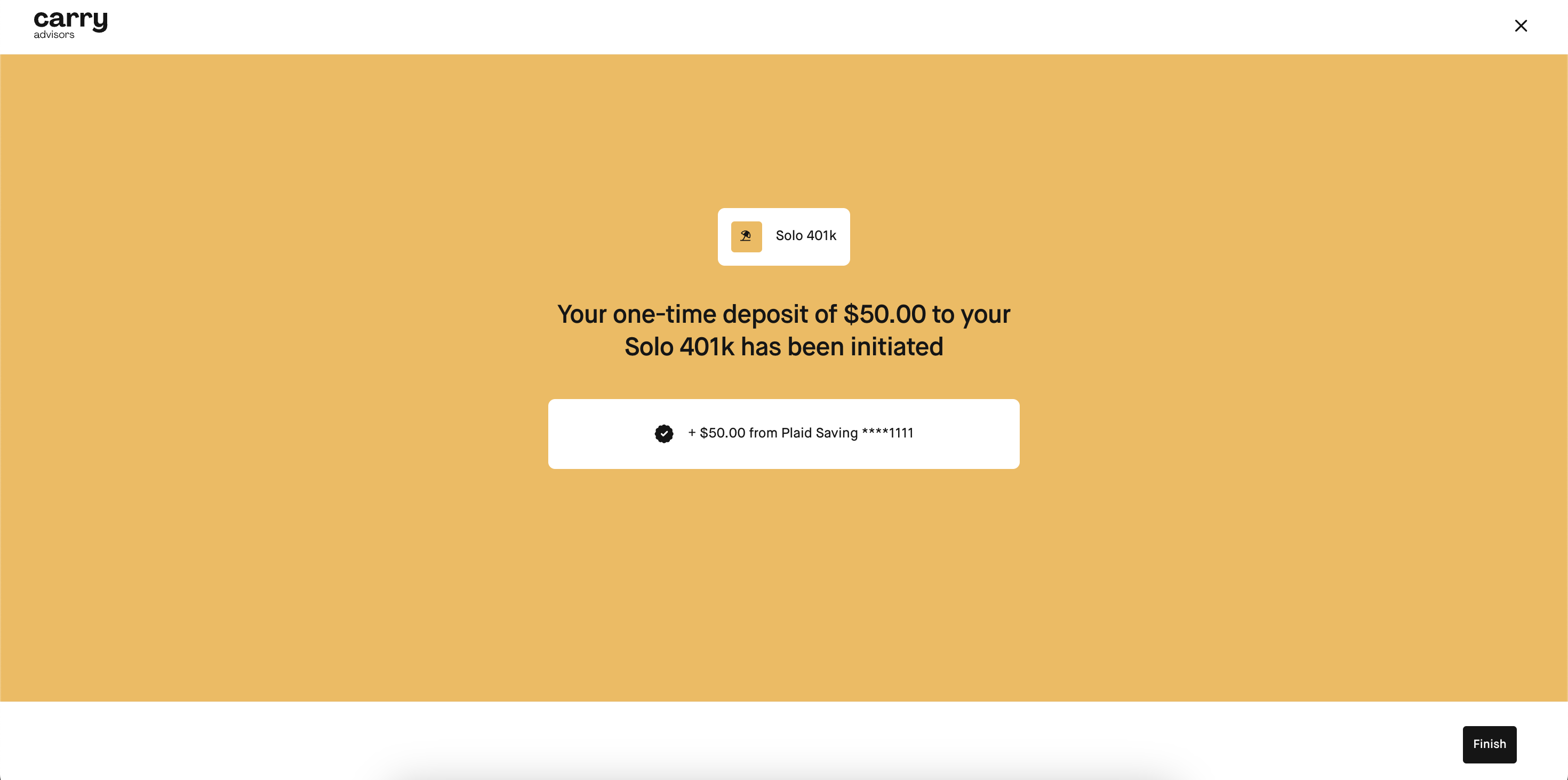

To make your first Mega Backdoor Roth deposit

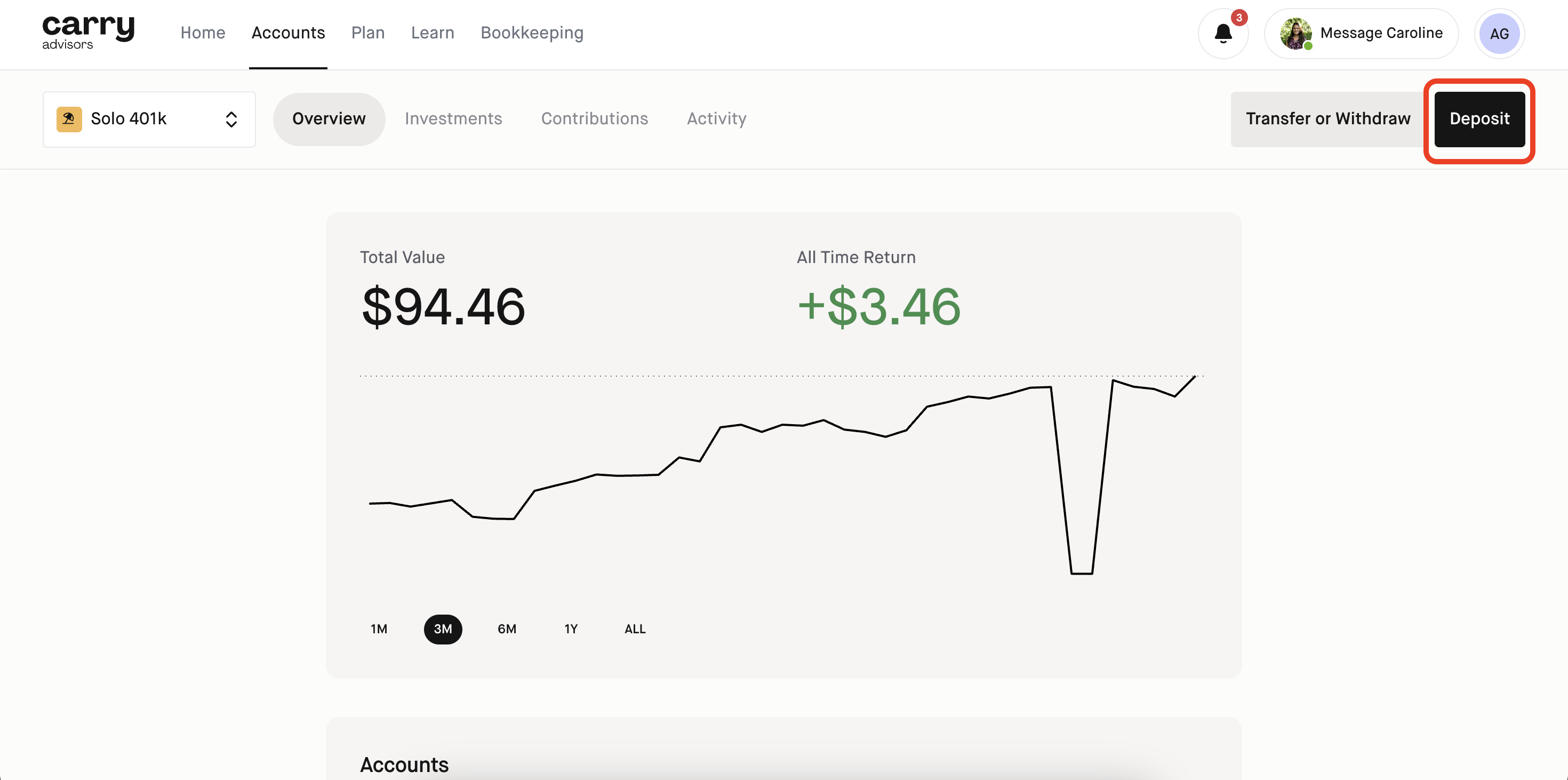

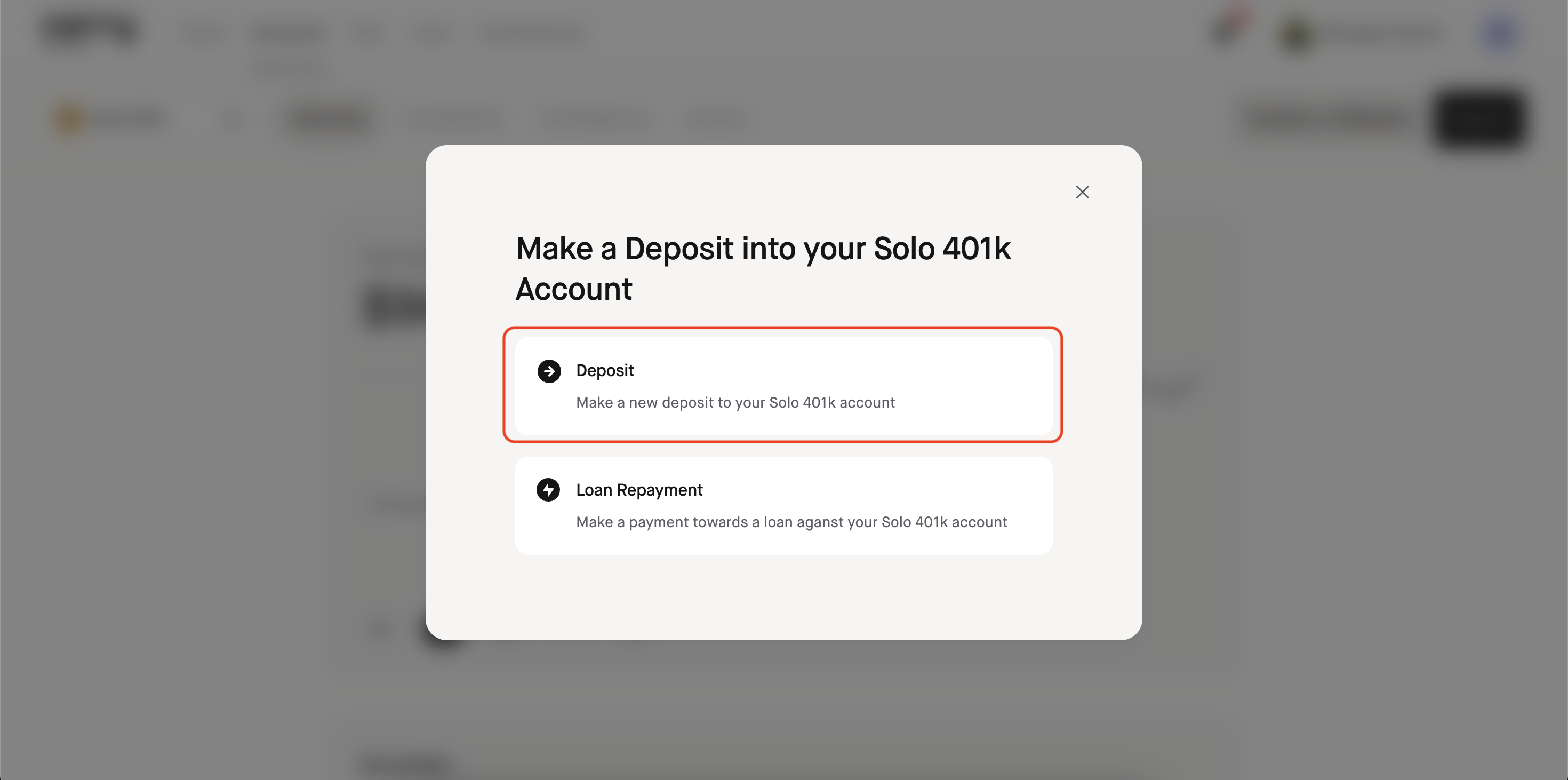

Go into your Solo 401k account and click "Deposit"

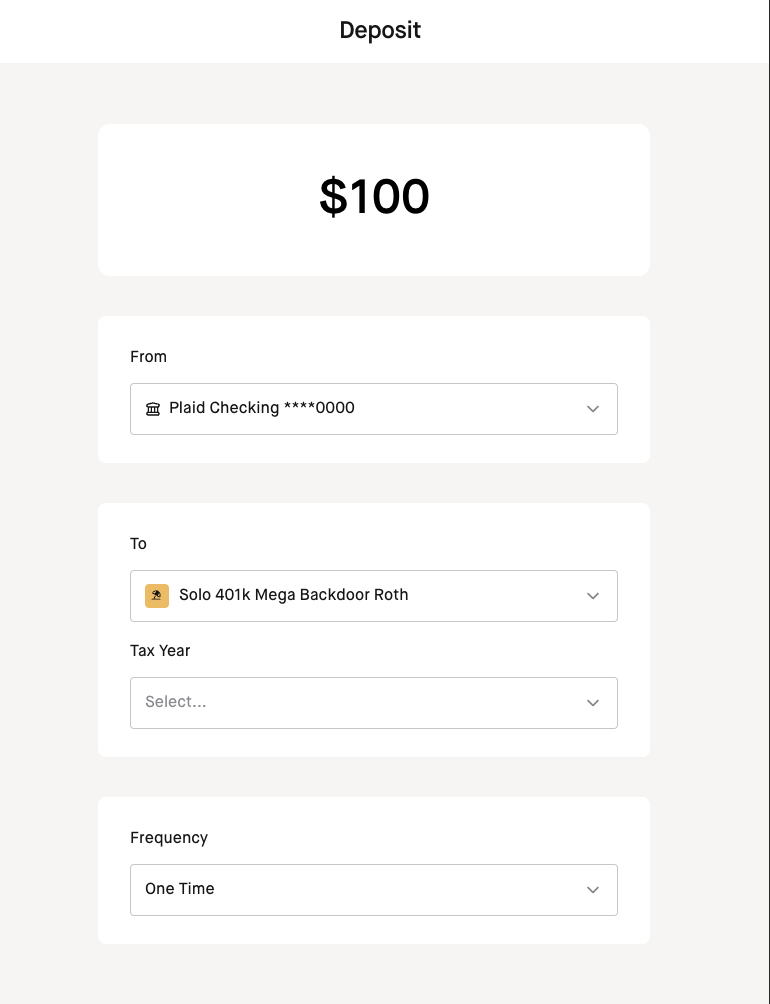

Choose Solo 401k Mega Backdoor Roth as the destination account and select the year:

Don’t forget to report the conversion in your 1099-R

Mega Backdoor Roth conversions must be reported to the IRS using the 1099-R form. Learn more about the 1099-R here.