How to get a solo 401k loan with Carry

The Carry Solo 401k supports the ability to take out a loan from your plan. You’re allowed to borrow up to 50% of your account value, up to a maximum of $50,000.

Solo 401k loans are fast, there are no credit checks, you can use the money for whatever you want, and you have up to 5 years to pay it back. If you’re using the money from the loan to acquire a dwelling unit as your principal residence, you may get up to 30 years for repayment.

The interest rate is prime rate (as reflected in the Wall Street Journal on the date of the loan) + 1%. You may qualify for a lower interest rate if you’re on active duty in the military. The interest is paid back to your Solo 401k plan account.

Our platform only supports one loan at a time and the funds for the loan have to come from one Solo 401k account, it cannot be across multiple accounts.

In order to take another loan out for the full eligible amount, you'd need to wait until 12 months have elapsed from the date you fully pay back the initial loan.

Maximum amount of loan: When added to the outstanding balance of all other loans from all plans of the Employer, a loan may not exceed the lesser of:

A) $50,000 minus the difference between the highest outstanding balance of loans in the past 12 months and the outstanding balance of loans from the Plan on the date the loan is made, or

B) The greater of (i) 50% of the vested account balance under the Plan; or (ii) $10,000.

Here’s how it works:

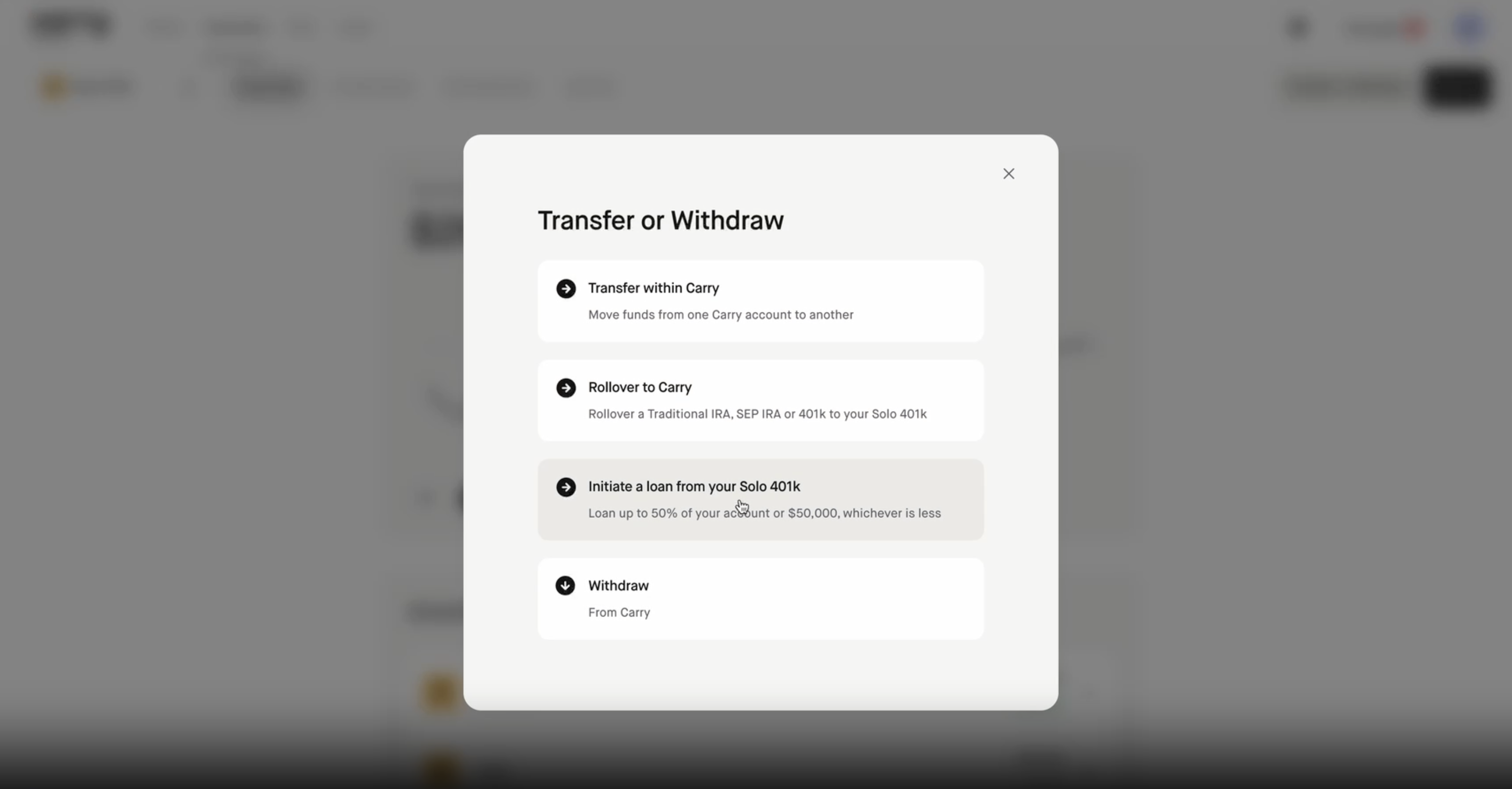

Step 1: Go to your Solo 401k account page and click 'Transfer or Withdraw'. Then click 'Initiate a loan from your Solo 401k'

Keep in mind that the loan start date will be the date you complete the process and withdraw the funds.

In order to withdraw funds, they must be available in cash and show as 'available to withdraw' (not in pending).

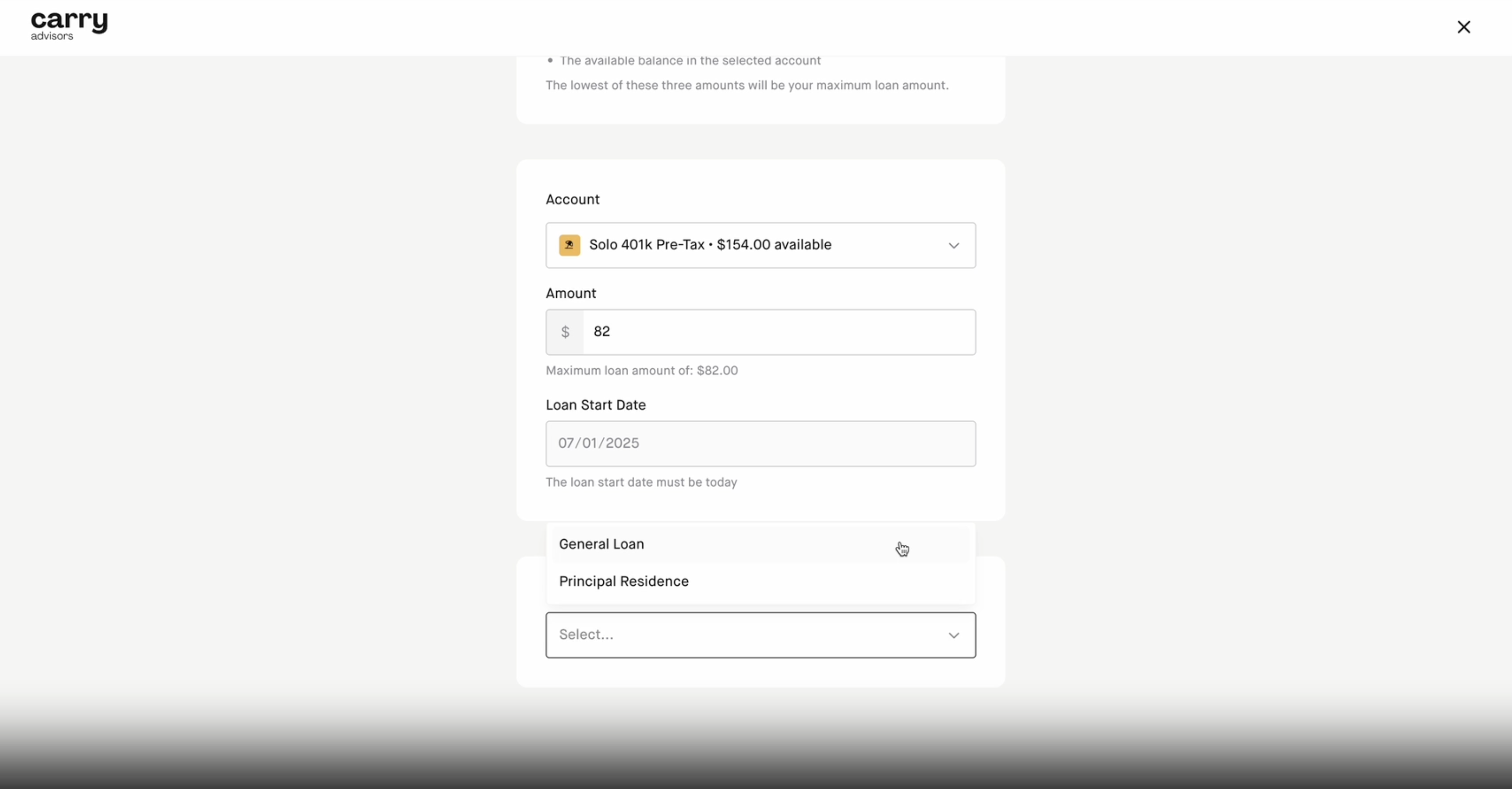

Step 2: Select the account, the amount you are borrowing and the loan type

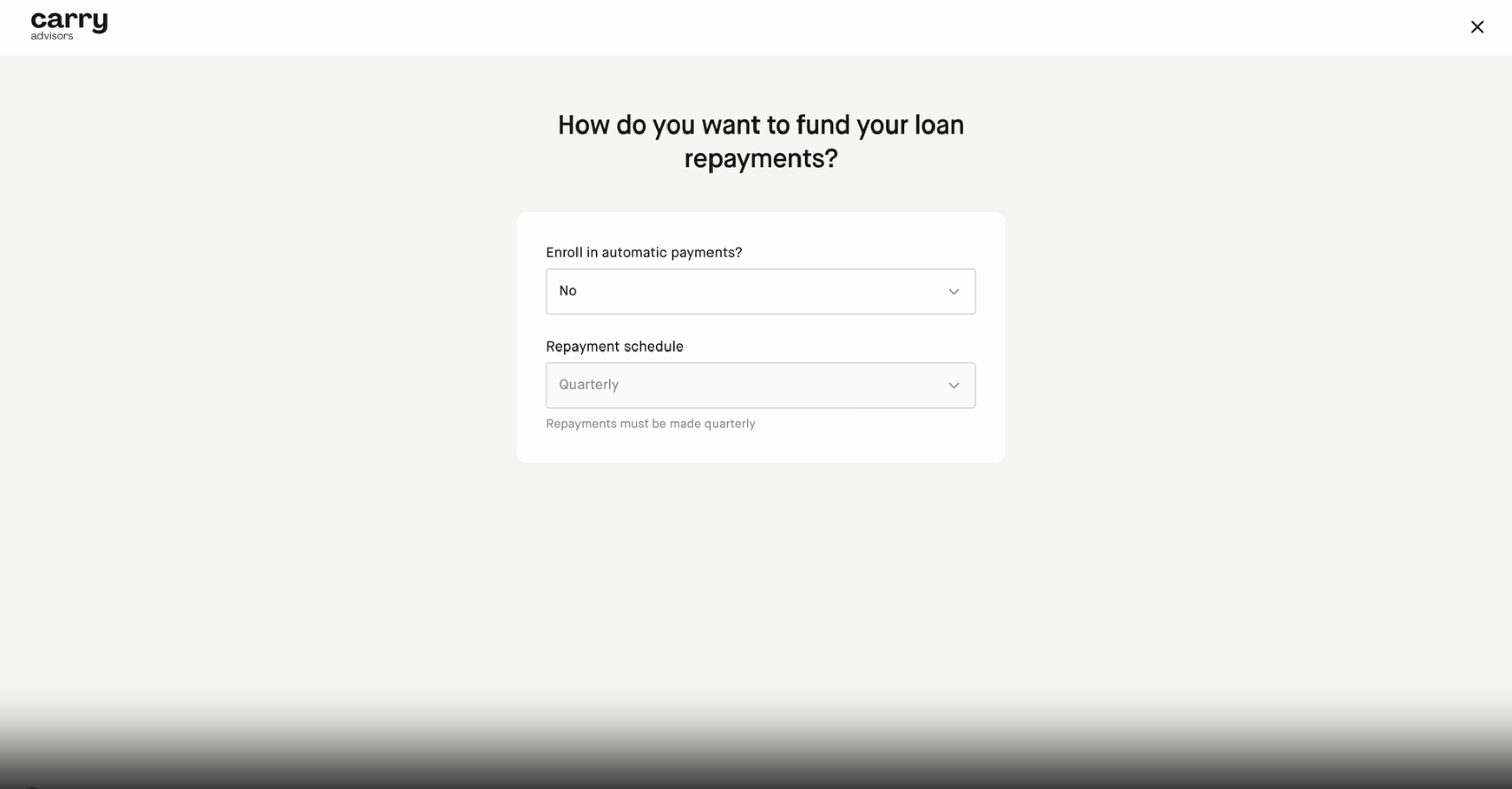

Step 3: Input how you want to fund your loan repayments

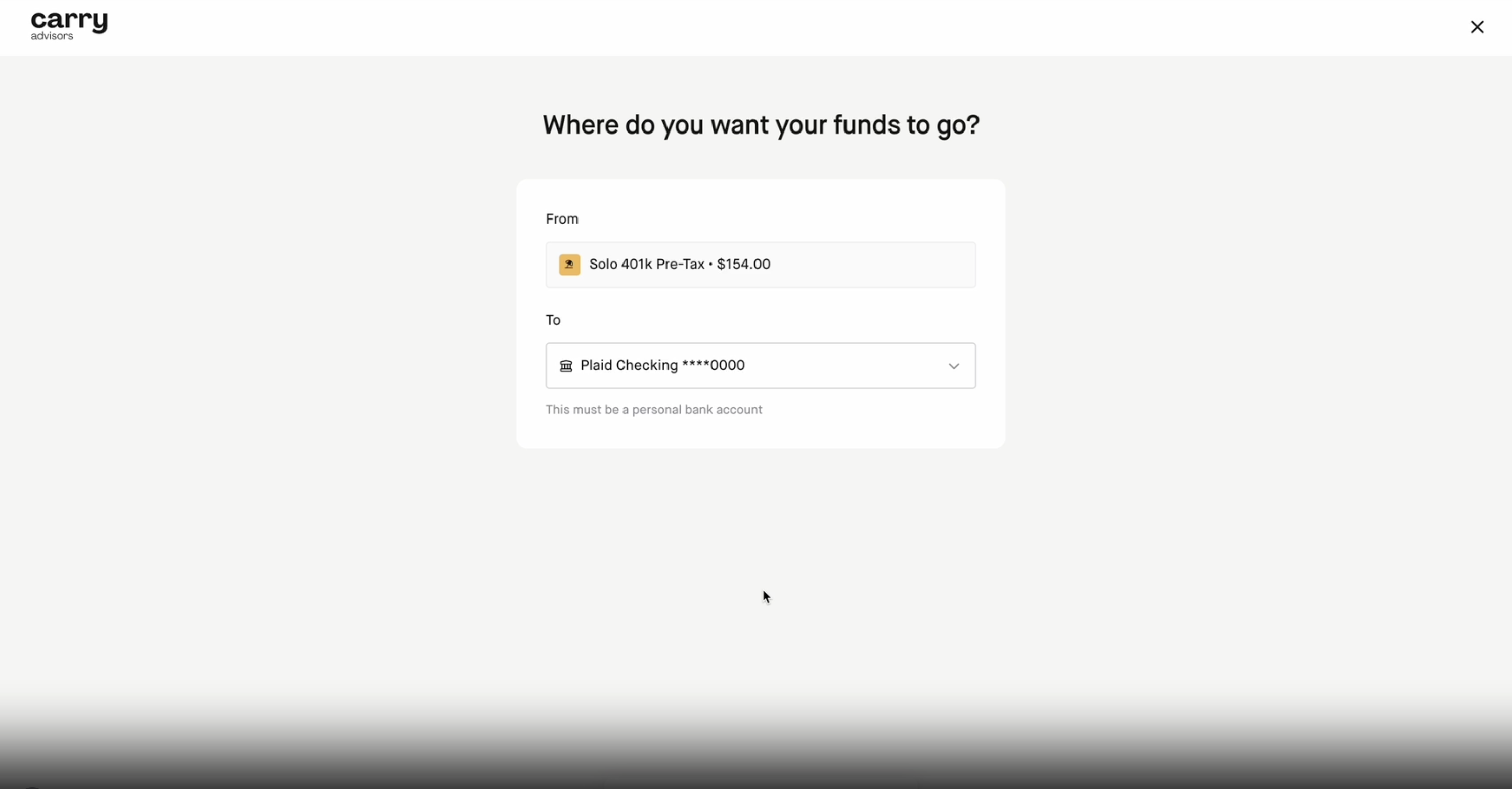

Step 4: Input the destination of the funds you are withdrawing for the loan

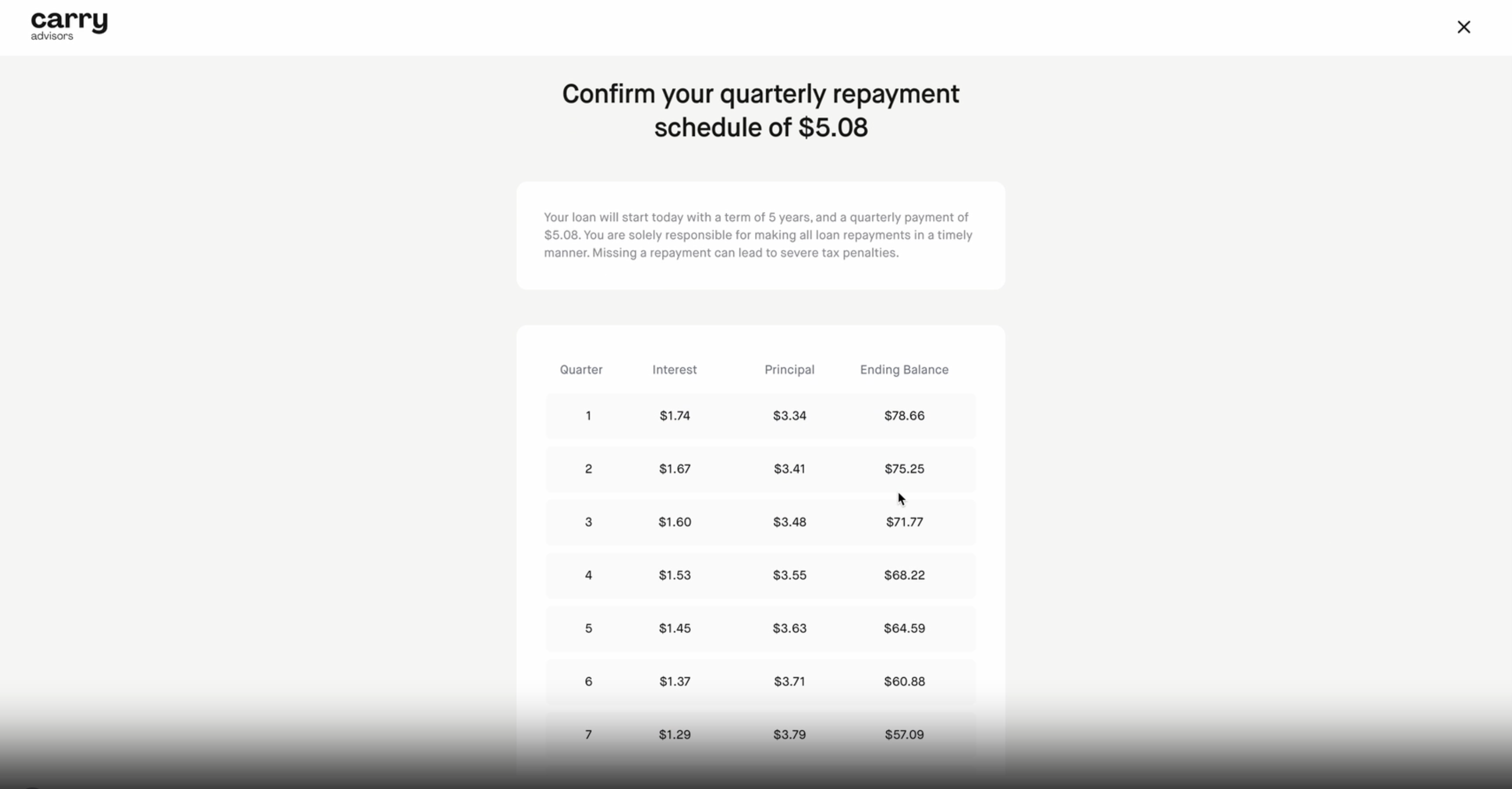

Step 5: Confirm your quarterly repayment schedule

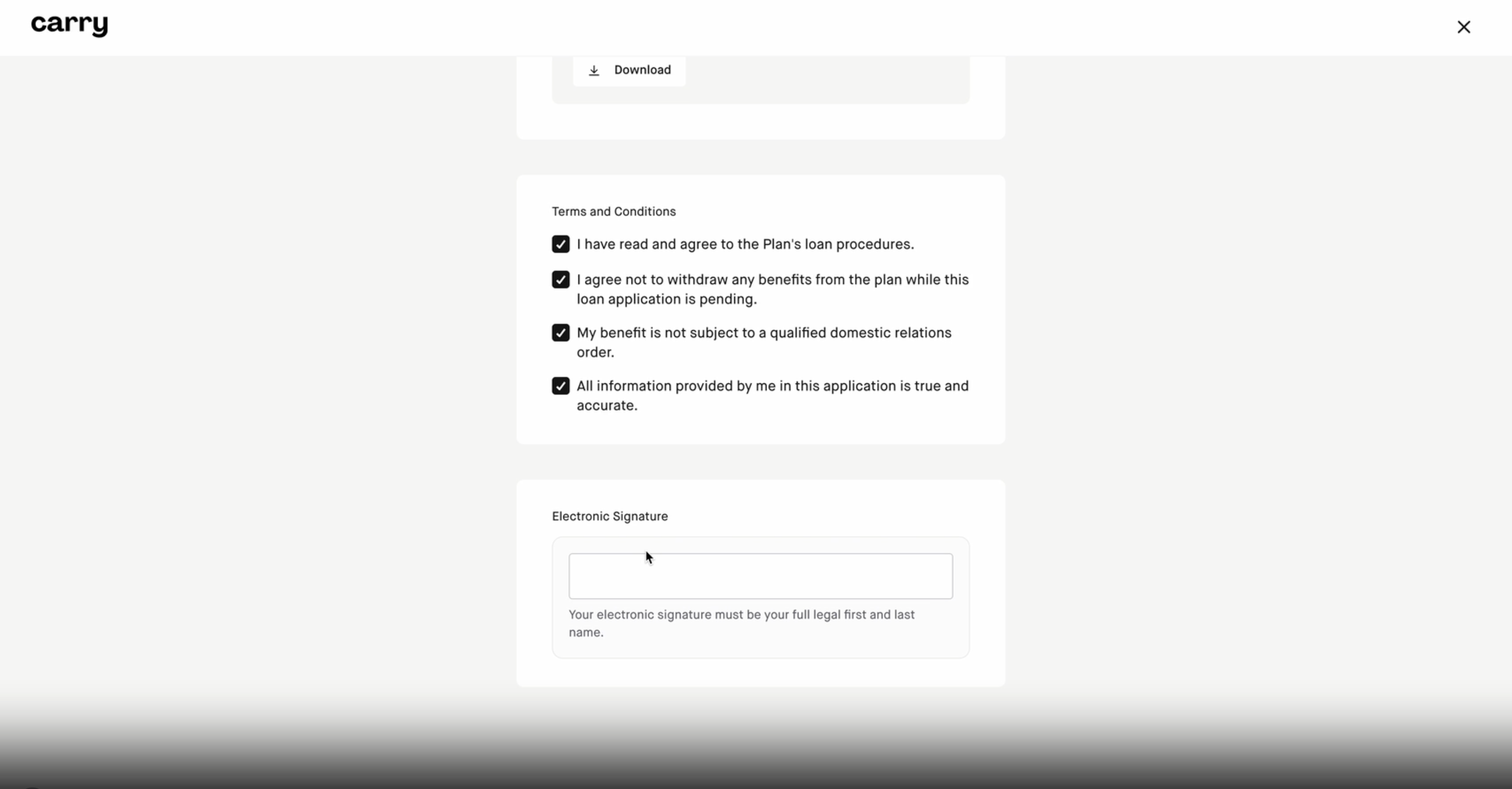

Step 6: Review the agreements, agree to the terms and conditions and complete your e-signature

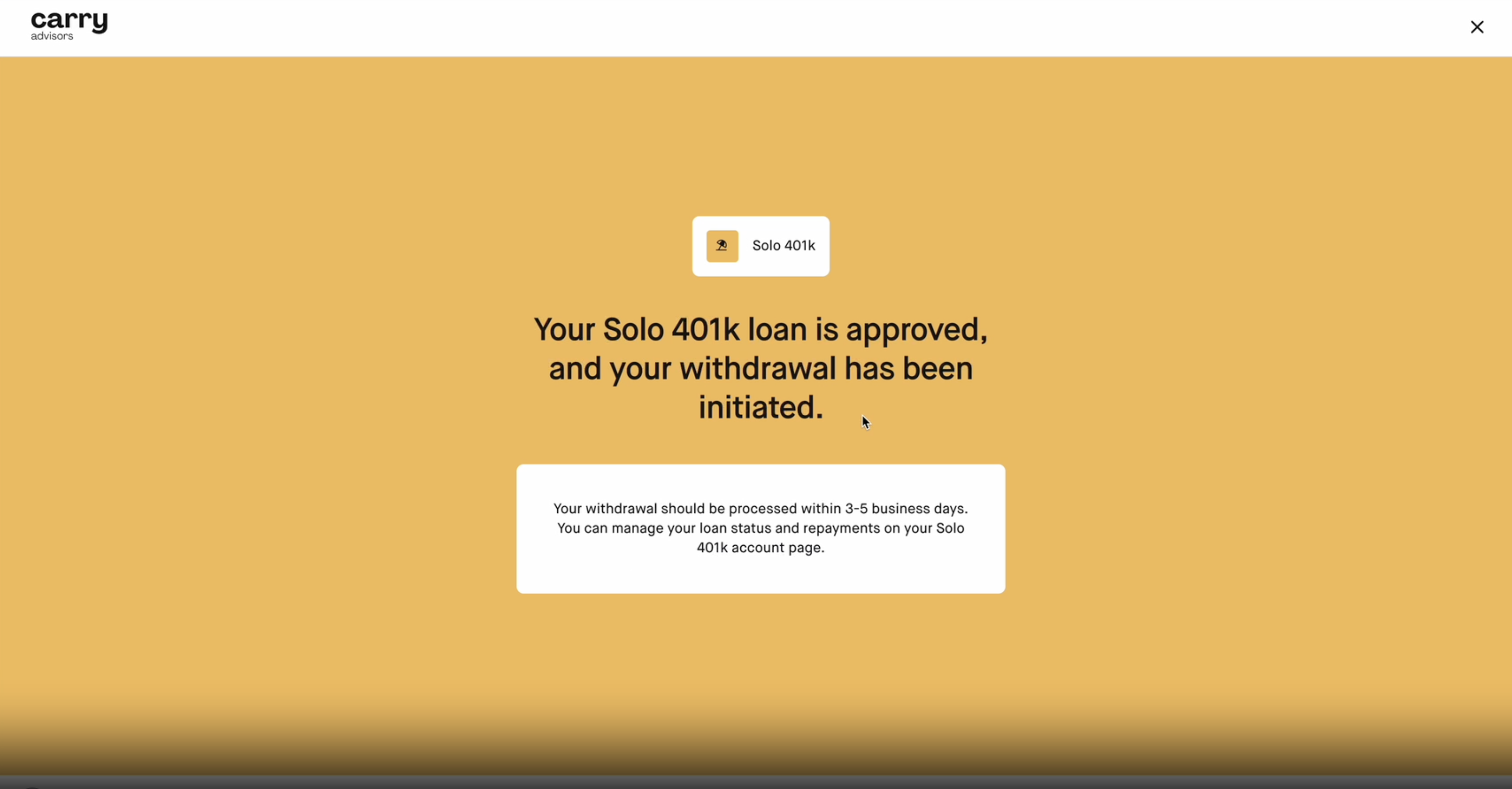

Step 7: You will be brought to a success screen

It will take a few business days for the funds to arrive in your bank account and you’ll receive a confirmation of your loan withdrawal via email once it’s been processed.

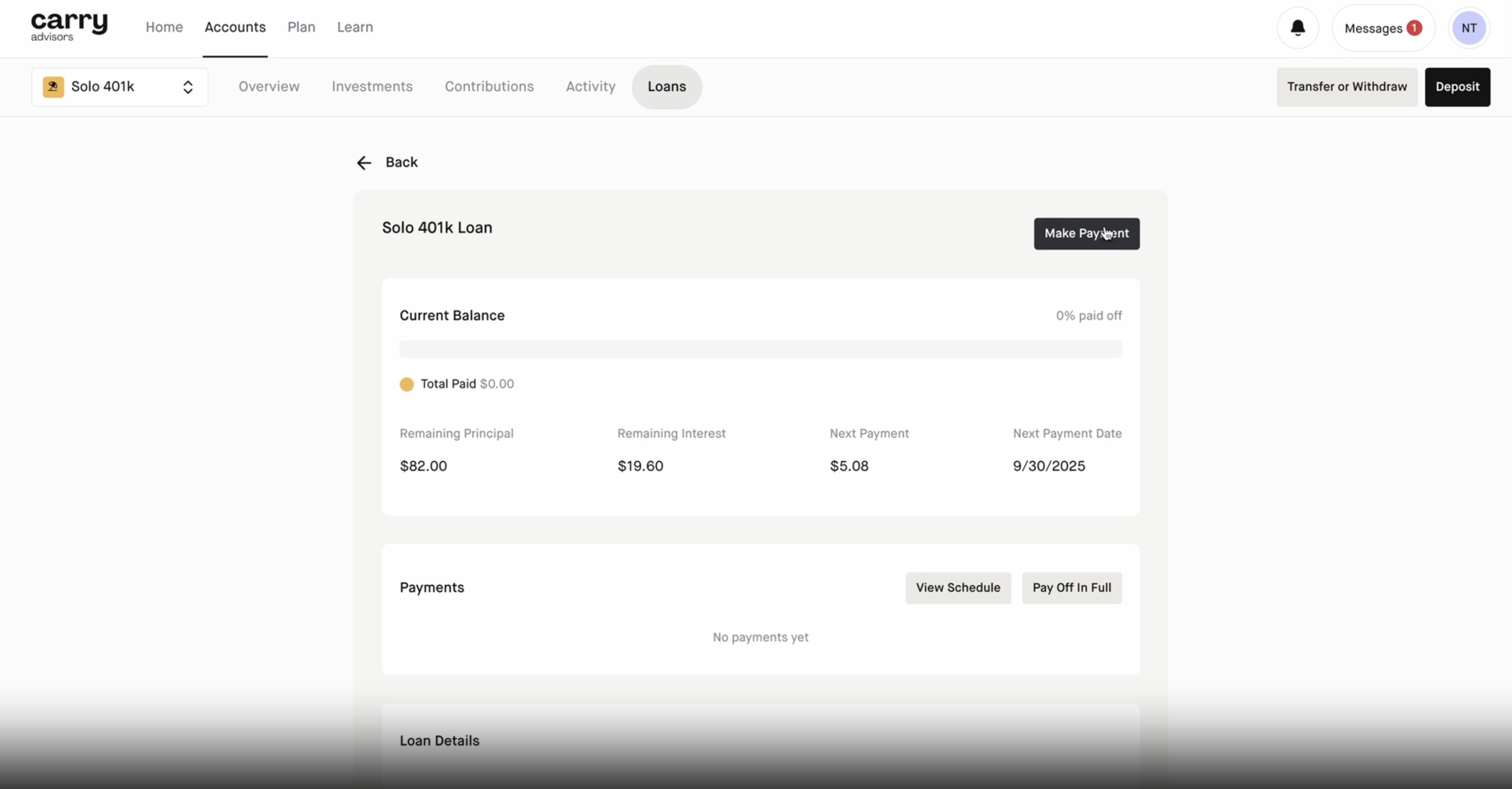

How to make repayments back into your solo 401k plan

To make a loan repayment:

> Click the 'Loans' tab from your Solo 401k account

> Click into the Loan

> select 'Make Payment' on the upper right hand side of the loan

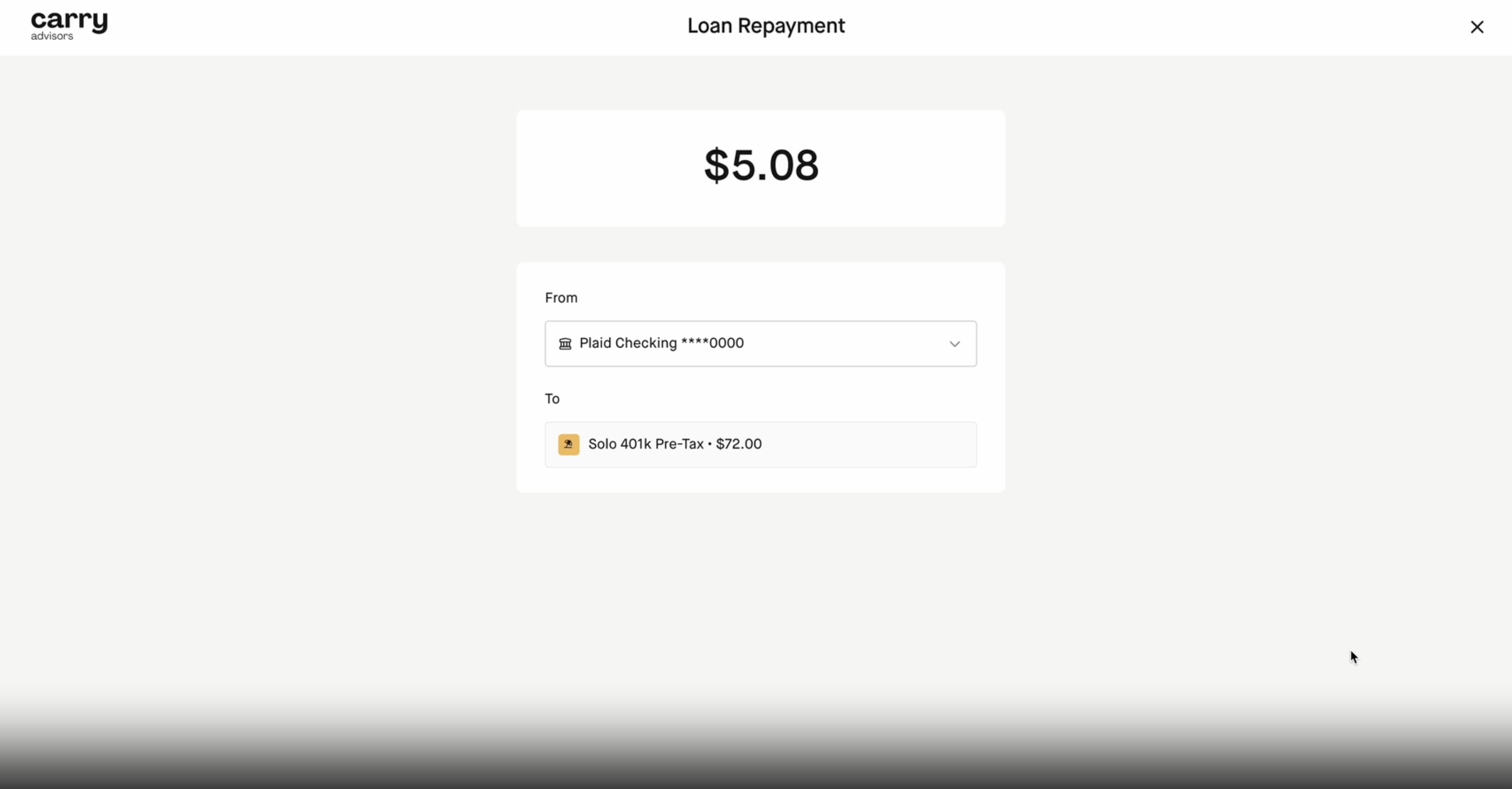

> Input the repayment amount and select the funding source and the account the funds are being repaid to

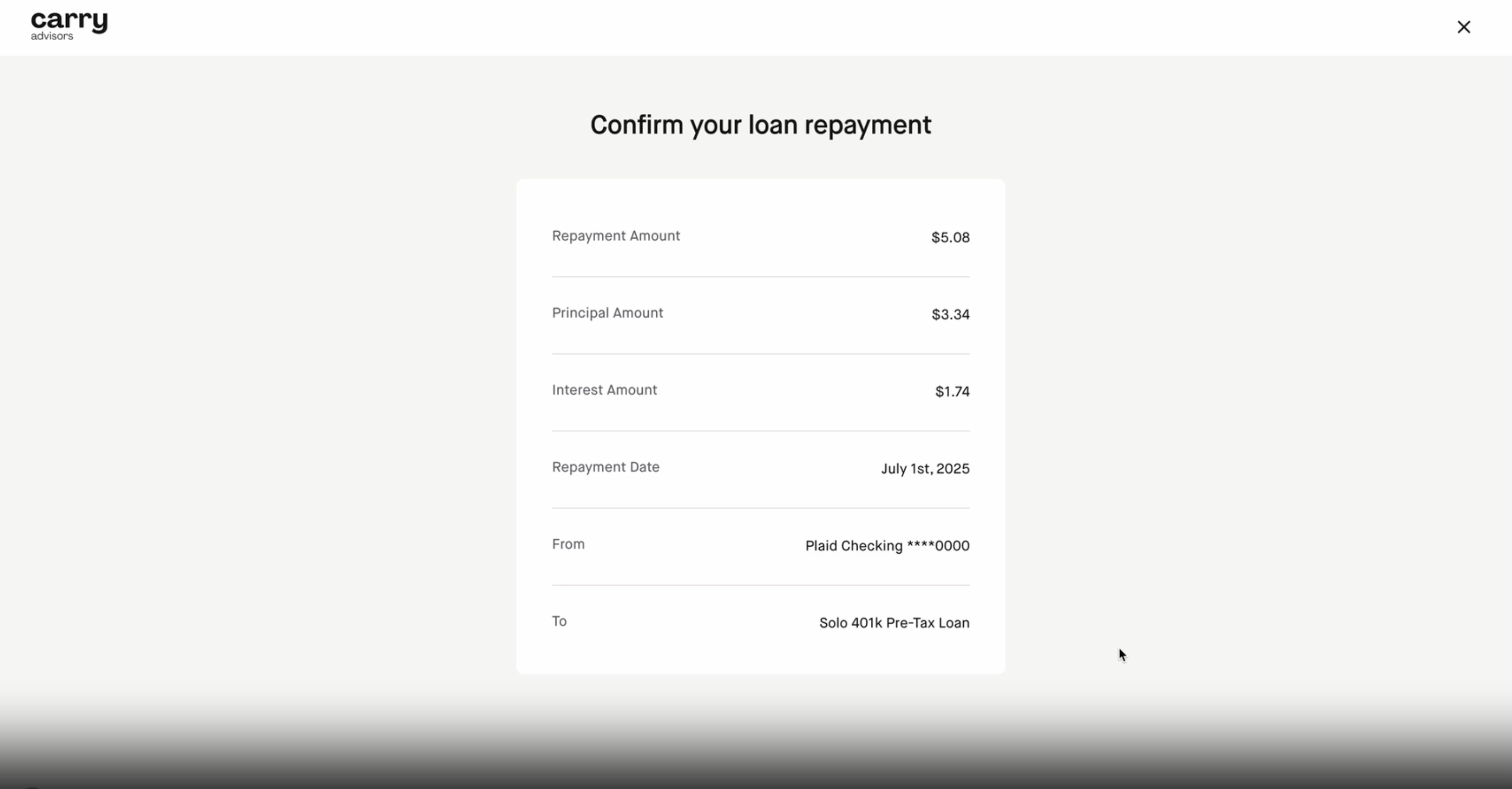

> Confirm the loan repayment details

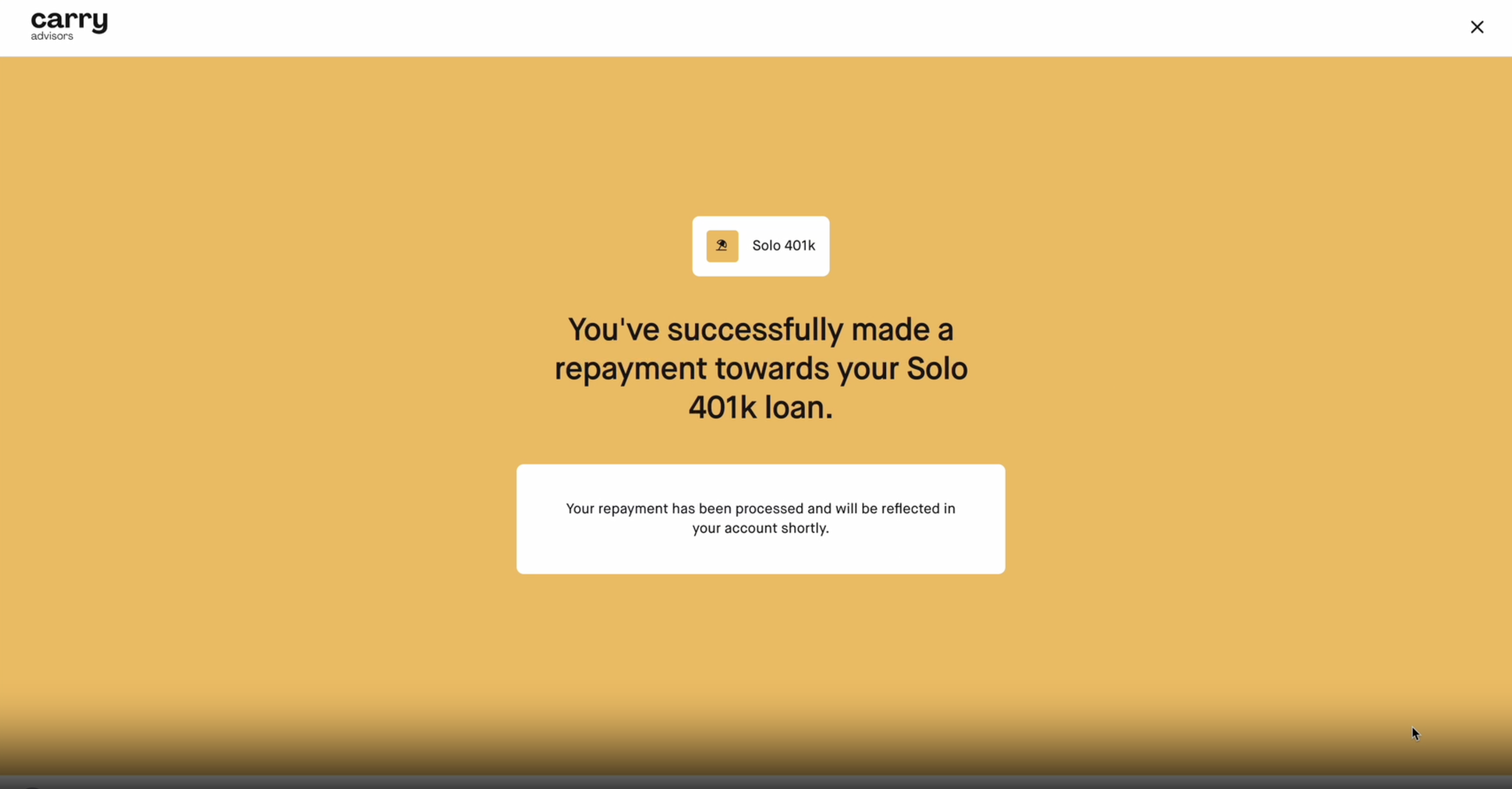

> You will then be brought to a success screen

How to set up or manage recurring loan repayment deposits

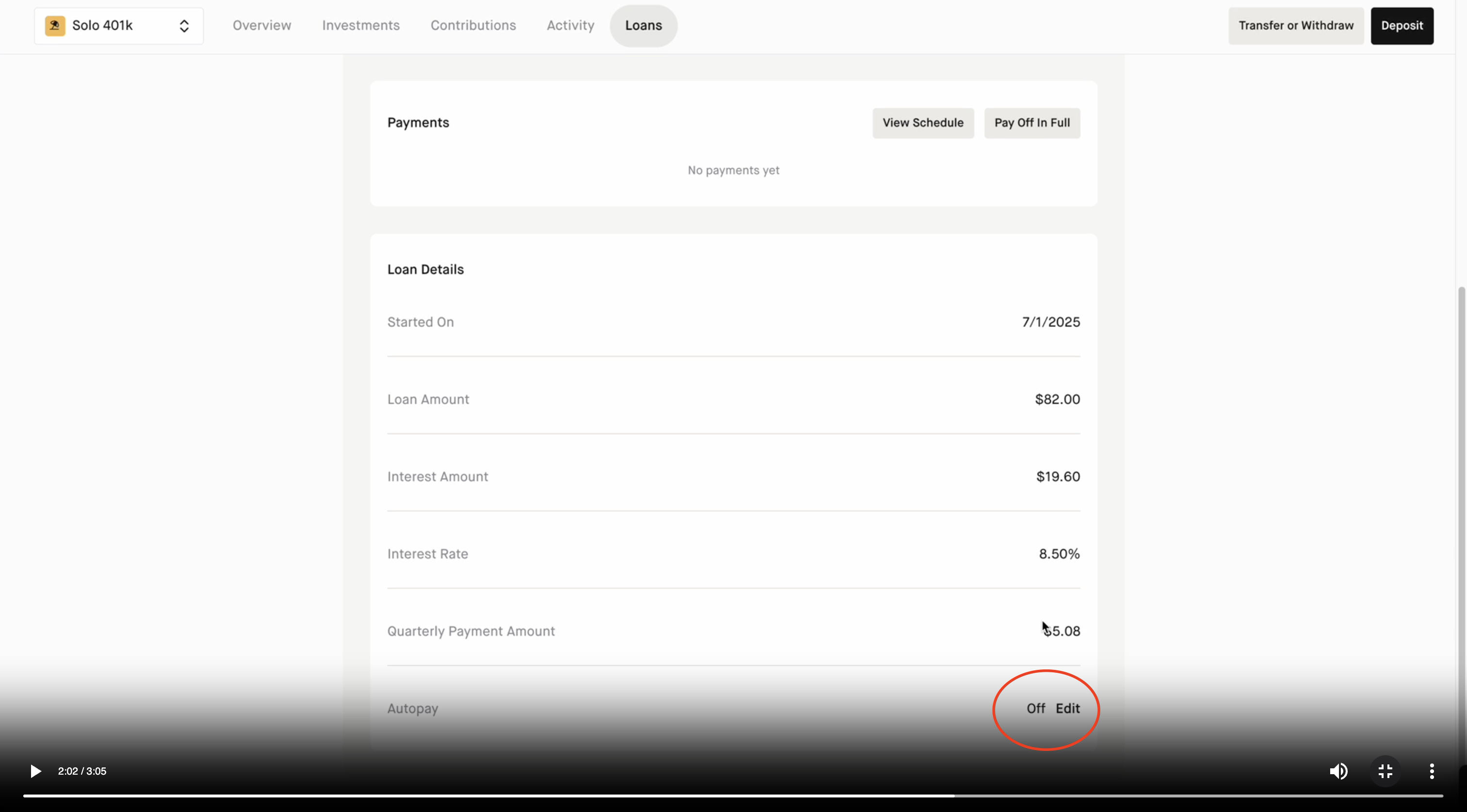

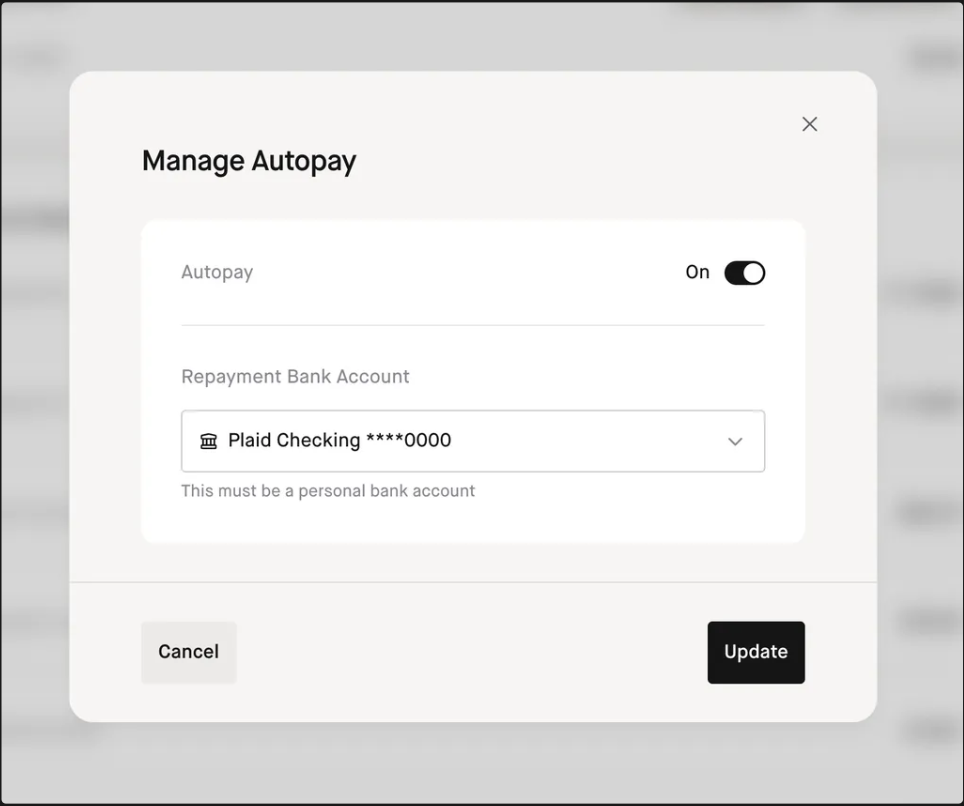

Step 1: Navigate to the Loans tab from your Solo 401k account page and scroll down to the Autopay section and click 'Edit'

Step 2: You can then turn Autopay on or off and select the repayment funding source

Click here to learn more about how solo 401k loans work.

If you took a Solo 401k loan out before July 7, 2025 this process may differ slightly for the time being - feel free to reach out to our team using the messaging functionality on the website or via email: support@carry.com if you have any questions.