How to invest in alternative assets via your IRA

Carry IRAs allow you to invest in alternative assets through tax-advantaged retirement plans. This is for clients who already have an investment opportunity you want to participate in. Some examples of investments are: private companies, real estate, or shares of a sports team.

The flow can take several weeks end to end to get your account set up and the investment reviewed so please plan ahead and submit the investment early. We cannot guarantee it will be processed before any sensitive deadlines.

*Alternative investing is only available on the Carry Pro subscription tier.

If you’re on the Carry subscription Core tier, you can upgrade your plan at any time by clicking your initials on the top right > Settings > Billing > and clicking on the 'Manage' Plan button next to Subscription.

Making your Alternative Investment:

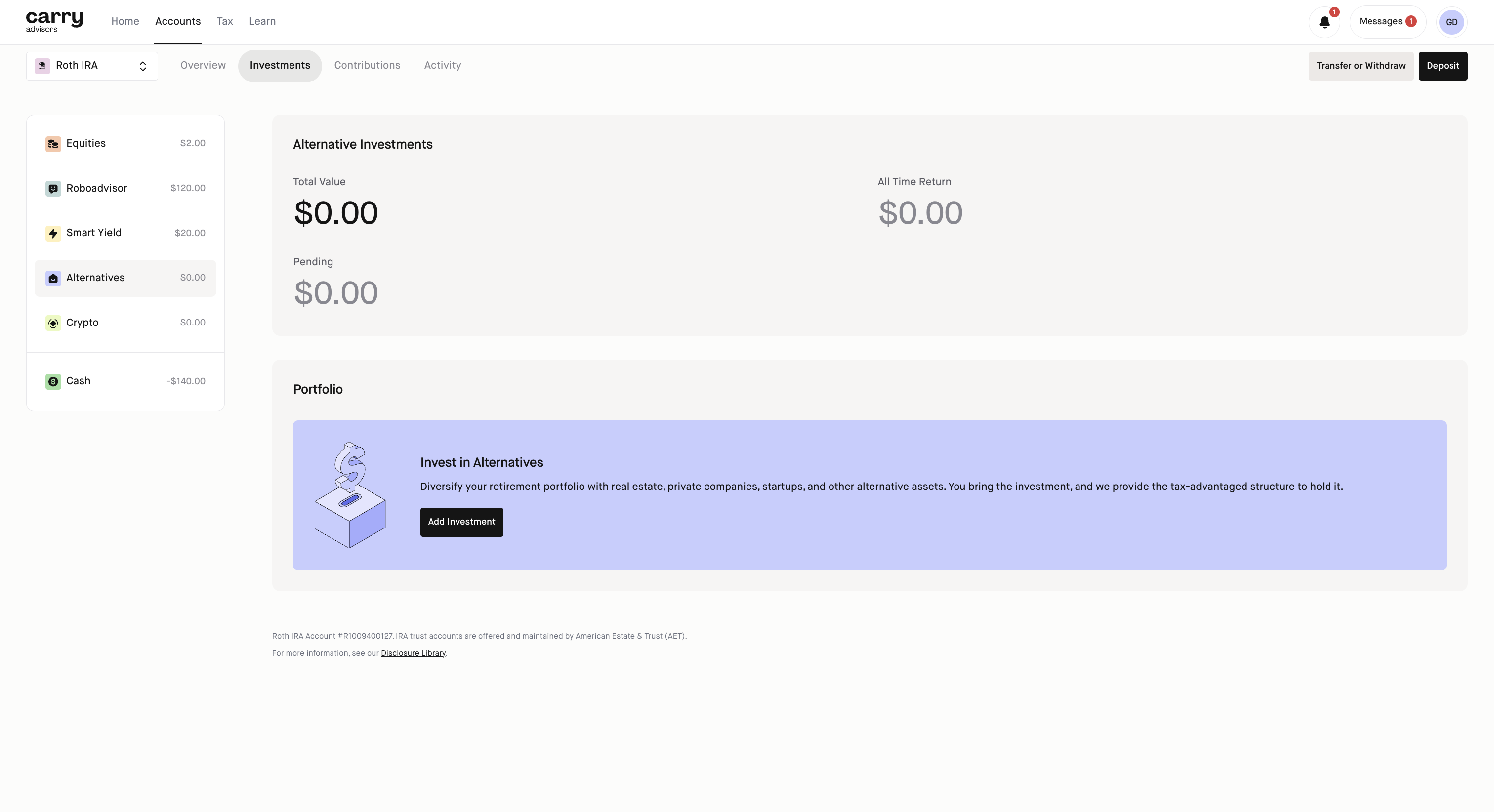

Step 1: Select your IRA account

Step 2: Click on Investments tab

Step 3: Select 'Alternatives', it it's not there click 'Add Investment' and select Alternatives and complete the flow

Step 4: Click 'Add Investment' on the bottom center of the screen

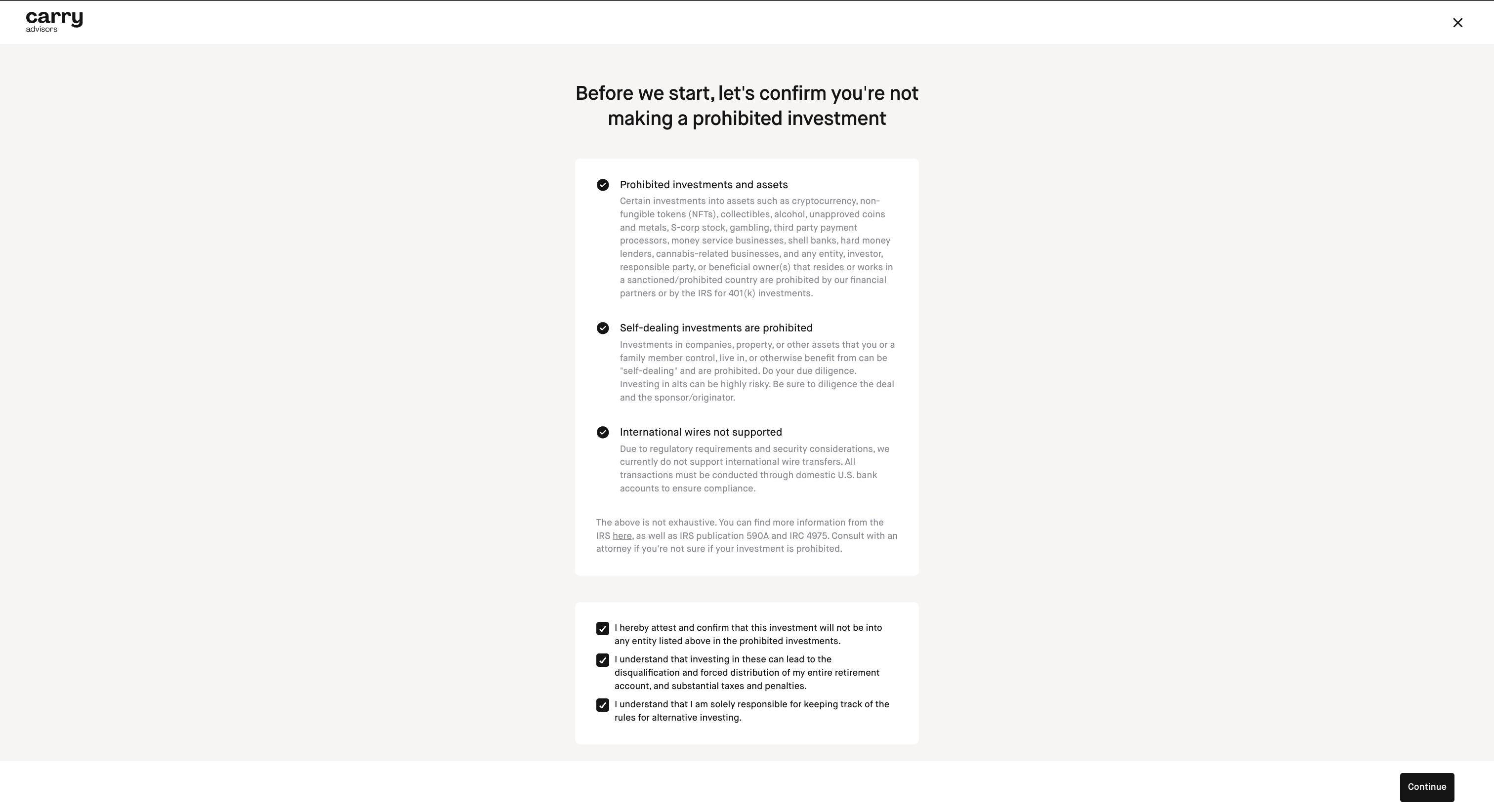

Step 5: Confirm the details on the screen and click Continue

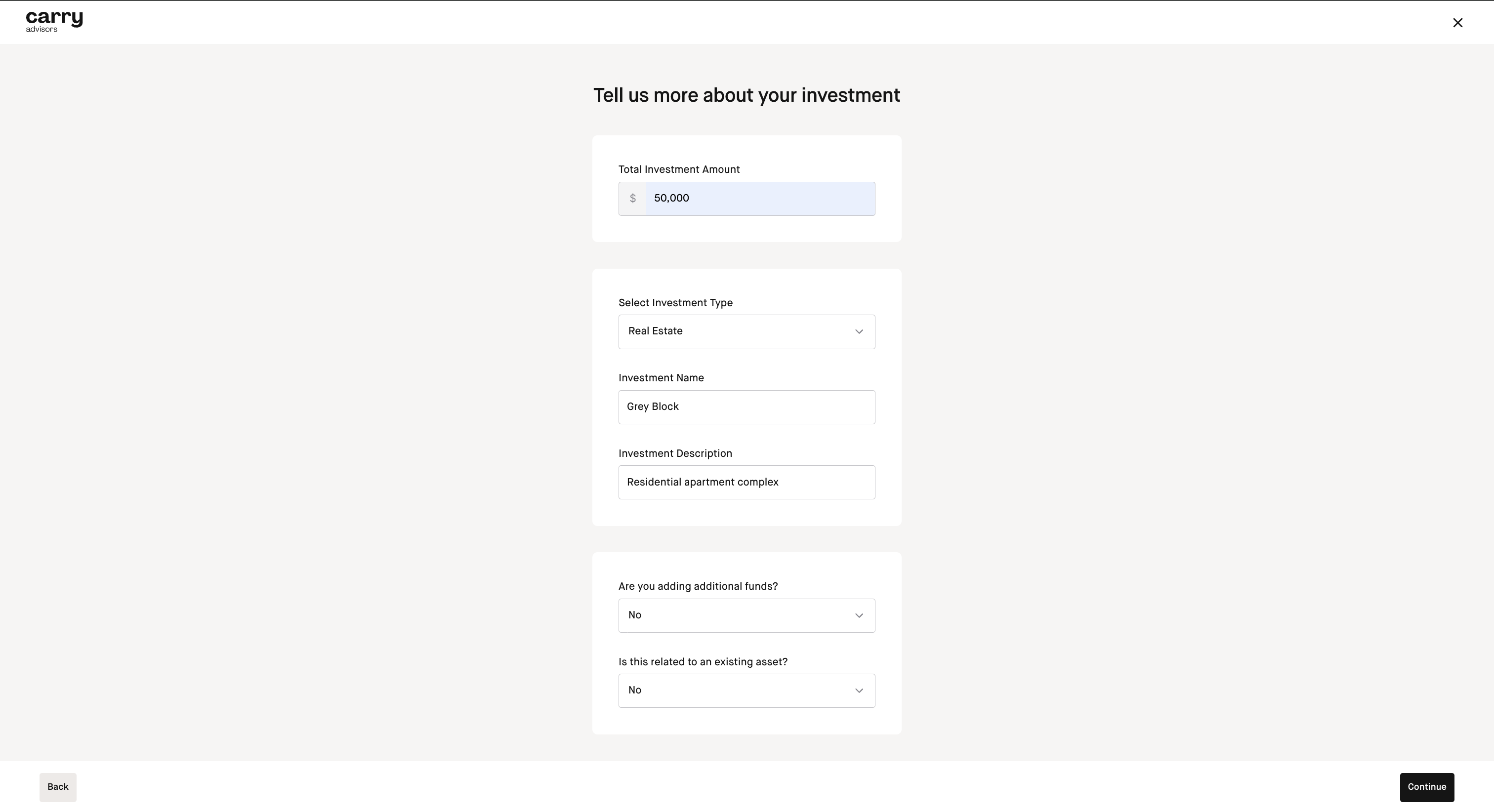

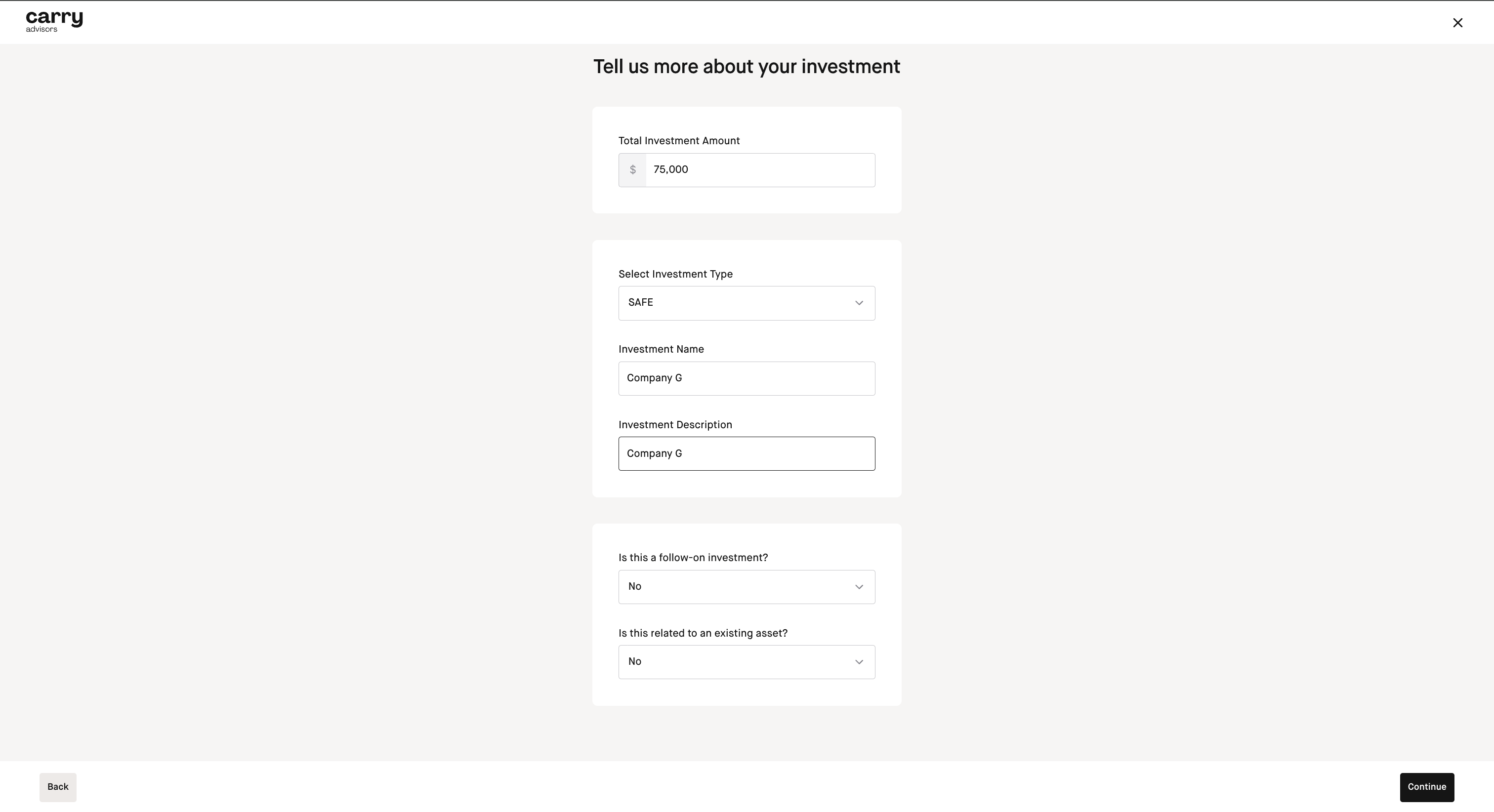

Step 6: Input the investment amount, investment type, investment name and investment description and whether you are adding additional funds or if this is related to an existing asset

Here is an example for the Real Estate Flow:

Here is an example if you are investing in a SAFE:

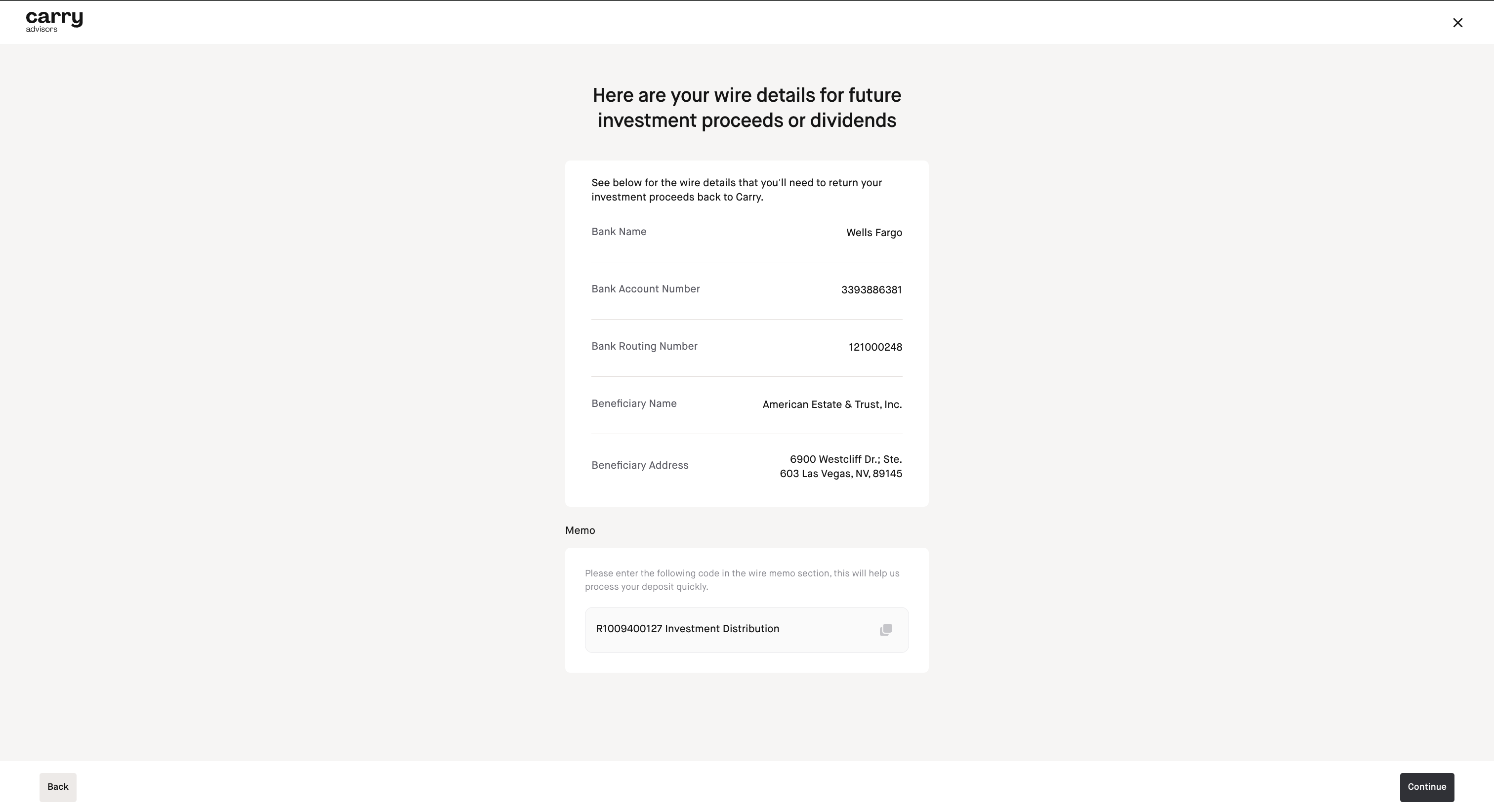

Step 7: On this next screen you will be given wire details for future investment proceeds or dividends. Keep a record of this information for your reference and click Continue

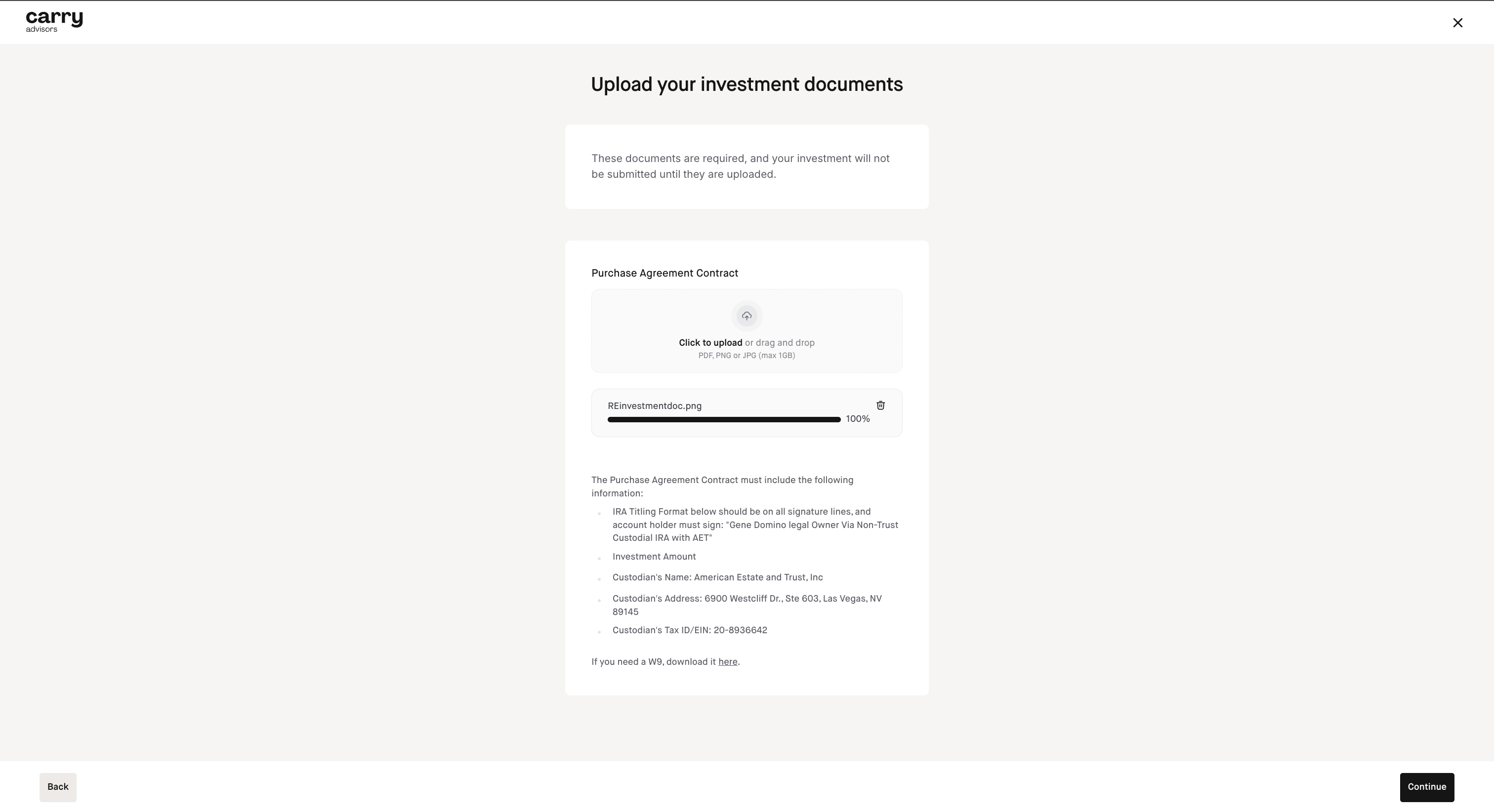

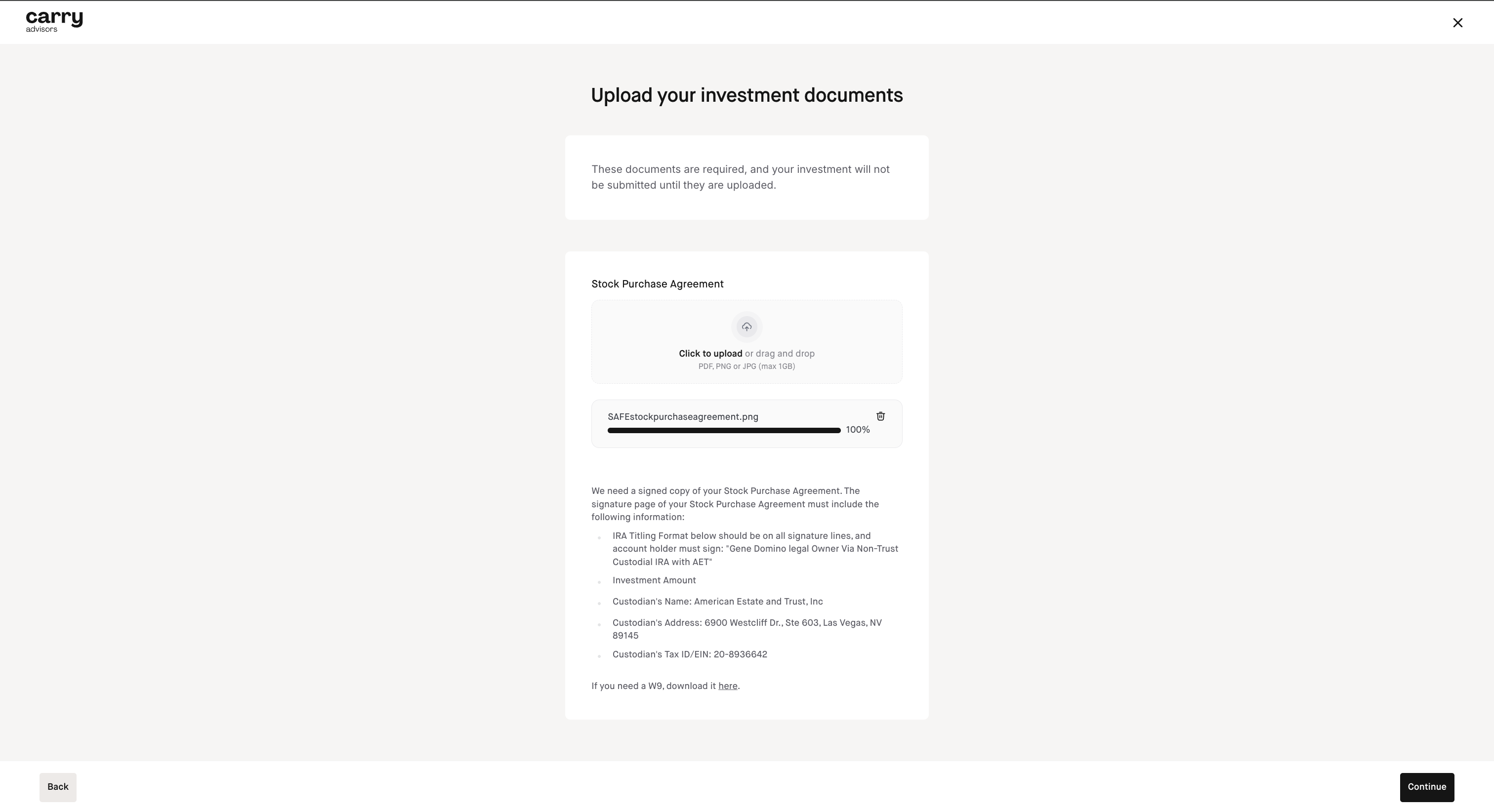

Step 8: Upload supporting documentation for the investment (this is required) and click Continue

Here is an example for a Real Estate investment where you will need to upload the Purchase Agreement Contract:

Here is an example for a SAFE investment where you will need to upload the Stock Purchase Agreement:

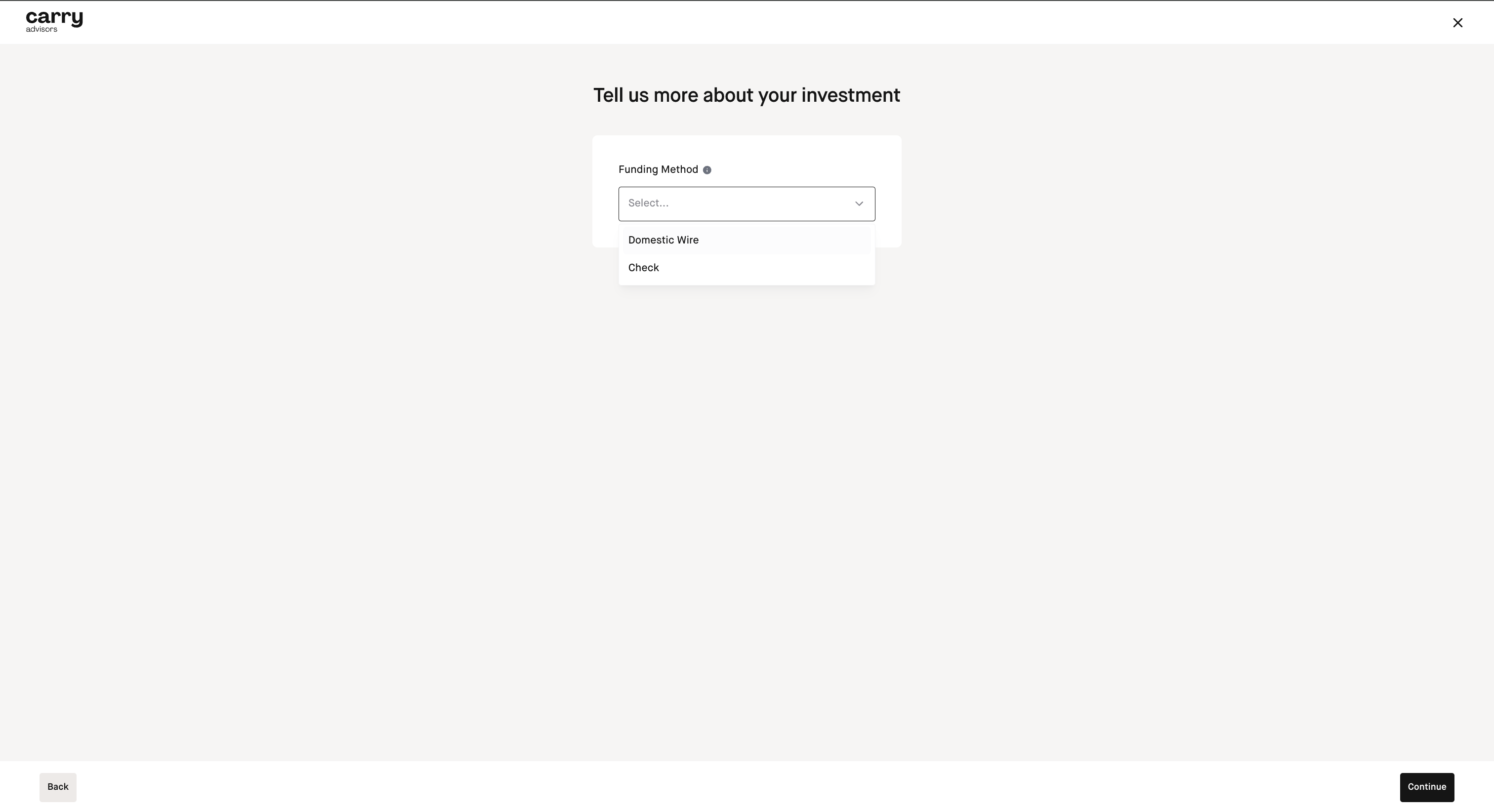

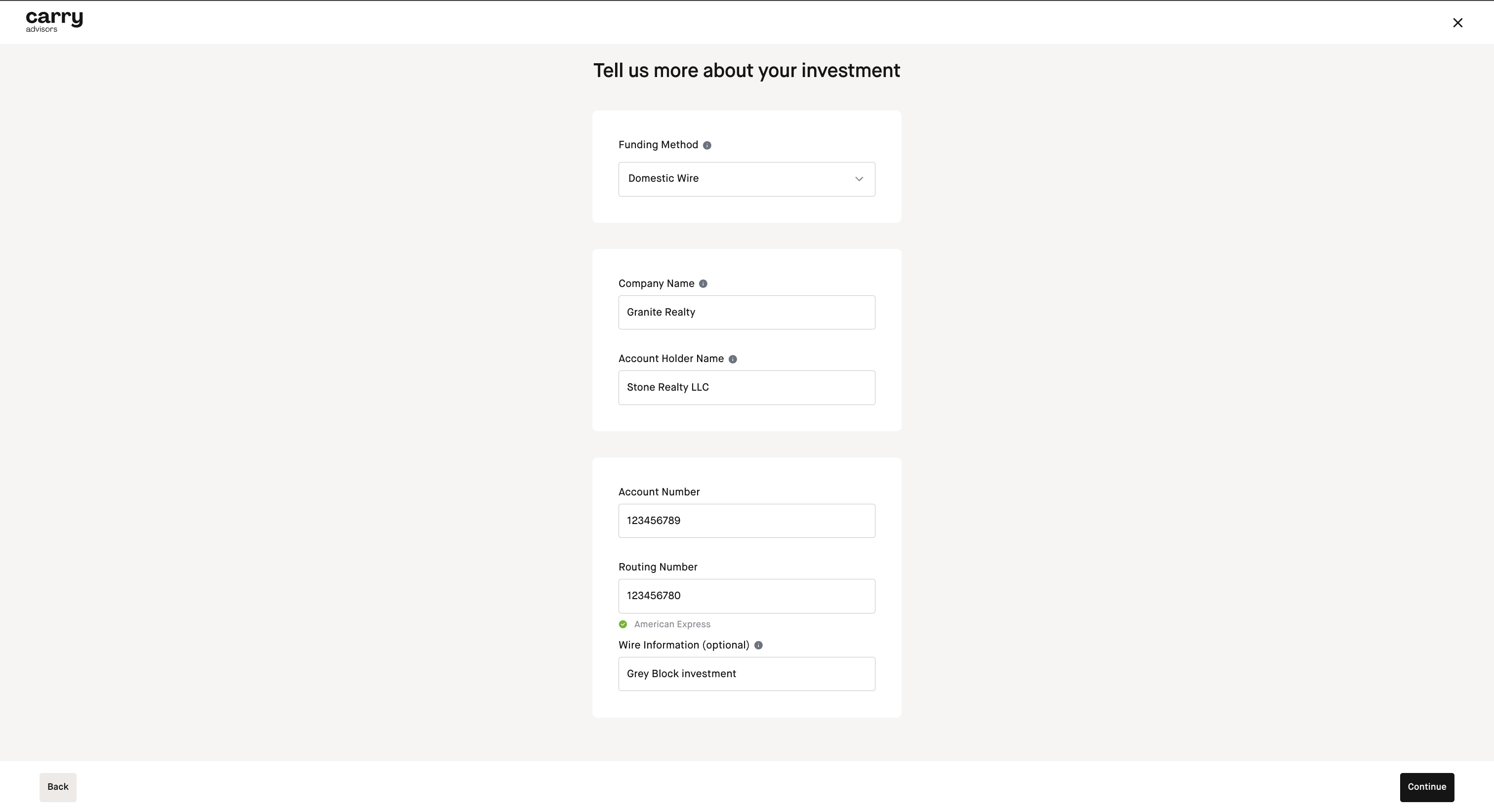

Step 9: Select Funding method of either wire or check and input the details and hit Continue

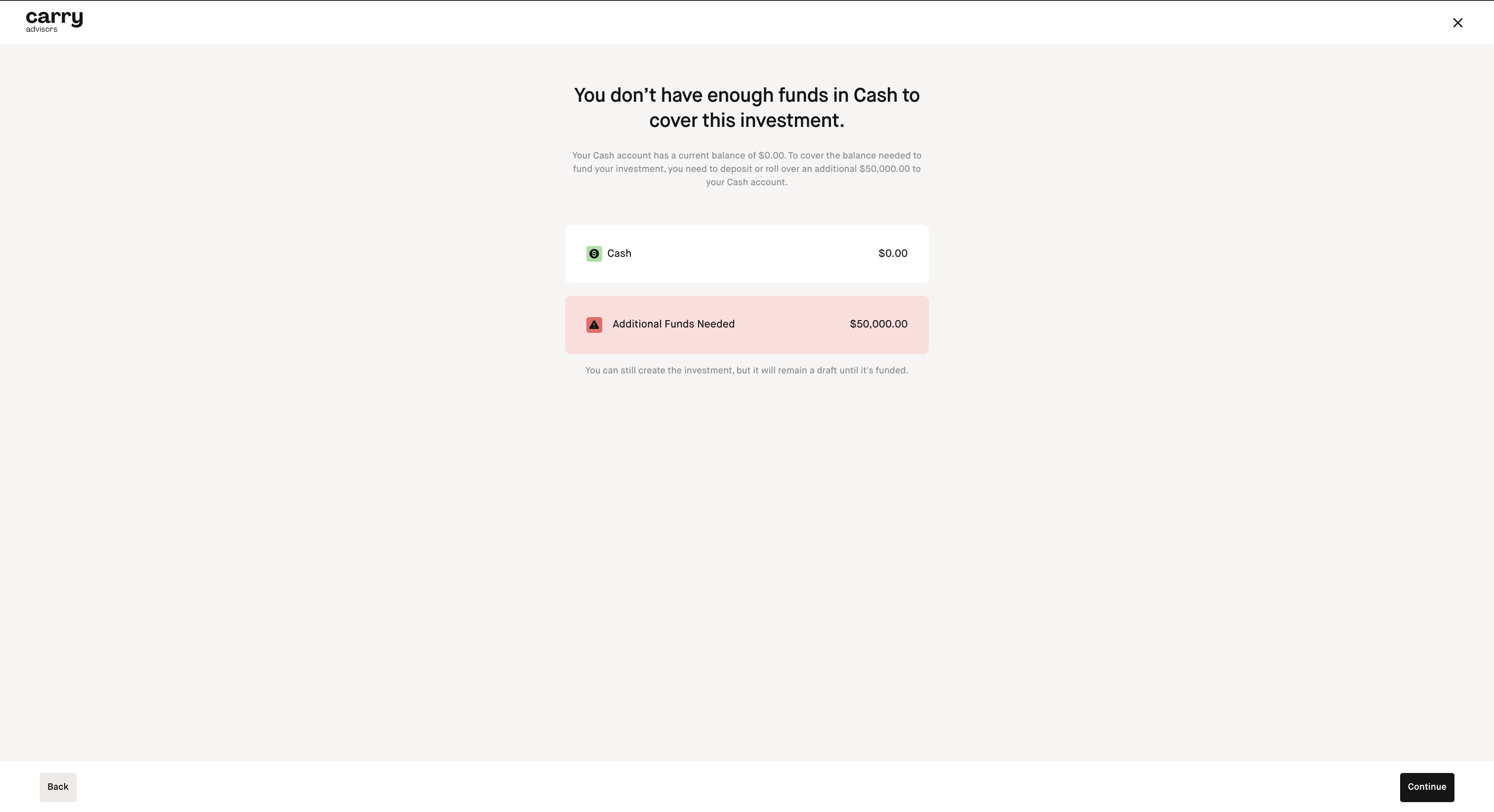

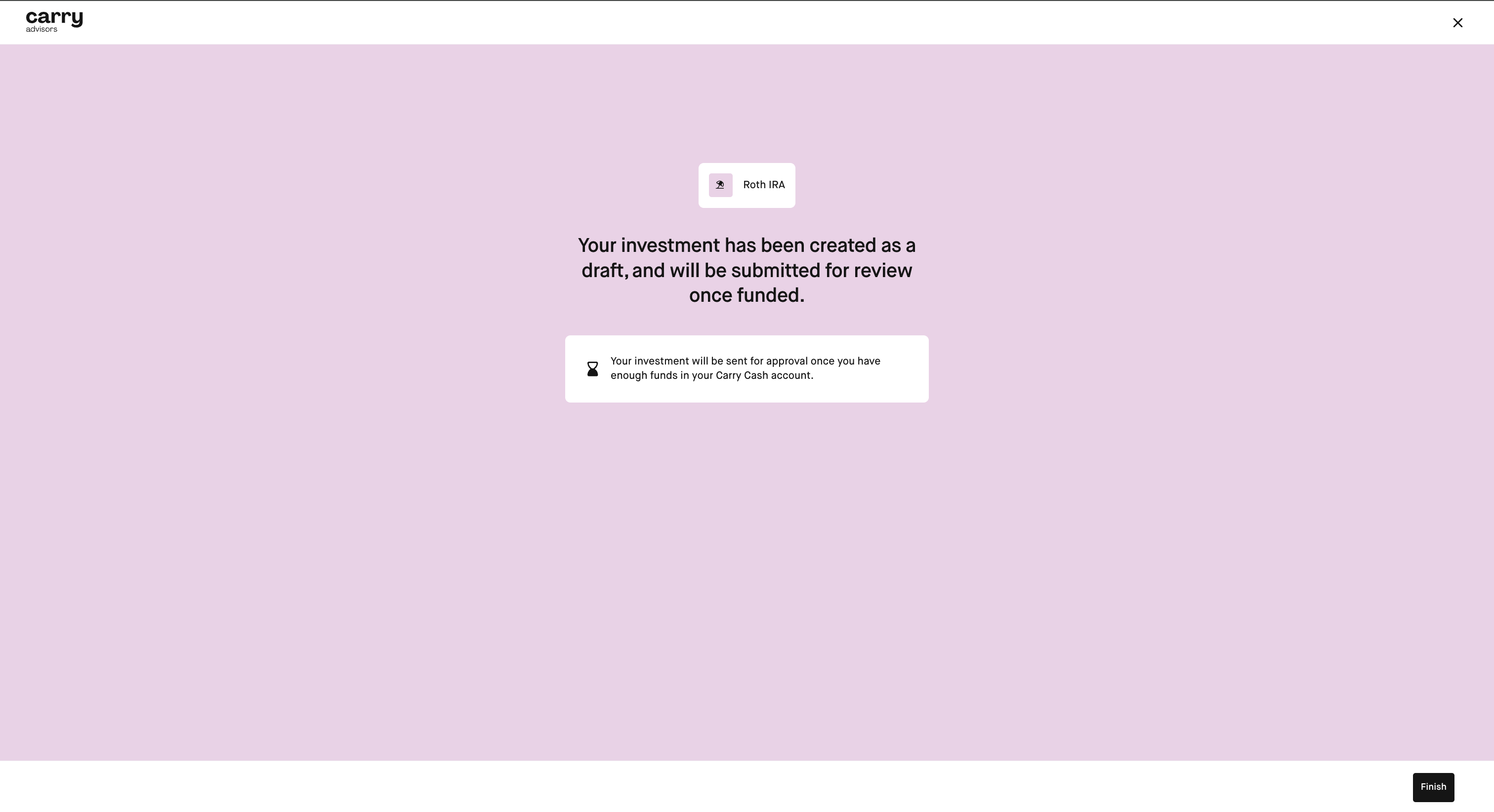

Step 10: You will see a confirmation screen of how much cash from your account ie being allocated to fund the investment (If you don't have cash in your account yet you can still proceed and the investment will be saved as a draft and submitted once cash in the account becomes available) and click 'Continue'

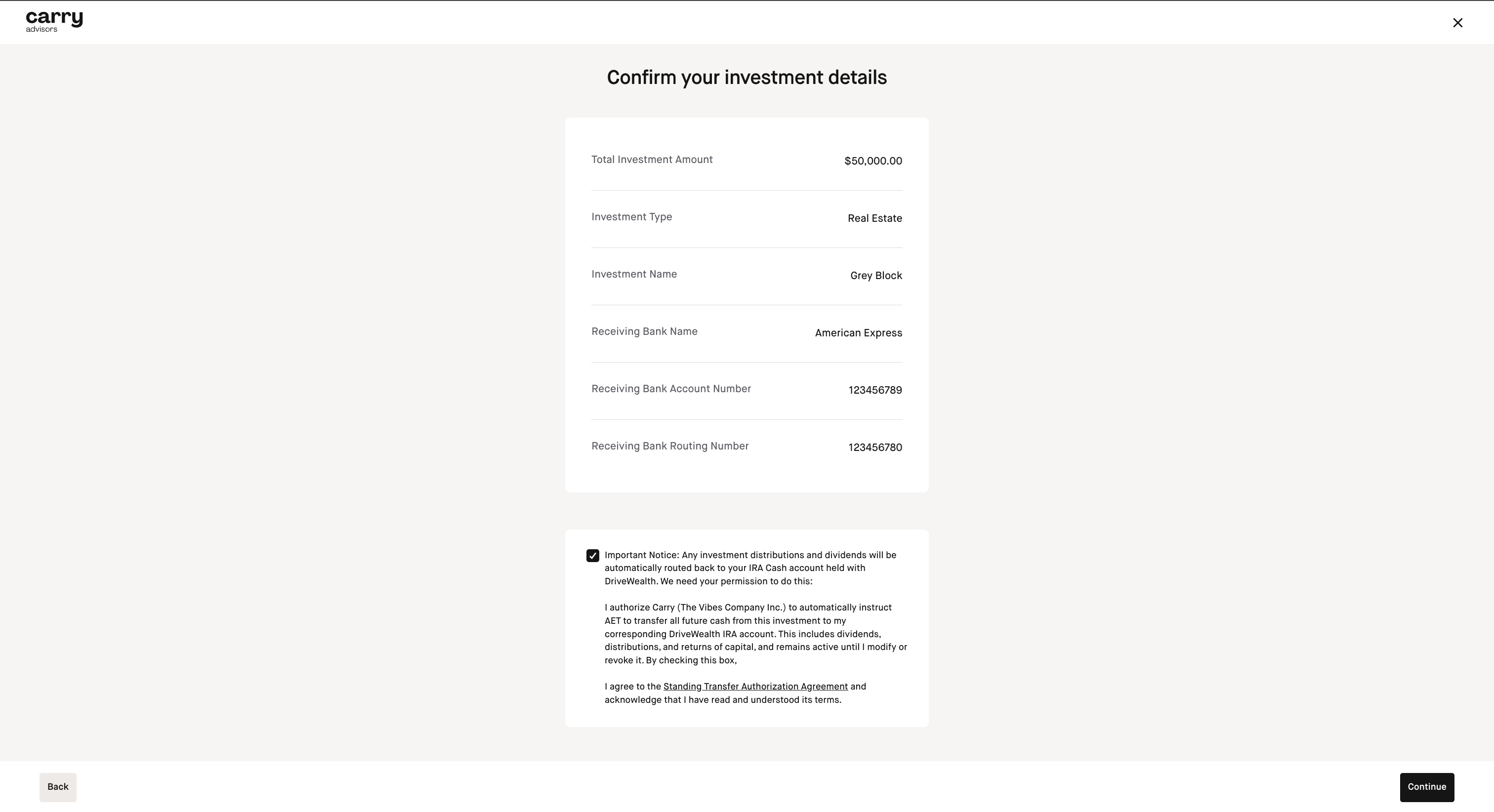

Step 11: Confirm your investment details and click Continue

Step 12: Confirmation screen will appear, click Finish

Self Dealing

Investments in companies, property, or other assets that you or a family member control, live in, or otherwise benefit from can be “self-dealing” and are prohibited. Do your due diligence. Investing in alts can be highly risky. Be sure to diligence the deal and the sponsor/originator.

The above is not exhaustive. You can find more information from the IRS See full list here, as well as IRS publication 590A and IRC 4975. Consult with an attorney if you’re not sure if your investment is prohibited.

How to submit Capital Calls or follow-on investments for alternative IRA investments you've already submitted

Step 1

Navigate to your Account

Step 2

Click on Alternatives

Step 3

Click Invest

Step 4

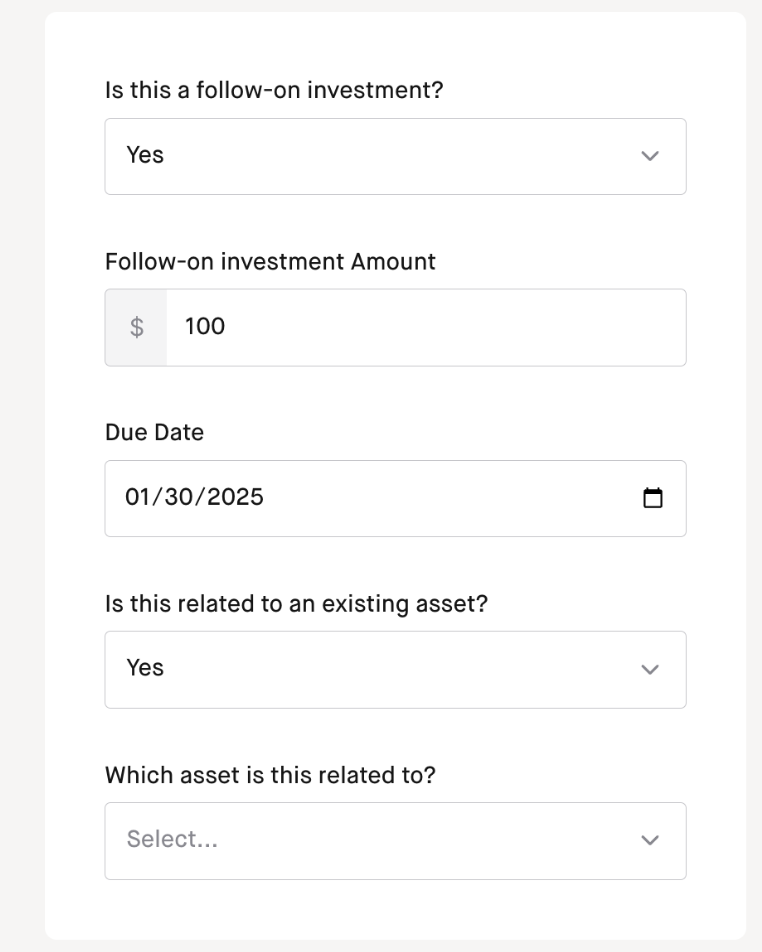

On the screen where it asks you to 'Tell us more about your investment', you'll want to answer the following questions:

1) Is this a follow-on investment

2) Is this related to an existing asset

3) Select which asset this capital call is related to

Step 5

Complete the rest of the investment flow

How to find wire details to provide to the folks who will be issuing any investment distributions for your alternative investment

To retrieve the wire details click the 3 dots on the right side of the submitted investment on the 'Alternatives' section of the Investments tab from the account page you invested from.