How to invest in alternative assets from your Carry Solo 401k

If you want to make investments into alternative assets like real estate, startups, and private equity outside of the Carry platform, you can easily do so through our partnership with Grasshopper Bank.

Alternative investing is only available on the Carry Pro subscription tier.

If you already have cash in the account you are investing from that is showing as 'available to withdraw' that you will be using to fund the investment, it will typically take 5-7 business days until the funds are sent out for the investment to be funded.

Step 1: Select your Solo 401K account

Step 2: Go to your 'Investments' tab

Click on 'Alternatives' or if it's not yet reflected click 'Add Investment' > 'Alternatives'

> Verify this isn't a prohibited investment > Enter the investment account / type / name.

Take note of the wire details if your investment pays dividends in the future.

How checkbook control works

The Carry Solo 401k Plan is a self-directed Solo 401k plan with checkbook control. With checkbook control, your Solo 401k funds are kept in their own checking account. As the trustee of the plan, you can wire funds from that account when you want to make investments.

With checkbook control, you can invest in alternative assets like:

Startups

Private equity

Real estate

Checkbook control is available directly within Carry.

Prohibited Investments via Solo 401k alternative asset flow

Certain investments are prohibited by our financial partners or by the IRS for 401(k) accounts. These prohibited investments include:

Assets or businesses involved in cryptocurrency trading, non-fungible tokens (NFTs), collectibles, alcohol, unapproved coins and metals, S-corp stock, gambling, third-party payment processors, money service businesses, shell banks, hard money lenders, cannabis-related businesses, religious organizations or adult entertainment.

Any illegal activities.

Any entity, investor, responsible party, or beneficial owner(s) residing or working in a sanctioned or prohibited country.

See full list here

Self Dealing

Investments in companies, property, or other assets that you or a family member control, live in, or otherwise benefit from can be “self-dealing” and are prohibited. Do your due diligence. Investing in alts can be highly risky. Be sure to conduct due diligence on the deal and the sponsor/originator.

The above is not exhaustive. You can find more information from the IRS See full list here, as well as IRS publication 590A and IRC 4975. Consult with an attorney if you’re not sure if your investment is prohibited.

Statements

If you'd like to access your Grasshopper bank statements, please reach out to the Carry team and we'd be happy to assist.

How to obtain the wire information for Solo 401k alternative asset distributions

To view for an investment that is in a draft state:

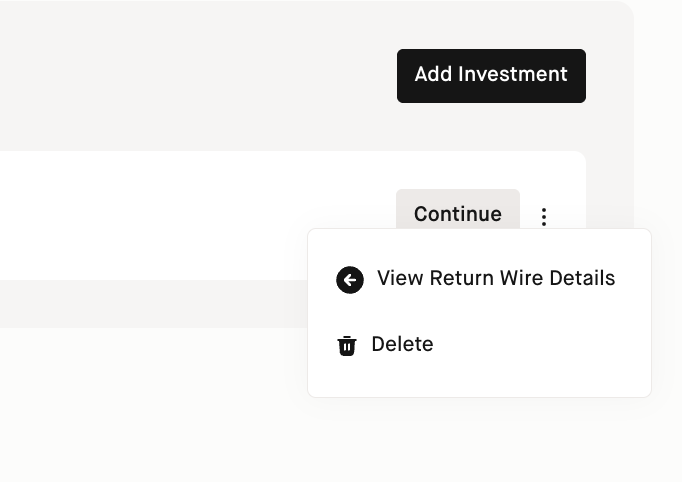

To view the wire details to provide to your end investment to send back distributions click the 3 dots to the right of a draft investment and click 'View Return Wire Details' as shown below

For a completed investment:

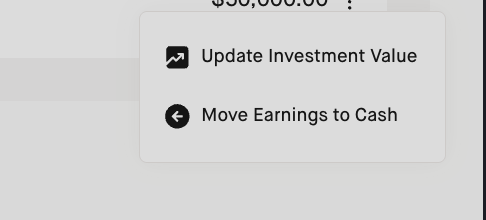

To view the wire details click the 3 dots next to the investment and click 'Move Earnings to Cash' which will then show you the Return Wire details.