How to move your After-tax account funds to your Carry Solo 401k Roth or Roth IRA account (to access the updated Mega Backdoor Roth Conversion flow)

*Please note that as of December 15, 2025, Carry will no longer support new deposits or investments directly within Solo 401k after-tax accounts. This applies to clients who have legacy accounts that had this ability.

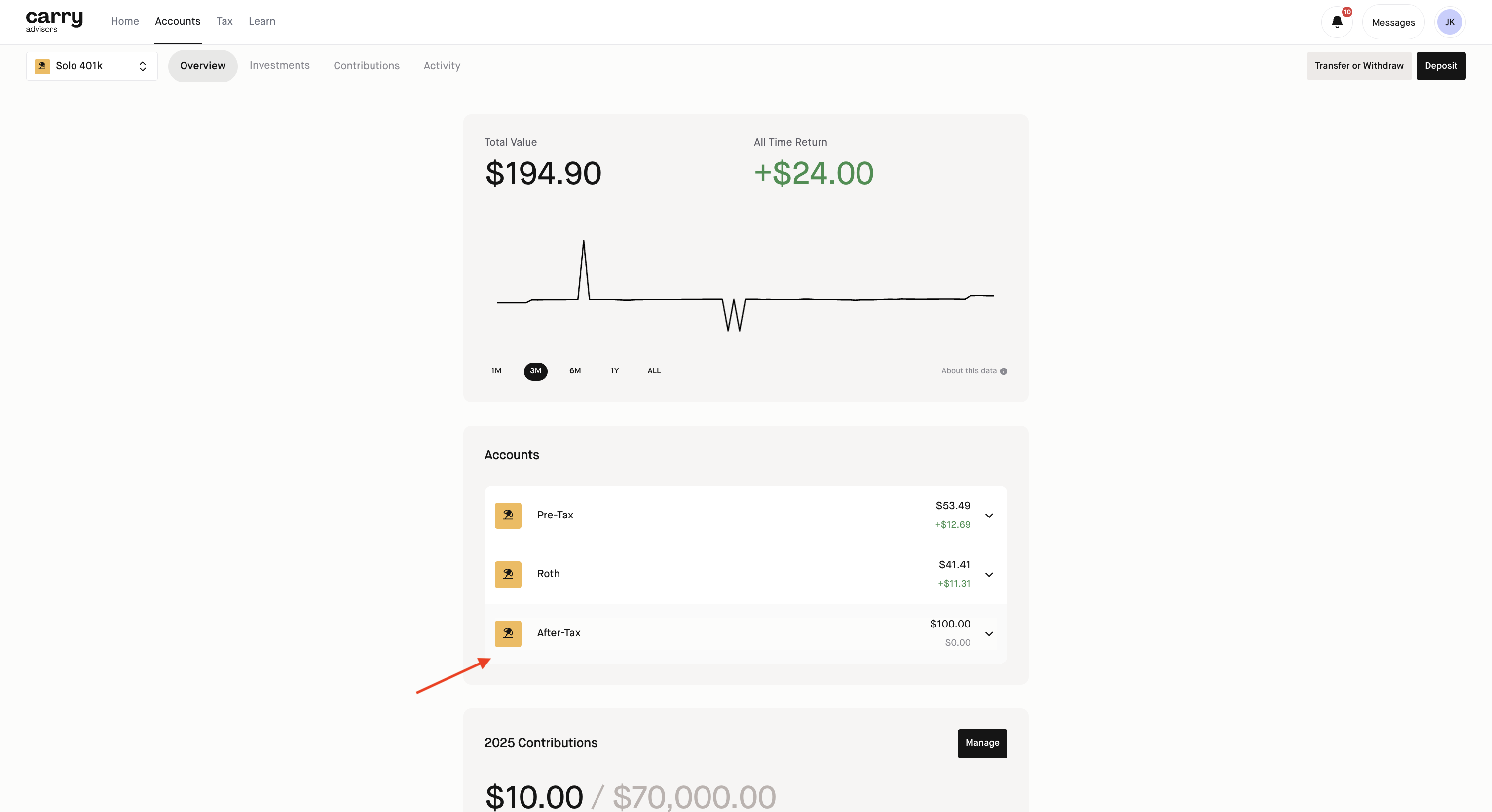

Step 1: Click into the After-tax account

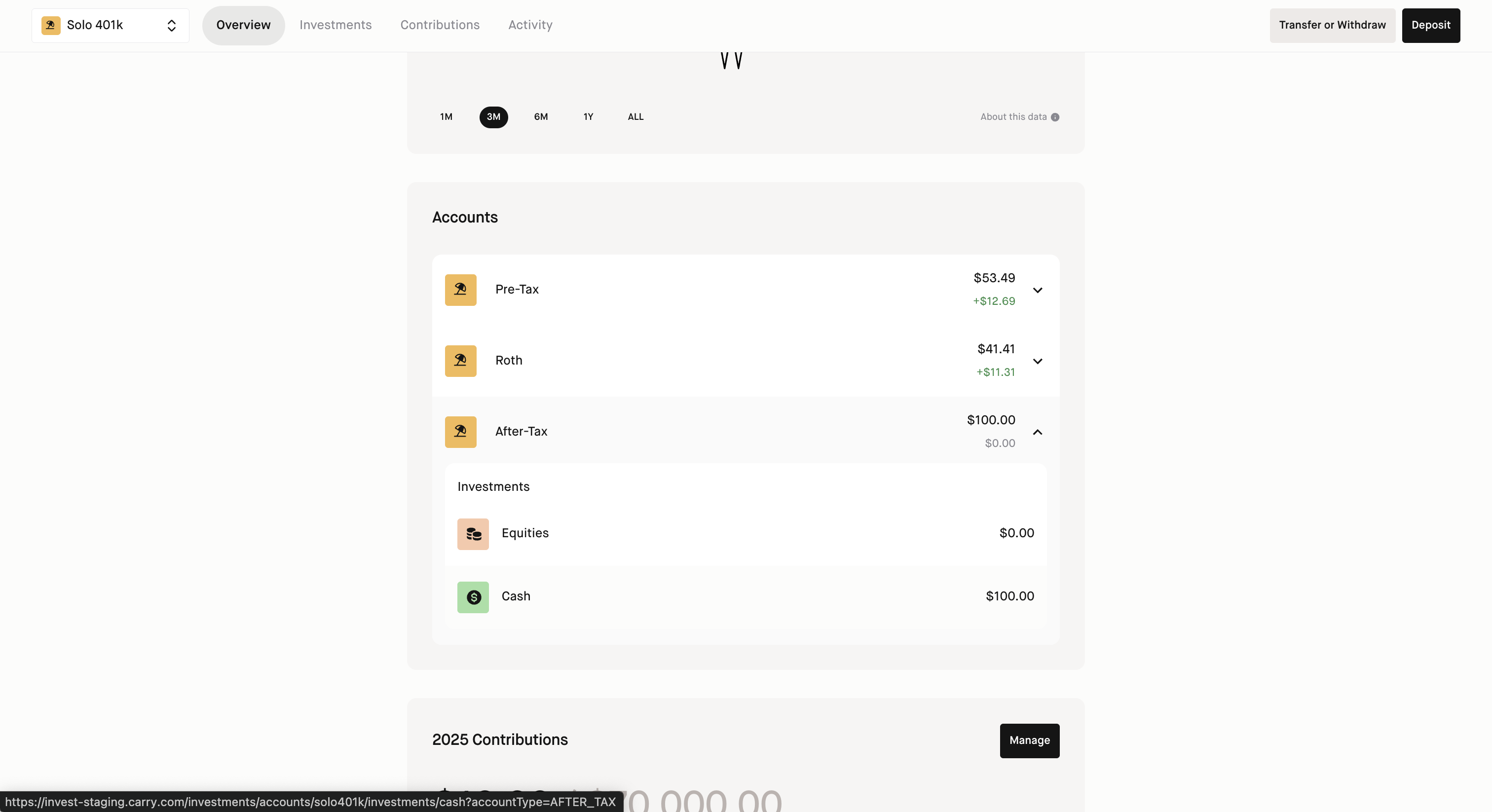

Step 2: Click into the Equities or Cash in the account to be brought to the After-Tax account's Investments page

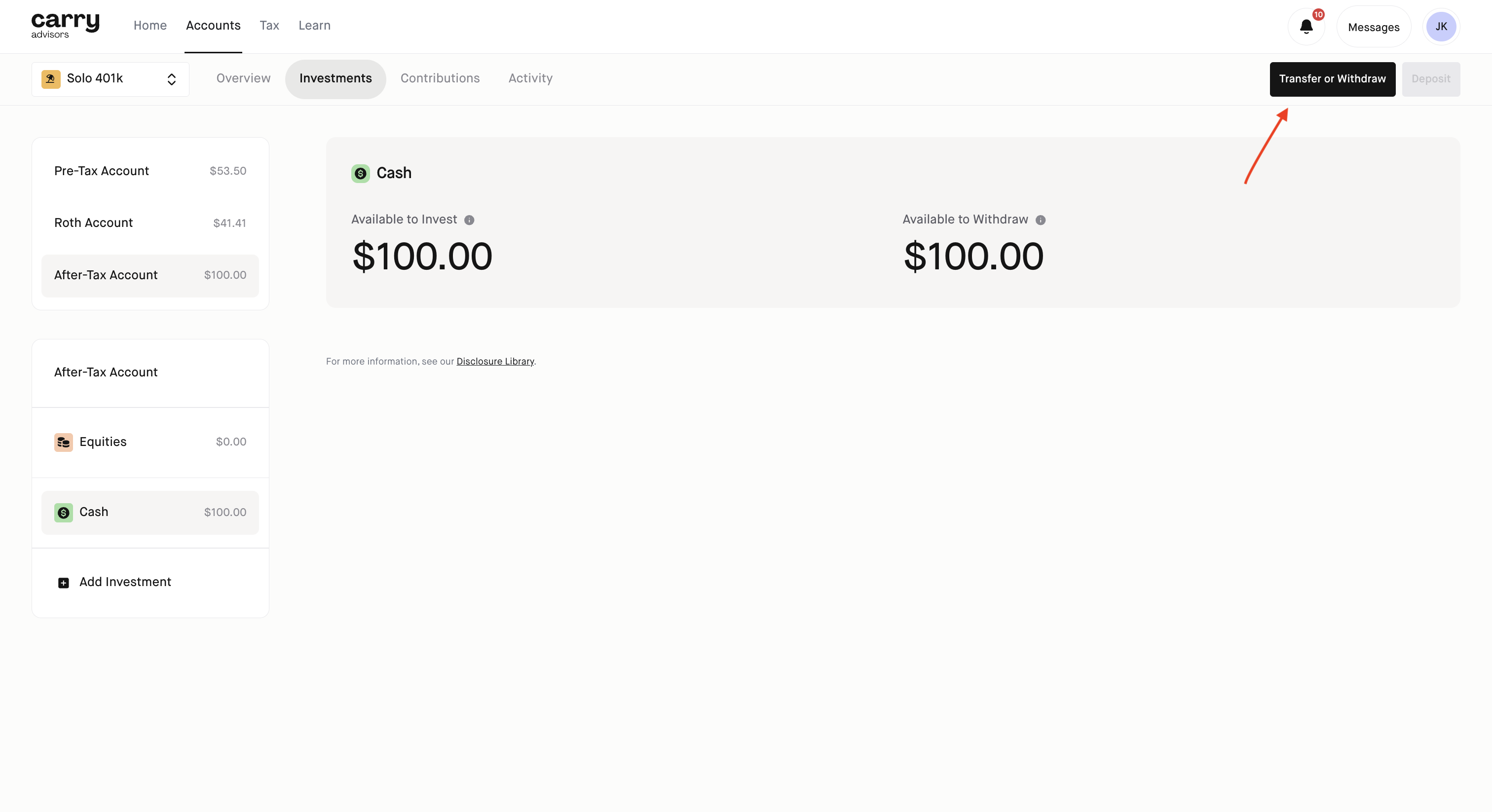

Step 3: If you have any equities invested in this account, sell the holdings so you can transfer the cash once the trade settles. Once all funds in the account are in cash and the cash is showing your full balance as 'available to withdraw' when you click into the 'Cash' section, then select 'Transfer or Withdraw'

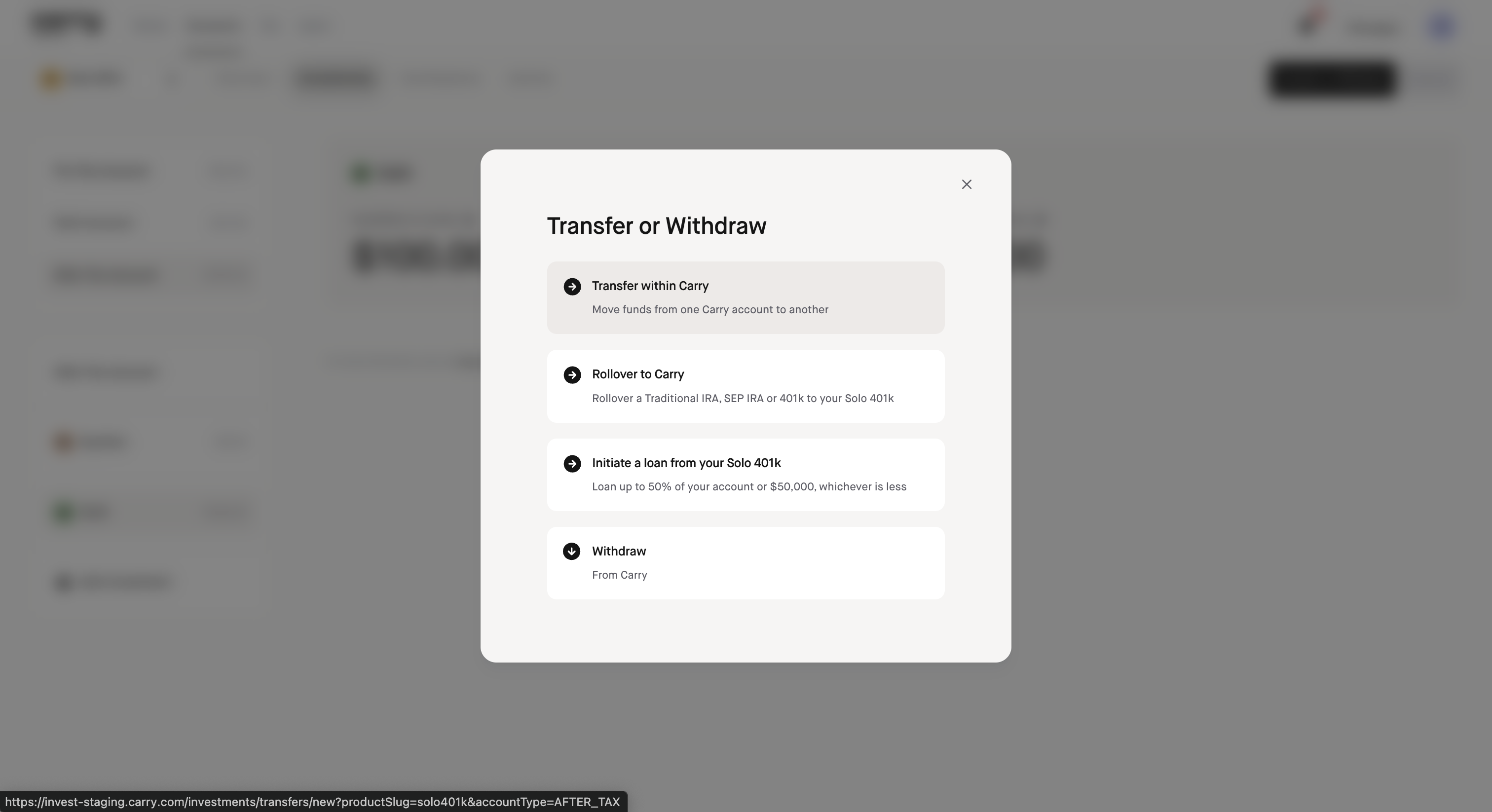

Step 4: Click 'Transfer within Carry'

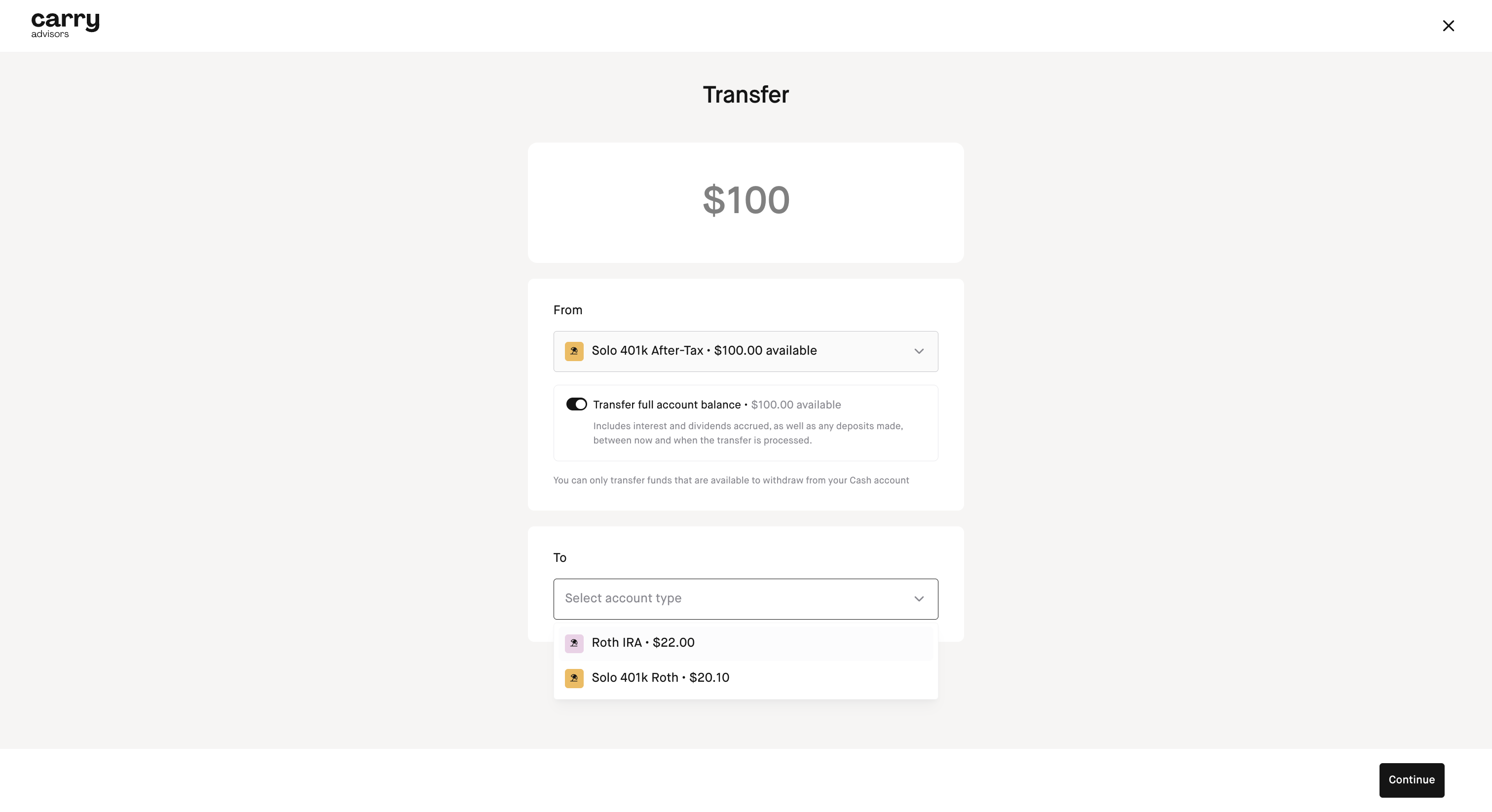

Step 5: Select the 'From' account as your Solo 401k After-Tax account and Toggle the 'Transfer full account balance'. Input the destination account as either your Roth IRA or Solo 401k Roth account and submit the transfer.

Step 6: Unlocking the new Mega Backdoor Roth conversion flow:

If you want to unlock the new automated Mega Backdoor Roth conversion flow, you will first need to bring your after-tax account balance is $0 by moving any funds to your Roth IRA or Solo 401k Roth account using the instructions above. Then you can unlock the new flow using the instructions here.

Moving funds off of Carry

If you want to move your After-tax account balance in addition to your other Solo 401k funds on the Carry platform to another Solo 401k provider, you'd need to restate your Solo 401k plan to them and ensure they are able to receive after-tax funds.

More details on how to do that here.