How to convert your Solo 401k pretax account funds to your Solo 401k Roth account

Step 1: Click into your Solo 401k account

Step 2: Click into any of the Investment types within your Solo Pre-Tax Account's Investments section (Equities, Cash, Roboadvisor, or Alternatives)

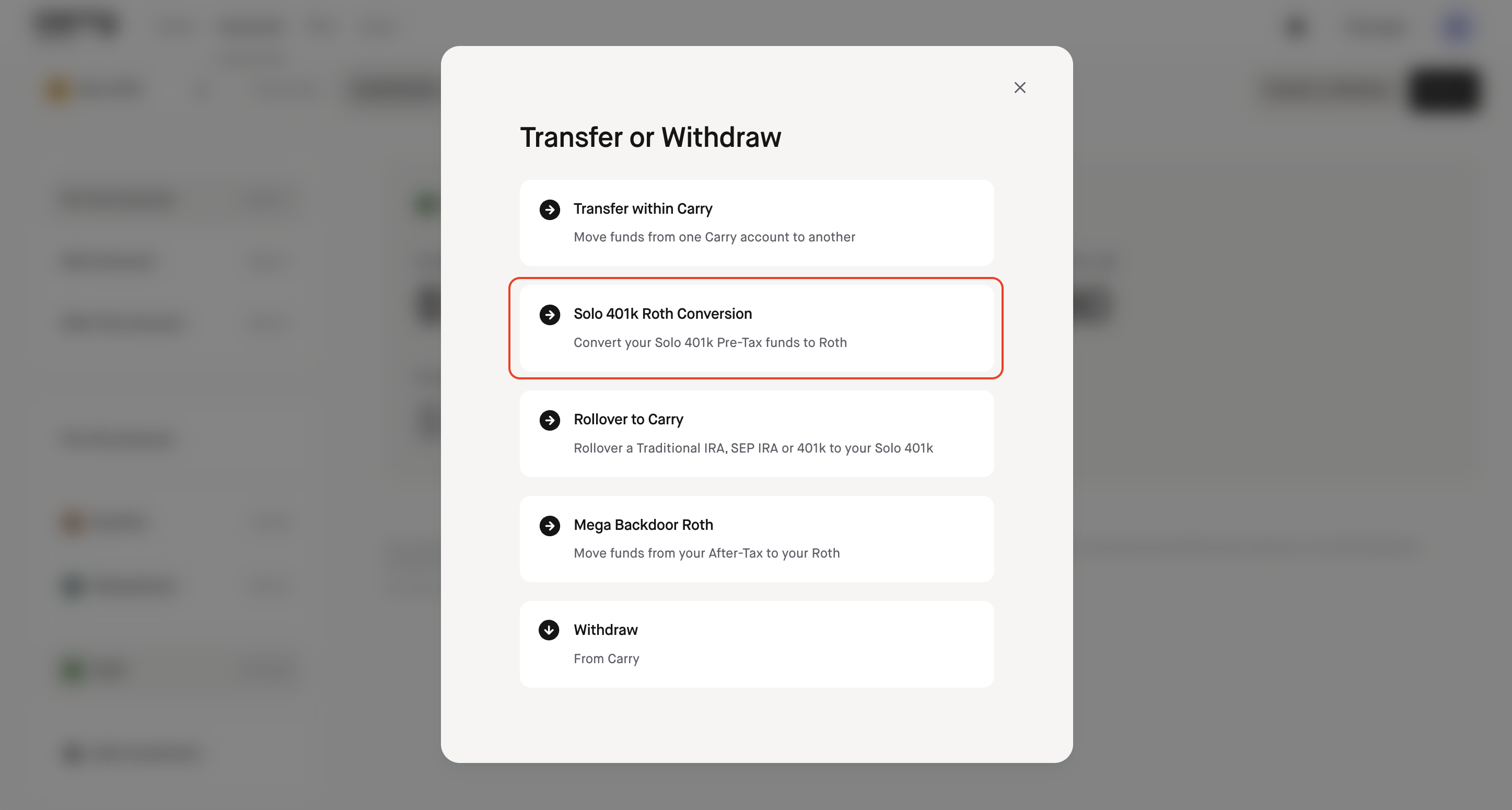

Step 3: Click 'Transfer or Withdraw' and select 'Solo 401k Roth Conversion'

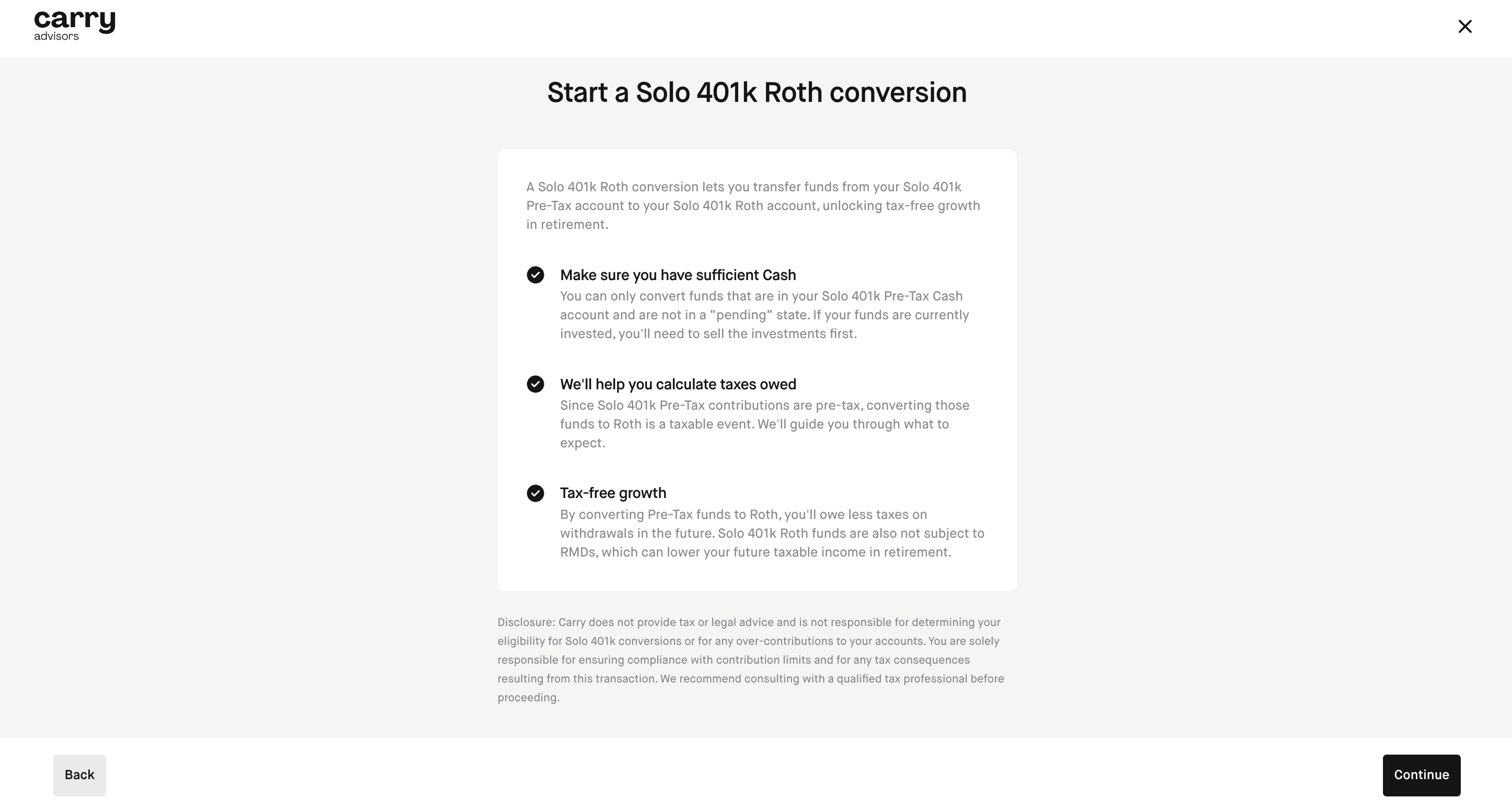

Step 4: Review the details on this screen and click 'Continue'

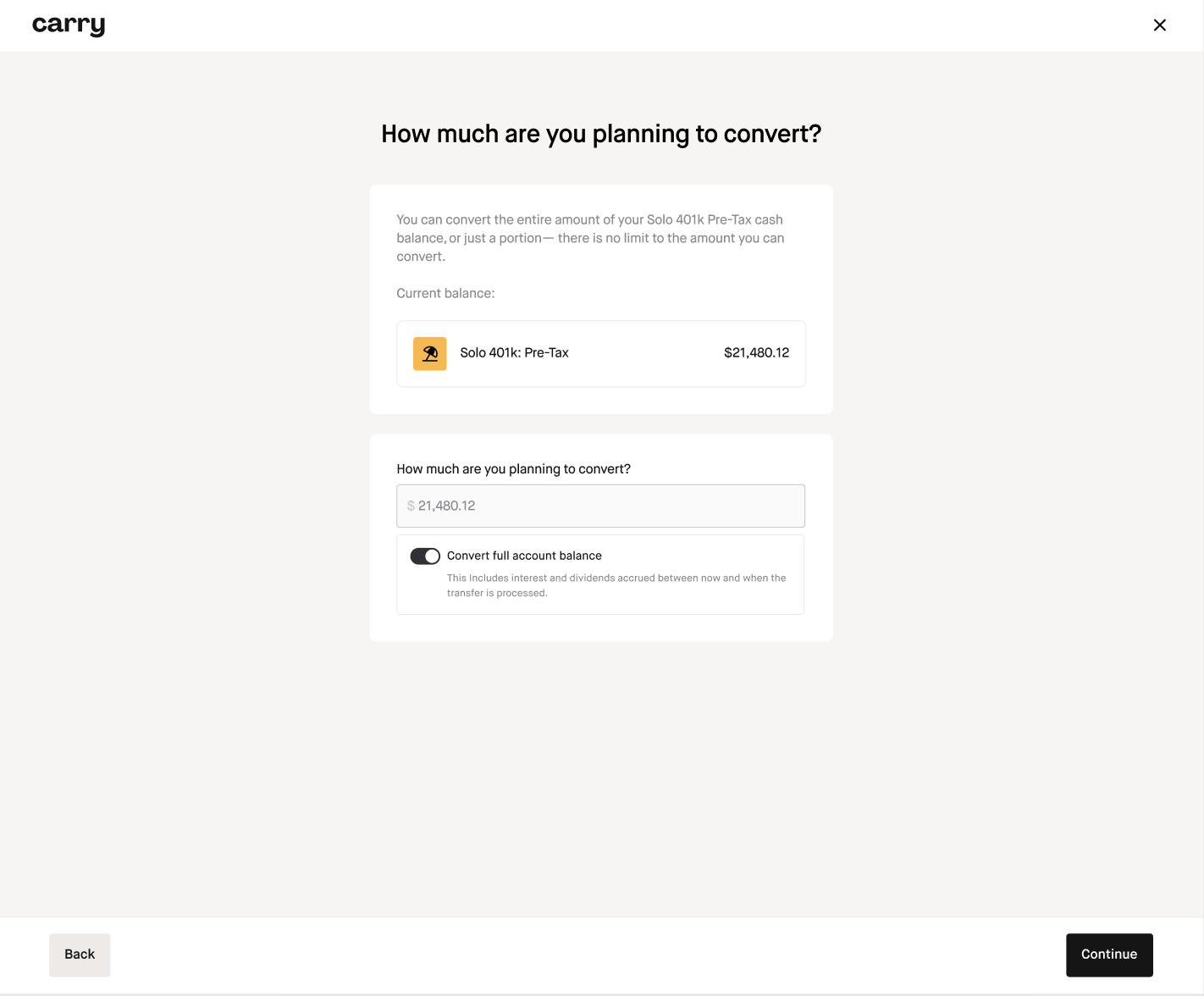

Step 5: Input how much you are planning to convert or toggle 'Convert full account balance' if you want to convert all the cash in your Solo 401k pretax to your Solo 401k Roth account and click 'Continue'

Step 6: You will be brought to a screen to review your current tax rate. Input your estimated taxable income - do not include the amount you are converting in this number and click 'Continue'.

Step 7: You will be shown your estimated owed income taxes from the conversion. Review this screen and click 'Continue'.

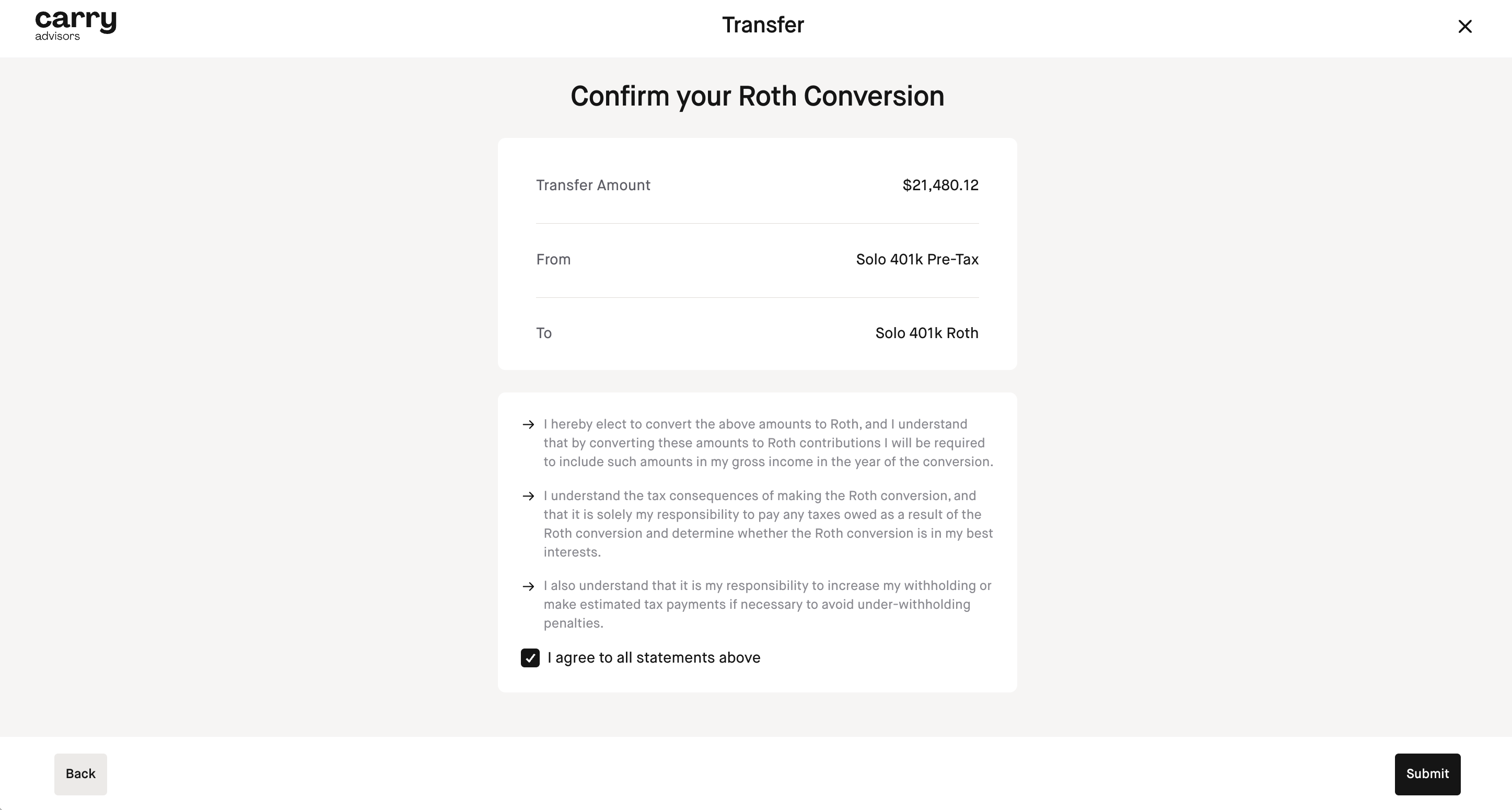

Step 8: Click 'Submit' to Confirm your Roth Conversion.

You will see a Solo 401k Roth conversion confirmation screen to confirm the conversion has been initiated.