Smart Yield FAQ

What exactly is Smart Yield?

Smart Yield is our premium cash management product—automatically allocating your funds to strategic money market funds that primarily invest in U.S. treasuries, government securities, or municipal bonds. Our intelligent system analyzes your unique tax situation to select investments with potential federal, state, and local tax advantages, aiming to deliver competitive after-tax yields compared to traditional savings accounts.

The income from these carefully selected funds is generally anticipated to have tax benefits—treasury funds typically offer state tax exemptions, while municipal funds may provide federal tax advantages—depending on fund composition and your tax situation. By targeting these tax-advantaged opportunities based on your specific circumstances, Smart Yield seeks to maximize your after-tax returns while maintaining the regular liquidity you need for your cash.

The service is offered by Carry Advisors LLC, our SEC-registered investment adviser, with brokerage services provided by Global Carry LLC and DriveWealth LLC, making it a comprehensive cash management solution that combines algorithmic optimization with professional investment management.

Are there any fees associated with Smart Yield?

Carry Advisors charges an advisory fee of 0.20% annually on all assets under management in your Smart Yield account. This fee is calculated daily and automatically withdrawn monthly by liquidating a portion of your money market fund investment.

In addition to these fees, the money market funds themselves have their own operating expenses (expense ratios) that are deducted directly from the fund's yield. These fund expenses vary by fund and are already factored into the yields we display.

Smart Yield is only available to Carry Core and Pro members with an active paid subscription.

Fee Waiver Policy:

Effective from Smart Yield's launch in May 2025, Carry Advisors is waiving all Advisory Fees for Smart Yield accounts through December 31, 2025. Beginning January 1, 2026, Smart Yield accounts will be subject to the standard 0.20% annual Advisory Fee as described above. Clients will receive at least 30 days advance notice before any Advisory Fees are implemented.

How quickly can I access my funds?

While your funds in Smart Yield are liquid, there are important timing considerations. Money market funds are securities subject to standard brokerage settlement processes, typically taking 1-2 business days to settle trades. Once your redemption has settled, it can take 3-5 days for the funds to arrive in your Cash account on Carry. This means the total process from withdrawal request to having funds available in your Cash brokerage account may take approximately 4-7 business days. We recommend planning ahead if you anticipate needing these funds for near-term expenses.

How often does Smart Yield move my funds?

Our algorithm regularly monitors your Smart Yield allocation to assess if your funds are optimally positioned based on current money market fund yields, your tax situation, and investment amount. We only initiate a reallocation when our algorithm identifies a material change in tax equivalent yield offered by another fund that would meaningfully benefit you. When determining whether to move your funds, we carefully consider factors like time out of market and transaction costs to minimize unnecessary trading. This balanced approach aims to maximize your potential yield while avoiding excessive movement of your assets. Actual trades, when deemed necessary, are executed during U.S. stock market trading hours, and implementation may take several days.

How does Smart Yield determine my tax bracket?

Smart Yield uses the Tax Inputs you provide - including your state of residence, taxable income, filing status, household income if filing jointly, and NIIT (net investment income tax) which would be based on the taxable income input. Based on this information, the algorithm estimates your federal and state tax brackets. For the most accurate optimization, it's important to keep your Tax Inputs current. Please note that Smart Yield doesn't consider all tax factors such as deductions, tax credits, local taxes, or changes in tax law, so consult with a qualified tax professional for comprehensive tax guidance.

How does Smart Yield work with retirement accounts?

Smart Yield works differently with retirement accounts like IRAs and Solo 401(k)s due to their tax-advantaged nature. When you enable Smart Yield for these accounts, our algorithm bypasses the tax optimization process since retirement accounts already have special tax treatment. Instead, it focuses solely on selecting the money market fund with the highest pre-tax yield based on your investment amount and other relevant factors. This approach recognizes the distinct tax characteristics of retirement accounts while still seeking to optimize your potential returns.

Is there a minimum investment required?

The minimum investment to use Smart Yield is just $1. However, it's important to understand that each money market fund within our program has its own minimum investment requirement determined by the fund provider. Depending on your total investment amount, you may not qualify for all available money market fund options in our selection, which could affect your potential yield. Our algorithm takes these fund-specific minimums into account when determining your optimal allocation, ensuring you're always placed in the best available option based on your investment amount. The Smart Yield system automatically handles this complexity for you, so you don't need to worry about monitoring individual fund requirements.

Can I use Smart Yield if I don’t live in a state with tax exemptions?

Absolutely! While Smart Yield's tax optimization benefits may be most noticeable for residents of states with income taxes, our service remains valuable even if you live in a state without income tax. For clients in states without income tax, our algorithm focuses primarily on selecting the money market fund with the highest pre-tax yield based on your investment amount and other factors. The service still provides professional management and automated fund selection to help maximize your potential returns.

How do I know if I qualify for tax-free earnings?

Your eligibility for tax-free earnings depends on several factors, including your state of residence and the composition of the money market funds. Money market funds that invest in U.S. Treasury securities may provide income that's exempt from state and local taxes. Similarly, those investing in municipal securities may provide income exempt from federal taxes. Our algorithm evaluates these factors based on your Tax Inputs. However, tax rules are complex and vary by state. For example, states like California, Connecticut, and New York require funds to hold at least 50% of assets in U.S. obligations for the income to qualify for state tax exemption. For definitive guidance on your specific situation, please consult a qualified tax professional.

What types of funds does Smart Yield invest in?

Smart Yield invests exclusively in money market funds that primarily hold high-quality, short-term securities such as U.S. Treasury securities, other U.S. government securities, municipal securities, and repurchase agreements. Our current investment options include funds from Vanguard, Schwab and other notable financial insitutions. All funds are selected based on criteria including fund size, expense ratios, track record, and credit quality. The specific fund selection is limited to those available through our custodian, DriveWealth LLC, and may change over time as we continuously evaluate investment options that may benefit our clients.

How secure is my money with Smart Yield?

Your Smart Yield investments are held in a brokerage account with DriveWealth LLC, a registered broker-dealer and FINRA/SIPC member. While money market funds seek to maintain a stable $1.00 per share price, they are investment securities, not bank deposits, and are not FDIC insured. However, your brokerage account is protected by SIPC insurance up to $500,000 (including up to $250,000 for cash) in the event of broker failure. It's important to understand that SIPC insurance does not protect against market losses or guarantee investment value. Money market funds generally invest in high-quality, liquid securities to help maintain stability, but all investments involve some risk.

Will Smart Yield reinvest my dividends?

Yes, Smart Yield automatically reinvests all dividend earnings back into the same money market fund where your investment is held. This reinvestment happens without any action required from you, allowing your earnings to potentially generate additional returns over time. You'll be able to see both your pending earnings and reinvested dividends within your Smart Yield account page. This automatic reinvestment feature helps maximize the compound growth potential of your Smart Yield investment.

When will I see my Smart Yield earnings?

You will see your earnings for the month reflected typically within the first 3 days of the following month. For example your earnings from May will be reflected by approximately June 3.

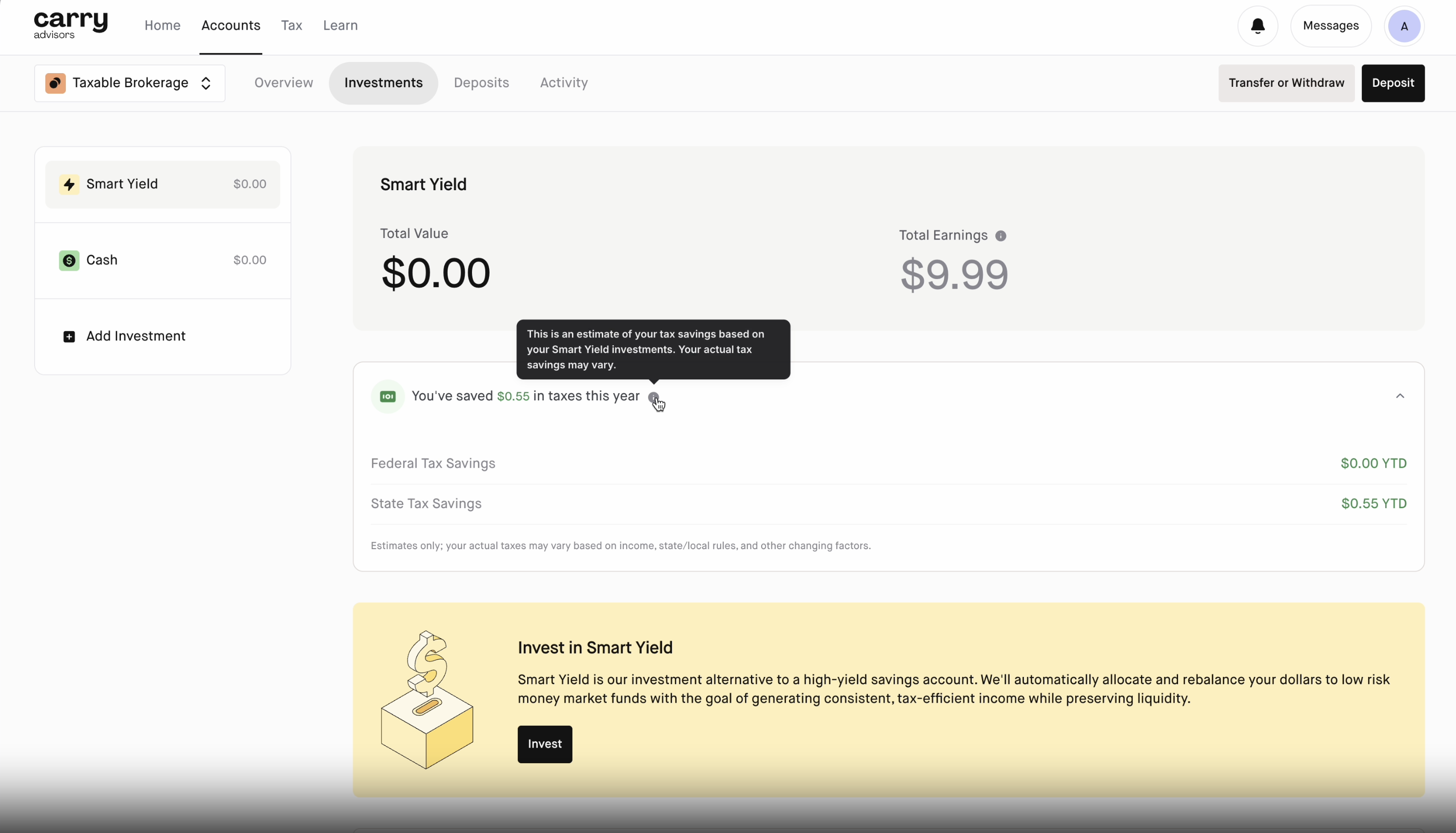

On the Smart Yield investments page below the Total Value section you will see the estimated taxes you've saved for the year. If you expand the section you will see estimated Federal and State Tax savings.