How do I rollover a 401k to a Traditional and/or Roth IRA with Capitalize?

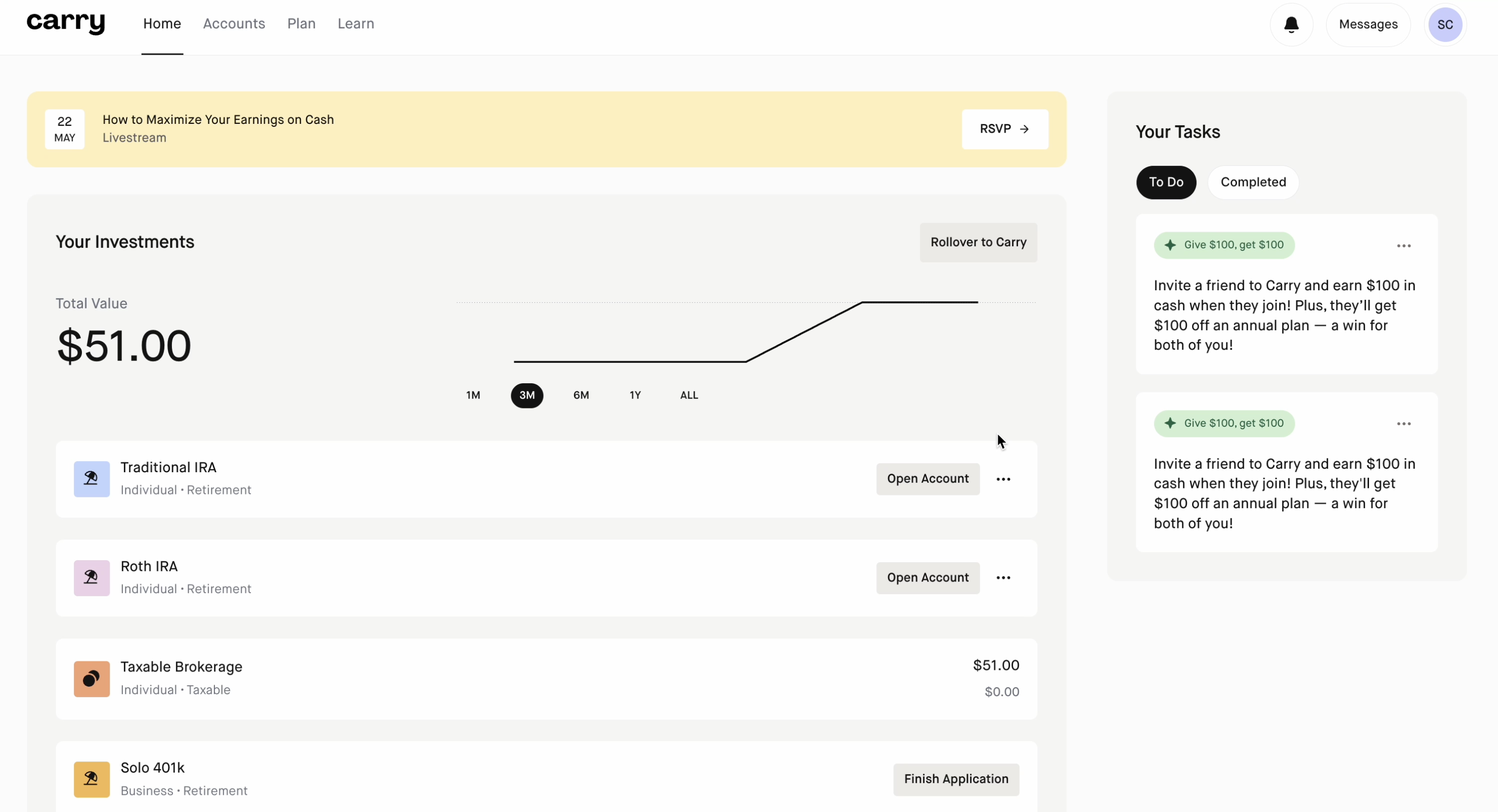

Step 1: Log into Carry, navigate to "Home", and select "Rollover to Carry".

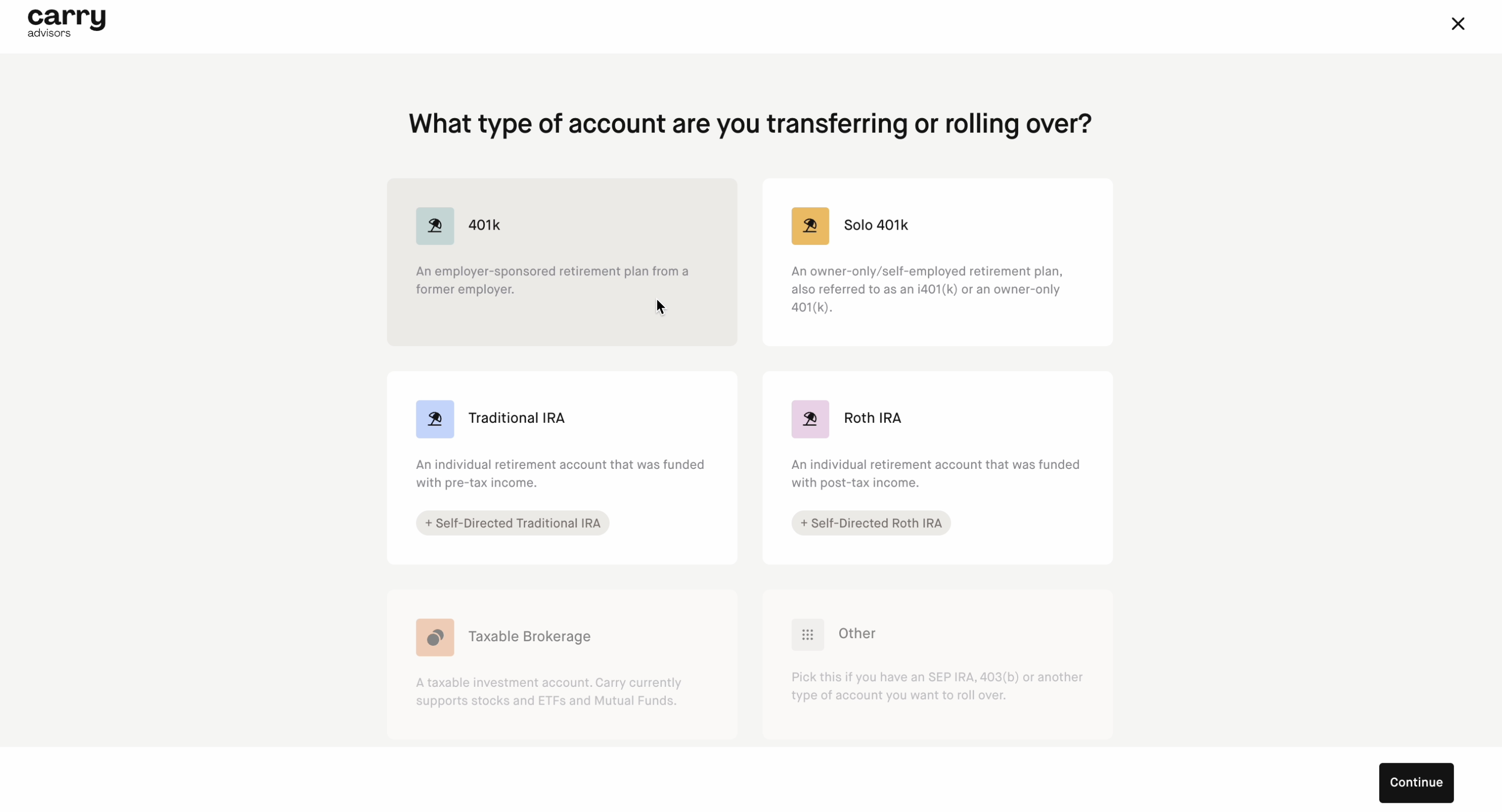

Step 2: Choose "401k" as the account you are rolling over.

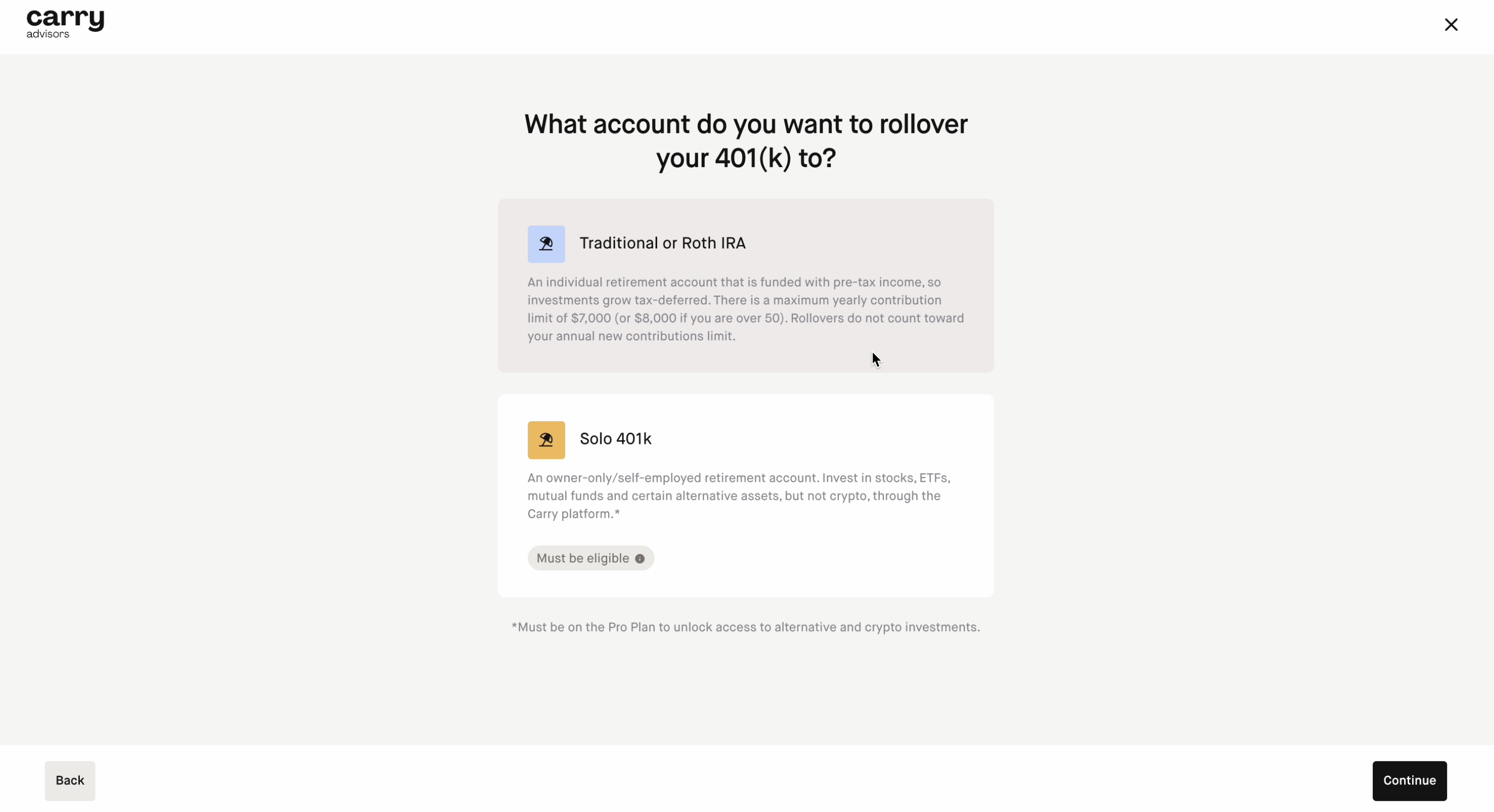

Step 3: Select the account you want to rollover your 401k to. Capitalize only supports rollovers to Traditional and/or Roth IRAs at this time.

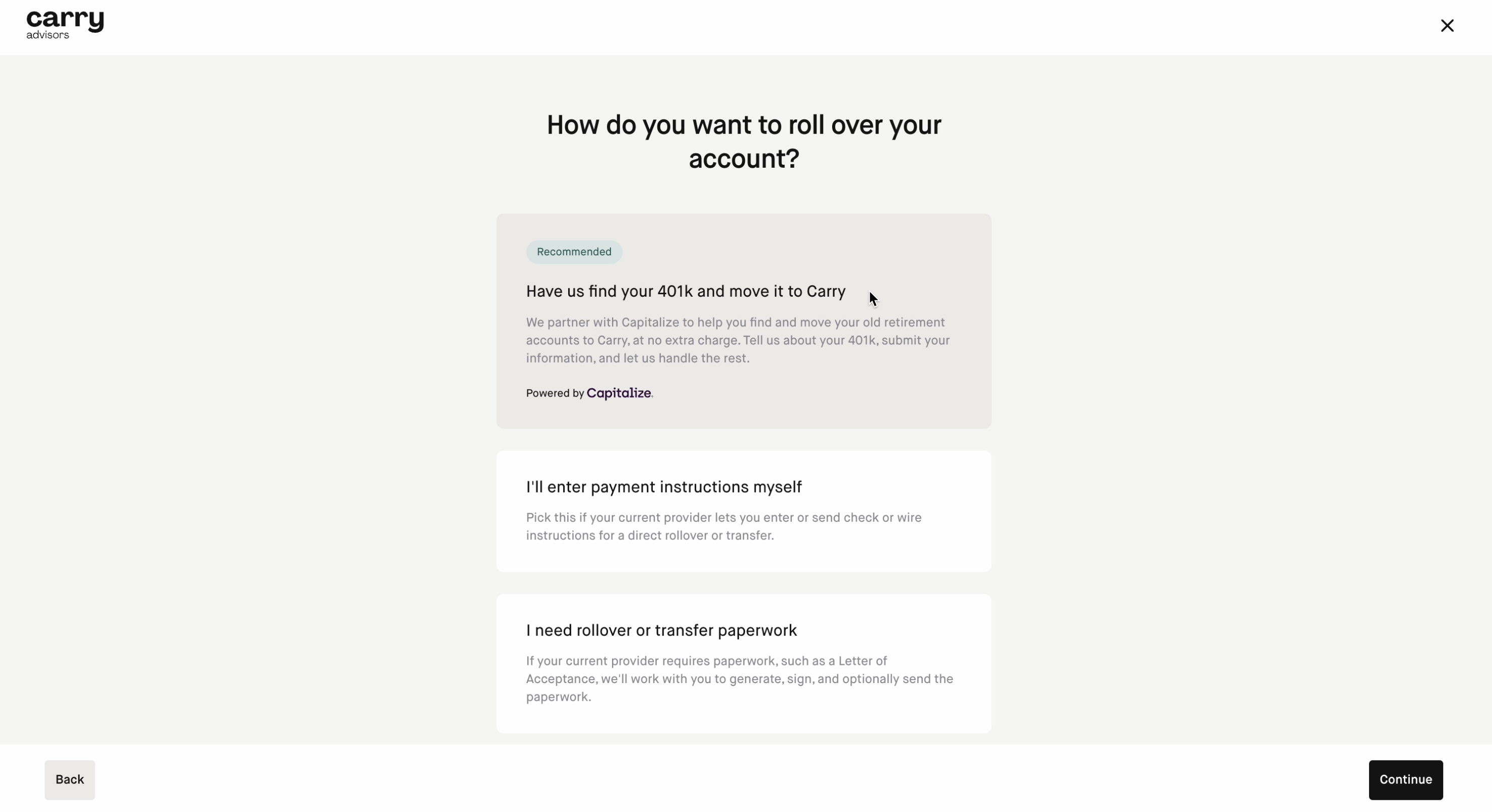

Step 4: Select "Have us find your 401k and move it to Carry" to rollover with Capitalize.

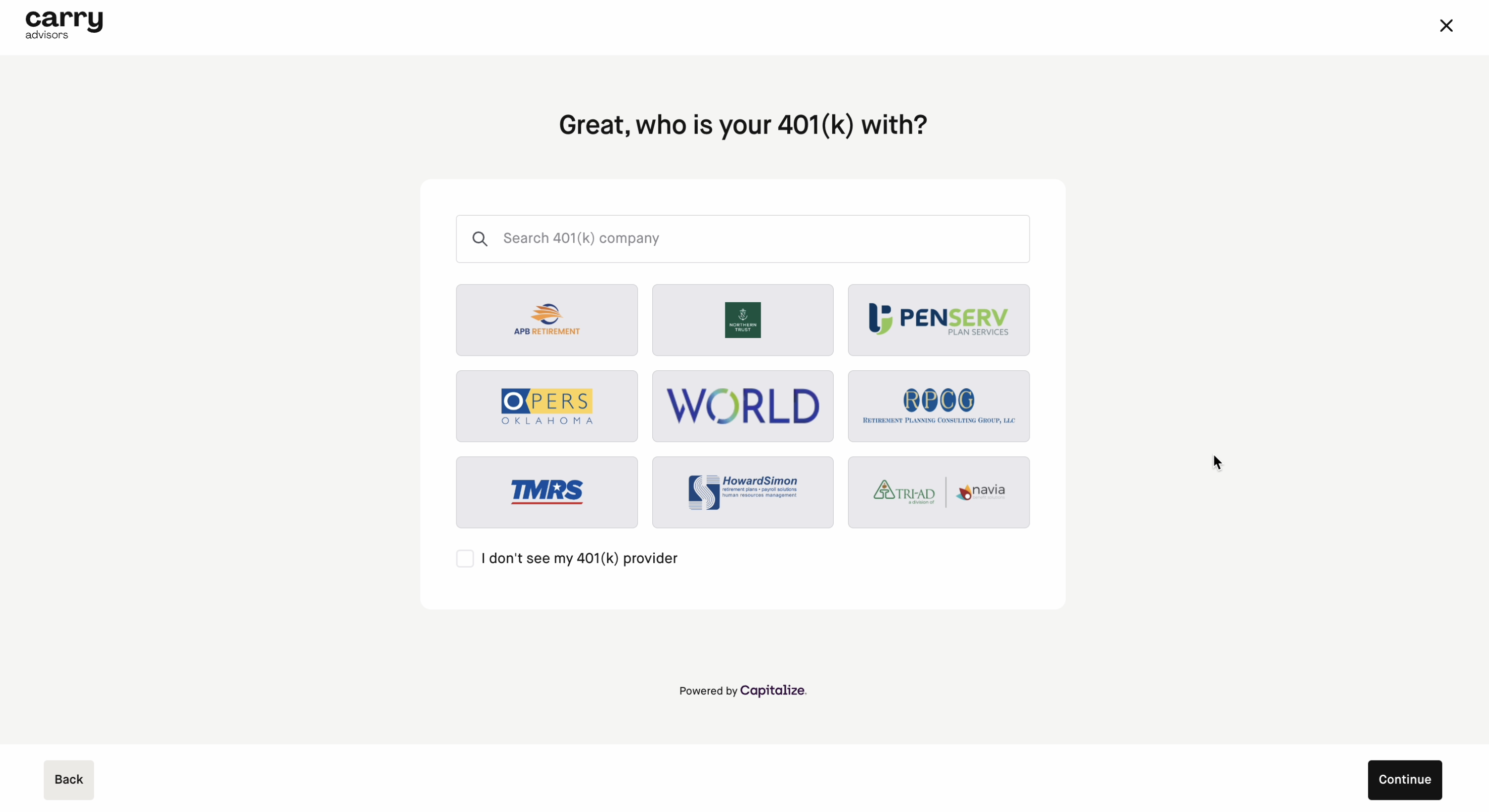

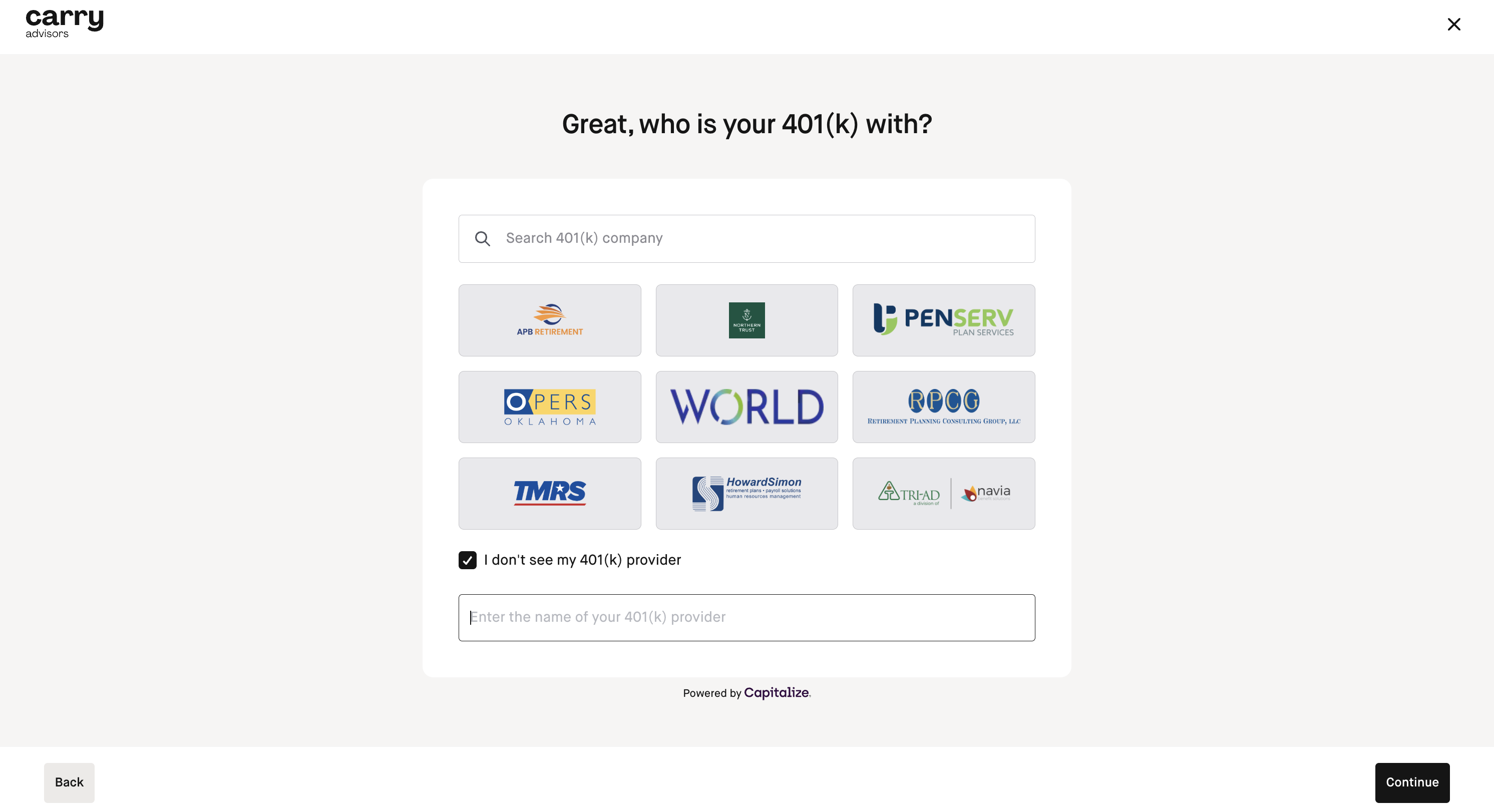

Step 5: Search and select for your 401k provider.

If you don't see their name, you can search for them by checking the "I don't see my 401(k) provider"

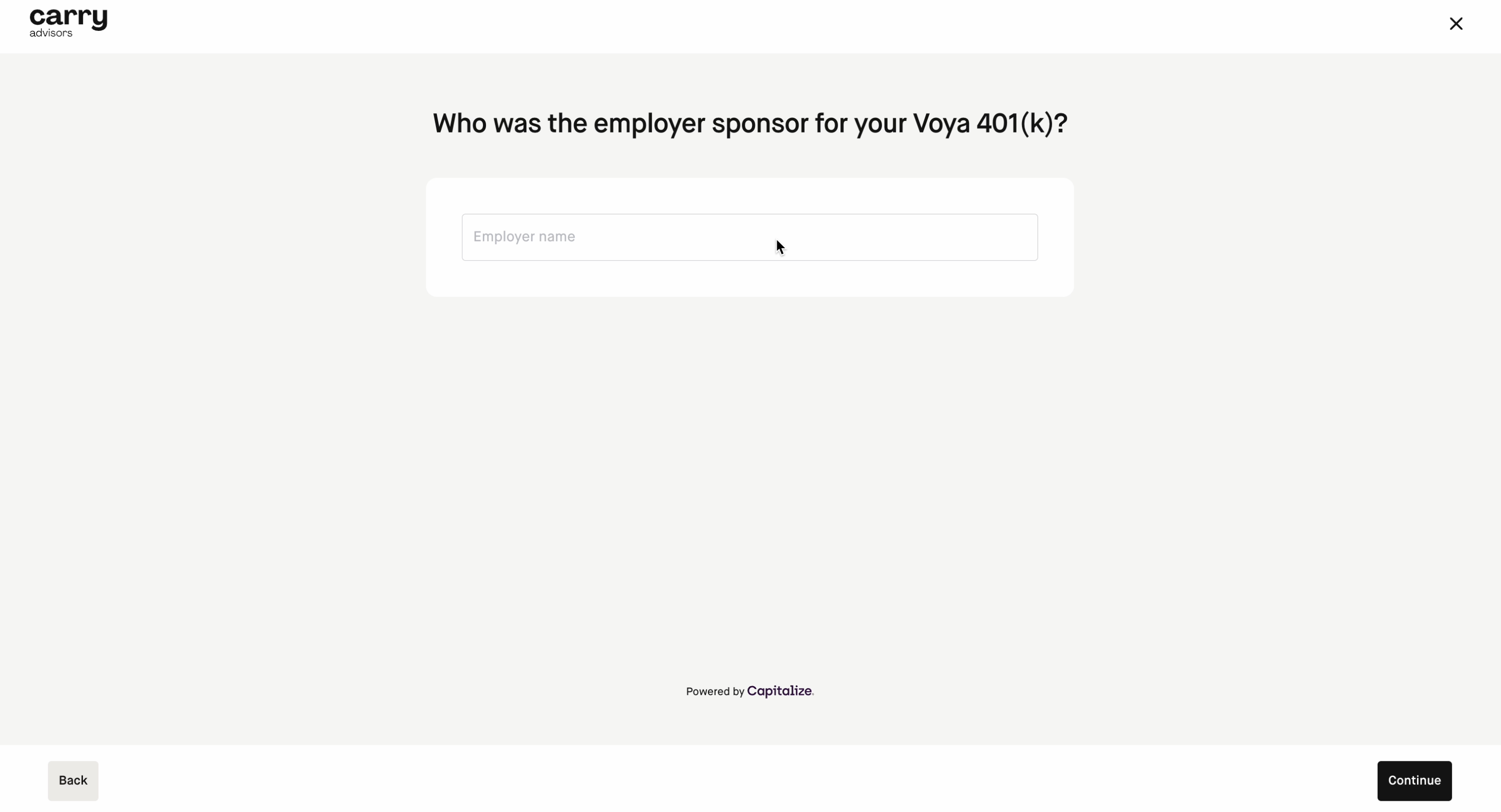

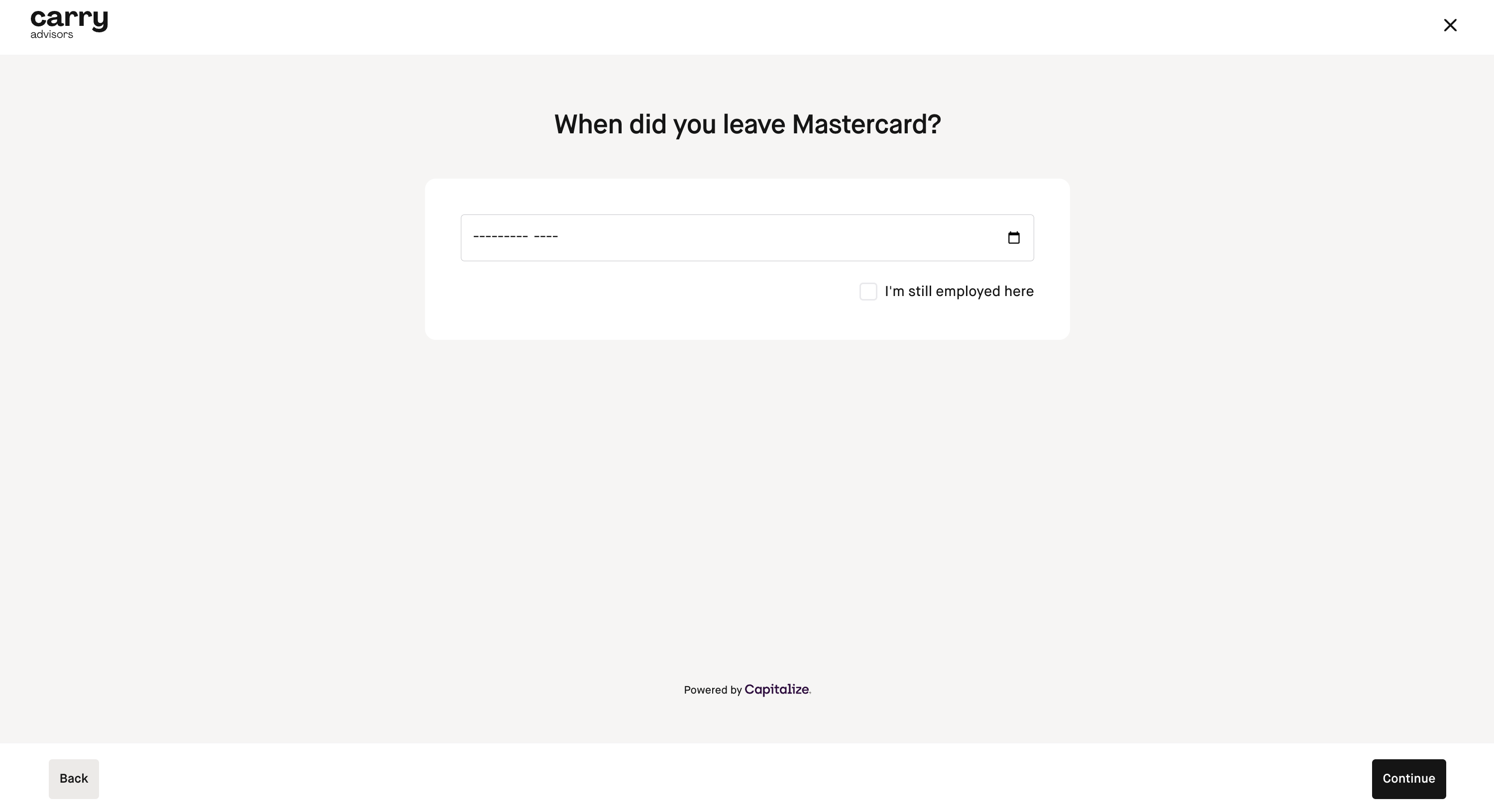

Step 6: Provide your employer name and last employment date.

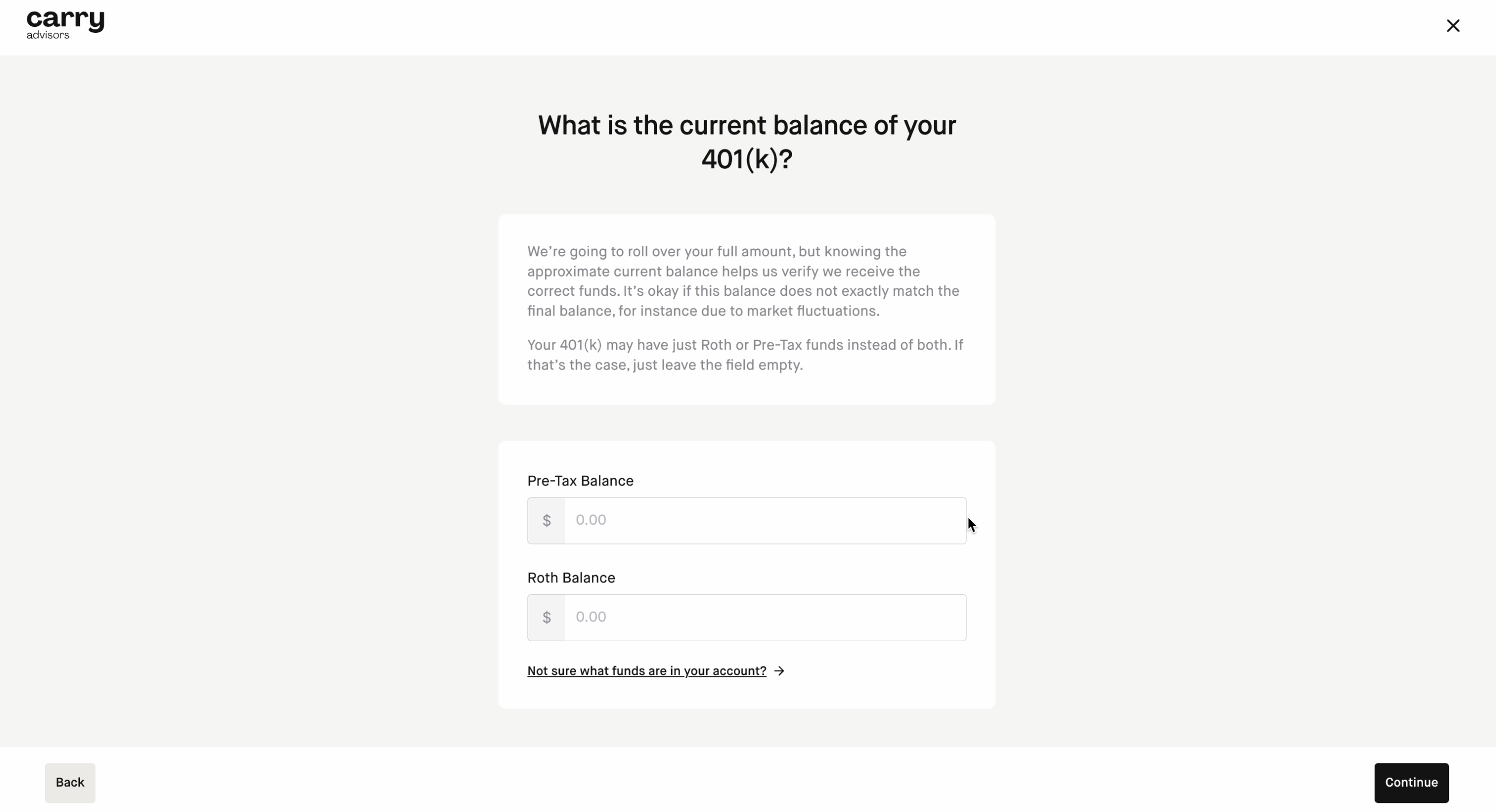

Step 7: Input the current balance of your 401k.

If you aren’t sure what type of funds are in your account, you can check your provider’s account statement or call your provider.

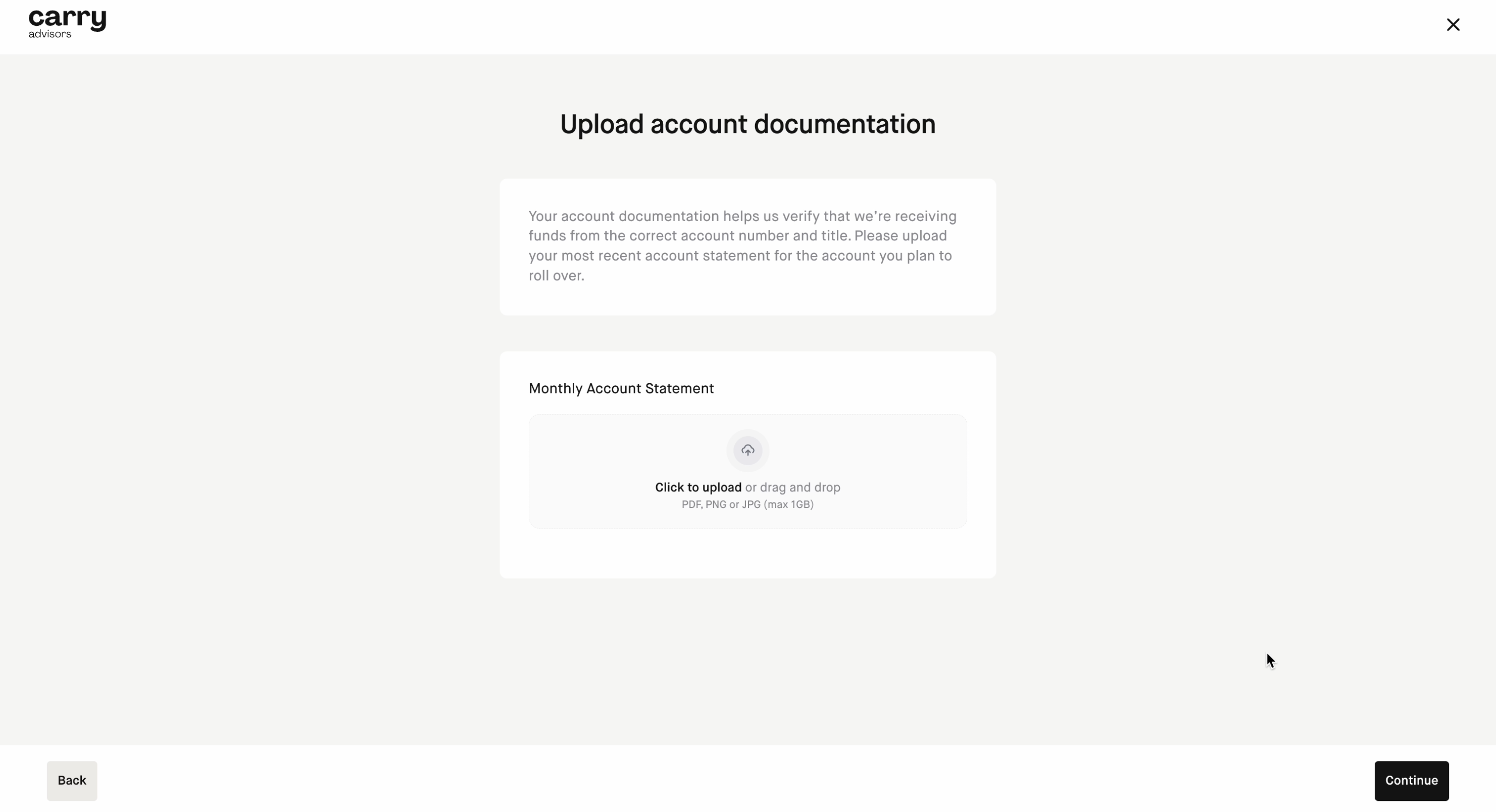

Step 8: Upload your most recent monthly account statement to verify the account we’ll be receiving funds from.

If your account has pre-tax funds, you'll be prompted to roll over to a Traditional IRA. If it has both Pre-Tax and Roth funds, you'll be prompted to roll over to a Traditional IRA and Roth IRA.

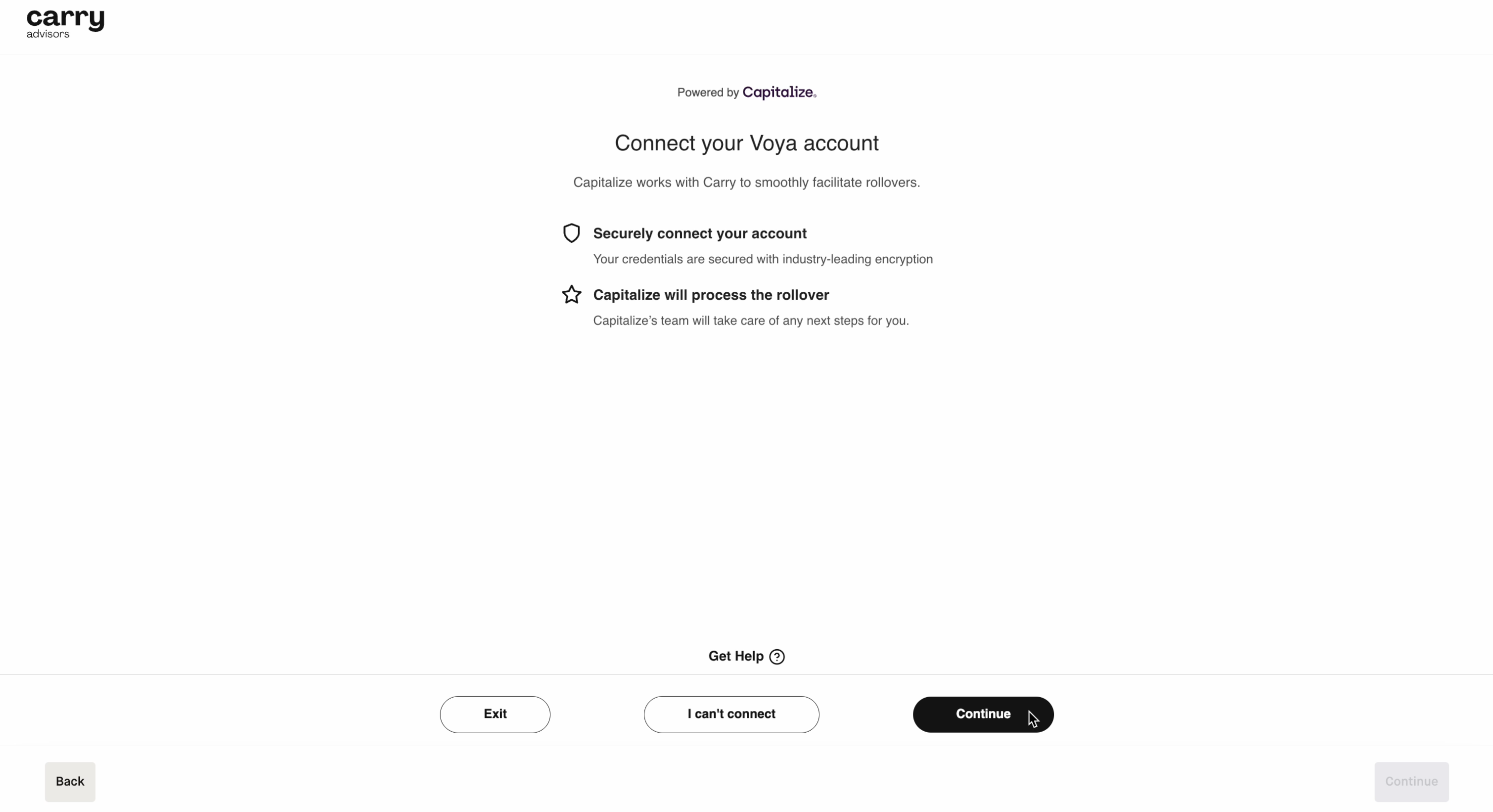

Step 9: Next, you'll need to confirm your information is correct and connect your retirement account to Capitalize. Click "Continue". You'll connect your 401k provider to Capitalize by logging in and verifying your phone number.

Step 10: You will reach the success screen and can click “Done”.

Step 11: The next screen will be a confirmation of your rollover, status, and next steps. Look out for information from Capitalize on any action required by you. You can click "Exit".

Step 12: You'll see this confirmation screen that your rollover has been initiated. You can click "Exit"

From here, you can track the status of your rollover in your Carry dashboard. Here are the possible statuses:

Rollover submitted: You have done everything you need to do in order for us to process (signed form, scheduled call, connected account, etc.).

Processing: Your rollover was initiated and the funds are in transit.

Complete: Your funds have settled in the destination account, and no further action is required.

Incomplete: Information is needed for the rollover to be validated. Details and action items can be found in your dashboard under "View Rollover".

Requires action: You may need to complete an action item, such as signing a form. Details can be found in your dashboard under "View Rollover".

Pending review: The transaction is under review by the Capitalize team. The Carry and/or Capitalize teams may reach out to you with more details and additional steps.

Ineligible: The origin 401k account you tried to roll over was not eligible, usually because there were no funds or the account is still active.

Canceled: The rollover was canceled either by you or assumed canceled due to inactivity.