How do I invest in ETFs with Carry?

Once you’ve added funds to your account and when you click into the cash section it shows as 'available to invest', you can start investing in ETFs directly.

You can also set up a recurring investment. More details on that here.

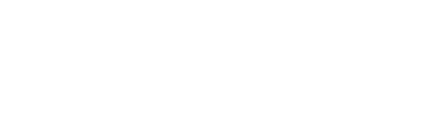

Step 1

To invest in ETFs, head over to the Investments section of the app under the Accounts tab and select 'Equities'. Select the account you would like to buy the ETF in or sell from.

Step 2

You can then explore popular ETFs and search for ones that you want to invest in.

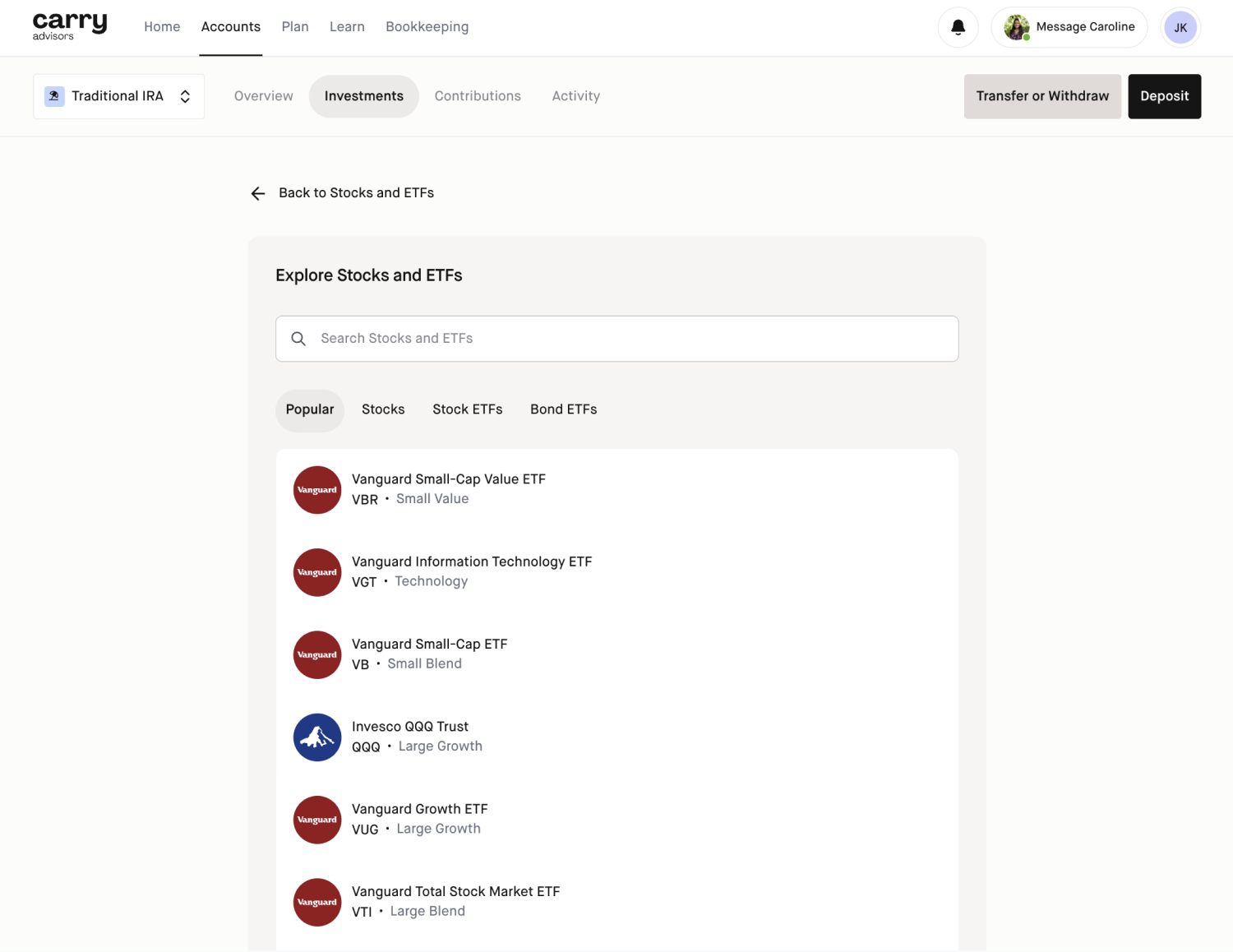

How to buy an ETF

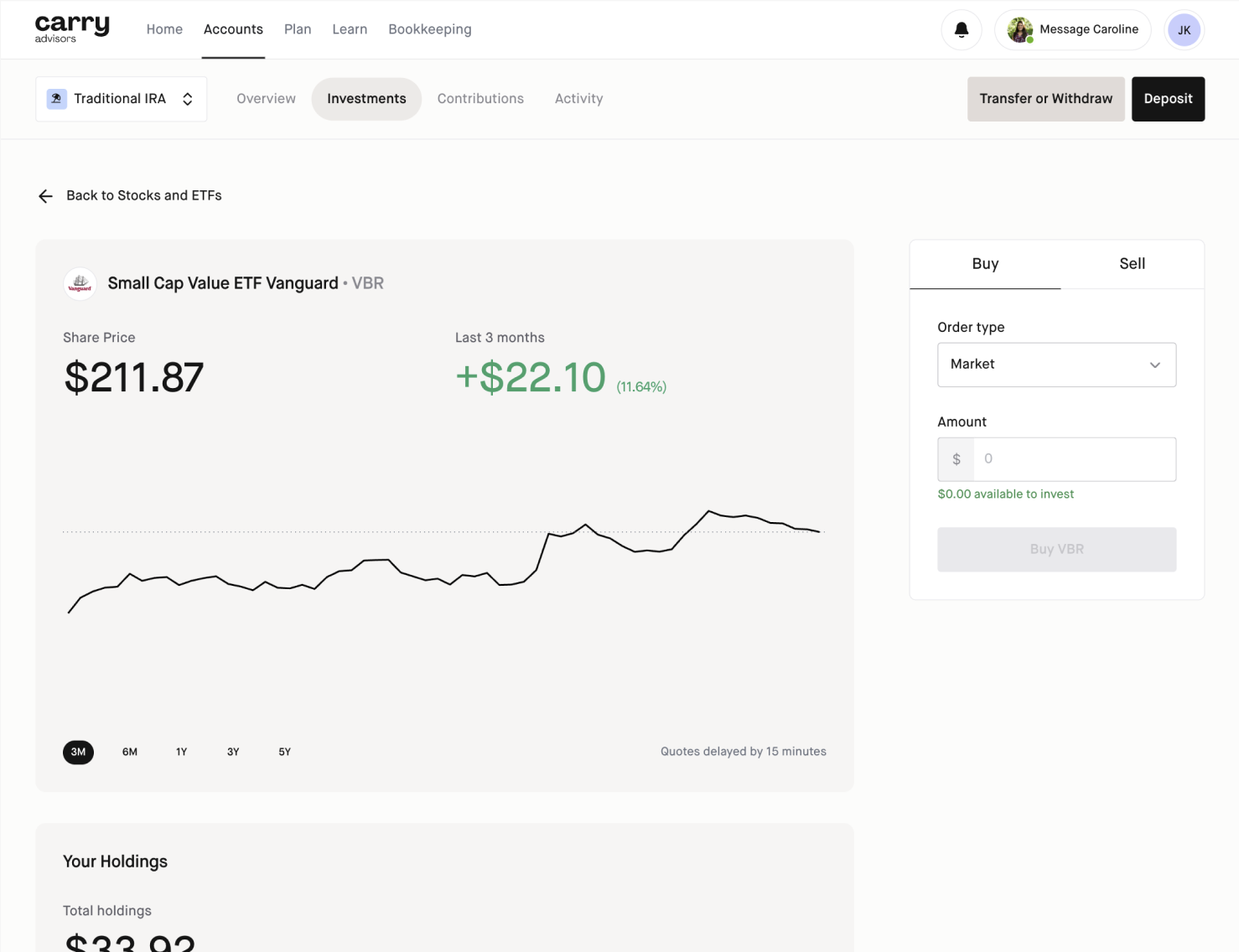

Select your desired Order Type: Market or Limit.

For Market Orders: Input the dollar amount you want to invest in the ETF. Then click Buy.

For Limit Orders: Input your desired limit price, number of shares, and limit expiration date. Then click Buy.

How to sell an ETF

Select your desired Order Type: Market or Limit.

For Market Orders: Input the dollar amount of ETF you want to sell. Then click Sell.

For Limit Orders: Input your desired limit price, number of shares, and limit expiration date. Then click Sell.

What is a market order?

A market order is an order to buy or sell an ETF at the market's best available price. It typically ensures an execution but doesn't guarantee a specific price. When the primary goal is to execute the trade immediately, a market order could be optimal.

What is a limit order?

A limit order is an order to buy or sell a security at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher.

Example: An investor wants to purchase shares of the VOO ETF for no more than $10.

What is a Stock ETF?

A stock ETF, or exchange-traded fund, is a type of investment company that allows investors to pool money into a fund that invests in stocks. ETFs are similar to mutual funds, but they can be traded throughout the day on a national securities exchange.

What is a Bond ETF?

These ETFs invest in a portfolio of bonds, such as U.S. Treasuries, high yields, or long-term and short-term bonds