How do I make a contribution to my Solo 401k?

Edited

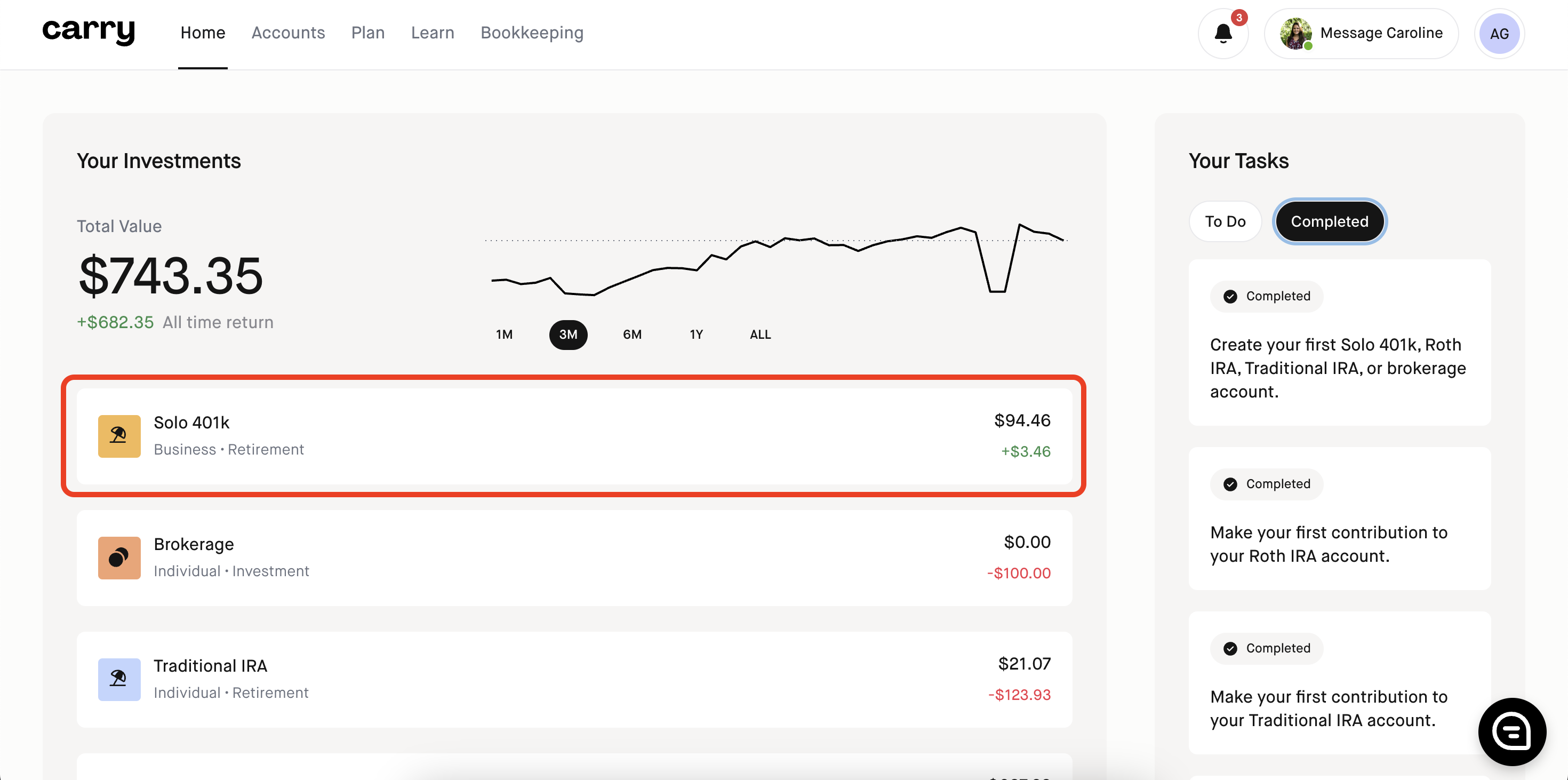

Step 1: Go into your Solo 401k Account

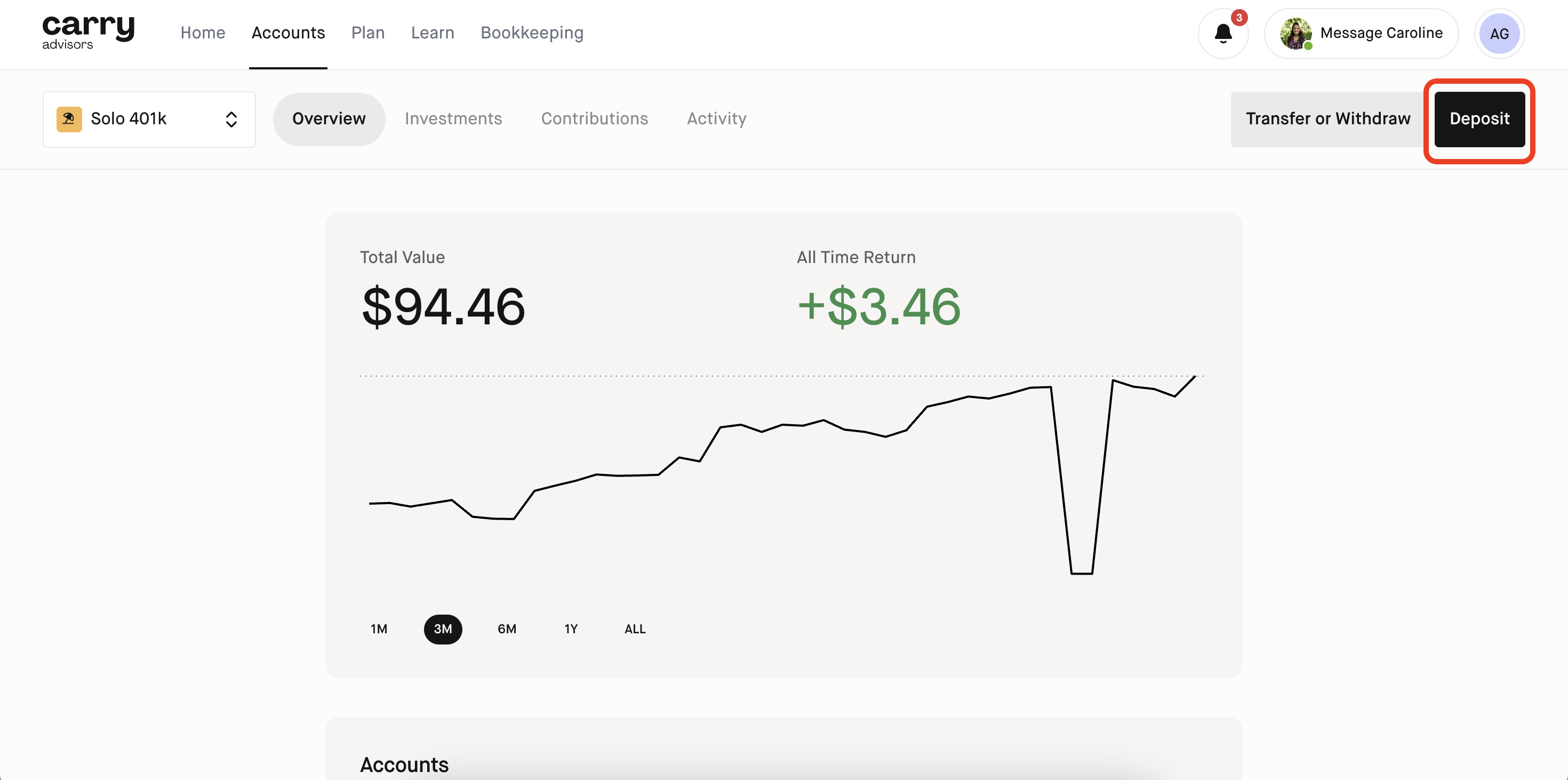

Step 2: Click "Deposit"

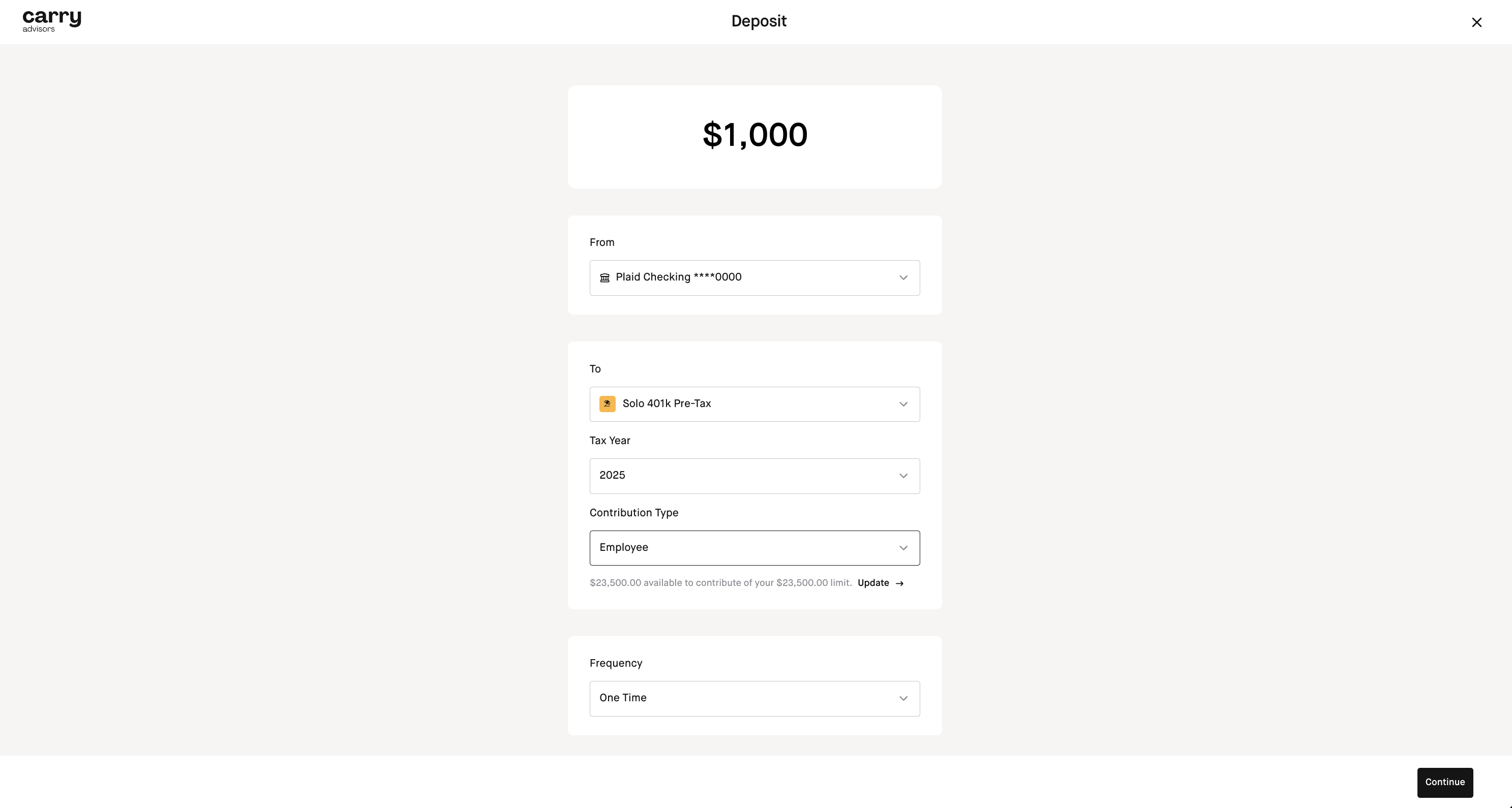

Step 3: Input deposit details:

The amount you'd like to contribute

Where the funds are coming from (a linked bank account, a manual ACH, or a wire deposit)

What year the the deposit is for

Which account the funds are going to (Solo 401k Pre-tax, Solo 401k Roth, or Solo 401k Mega Backdoor Roth)

The contribution type (Employee or Employer) if the funds are going to a Solo 401k Pre-Tax account. All Solo 401k Roth and Solo 401k Mega Backdoor Roth contributions are considered employee after-tax contributions.

The frequency of deposits (One-time, or recurring at a daily, biweekly, monthly, or quarterly basis)

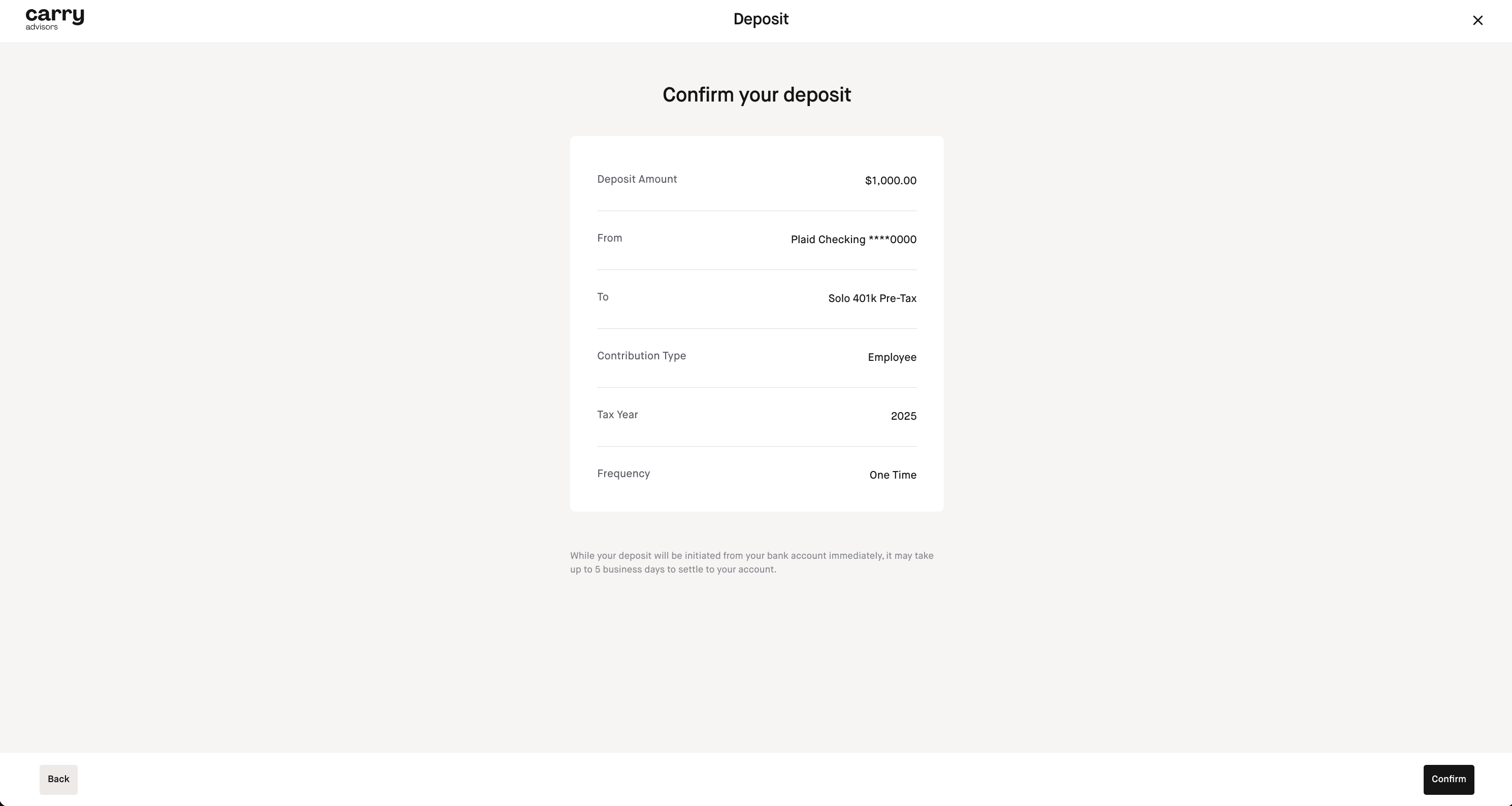

Step 4: Confirm the details of your deposit

Review your deposit information and finalize your contribution by clicking "Confirm".