How to invest in crypto within your Carry IRA (Roth or Traditional)

There are two different ways to invest in crypto via your IRA accounts:

Through Crypto ETFs such as Bitcoin or Ethereum

Directly via your Carry IRA account (Roth and Traditional)

Solo 401k

We don't support direct investing in cryptocurrencies through a Carry Solo 401k account at this time, but you can invest in available Crypto ETFs in your Solo 401K. If you contribute to a Mega Backdoor Roth Conversion and select your Roth IRA on Carry as the destination for those funds then you could invest directly into Crypto once the funds are in the Roth IRA. More details on that linked here.

*Direct Crypto investing within IRA accounts is only available with Carry Pro membership. You must maintain a Pro Carry membership if you hold crypto in your IRA account.

1. Crypto ETFs

You can invest in Crypto ETFs through any Carry account, allowing you to get exposure to Bitcoin or Ethereum. Crypto ETF trading is available in all Carry accounts.

To invest in a crypto ETF through Carry, select the account you want to invest from. If you don't have any cash in the account you'll need to deposit funds first or alternatively you can any use existing available cash in the account.

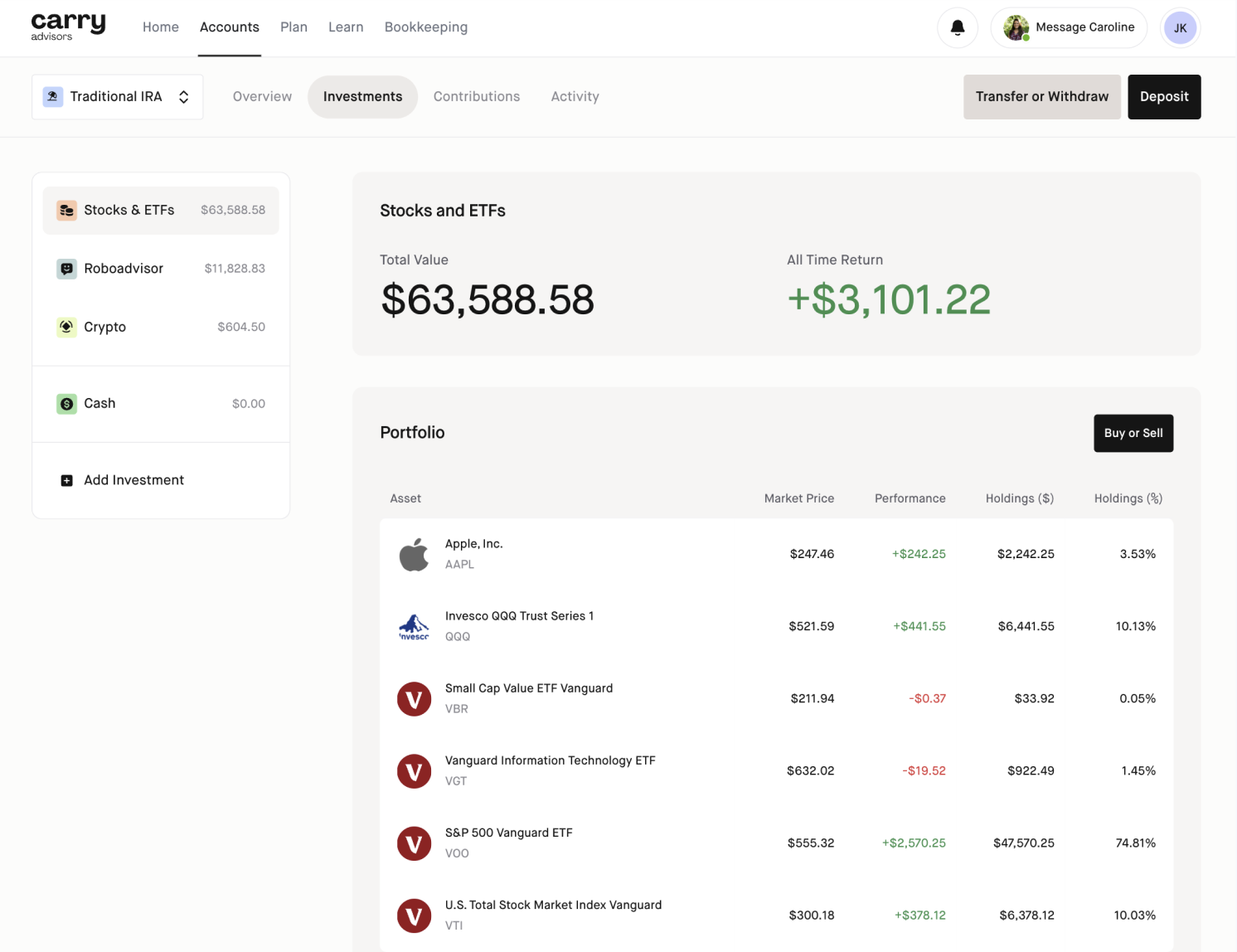

Then, head over to the Accounts page, and under the Investments tab, click 'Equities'.

Click 'Buy or Sell' and Search/select the Crypto ETF that you want to invest in.

2. Investing in Crypto directly through an IRA

You can invest in crypto natively on the Carry platform with Carry’s Traditional or Roth IRAs. Our 3rd party trust company uses an institutional Coinbase account to custody the funds.

Step 1: Select the IRA account that you want to invest from.

Step 2: Fund your crypto cash account

Make a deposit into your cash account or you can use existing crypto cash in the account to fund the investment.

If you have cash that you want to move to 'crypto cash' to be used for a crypto investment click into the 'Cash' section and select 'Transfer to Crypto Cash'.

*Please note It typically takes 5-10 business days for the funds to move from cash to crypto cash.

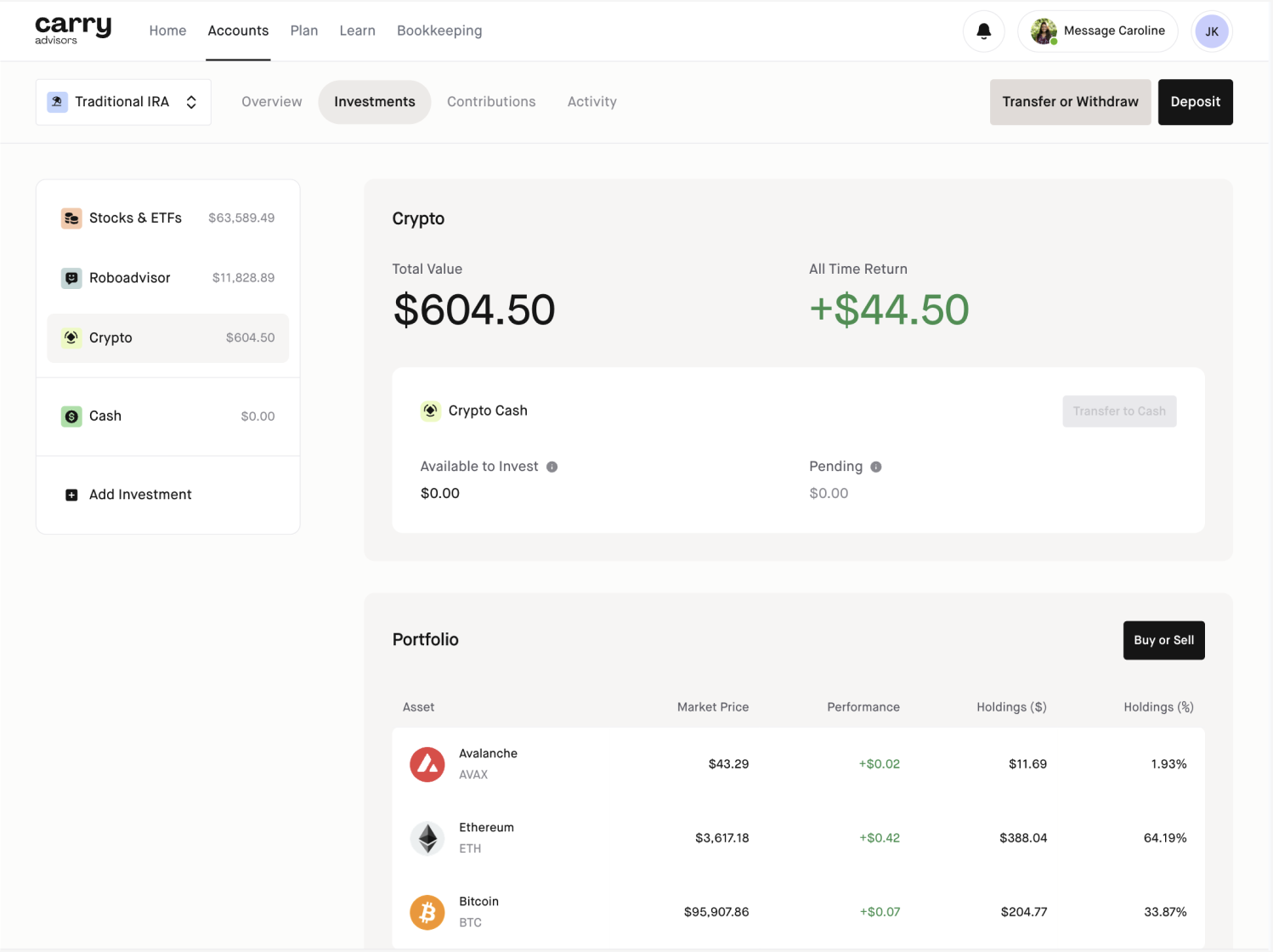

Step 3: Once you have crypto cash available to be invested, navigate to the Investments tab under the account you want to invest from and click on Crypto. If you don't see it yet click '+ Add Investment' and add Crypto.

Select buy or sell

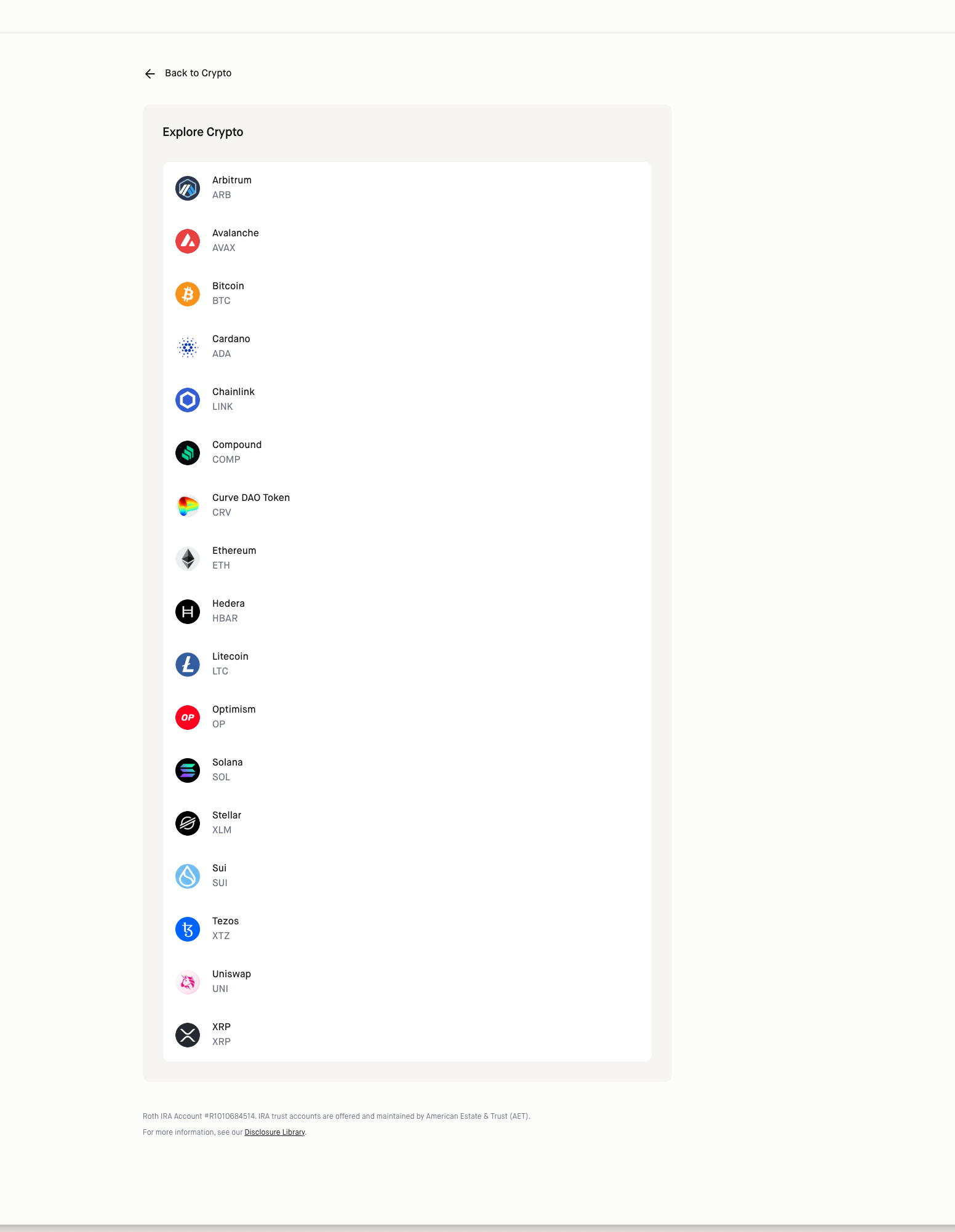

> search and select the crypto you want to invest in

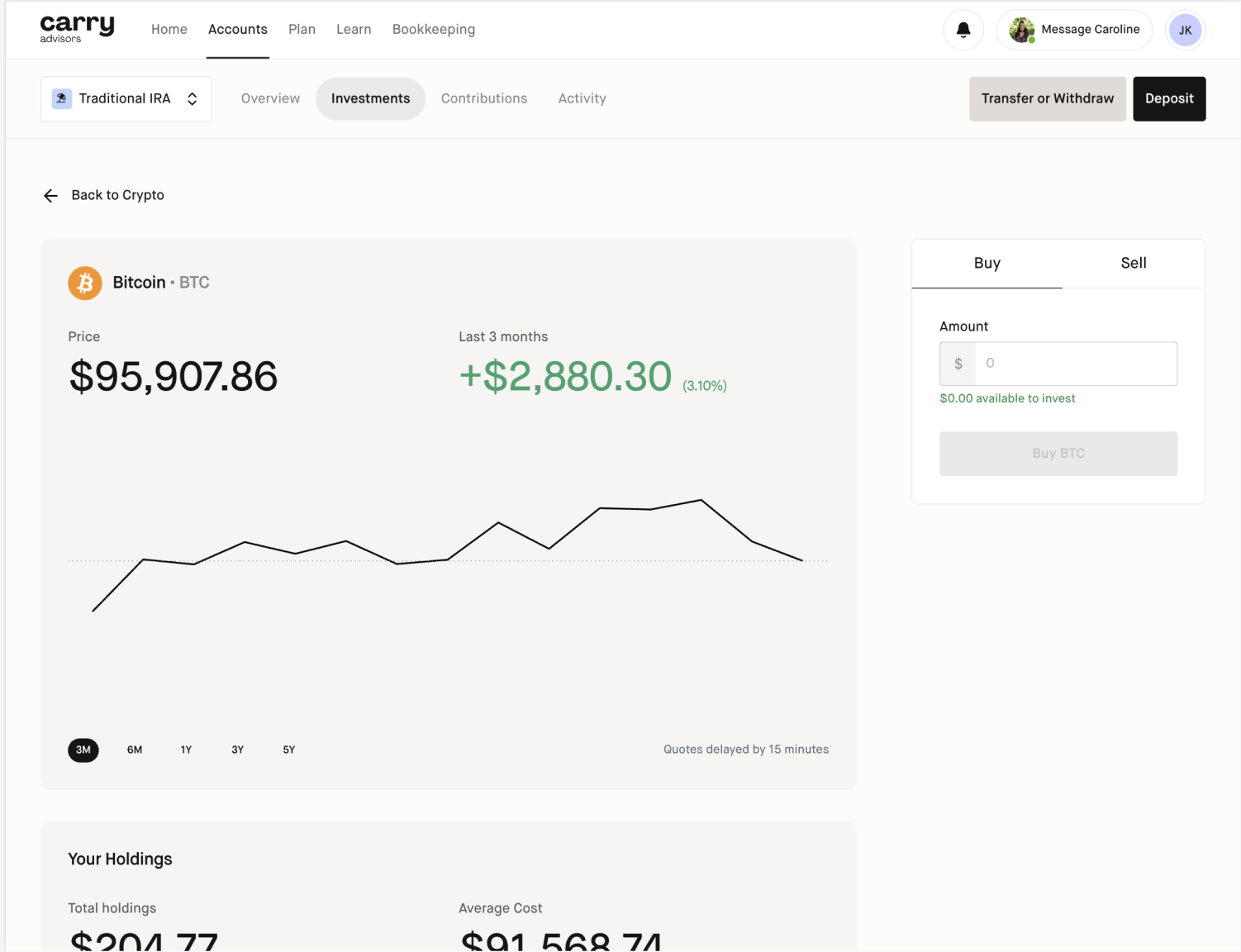

> select the account you want to invest from

> enter the dollar amount you would like to buy or sell

> review and submit your order

You can view all of your recent transactions when you visit your account screen.