Solo 401k Over-Contributions

Contributions to a Solo 401k are limited by many factors, including annual limits, your business/self-employment profits, other 401(k) plans you may participate in, and the type and mix of Solo 401k contributions you are making.

If you find out you have over-contributed to your Solo 401k plan, you should move quickly to correct it. We strongly suggest working with a qualified accountant or attorney who can guide you through the process.

If the employee contributions were invested or already converted using Mega Backdoor Roth, we strongly recommend you speak with an accountant to guide you on next steps on how to process the over-contribution.

At a high level, the path to correcting an over-contribution will depend on the type of funds that were over-contributed.

Please note that once the funds are withdrawn for corrections you may not be able to make contribution elections or contributions again depending on the deposit type and correction made.

Solo 401k Employee Over-Contributions

Excess employee contributions (employee pre-tax or Roth salary deferrals, or employee voluntary after-tax contributions) can generally be withdrawn before the tax filing deadline without any penalty.

In Carry, you can process a withdrawal of excess employee contributions by using the withdraw flow, and choosing the "corrective withdrawal" reason.

If insufficient cash is available to withdraw, you'll need to sell out of positions so that there is cash available, and then wait for the trades to settle and the cash shows as 'available to withdraw' within your cash tab for the account.

Click into the Account

> Transfer or Withdraw

> Withdraw from Carry

> Input Amount

> Select account

> Select where you want the funds to be sent

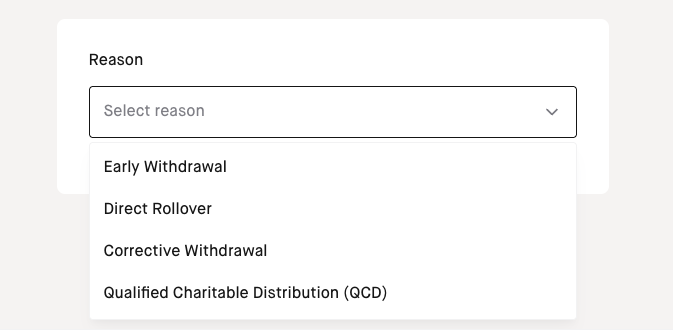

> Select reason 'Corrective withdrawal' as shown below

> Select the year

> Continue

> Review and agree to the requirements

> Continue to Submit

You will likely also have to remove the over-contributed amount (the basis), and any associated earnings from interest or investment gains. We recommend working with an accountant or tax advisor for this process.

Solo 401k Employer Over-Contributions

Excess employer contributions (employer pre-tax profit-sharing contributions) generally must remain in the plan, and will be subject to a penalty on top of any tax that is owed.

In addition, the excess employer contribution amount will be carried over into future years. You will need to factor this in to any additional contribution limits, to avoid over-contributing in the future.

Plan Operation

In addition to fixing the over-contribution and paying any taxes and penalties that are owed, you should take steps to ensure that over-contributions do not occur again. This is typically a requirement in order to keep the plan in good standing. We recommend consulting with an accountant or attorney to help guide you through this process.

Tax Reporting

You may have to file Form 5330 which generally is for employer over contributions, and amend or update other tax forms, in certain situations. You should work with your accountant or tax preparer to accurately report any over-contributions, corrections or penalties.