How to change your Solo 401k Contribution Election

Edited

In order to be able to contribute to your Solo 401k for any year, you'll want to have an election for the year you're trying to contribute to. Your election can be edited as your financial circumstances change. If you need to make an election or edit your election, follow these steps to do so:

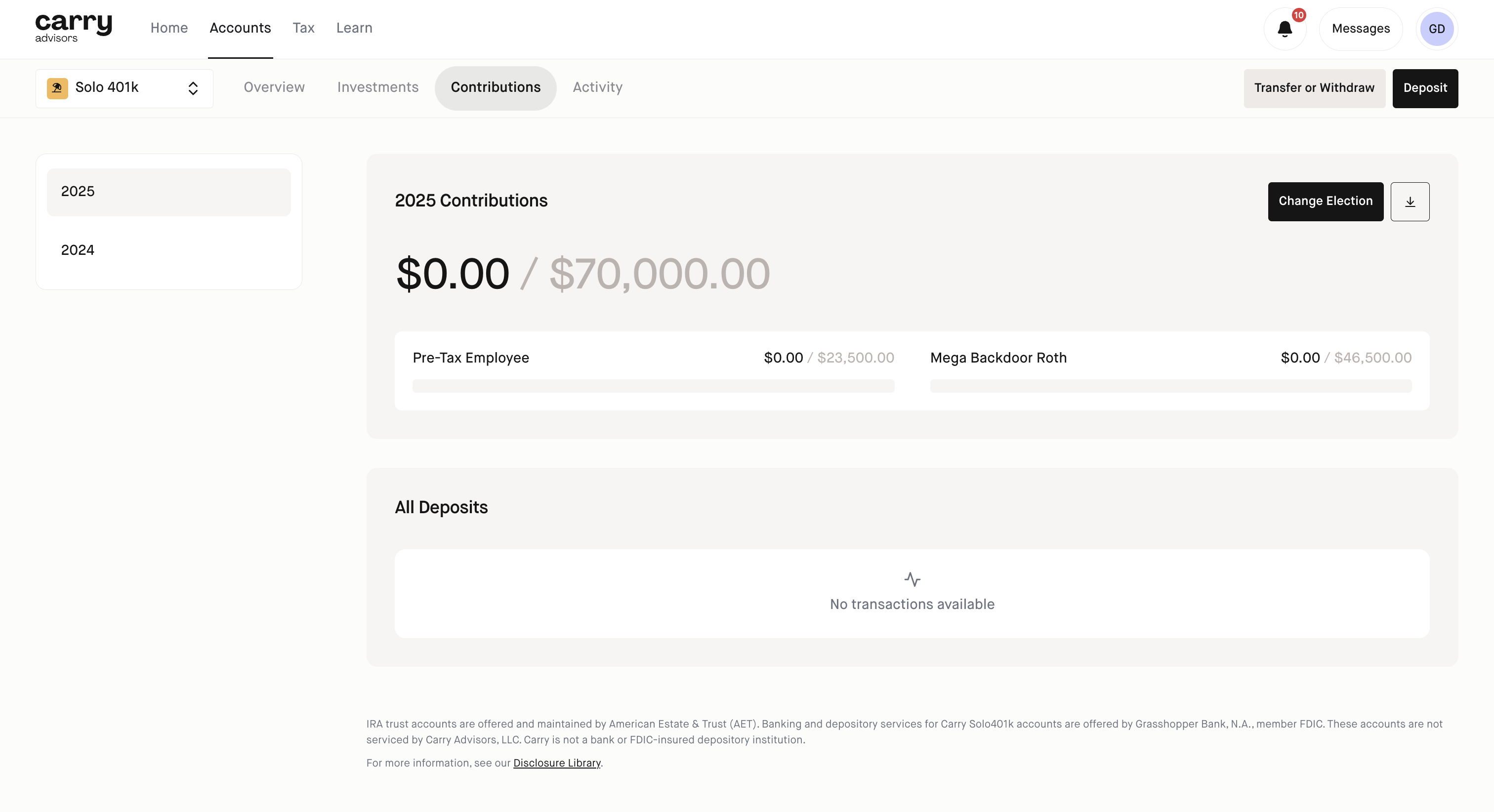

Step 1: Navigate to your Solo 401k Contributions tab and click 'Change Election' on the top right

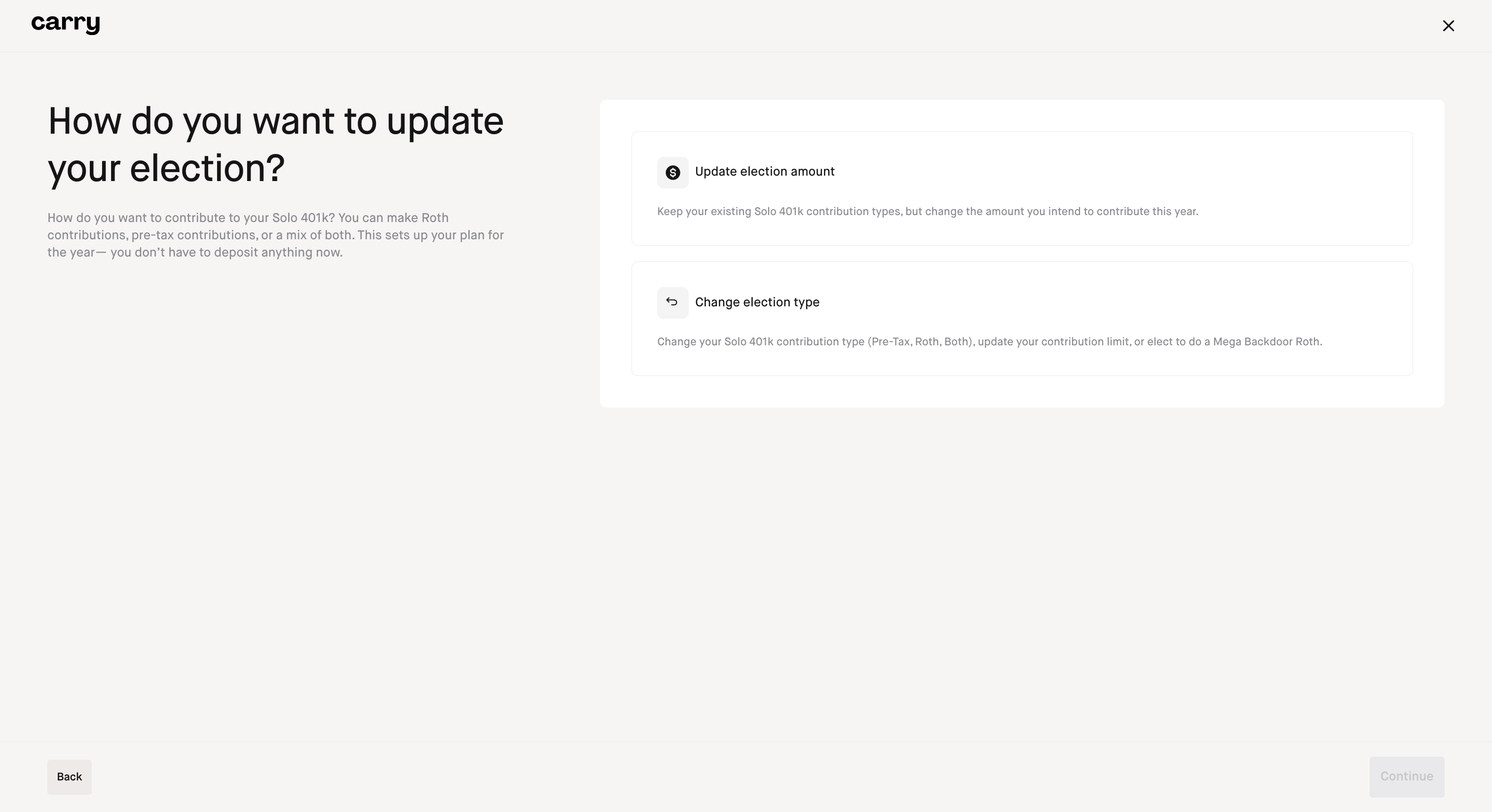

Step 2: Select if you are making updates to the election amount or if you need to change election type and click 'Continue'

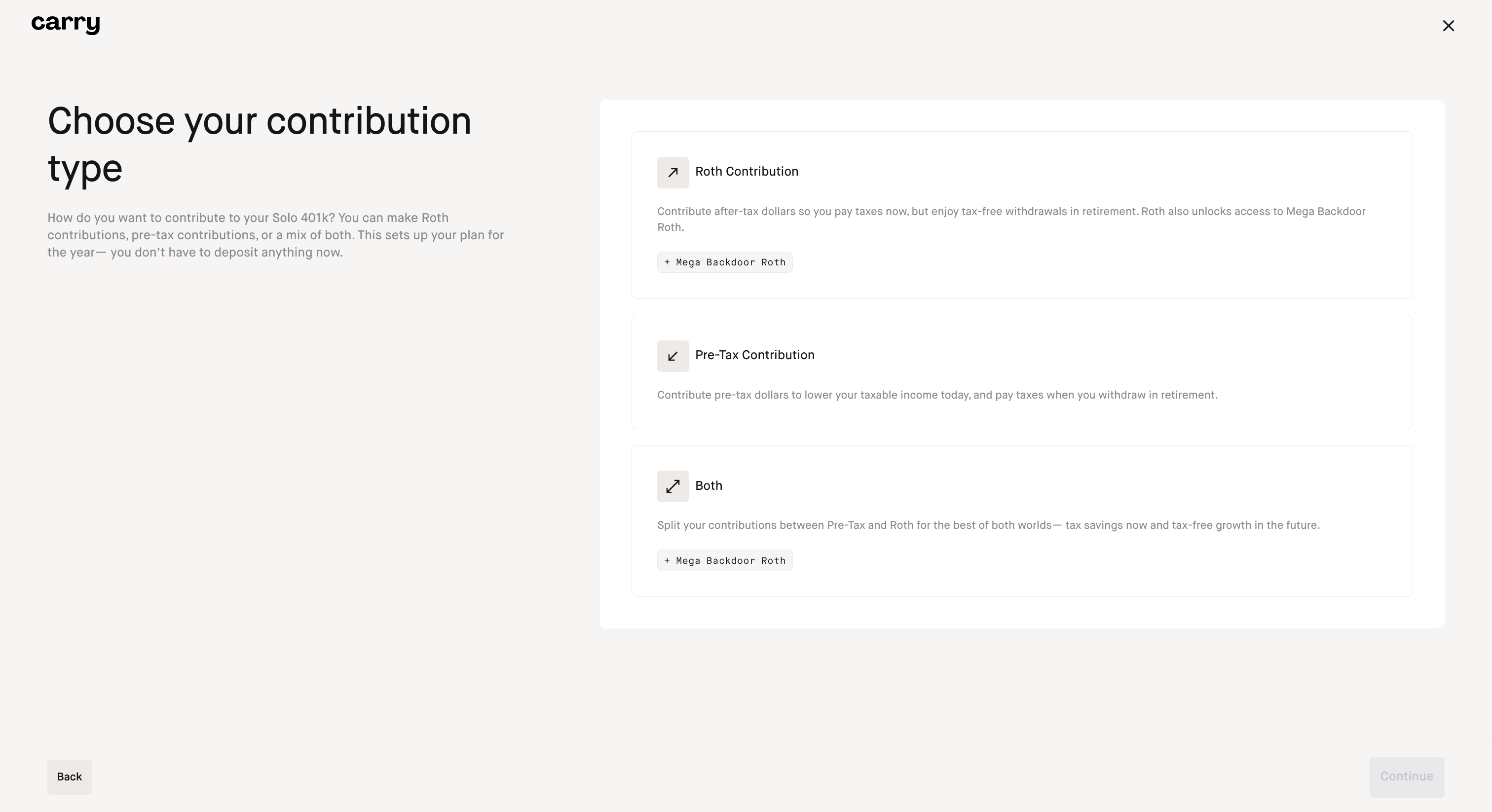

If you clicked 'change election type' you'll be brought to this screen where you can choose your contribution type:

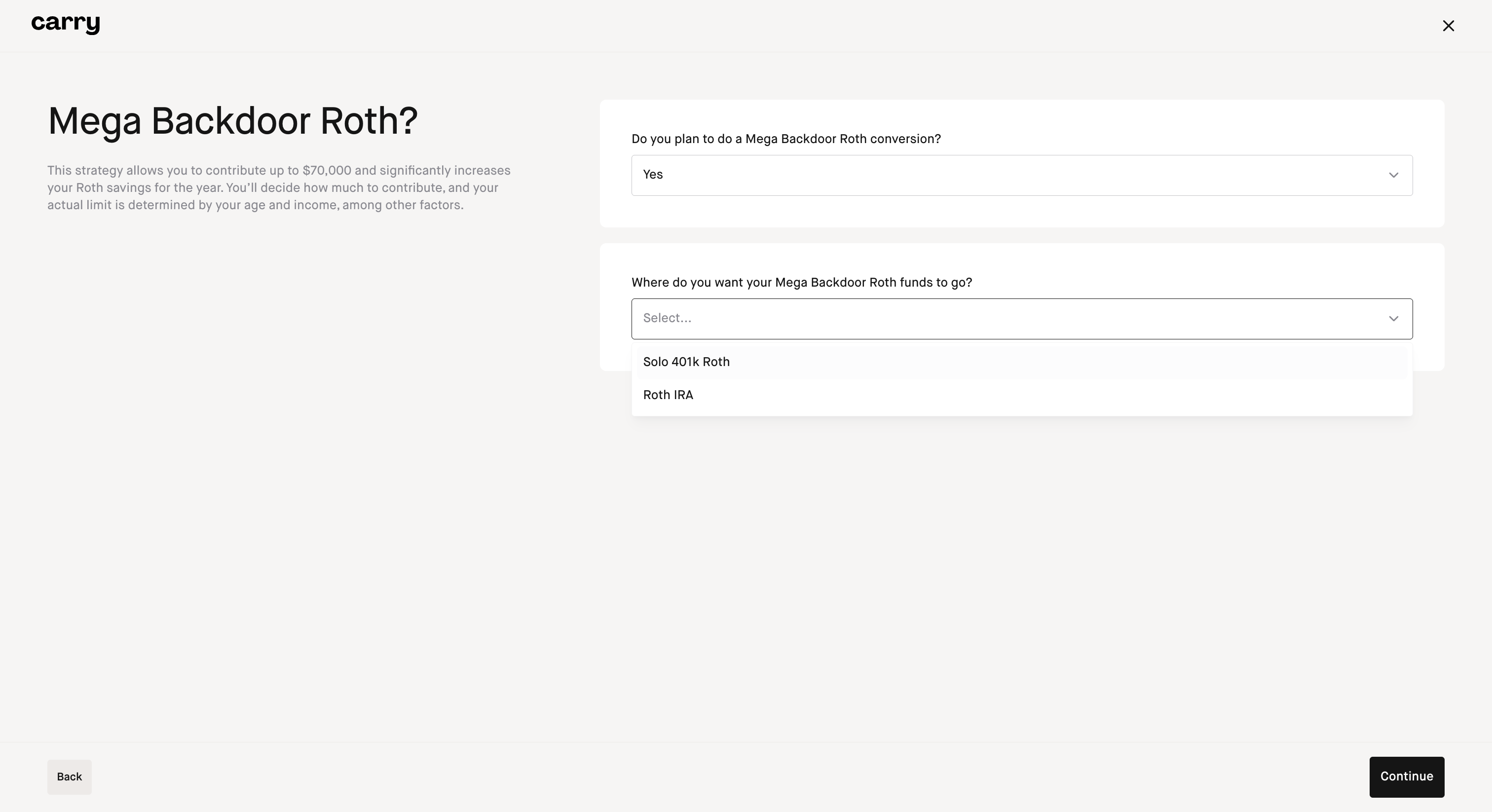

Step 3: If you chose an option that included Mega Backdoor Roth this next step will ask if you want do do a Mega Backdoor Roth conversion.

If you're unsure, you can learn more about the Mega Backdoor Roth strategy and its advantages here.

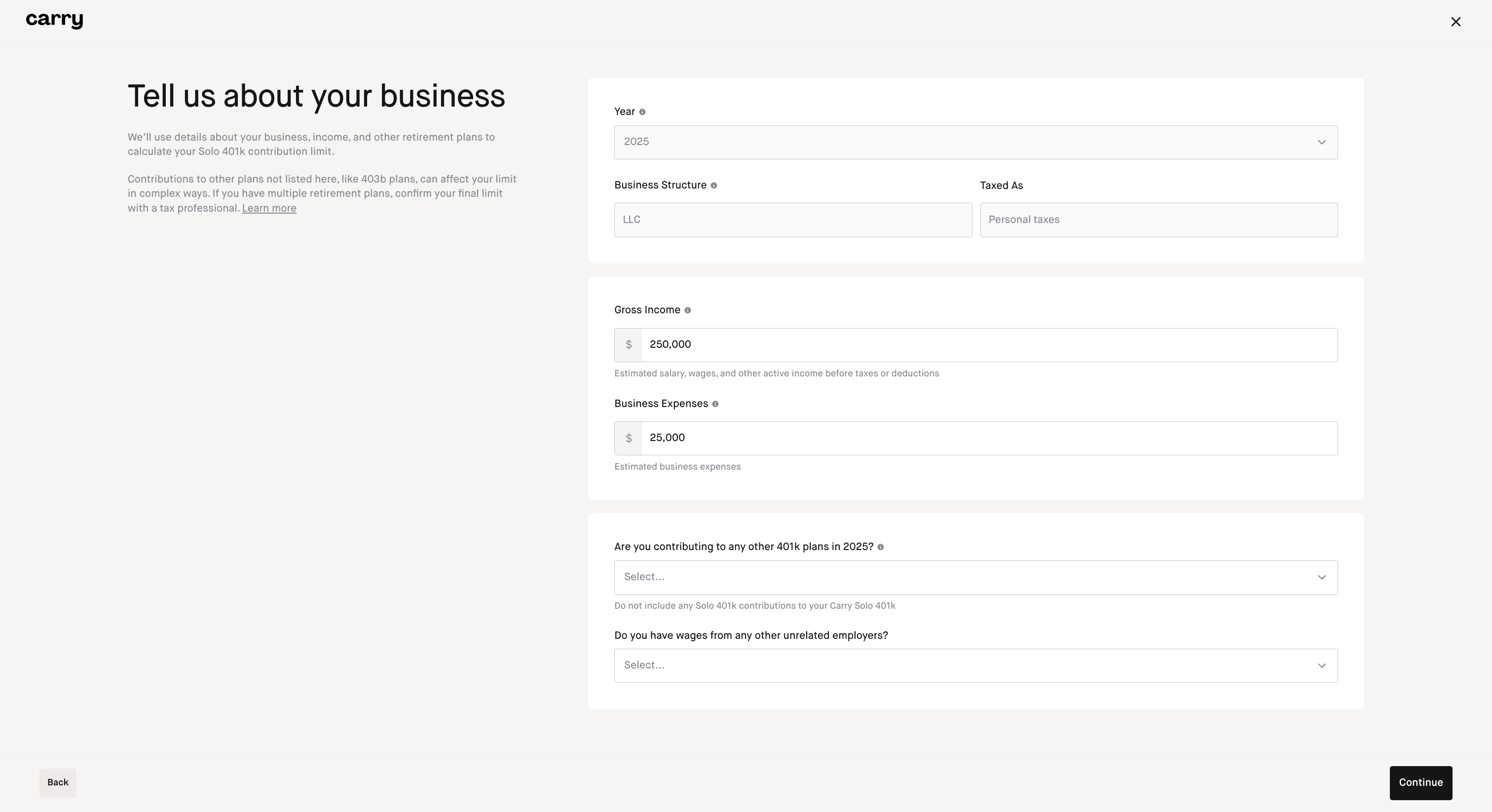

Step 4: Tell us about your self-employed gross income and expenses, as well as if you've contributed any dollars to other 401k plans during the tax year

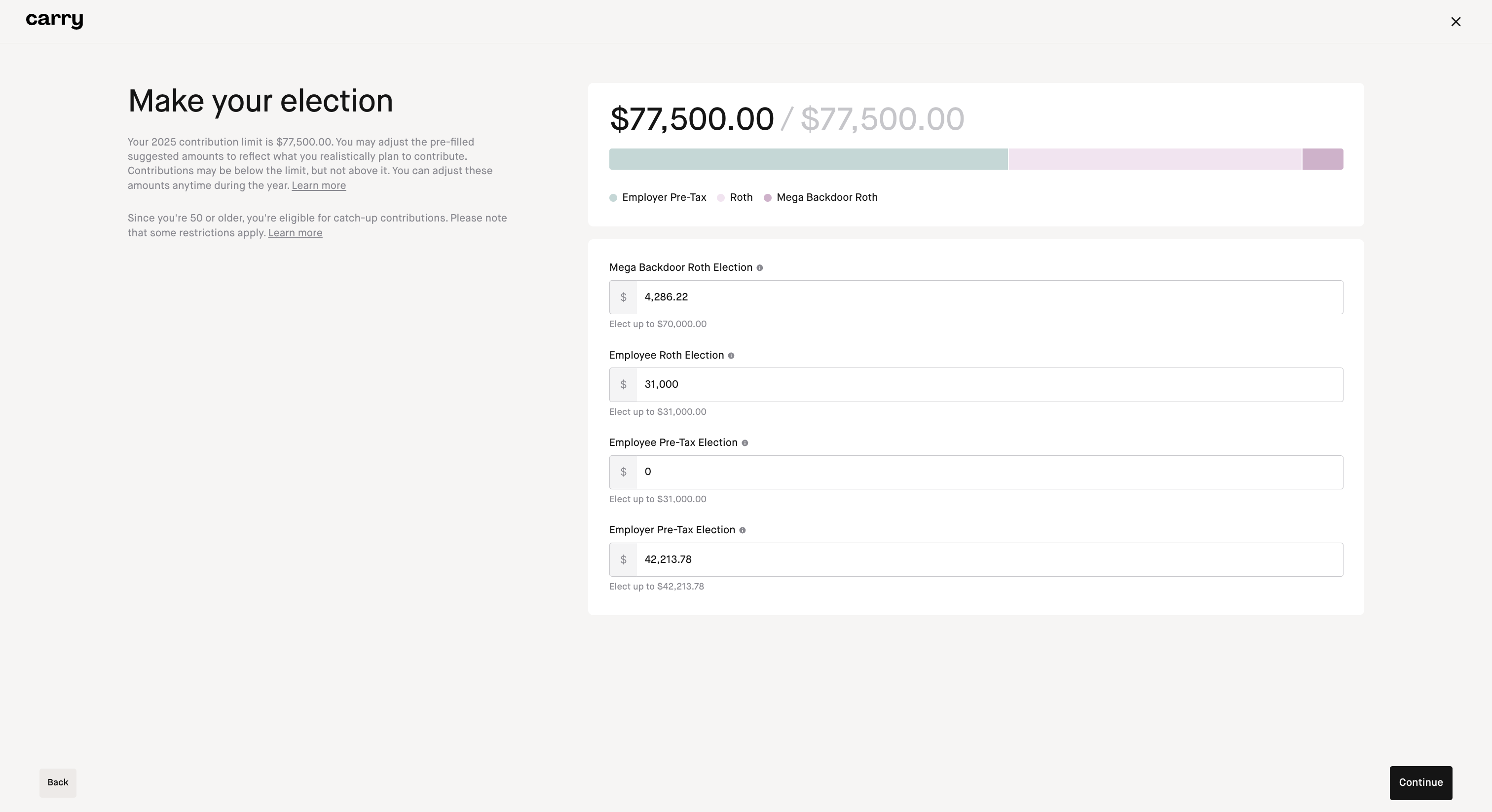

Step 5: You'll then be brought to a screen that shows your maximum contribution election limit where you can make your election for each contribution type

The contribution limit for each category is dynamic and will change as you input numbers into each field. When you're finished with entering the amounts you'd like to contribute for each category, click 'Continue'.