How do I invest in Smart Yield?

Step 1: From the Home page select the account type you want to invest in Smart Yield from.

You can choose from a Taxable brokerage account or the other accounts you have (Solo 401k pretax, Solo 401k Roth, Traditional IRA, or Roth IRA) on the Carry platform. If you don't have these accounts open, you'll have to open them first to invest in Smart Yield within the account. Learn more.

In this article, we've selected a Taxable Brokerage Account to invest into Smart Yield from.

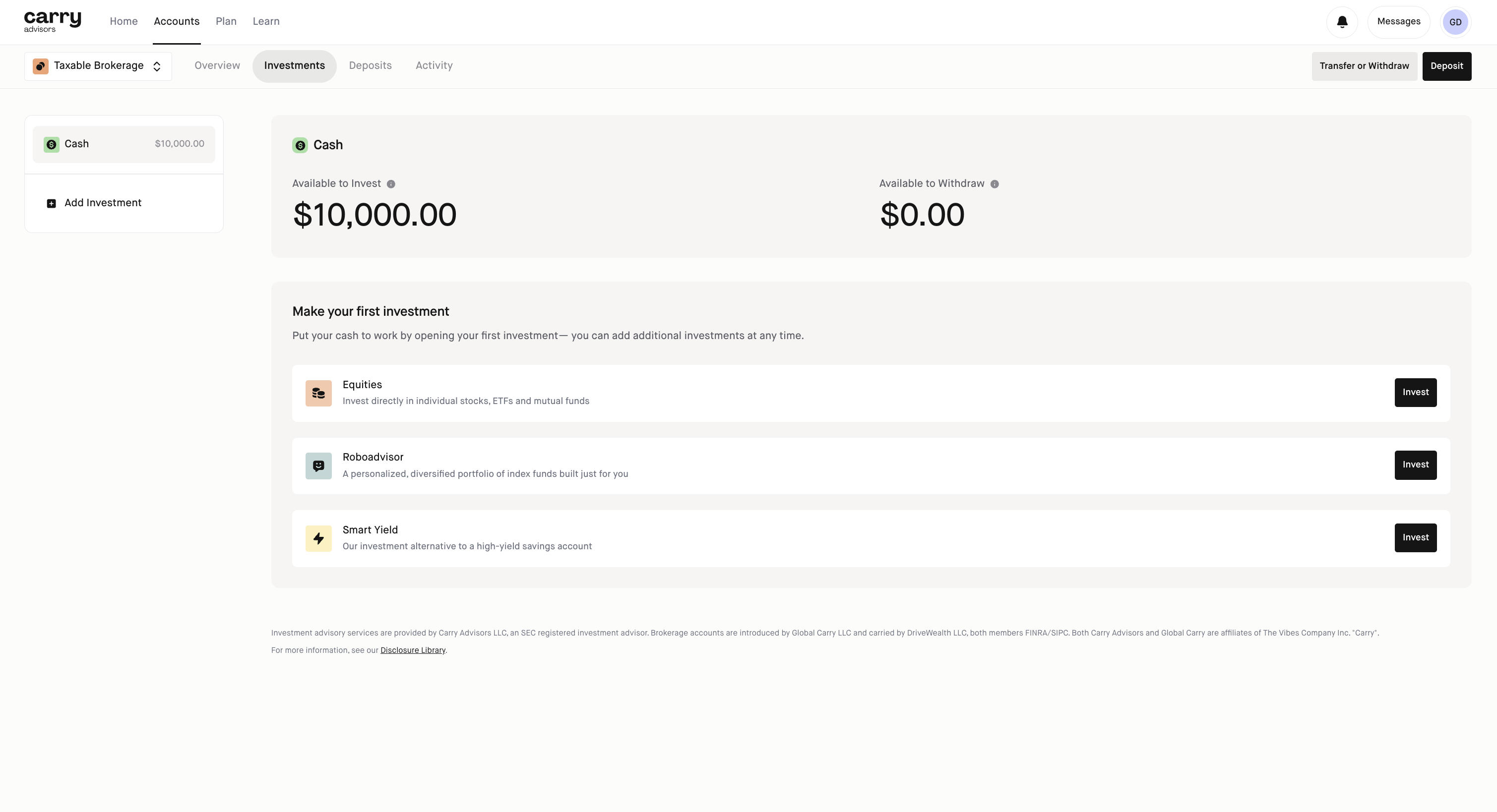

Step 2: Navigate to the 'Investments' tab within the account you are investing from and click '+ Add Investment' on the left navigation bar to add Smart Yield as an investment type or 'Invest' at the bottom of the screen.

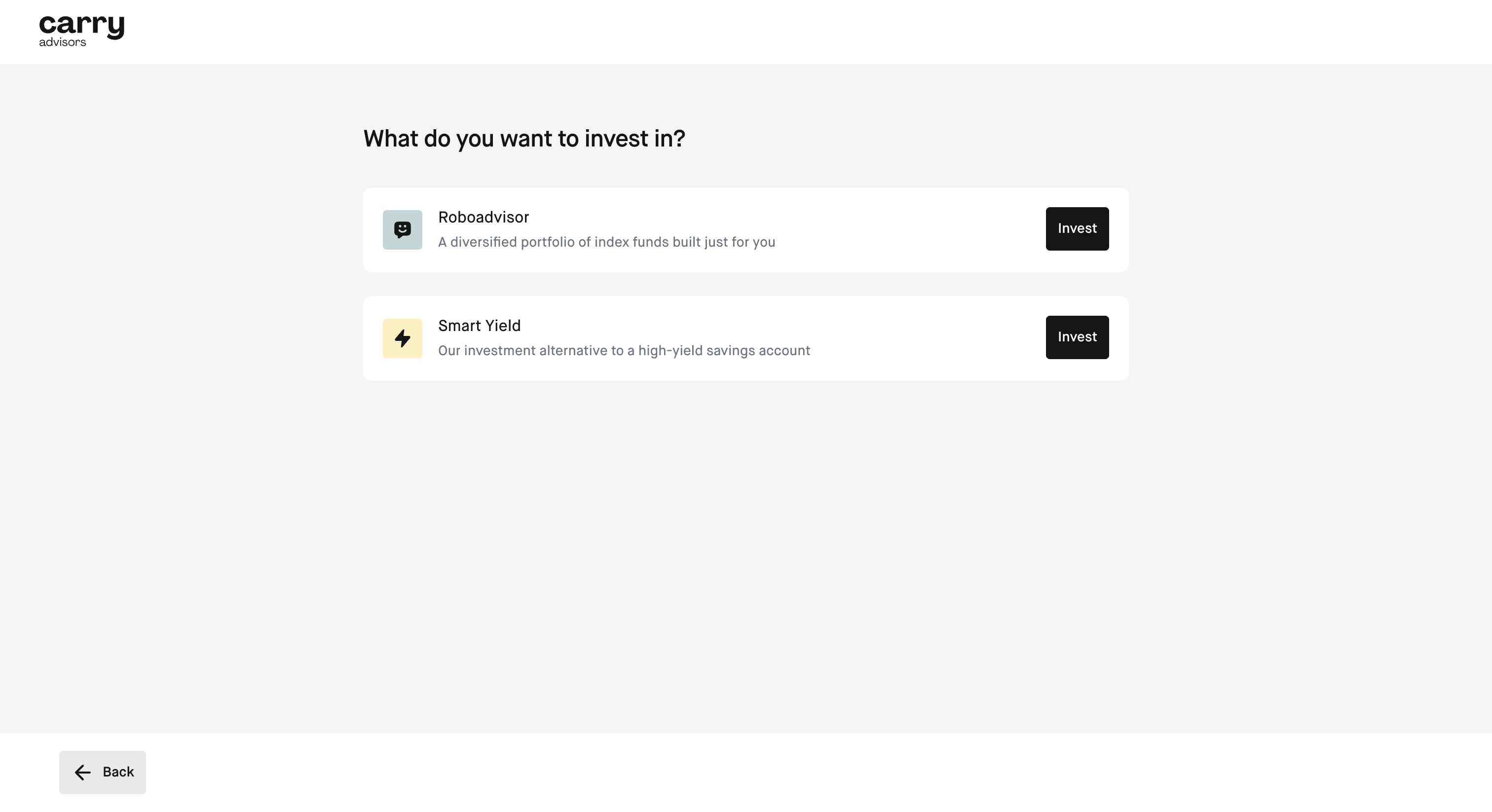

Step 3: Then click 'Invest' next to Smart Yield

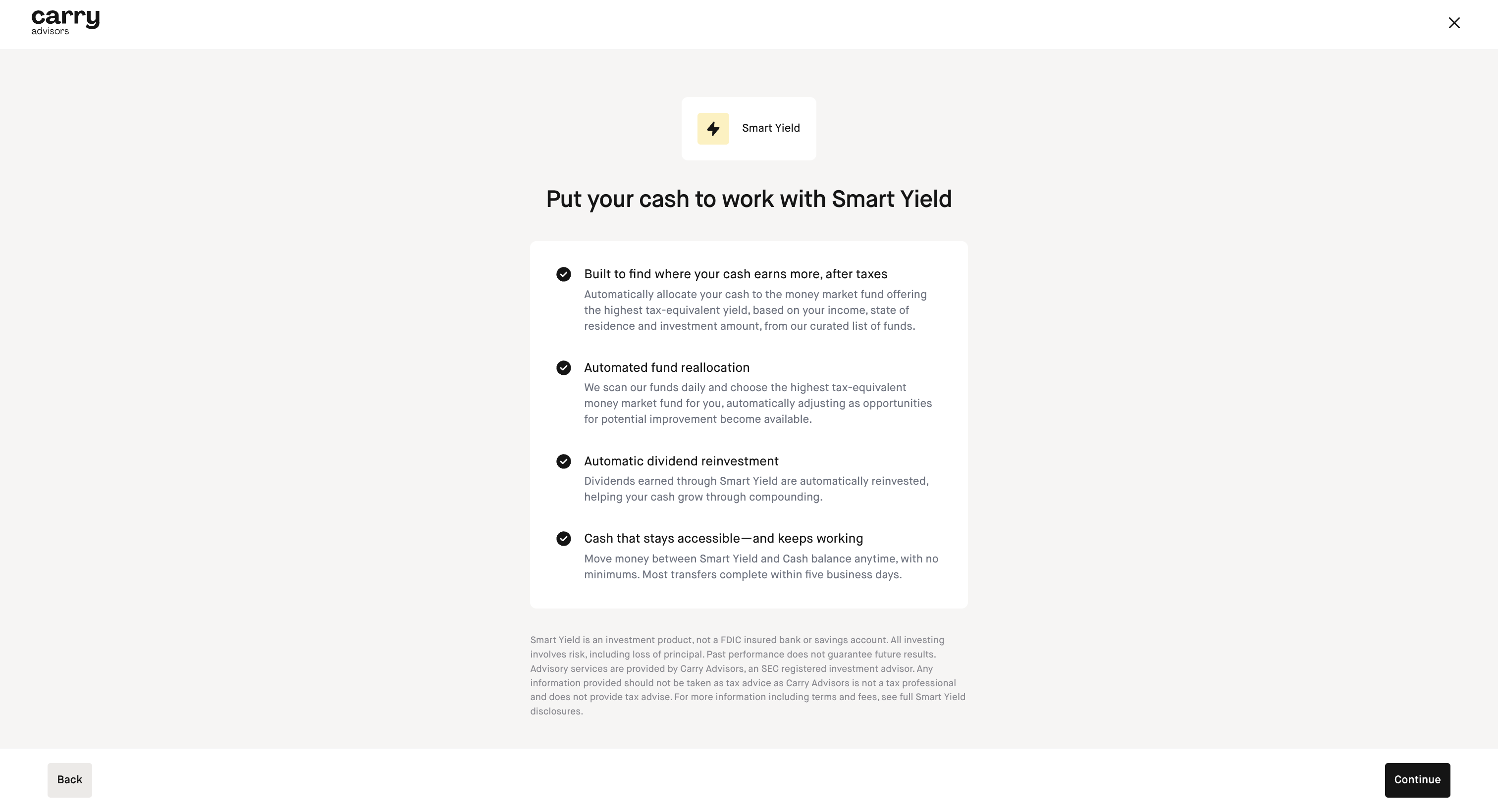

Step 4: Click 'Continue'

Step 5: Now, you'll be taken through a few screens to confirm your account information is correct. If it is, select 'Continue'. If not, you can update your information in Settings.

You'll also need to answer a few questions related to employer compliance and personal investing style.

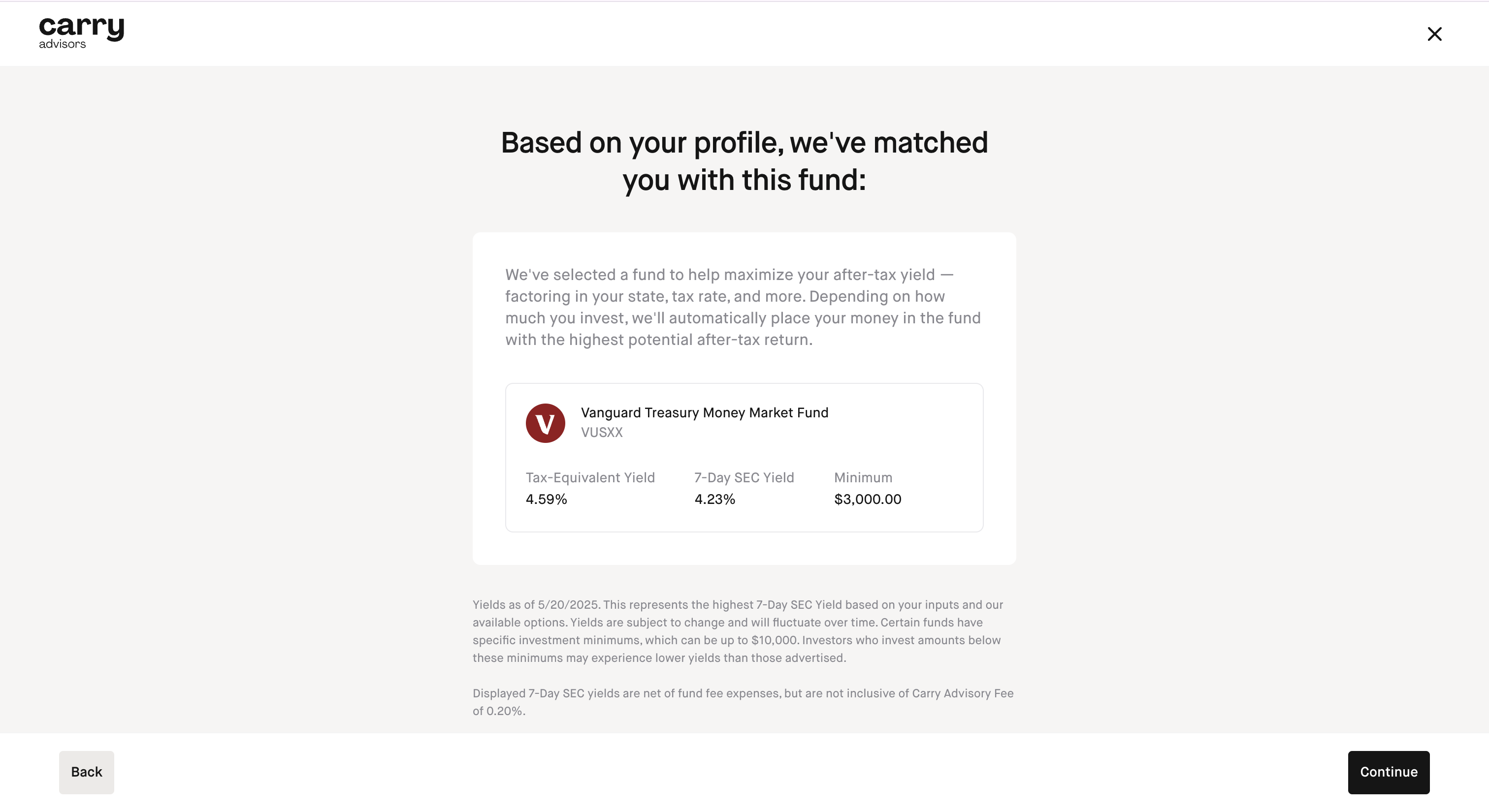

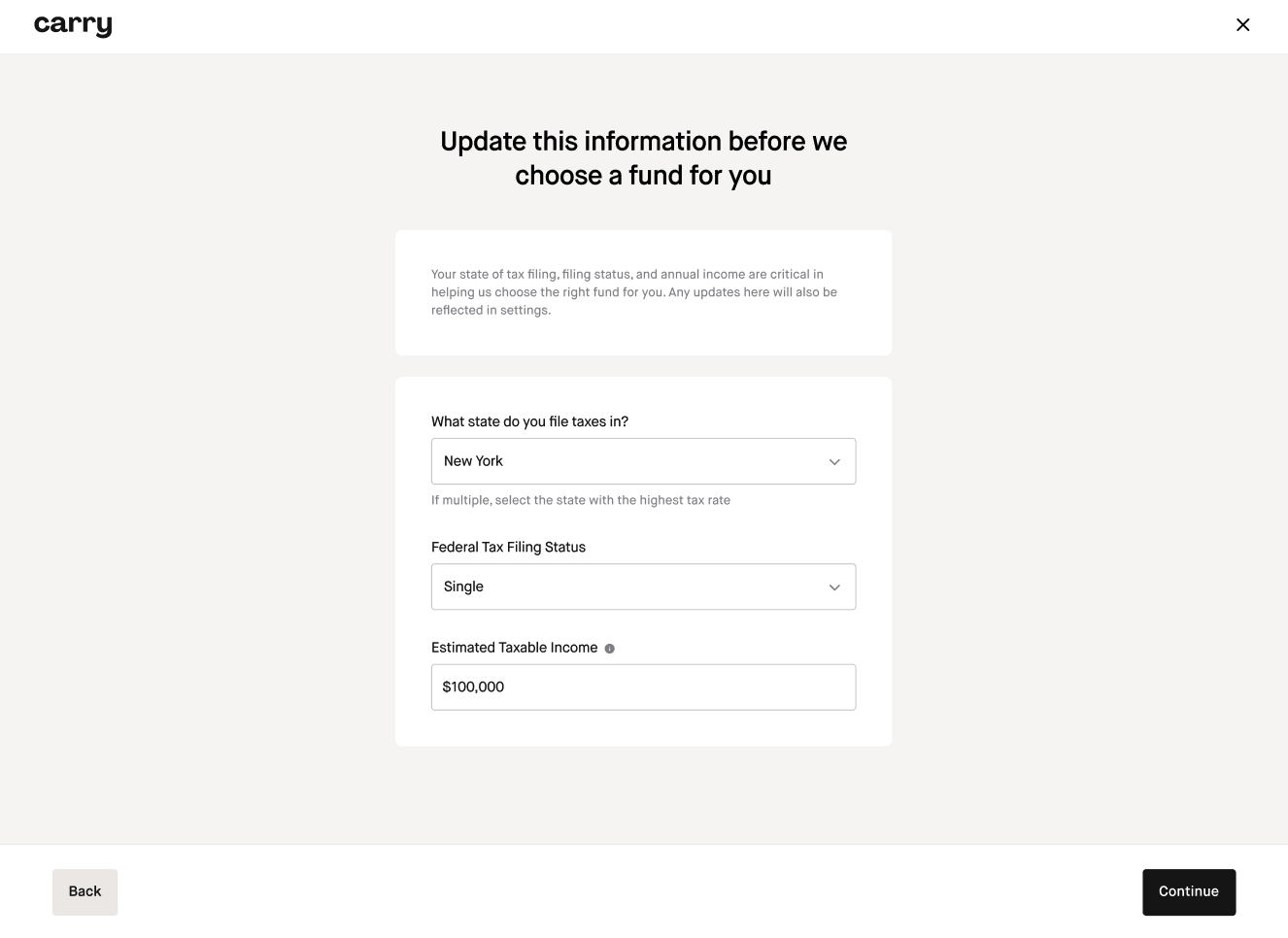

Then, confirm your state of tax filing, filing status, and annual income to get matched with fund options. Then click 'Continue'

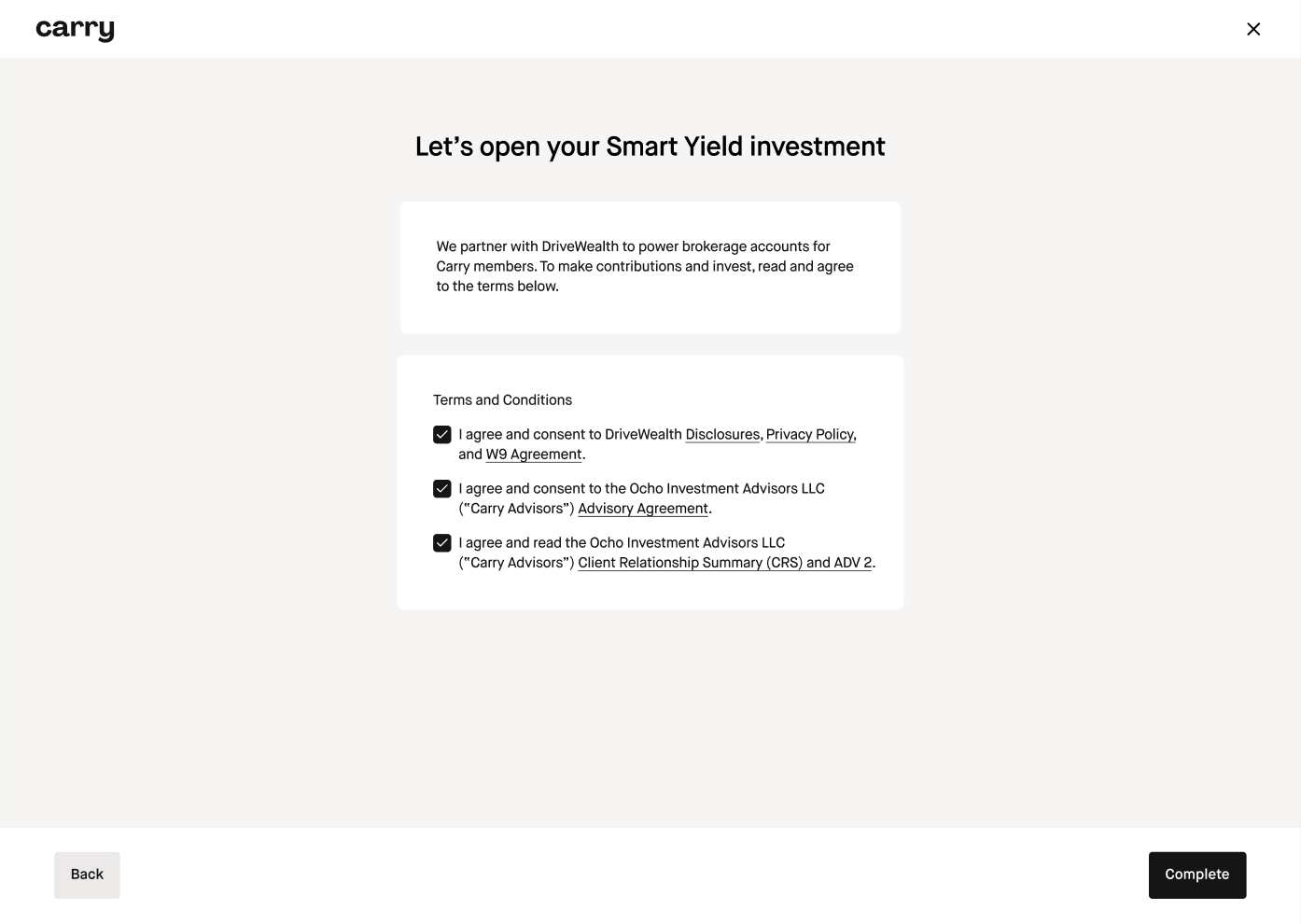

Step 6: Open your Smart Yield investment account by checking the boxes and click 'Complete'

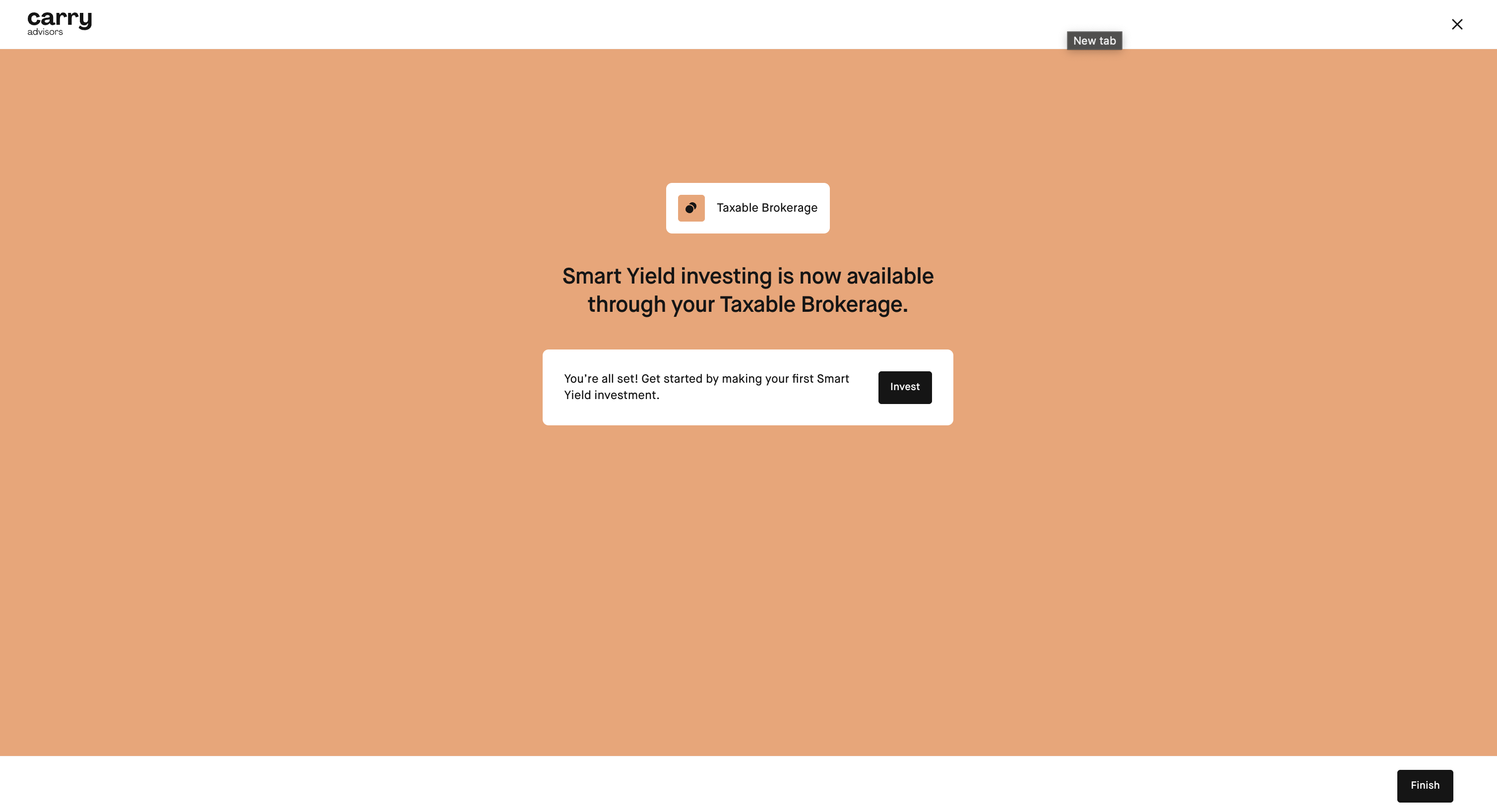

Step 7: Now, you can invest funds into in Smart Yield

If you have uninvested cash, you can immediately invest it in Smart Yield. Click 'Invest' to do so.

If you don't have uninvested cash ready to invest, you can make a Cash deposit to your account. Once the cash is in the account, you can invest it into Smart Yield.

Note that this can take 5-7 business days to fully clear and settle before it's available to be invested in Smart Yield. During this period, we restrict selling or making additional investments into Smart Yield.

Investing in Smart Yield

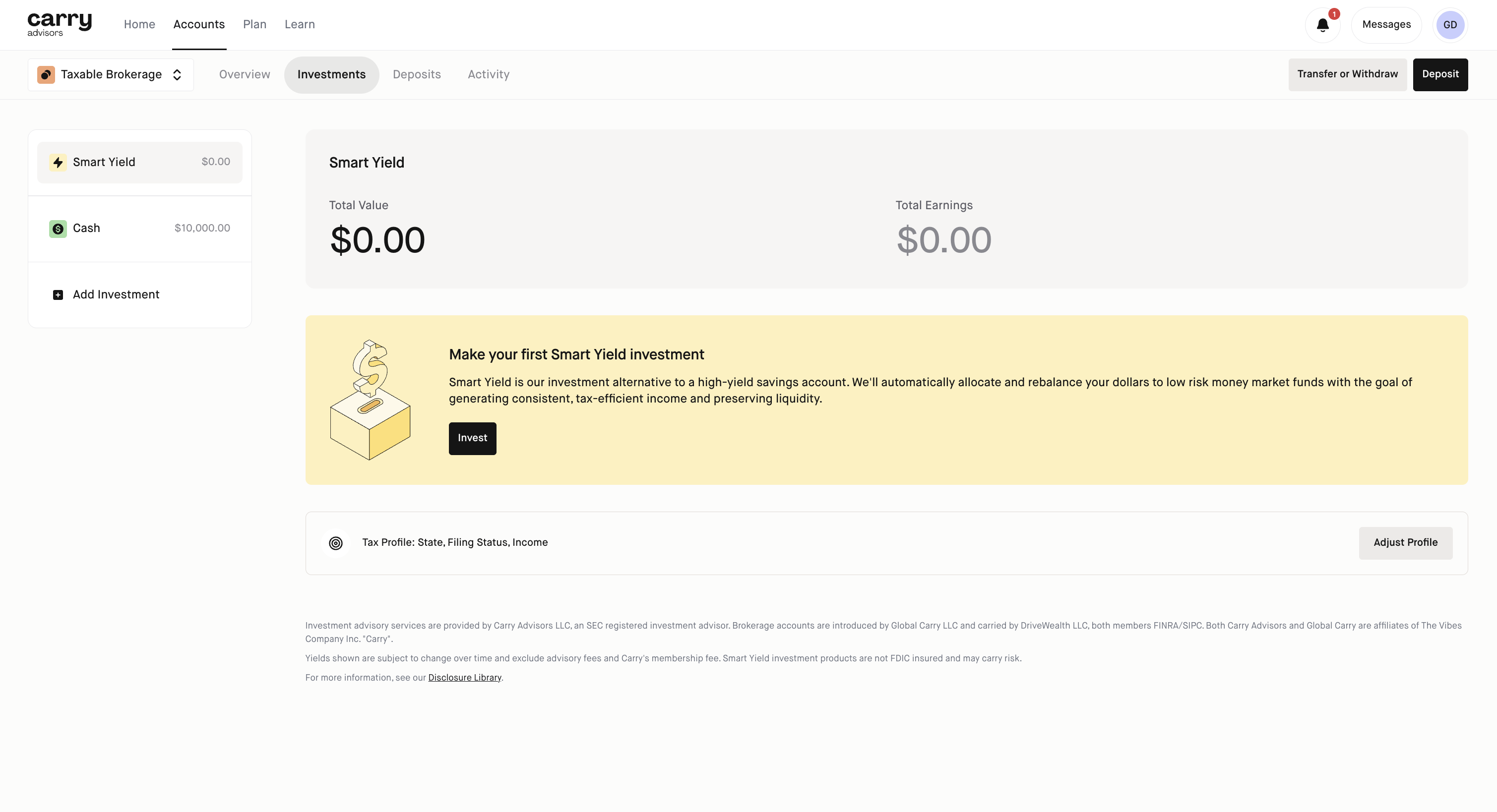

Step 1: From the 'Investments' tab within Smart Yield you can click 'Invest'

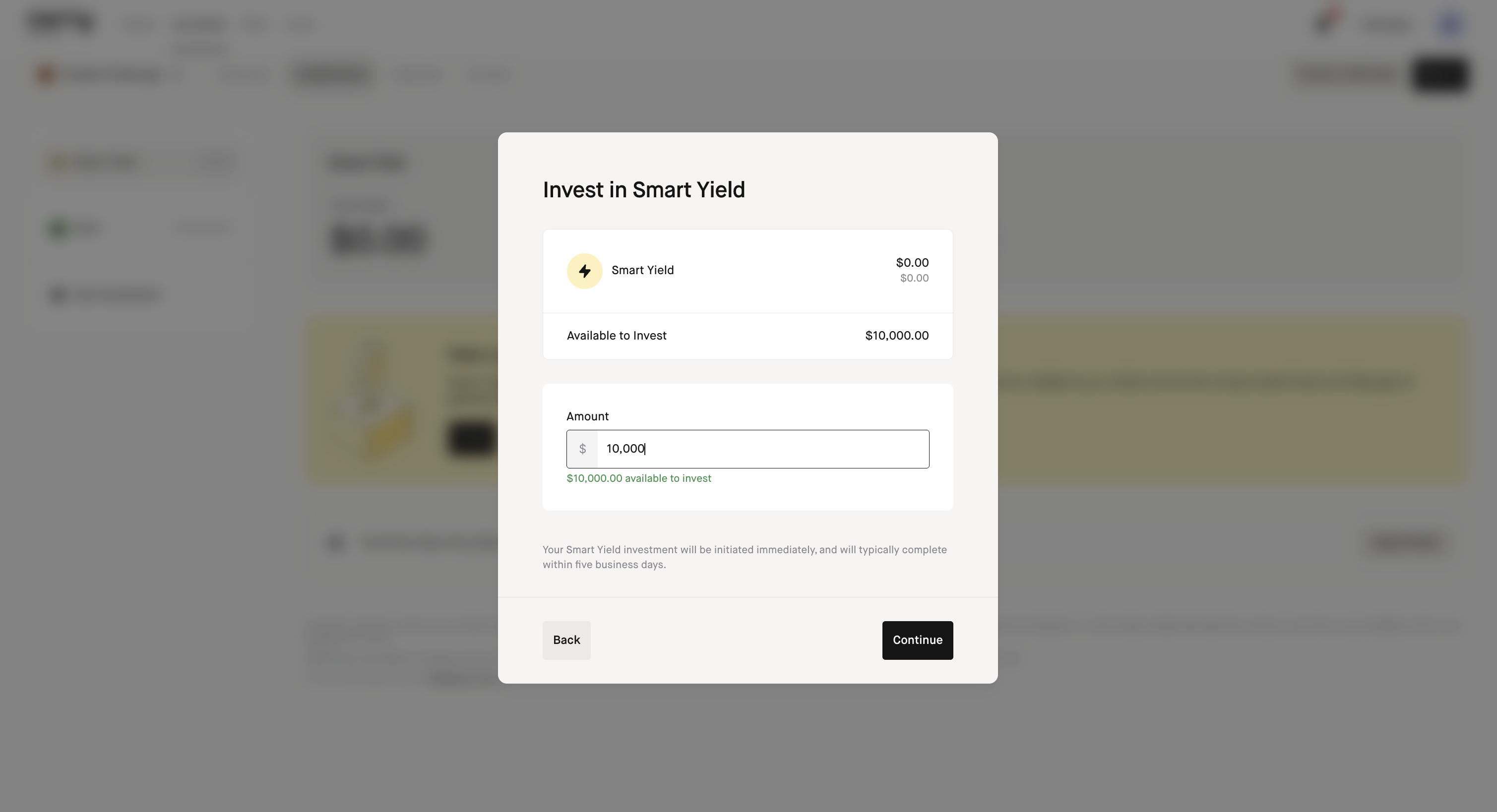

Step 2: Input the amount you want to invest, from the amount that's available to invest. Then click 'Continue'

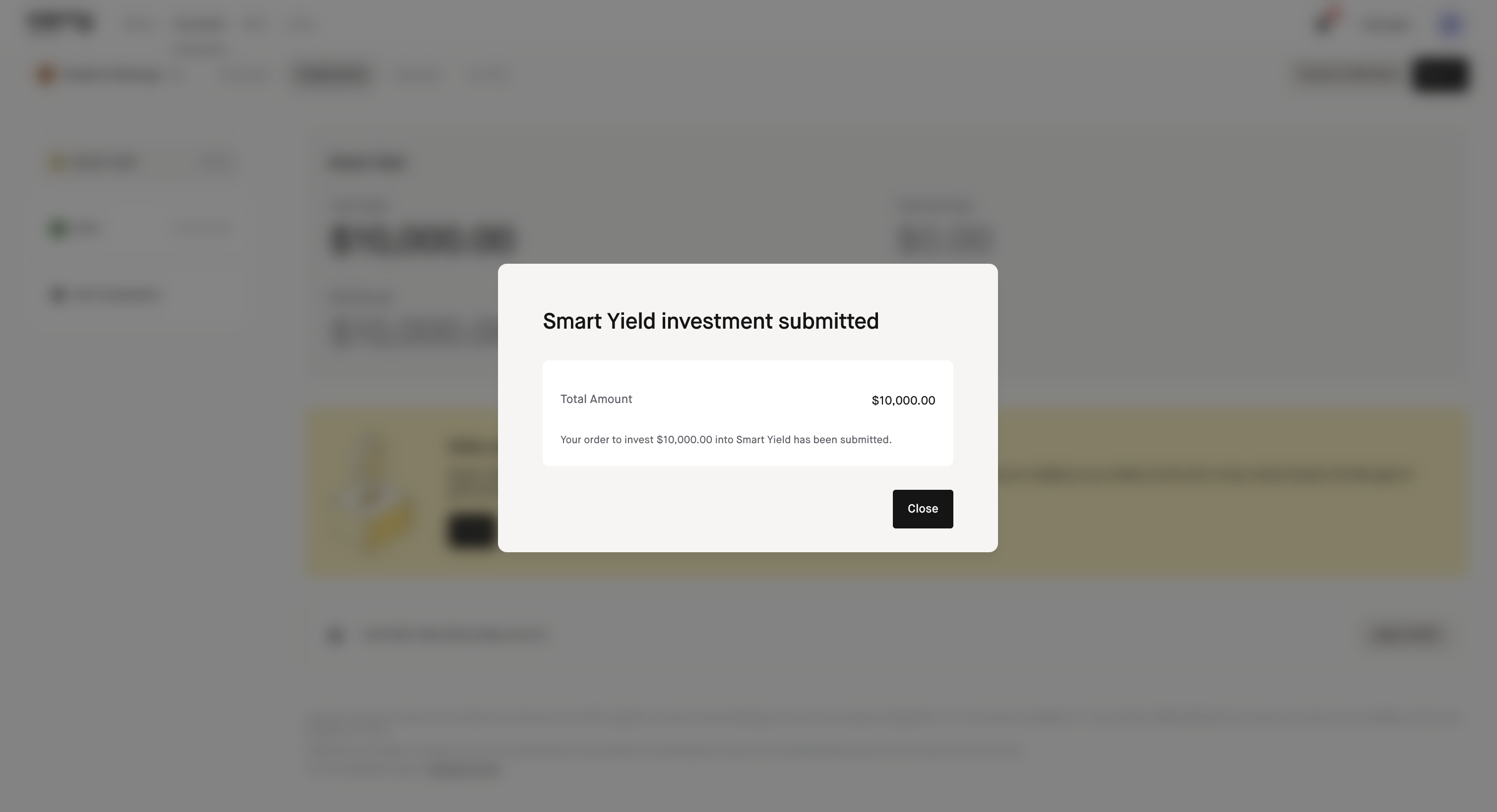

Step 3: You'll see a confirmation modal that your investment has been submitted

From there, you'll return to the 'Investments' page where you'll see your pending transfer, which should complete within 5 days.

Step 4: Once the funds are deployed to be invested, they'll be automatically invested into the chosen fund for you.

Step 5: When your funds are being actively reallocated, you'll see your Holdings in a "Rebalancing" state.

If you'd like to Sell Smart Yield

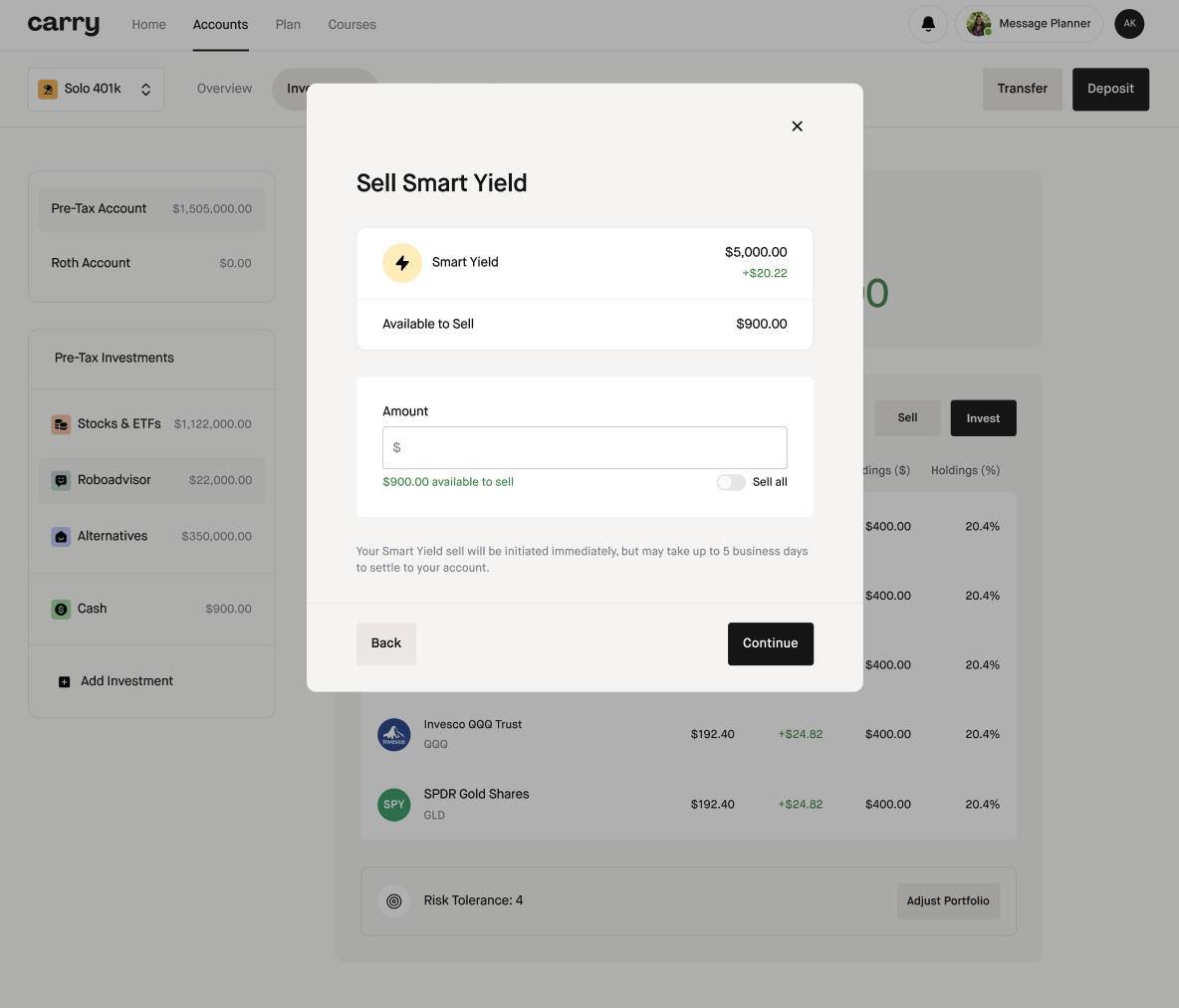

Step 1: Click 'Sell' to bring up a modal where you can input the amount you want to sell. Then, click 'Continue' and then 'Submit'

Step 2: You'll see a confirmation modal that your sell has been initiated Now you will return to the 'Investments' tab where you'll see your pending outgoing transfer, which should complete within 5 business days.

Your holdings and total value might differ during this period, and you will be unable to sell or invest in Smart Yield while this happens.

If you'd like to adjust your tax profile

Step 1: You can do so as you're adding Smart Yield as an investment account, or anytime after by clicking 'Adjust Profile' on the 'Investments' page.

Step 2: You can update your state of residence, federal tax filing status, and estimated taxable income here. Click 'Continue' when you've made your updates.

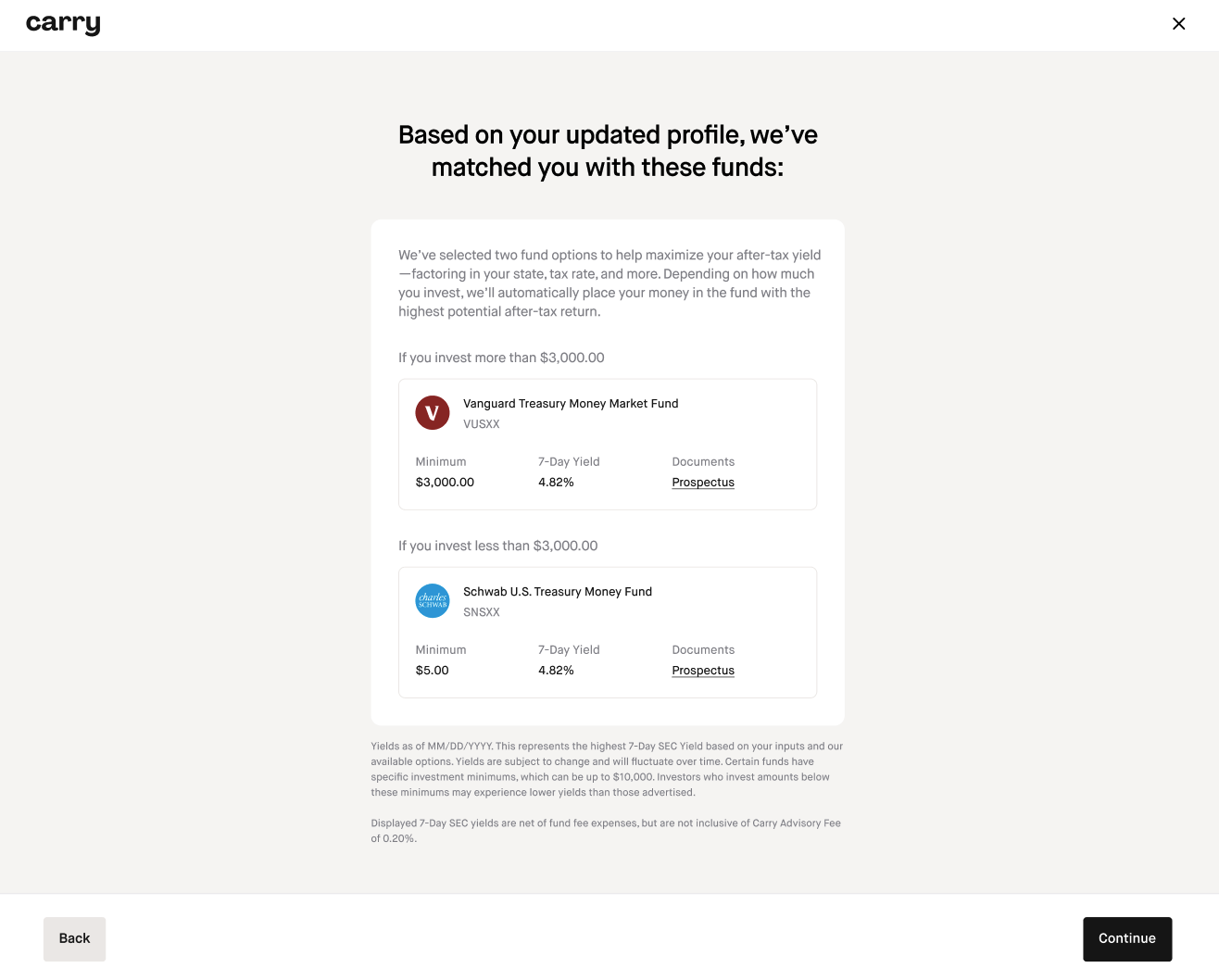

Step 3: You may get matched to new funds based on your updated profile. You can click 'Continue' to return back to the dashboard

For more details about Smart Yield, visit the FAQ page here.